-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: IMF, BOE Flash Warning Signals

HIGHLIGHTS

- MNI BOE Bailey Doubles Down On Pension Fund Ultimatum

- IMF CUTS 2023 WORLD GDP OUTLOOK, WARNS `WORST IS YET TO COME'

- IMF KEEPS '22 WORLD GROWTH OUTLOOK AT 3.2%, CUTS '23 BY 0.2 PPT

- FED MESTER: NEED PROGRESS ON INFLATION BEFORE DOWNSHIFTING HIKES

Key links: MNI: 'Worst Is Yet To Come,' 2023 Like Recession For Many-IMF / MNI SOURCES: G7 To Repeat Commitment To Market-Determined FX / MNI INTERVIEW: Fed May Hike More Than FOMC Says - Blanchard

US TSYS: BOE Bailey Busts Rally

Tsys pared gains along with equities in late Tuesday trade after BoE Gov Bailey, speaking in DC, warned of "serious risk to financial stability in the UK".

- Bailey also doubled down on message to pension funds is that "you've got three days left" reinforcing that the current intervention in markets is temporary and that "we will be out" by the end of the week.

- Other market watchers suggested the late reversal is do to factors outside the gilt market than actually from the market participants this is directly impacting based on the day's low take-up in purchase operations.

- Tsys had rallied overnight after the BoE Linkers will now be eligible in the daily gilt purchase operations for the remainder of this week: up to GBP5bln linkers will be eligible for purchase (14:15-14:45BST) and GBP5bln of long conventional (15:15-15:45BST - an hour later than previous operations). Corporate bonds sales scheduled for today and tomorrow "will not take place".

- Focus turns to Wednesday's Sep FOMC minutes release at 1400ET, CPI Thursday at 0830ET.

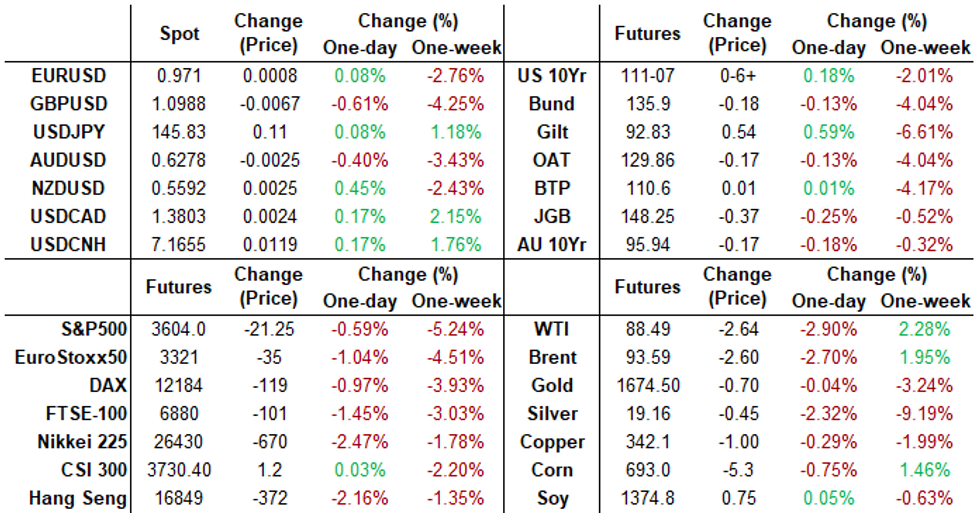

- Currently, the 2-Yr yield is down 0.4bps at 4.3037%, 5-Yr is up 1.1bps at 4.1528%, 10-Yr is up 4.3bps at 3.9245%, and 30-Yr is up 5.3bps at 3.8943%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00686 to 3.05943% (-0.00686/wk)

- 1M +0.02886 to 3.34557% (+0.03200/wk)

- 3M +0.02157 to 3.94071% (+0.03200/wk) * / **

- 6M +0.02586 to 4.45329% (+0.06858/wk)

- 12M +0.04843 to 5.09843% (+0.10214/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 3.94071% on 10/11/22

- Daily Effective Fed Funds Rate: 3.08% volume: $113B

- Daily Overnight Bank Funding Rate: 3.07% volume: $282B

- Secured Overnight Financing Rate (SOFR): 3.05%, $968B

- Broad General Collateral Rate (BGCR): 3.00%, $394B

- Tri-Party General Collateral Rate (TGCR): 3.00%, $371B

- (rate, volume levels reflect prior session)

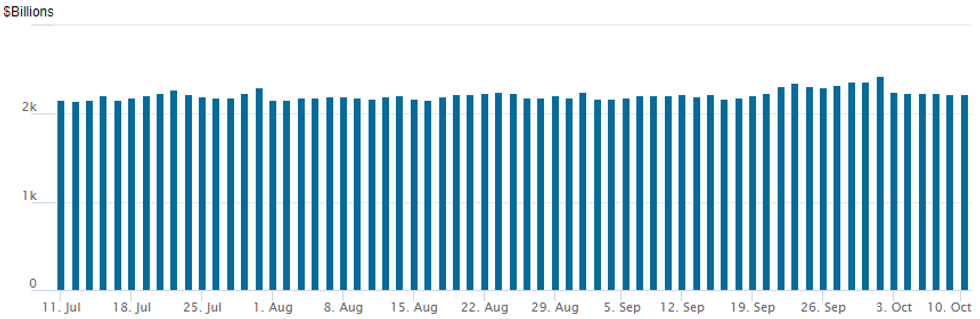

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,222.479B w/ 100 counterparties vs. $2,226.950B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Better volumes resumed Tuesday with participants back from extended holiday weekend, outright put and put spreads outpacing calls on two-way flow.- Large Eurodollar spd included a sale of 40,000 Dec 95.12.95.50 put spds from 26.0 to 25.5 - rolling down the 95.50 strike. Salient SOFR options Block had an account purchase +20,000 SFRH3 95.62/96.25 call spds 5.5 over SFRH3 94.62/95.00 put spds.

- Some chunky call trades reported, notable buyer of 40,000 Jan Eurodollar 95.25/95.43/95.81 broken call flys for 0.5 credit - looking to capitalize on a slow grind higher in underlying futures into early 2023 (looking for rate hike pricing to cool).

- SOFR Options:

- Block, +20,000 SFRH3 95.62/96.25 call spds 5.5 over SFRH3 94.62/95.00 put spds

- Block, 10,000 SFRV2 95.50/95.56 put spds, 3.0 ref 95.53

- Block, -7,500 SFRV2 95.56 puts, 7.0 ref 95.54

- 11,300 SFRX2 96.00 calls

- 6,000 SFRV2 95.25/95.87 strangles

- Eurodollar Options:

- Block another -10,000 Dec 95.12/95.50 put spds down to 25.5

- BLOCK, total -30,000 Dec 95.12/95.50 put spds, 26.0 ref 95.15 to -.145

- +40,000 Jan 95.25/95.43/95.81 broken call flys, 0.5 cr

- 5,000 Dec 95.12/95.37 put spds

- Treasury Options:

- 10,000 FVX2 114 calls, 6 ref 111-15

- +10,000 FVZ 106 puts, 43 ref 106-29.25 to -29.5

- 3,000 FVX2 107 puts, 16 ref 106-29.25

- 10,000 TYZ 111.5 puts, 138 ref 111-11

- Block, 7,500 FVZ2 106.25/107.25 put spds, 28.5

- Block, 10,000 FVZ2 106.25 puts, 49 ref 106-30.75

- Block, 5,000 TYX 110.5 puts, 38

- 2,000 TYX2 113.25 calls, 8

- 2,000 TYX 115.5 calls

- Blocks, 10,000 FVZ2 106.25 puts, 53-55 ref 106-24.75 to -22.75

Late Equity Roundup: BoE Bailey Ultimatum Saps Stocks and Rate Bid

Stock indexes reverse second half gains, trade weaker with Tsys after BoE Gov Bailey, speaking in DC, warned of "serious risk to financial stability in the UK". Currently, SPX eminis trade -40.5 (-1.12%) at 3584.25; DJIA -68.44 (-0.23%) at 29134.61; Nasdaq -179.5 (-1.7%) at 10362.85.

- Bailey also doubled down on message to pension funds is that "you've got three days left" reinforcing that the current intervention in markets is temporary and that "we will be out" by the end of the week.

- Other market watchers suggested the late reversal is do to factors outside the gilt market than actually from the market participants this is directly impacting based on the day's low take-up in purchase operations.

- Consumer Staples (+0.72%), Real Estate (0.41%) and Health Care (+0.18%) shares outperformed, stemming broader weakness in Communication Services (-2.16%), Information Technology (-2.09%) and Financials (-1.62%).

- Reminder: Q3 equity earnings kicks off with PepsiCo (PEP) tomorrow before the open, Walgreens Boots (WBA), Dominos (DPZ), Progressive (PGR), Delta (DAL) and Blackrock (BLK) early Wednesday.

E-MINI S&P (Z2): Bear Trigger Remains Exposed

- RES 4: 4234.25 High Aug 26

- RES 3: 4175.00 High Sep 13 and a key resistance

- RES 2: 3897.73 50-day EMA

- RES 1: 3820.00 High Oct 5

- PRICE: 3600.00 @ 1545ET Oct 11

- SUP 1: 3571.75 Low Oct 3 and the bear trigger

- SUP 2: 3558.97 1.382 proj of the Aug 16 - Sep 7 - 13 price swing

- SUP 3: 3506.38 1.50 proj of the Aug 16 - Sep 7 - 13 price swing

- SUP 4: 3453.78 1.618 proj of the Aug 16 - Sep 7 - 13 price swing

S&P E-Minis remains below last week’s high of 3820.00 on Oct 5. This level marks a key resistance, where a break is required to reinstate a short-term bullish theme. The broader trend remains down and attention is on the bear trigger at 3571.75, the Oct 3 low. A break of this level would confirm a resumption of the broader downtrend and open 3558.97, a Fibonacci projection.

COMMODITIES: Oil Slips As Demand Fears Linger

- Crude oil slips further, down circa 1.5% after yesterday’s decline but just about in Friday’s range as part of last week’s surge. Biden has kicked off re-evaluating the US relationship with Saudi Arabia after it led OPEC+’s decision for a planned slashing in oil output whilst Mexico has begun its Hacienda Hedge, purportedly locking in circa $75/bbl for 1H23.

- WTI is -1.6% at $89.67 with a session low of $88.35 holding above support at the 50-day EMA of $87.53, whilst resistance remains at $93.64 (Aug 10 high).

- Brent is -1.7% at $94.49, also holding above support at the 50-day EMA of $92.60.

- Gold is +0.6% at $1678.8, gaining on USD weakness on the day after a solid uptrend for the greenback, but remaining some way off the bull trigger at $1729.5 (Oct 4 high).

- On gas, the FT reports the EU wants to require companies to use a join gas purchase platform in order to help lower energy costs, hitting after close for EU energy markets with TTF +1.7% on the day.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/10/2022 | 2350/0850 | * |  | JP | Machinery orders |

| 11/10/2022 | 0000/2000 |  | KR | Bank of Korea policy decision | |

| 12/10/2022 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 12/10/2022 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 12/10/2022 | 0600/0700 | ** |  | UK | Trade Balance |

| 12/10/2022 | 0600/0700 | *** |  | UK | Index of Production |

| 12/10/2022 | 0600/0700 | ** |  | UK | Index of Services |

| 12/10/2022 | 0800/0900 |  | UK | BOE Haskel Keynote Speech at The Productivity Institute | |

| 12/10/2022 | 0900/1100 | ** |  | EU | Industrial Production |

| 12/10/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 12/10/2022 | 0930/1030 |  | UK | BOE FPC Sept 30 meet minutes | |

| 12/10/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 12/10/2022 | 1135/1235 |  | UK | BOE Pill in Conversation with SCDI | |

| 12/10/2022 | - |  | EU | ECB Lagarde & Panetta IMF/World Bank Annual Meetings | |

| 12/10/2022 | 1230/0830 | *** |  | US | PPI |

| 12/10/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 12/10/2022 | 1330/1530 |  | EU | ECB Lagarde in Conversation with Tim Adams (IIF) | |

| 12/10/2022 | 1400/1000 |  | US | Minneapolis Fed's Neel Kashkari | |

| 12/10/2022 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/10/2022 | 1700/1800 |  | UK | BOE Mann Canadian Association for Economics Webinar | |

| 12/10/2022 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 12/10/2022 | 1745/1345 |  | US | Fed Vice Chair Michael Barr | |

| 12/10/2022 | 2230/1830 |  | US | Fed Governor Michelle Bowman |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.