-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI ASIA MARKETS ANALYSIS: Inflation Expectations Decline

- NY FED: Short-Term Inflation Expectations Decline; Perceived and Expected Credit Conditions Mostly Unchanged

- NY FED: BROADEST SHARE OF BANKS WITH WEAKER LOAN DEMAND SINCE '09, Bbg

- CHICAGO FED’S AUSTAN GOOLSBEE GETTING `VIBES' THAT A CREDIT SQUEEZE IS BEGINNING, Bbg

- GOOLSBEE: PRODUCER PRICES MOVED INTO DEFLATIONARY ENVIRONMENT, Bbg

- GOOLSBEE: FAILING TO RAISE DEBT CEILING WOULD BE GREVIOUS WOUND, Bbg

Key Links: MNI BRIEF: Fed Survey Shows Lending Standards Tightened In Q1 / MNI BRIEF: NY Fed Consumer Inflation Expectations

Tsys Off Lows, Heavy Issuance Weighed; SLOOS Lending Tightened

Just off late session lows, Tsys under deal-tied hedging pressure from heavier than expected corporate bond issuance today ($6B Merck 6pt and $2.25B Apple 5pt lead Monday's $20B+ issuance) on a mainly quiet session with London out for King Charles Coronation celebration.- Treasury futures traded lows following the release of the latest quarterly NY Fed Sr Loan Officer Survey (SLOOS) showed lending standards tightened across all sectors.

- Not a big surprise, banks reported a further tightening of lending standards in commercial and industrial loans, small business credit as well as commercial real estate in the first quarter, according to the Fed's latest Senior Loan Officer Survey released Monday, likely reflecting the fallout from U.S. regional banking turmoil that led to a number of bank failures.

- President Biden and House speaker McCarthy are expected to discuss the debt limit on Tuesday, while data focus is on CPI read for April on Wednesday and PPI on Thursday.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00469 to 5.05495 (+.03156 total last wk)

- 3M +0.03345 to 5.07218 (-.04259 total last wk)

- 6M +0.06484 to 5.01035 (-.13406 total last wk)

- 12M +0.09853 to 4.65213 (-.25548 total last wk)

- Daily Effective Fed Funds Rate: 5.08% volume: $112B

- Daily Overnight Bank Funding Rate: 5.06% volume: $278B

- Secured Overnight Financing Rate (SOFR): 5.06%, $1.517T

- Broad General Collateral Rate (BGCR): 5.03%, $569B

- Tri-Party General Collateral Rate (TGCR): 5.03%, $558B

- (rate, volume levels reflect prior session)

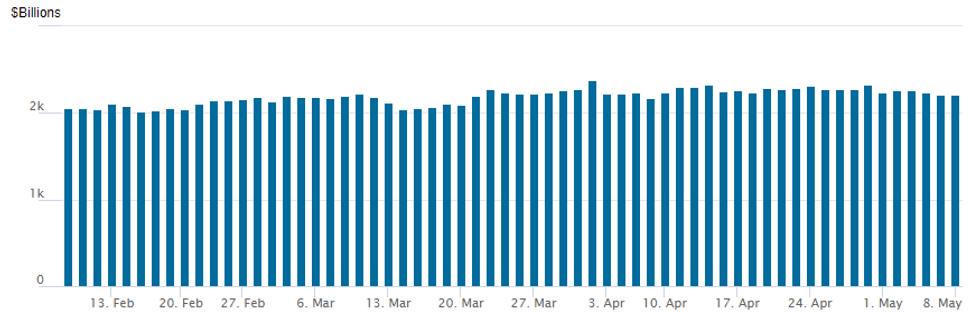

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips back to $2,217.601B w/ 104 counterparties, compares to prior $2,207.415B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTIONS SUMMARY

SOFR Options:

+2,500 SFRQ3 94.75/95.06/95.25 broken put flys, 0.75

+5,000 OQM3 97.00 calls, 17.5 ref 96.69/0.34%

+3,000 OQZ3 96.87 puts, 45 vs. 97.095/0.40%

2,000 OQM3 96.06/96.37/96.62 broken put flys

+10,000 SFRM 95.00/95.50 call spds, 4.5

7,250 SFRM3 94.68/94.81/94.93 2x3x1 put flys

1,000 SFRM3 94.75/945.87/95.00 2x3x1 put flys ref 94.95

1,000 SFRM3 94.75/94.87 2x1 put spds, ref 94.95

Treasury Options:

Block, 7,500 TYM3 115.5 calls 13 over FVM3 110.25 calls

-2,000 TYM 116.5 calls, 26 ref 115-14

+20,000 FVM3 108 puts, 2.5 to 3 ref 110-01.25/0.07%

+6,250 TYM3 115.25116.25 call spds 0.0 over114.25 puts

-14,000 FVM3 109.75/110.25 put spds, 17.5 ref 110-00.5 to 00

3,000 TY Wednesday weekly 114.5/115.25 put spds vs. 116.5/117 call spds

EGB CASH CLOSE: Reversing moves seen in equities

- EGBs have generally reversed moves in equities seen today with little liquidity in the trading session given the public holiday in the UK.

- Indeed, moves in 10-year Bunds have been more measured than those seen in 10-year USTs today with the former up 2.6bp versus the 5.3bp move seen in 10-year USTs at the time of writing. The limited moves seen in Bunds versus USTs may be partly due to the disappointing German industrial production print seen this morning.

- There has also been a different move in curves with German 2s10s flattening (in contrast to the modest steepening seen in US 2s10s).

- Spreads have widened a little today for both semi-core and peripherals with 10-year BTP-Bund spreads over 2bp wider on the day at writing.

- Bund futures are down -0.34 today at 135.57 with 10y Bund yields up 2.8bp at 2.317% and Schatz yields up 4.4bp at 2.607%.

- BTP futures are down -0.45 today at 114.42 with 10y yields up 4.9bp at 4.238% and 2y yields up 3.8bp at 3.295%.

- OAT futures are down -0.35 today at 129.78 with 10y yields up 3.1bp at 2.905% and 2y yields up 3.7bp at 2.778%.

Equities Roundup, Energy and Regional Banks Outperform

Stocks have drifted off midday lows, near early session highs on narrow range: S&P E-Mini Futures up 5.5 points (0.13%) at 4155.75; DJIA down 39.36 points (-0.12%) at 33637.09; Nasdaq up 24.8 points (0.2%) at 12258.85.

- Energy, Communication Services and Financial sectors still outperforming, Energy shares supported by a rebound in crude (WTI +1.75 at 73.09), Financials as regional bank stocks continue to recover from last week's selling (PacWest Bancorp +4% at the moment vs. over 30% on the open).

- From a technical point of view, SPX is still well above support at 4062.25 Low May 4 and key near-term support. On the flipside, a continuation higher would refocus attention on key resistance and the bull trigger at 4206.25, the May 1 high. A break of this level would confirm a resumption of the bull trend that started Mar 13.

- Quarterly earnings resume after the close: Trex, Devon Energy, McKesson Corp, Lucid Group, Talos Energy, Diversified Healthcare Trust, Palantir Technologies, Western Digital Corp, International Flavors & Fragrances and PayPal Holdings.

E-MINI S&P TECHS: (M3) Strong Bounce Defines Key Short-Term Support

- RES 4: 4288.00 High Aug 19 2022

- RES 3: 4244.00 High Feb 2 and a medium-term bull trigger

- RES 2: 4223.00 High Feb 14

- RES 1: 4163.25/4206.25 High May 5 / 1

- PRICE: 4154.75 @ 1445ET May 8

- SUP 1: 4062.25 Low May 4 and key near-term support

- SUP 2: 4052.50 Low Mar 30

- SUP 3: 4022.75 50.0% retracement of the Mar 13 - May 1 bull leg

- SUP 4: 4006.00 Low Mar 29

S&P E-minis reversed course Friday and prices have climbed back above the 50-day EMA, which intersects at 4099.70. A continuation higher would refocus attention on key resistance and the bull trigger at 4206.25, the May 1 high. A break of this level would confirm a resumption of the bull trend that started Mar 13. Key support has been defined at 4062.25, the May 4 low. A break of this level would be bearish.

COMMODITIES

- WTI Crude Oil (front-month) up $1.76 (2.47%) at $73.11

- Gold is up $5.39 (0.27%) at $2022.19

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/05/2023 | 2301/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 09/05/2023 | 0130/1130 | *** |  | AU | Retail trade quarterly |

| 09/05/2023 | 0645/0845 | * |  | FR | Foreign Trade |

| 09/05/2023 | 0800/1000 |  | EU | ECB Lane in Policy Panel at IMF event | |

| 09/05/2023 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 09/05/2023 | 1230/0830 |  | US | Fed Governor Philip Jefferson | |

| 09/05/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 09/05/2023 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 09/05/2023 | 1605/1205 |  | US | New York Fed's John Williams | |

| 09/05/2023 | 1700/1900 |  | EU | ECB Schnabel Lecture at Hessischer Kreis e.V. | |

| 09/05/2023 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.