-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Higher PPI Sets Stage For FOMC

HIGHLIGHTS

- US-RUSSIA: Def Sec Austin Warns That Russia Is Expanding Its Nuclear Arsenal

- US: USTR: US Rejects WTO Ruling On Trump Era Tariffs

- EU: Scholz: Germany Could Become European Center For Semiconductor Production

- US: Senator Kyrsten Sinema To Switch Party Affiliation To Independent

- ISRAEL PRESIDENT EXTENDS DEADLINE TO FORM COALITION BY 10 DAYS, Bbg

Key links: MNI Fed Preview - December 2022: Forecasting The End / MNI INTERVIEW: Real Rate To Climb In 2023 Even As Fed Cuts / MNI SOURCES: Rates/QT Trade-Off Central To Next ECB Decision

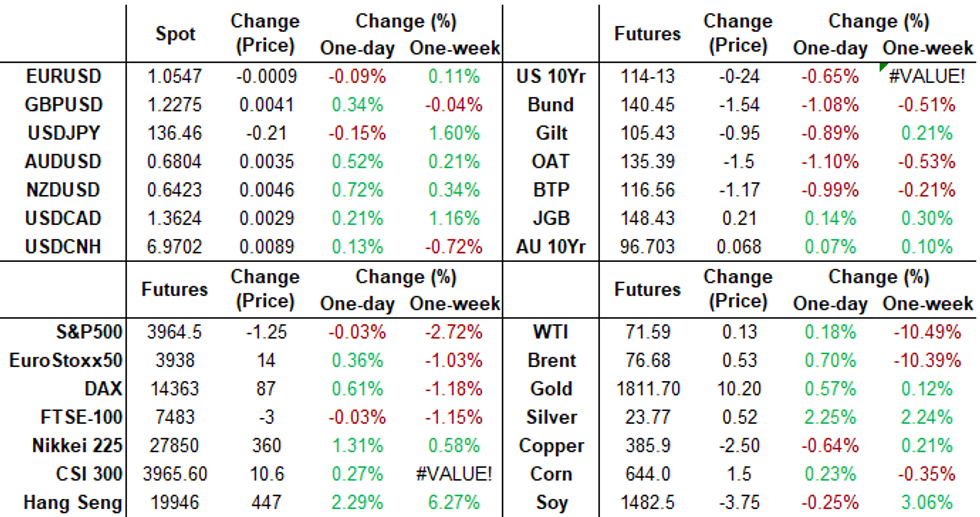

US TSYS: 10YY Crests 3.57% Post-PPI

Tsys remain weaker, gradually extending session lows since midmorning after some initial volatility post PPI. Tsy futures gapped lower after PPI comes out little higher than expected (MoM +0.3% vs. 0.2% est; ex F&E +0.4% vs. +0.2% est); U. of Mich. Sentiment (59.1 vs. 56.8 prior).

- Futures rebounded over half the initial move before selling off/extending lows again a half hour later, desks noted two-way positioning/unwinds ahead next week's CPI and FOMC. Notably, yield curves had considerably bear steepened off wk's 40Y lows: 2s10s tapped -74.466 high (+8.523).

- Trading desks eyed short end support in the face of next Monday's staggered auctions: 26W bills and 3Y Notes at 1130ET, 13W bills and 10Y Notes at 1300ET in order to maintains 2 day gap between last auction and settle.

- Focus turns to CPI for Nov next Tue (MoM 0.3% est, 7.3% YoY) and final FOMC of 2022 Wed afternoon.

- FOMC will step down the pace of rate hikes to 50bp at the December meeting. But it will likely signal via the Dot Plot that it intends to tighten by a further 75bp to a terminal rate above 5% in 2023.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00200 to 3.81800% (+0.00527/wk)

- 1M -0.00400 to 4.27029% (+0.08543/wk)

- 3M -0.00200 to 4.73314% (+0.00057/wk)*/**

- 6M -0.01900 to 5.13971% (-0.00943/wk)

- 12M -0.00100 to 5.49943% (+0.07000/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.77857% on 11/30/22

- Daily Effective Fed Funds Rate: 3.83% volume: $99B

- Daily Overnight Bank Funding Rate: 3.82% volume: $270B

- Secured Overnight Financing Rate (SOFR): 3.80%, $1.087T

- Broad General Collateral Rate (BGCR): 3.76%, $418B

- Tri-Party General Collateral Rate (TGCR): 3.76%, $392B

- (rate, volume levels reflect prior session)

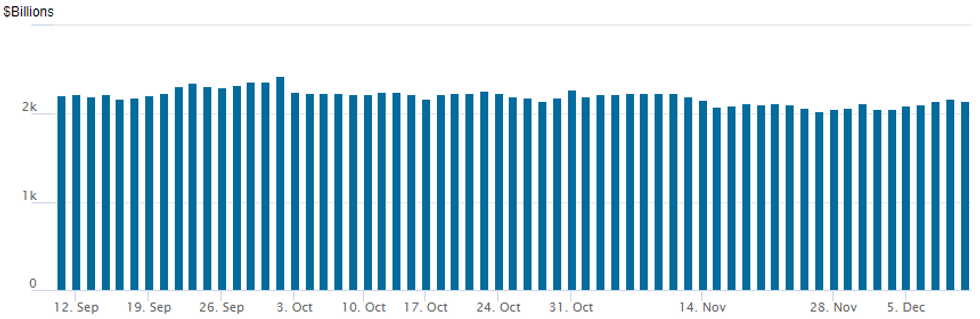

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,146.748B w/ 96 counterparties vs. $2,175.973B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Modest trade volumes turned mixed after Friday's higher than exp PPI weighed on underlying futures, 10YY climbed to 3.5691% by the close. Highlight trade:- SOFR Options:

- Block, 2,500 SFRZ4 99.50/100.0 1x2 call spds, 0.5 ref 96.905

- Block, 6,000 short Mar SOFR 97.00/97.50 call spds, 4.0 ref 96.05

- -15,000 short Jan 95.00/95.25/95.50 put flys, 1.5 ref 96.03

- 5,500 short Dec SOFR 95.00/95.12/95.31/95.43 put condors ref 95.65

- Block, 10,000 Green Jan SOFR 97.25/97.62 call spds, 8.0 ref 97.025

- +10,000 SFRZ 97.50 calls, 12.0

- Block, 2,000 short Dec 95.43/95.62 2x1 put spds, 1.5 vs. 95.63/0.09%

- appr 13,000 SFRZ 95.56 calls, cab

- 4,000 SFRZ 95.50/95.56/95.62 call flys, 1.0 ref 95.4775

- 2,000 Green Jan SOFR 96.50/96.75 3x2 put spds ref 97.065

- Eurodollar Options:

- Block, 10,000 EDZ2 95.25/95.37 call spds, 2.75 vs. 95.2475/0.42%

- Block, 20,000 EDZ2 95.25/95.37 call spds, 2.5 vs. 95.2475/0.42%

- 2,500 EDM3 94.62 puts, 21.5

- Treasury Options:

- 6,600 wk3 TY 113.25/114.25/115.25 iron flys, 45 ref 114-08

- 6,000 TYF 111 puts, 3-4

- 6,000 TYF 111/112 3x1 put spds, 1 net ref 114-07.5

- 2,500 TYF 113.25 puts, 22-26 ref 114-14.5 to -10

- 6,000 FVH 112.5 calls, 14.5 ref 109-01

EGBs-GILTS CASH CLOSE: Bunds Cheapen Vs Swaps On High TLTRO Repayments

European yields rose continuously for most of Friday's session, with core FI erasing most of the week's rally.

- The German curve weakened in parallel, while the UK curve was mixed.

- ECB TLTRO repayments came in higher than expected at E447.5bln

- Asset swap spreads tightened as German yields rose, with collateral seen coming back to market, thereby easing shortages.

- The biggest single move of the day, though, came after US producer price data came in higher than expected - 10Y Bund and Gilt yields rose over 4bp.

- Attention turns to next week's heavy central bank schedule, with decisions among others by the ECB, BoE, and Federal Reserve.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 9.1bps at 2.16%, 5-Yr is up 11bps at 1.943%, 10-Yr is up 11.3bps at 1.933%, and 30-Yr is up 10.7bps at 1.746%.

- UK: The 2-Yr yield is up 8.8bps at 3.426%, 5-Yr is up 5.2bps at 3.254%, 10-Yr is up 9.2bps at 3.181%, and 30-Yr is up 5.5bps at 3.57%.

- Italian BTP spread up 3.1bps at 190.6bps / Spanish up 1.9bps at 102.4bps

FOREX: Post-PPI USD Strength Reverses, Eyes On Upcoming Event Risk

- US PPI data surprised to the upside on Friday, prompting a quick spike in the greenback amid pressure on equity indices. The move was most notable in USDJPY which rallied over 100 pips to fresh intra-day highs of 1.3690.

- Despite the initial USD surge, momentum faded thereafter, and the greenback slowly reversed lower throughout the course of the afternoon, aided by a softer inflation component within the UMich survey and as markets turn their focus to next week’s CPI and major central bank decisions.

- With equities trading back into positive territory, the likes of GBP, AUD and NZD erased the entirety of the post-data weakness and all look set to post gains of above 0.5% on Friday.

- GBPUSD’s trend condition remains bullish. Price has traded through the 200-dma and maintains a bullish sequence of higher highs and higher lows. Note that moving averages studies remain in a bull-mode position. A resumption of gains places the focus on 1.2406, the Jun 16 high.

- EURGBP edged toward the bottom-end of the week's range into the Friday close - with support layered between 0.8556-62 but seen stronger into the 200-dma/Dec 1 low, both of which cross at 0.8547. Weakness through here would be the cross at the lowest levels since late August.

- Attention turns to Tuesday’s US CPI report followed by a host of major central bank decisions next week including the Fed and the ECB.

FX Expiries for Dec12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0450(E504mln), $1.0510-20(E2.4bln), $1.0550-51(E639mln), $1.0610-20(E993mln)

- USD/JPY: Y135.00-15($1.1bln), Y136.00-05($1.0bln), Y138.00($1.5bln), Y139.08($574mln)

- GBP/USD: $1.2150(Gbp755mln)

- USD/CNY: Cny7.1665($1.2bln)

Late Equity Roundup: Comm Services Leaven Weaker Energy Shares

Little change for stocks indexes trading marginally mixed after the FI close, inside session range after initial post-PPI sell-off, Communication Services sector outperforming. SPX eminis currently trade -3.75 (-0.09%) at 3962; DJIA -91.7 (-0.27%) at 33688.9; Nasdaq +4.3 (0%) at 11086.19.

- SPX leading/lagging sectors: Communication Services (+0.65%) outperformed after better selling Thu, Netflix climbing 4.47% following upgrade by Wells Fargo, follow through support for Paramount +5.06%, Warner Bros +3.39% and Disney +1.5%. Next up, Real Estate (+0.59%) followed by Information Technology (+23%), the latter lead by hardware/memory storage names (NTAP +1.55%, WDC +1.89%, AAPL +1.00%).

- Laggers: Energy (-1.82%) clear underperformer lead by oil and gas shares (DVN -5.64%, SLB -5.23%, Hal -5.06). Health Care (-0.65%) and Materials (-0.35%) follow.

- Dow Industrials Leaders/Laggers: Goldman Sachs (GS) bounced +2.15 to 360.59, Boeing (BA) +2.14 at 181.22, Salesforce.com (CRM) +1.77 at 131.90.

- Laggers: Chevron (CRX) -4.24 at 169.30, Amgen (AMGN) -4.99 at 280.58, United Health (UNH) -3.46 at 544.46.

E-MINI S&P (Z2): Key Support Lies At The 50-Day EMA

- RES 4: 4234.25 High Aug 26

- RES 3: 4175.00 High Sep 13 and a key resistance

- RES 2: 4146.63 76.4% retracement of the Aug 16 - Oct 13 downleg

- RES 1: 4110.00 High Dec 1

- PRICE: 3961.50 @ 1455ET Dec 9

- SUP 1: 3918.99/3914.00 50-day EMA / Low Dec 7

- SUP 2: 3912.50 Low Nov 17

- SUP 3: 3750.00 Low Nov 9

- SUP 4: 3704.25 Low Nov 3 and key short-term support

S&P E-Minis is trading closer to this week's lows. The recent move down is considered corrective - for now. The uptrend that started on Oct 13 remains intact but attention is on support at the 50-day EMA, which intersects at 3918.99. A clear break of this EMA would threaten bullish conditions and suggest potential for a deeper reversal. The bull trigger, to resume recent bullish activity, is at 4110.00.

COMMODITIES: Oil Slide Hits Double Digits/Supply Cares Pushed To Background

- Crude oil is on track to end every day lower this week for a 12% decline on the week and at new year to date lows.

- News from the session has included Xi saying China is willing to boost oil & gas imports from GCC countries whilst TC Energy is planning to restart one leg of the shuttered Keystone oil pipeline Dec 10 with the leg that extends to the Cushing, Okla, storage hub expected to restart Dec 20.

- Most recently, the US rig count falling by 4 during the week in a potential sign that shale drilling may be slowing has done little to change prices.

- WTI is -1.4% at $70.46, clearing support at $71.12 (yesterday’s low) and coming close to testing the psychological $70. Highlighting the continued downward trend, most active strikes in the CLF3 have been $65/bbl puts today.

- Brent is -1.0% at $75.42, through yesterday’s low of $75.74 to next open $72.33 (1.00 proj of the Nov 7 – 28 – Dec 1 price swing).

- Gold is +0.45% at $1797.19, moving closer to key resistance at $1807.9 (Aug 10 high).

- Weekly moves: WTI -12%, Brent -12%, Gold 0.0%, US Nat Gas -2%, EU TTF Nat Gas +2.5%

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/12/2022 | 0001/0001 |  | UK | Rightmove House Prices | |

| 12/12/2022 | 0700/0700 | ** |  | UK | UK Monthly GDP |

| 12/12/2022 | 0700/0700 | ** |  | UK | Trade Balance |

| 12/12/2022 | 0700/0700 | *** |  | UK | Index of Production |

| 12/12/2022 | 0700/0700 | ** |  | UK | Index of Services |

| 12/12/2022 | 0700/0700 | ** |  | UK | Output in the Construction Industry |

| 12/12/2022 | 1330/0830 | * |  | CA | Household debt-to-disposable income |

| 12/12/2022 | 1600/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 12/12/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 12/12/2022 | 1630/1130 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 12/12/2022 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 12/12/2022 | 1800/1300 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 12/12/2022 | 1900/1400 | ** |  | US | Treasury Budget |

| 12/12/2022 | 2025/1525 |  | CA | Governor Macklem speech in Vancouver | |

| 12/12/2022 | 2200/1700 |  | CA | BOC Governor Macklem press conference |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.