-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Heavy Short End Sales Weighs on Rate Cut Odds

MNI ASIA MARKETS ANALYSIS: Curves Flatter Ahead Inauguration

MNI ASIA MARKETS ANALYSIS: Inflation Outlook Softening

HIGHLIGHTS

- ECB'S RENH SAYS RATES WILL STILL HAVE TO RISE SIGNIFICANTLY, Bbg

- GOLDMAN'S CURRIE SEES OIL AT $110 A BARREL BY Q3 ON CHINA, Bbg

- U.S. military tanks at Dutch port en route to NATO frontier, Reuters

- FAA ORDERED AIRLINES TO PAUSE DOMESTIC DEPARTURES UNTIL 9AM ET, Bbg

US TSYS: Curves Bull Flatten, Inflation Expectations Cool

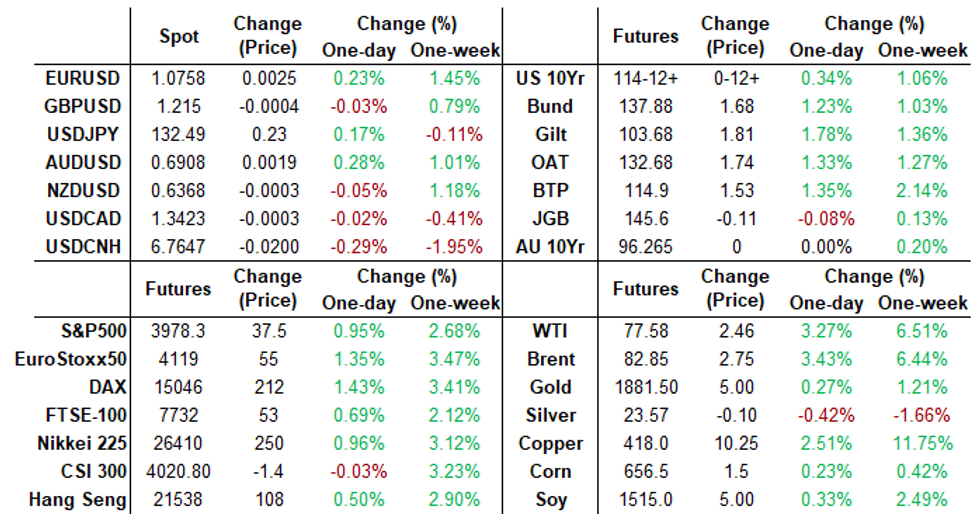

Tsys futures near session highs after the bell, 30YY currently 3.6782% (-.0758), yield curves unwinding Tue's steepening (2s10s -4.602 at -68.070).

- Bonds bid with EGBs, underscored by MNI exclusive story: ECB Doves Eye Smaller Hikes As Inflation Falls: "more dovish officials are prepared to seize on an expected slide in headline inflation from the spring to argue for a slowdown in the pace of tightening, Eurosystem officials told MNI."

- Limited economic data on day (MTG REFIS +5% SA; PURCH INDEX -1%). Focus on Thu's CPI read: MoM (0.1%, -0.1%); YoY (7.1%, 6.5%). Post data Fed speak Thu w/ StL Fed Bullard, on eco/mon-pol, Q&A at 1130ET, Richmond Fed Barkin at 1240ET.

- Carry-over corporate debt issuance and pre-auction short selling ahead $32B 10Y note auction re-open helping keep prices contained. Tsy futures bounce higher after $32B 10Y note auction re-open (91282CFV8) stops through w/ 3.575% high yield vs. 3.580% WI; 2.53x bid-to-cover vs. 2.31x prior.

- Indirect take-up 67.02% vs. 59.45% prior; direct bidder take-up 17.92% from 18.70% prio, primary dealer take-up 15.06% vs. 21.86%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00458 to 4.31329% (-0.00014/wk)

- 1M -0.00643 to 4.42343% (+0.02186/wk)

- 3M +0.00914 to 4.81500% (+0.00514/wk)*/**

- 6M -0.01386 to 5.12800% (-0.06900/wk)

- 12M -0.01614 to 5.41757% (-0.14140/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.81500% on 1/11/23

- Daily Effective Fed Funds Rate: 4.33% volume: $109B

- Daily Overnight Bank Funding Rate: 4.32% volume: $293B

- Secured Overnight Financing Rate (SOFR): 4.31%, $1.124T

- Broad General Collateral Rate (BGCR): 4.27%, $437B

- Tri-Party General Collateral Rate (TGCR): 4.27%, $407B

- (rate, volume levels reflect prior session)

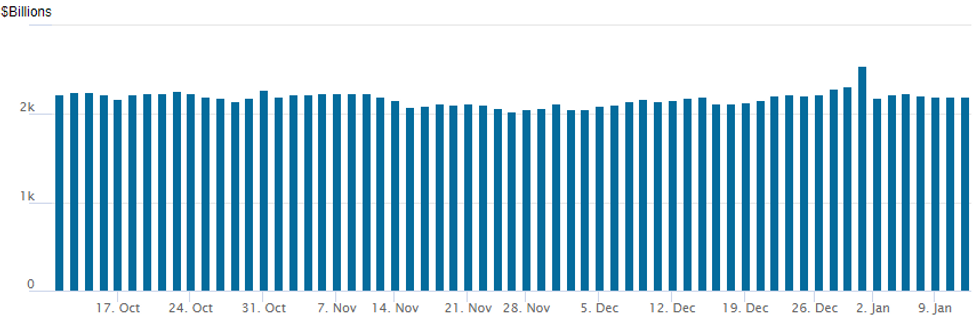

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage rebounds to $2,199.170B w/ 99 counterparties vs. prior session's $2.192.942B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

FI option volume surged Wednesday, driven largely by upside call and call spreads as underlying futures climbed back near middle of the week's range. Yield curves bull flattened as rate futures reacted to softer inflation metrics and prospect of less aggressive forward rate hikes. Salient SOFR trade: buyer over 100,000 SFRZ3 98.00/98.50 call spds, 1.5 ref 95.63.- SOFR Options:

- Block, 19,979 SFRF 95.12 calls, 4.25 vs. 95.125/0.50%

- Block, +10,000 SFRU3 95.00/95.25 3x2 put spds, 7.0

- Block, 5,000 SFRG3 94.93/95.00/95.06 put flys, 0.75 net vs. 95.09

- 5,000 SFRK3 94.68/94.93/95.18 put flys ref 95.08

- Block, 10,000 SFRZ3 98.00/98.50 call spds, 1.5 ref 95.63 - adds to 100k traded on screen earlier

- 5,000 SFRH3 95.31/95.43 call spds ref 95.125

- +100,000 SFRZ3 98.00/98.50 call spds, 1.5 ref 95.63

- Block, 5,000 OQH3 95.50/95.75 put spds, 5.75 on splits ref 96.095

- Block, 6,239 SFRG3 95.18/95.43 4x5 call spds, 13.0 vs. 95.115/100%

- Block/screen 6,500 OQF3 96.25 calls vs. 2QF3 97.18 calls

- Block, 2,500 OQF3 96.31 calls .5 over 2QF3 97.25 calls

- 2,500 2QG3 97.37/97.62 call spds ref 97.065

- Block, 2,000 SFRF3 95.12/95.25 call spds, 3.0 ref 95.12

- 1,000 SFRH3 94.75/95.00/95.25/95.50 call condors ref 95.12

- 1,000 SFRH3 95.37/95.50/95.62 call trees ref 95.12

- 1,125 SFRH3 95.37/95.50/95.56 call trees ref 95.12

- 1,395 SFRZ3 94.50/95.00/95.50 put flys, ref 95.665

- 1,500 OQG3 95.5/95.62/96.00 broken put flys, ref 96.15

- Treasury Options:

- Over 14,800 TYG3 114.75 calls, 33 ref 114-09.5

- Over 24,000 FVG3 109.5 calls, 22 ref 109-05.75

- 5,000 TYG3 115.5/116.5 call spds, 12 ref 114-10.5

- 22,300 TYG 111 puts, 2 ref 114-11 to -08.5

- 1,800 TYG 112 puts ref 114-11.5

- 1,700 TYG 113.25 puts vs. 114.5/115.5 call spds ref 114-06.5

EGBs-GILTS CASH CLOSE: Broad Rally As Doves Have Their Day

EGB and Gilt yields fell sharply Wednesday amid largely dovish ECB revelations.

- Early in the session, EGBs rallied as ECB hawk Holzmann signalled support for a cautious approach on QT. And just before the cash close, MNI published an ECB sources piece pointing to potential for smaller hikes later in the year as inflation fades.

- ECB terminal rate pricing fell 11bp on the session (below 140bp hikes by July) and combined with Holzmann's comments, periphery EGB spreads fell sharply. GGBs outperformed, while 10Y BTP/Bund spreads printed below 180bp for just the third time since April 2022.

- SONIA rallied as well, with the Gilt curve flattening, with multiple factors cited including follow-through from Tuesday's huge BOE Financial Stability Sales operation.

- Some of the rally was also attributed to position squaring ahead of US CPI, which is Thursday's (indeed the week's) focus; we also get an appearance by BoE's Mann and the ECB's economic bulletin.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 6.6bps at 2.588%, 5-Yr is down 12.2bps at 2.222%, 10-Yr is down 10.4bps at 2.204%, and 30-Yr is down 11bps at 2.139%.

- UK: The 2-Yr yield is up 5.2bps at 3.53%, 5-Yr is down 13bps at 3.335%, 10-Yr is down 14.8bps at 3.409%, and 30-Yr is down 15.1bps at 3.756%.

- Italian BTP spread down 8.3bps at 183.1bps / Greek down 12bps at 197bps

EGB Options: Large Bund Upside And Euribor Vol Selling Wednesday

Wednesday's Europe rates / bond options flow included:

- RXH3 140/142cs bought for 43.5 in 10k

- RXG3 133/131/130p fly, sold at 8.5 in 1k

- RXG3 136.0/135.5 put spread bought for 13 in 3k

- ERZ3 96.62^ sold at 75.5 in 20k

- ERH3 97.12/97.00/96.875/96.75 p condor bought for 8 in 6k

FOREX: EURCHF Back Above Parity Following Technical Breach

- While most major currencies traded with a subdued tone on Wednesday ahead of key US data on Thursday, the Swiss Franc has shown notable weakness following a key technical break higher for EURCHF.

- EURCHF is up 1.12% approaching the APAC close and is the standout mover in today’s session. Continued Euro resilience has bolstered the pair however the move certainly seems technical in nature, following the break of a confluence of resistance levels. First of all, the 0.9925 December highs which sparked topside momentum and has now seen us trade above the July/Oct highs as well as pivot resistance at the March 2023 lows of 0.9972.

- Decent follow through has seen the pair trade above parity for the first time since July 2022 with immediate resistance next seen at 1.0046, the July 04 high. Swiss weakness filtered through to USDCHF which reversed a solid portion of the losses incurred since last Friday’s US data.

- Elsewhere, currency markets have picked up where they left off Tuesday with risk proxies moderately outperforming and EUR/USD holding well above the 1.07 handle and extending to fresh trend highs above 1.0760 on the US cash equity open before consolidating around this level.

- AUD's 0.33% gains follow a modest beat on expectations for November CPI this morning, which edged higher to 7.3% Y/Y and 5.6% on a trimmed mean basis. This keeps a bullish theme intact, with the pair having cleared 0.6893, the Dec 13 high this week to confirm a resumption of the uptrend that started Oct 13. The focus is on 0.6976, a Fibonacci projection. Key support lies at 0.6688, the Jan 3 low.

- Chinese CPI/PPI data is due overnight, however, markets may remain in a holding pattern ahead of Thursday's key US CPI release.

FX: Expiries for Jan12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0650(E1.2bln), $1.0670-90(E3.9bln), $1.0750(E2.4bln), $1.0770-75(E1.5bln)

- USD/JPY: Y140.00($1.3bln)

- AUD/USD: $0.6825($511mln)

- USD/CAD: C$1.2900($1.8bln), C$1.3650($1.4bln), C$1.4000($1.3bln)

Late Equity Roundup: Near Late Highs, Real Estate Outperforms

Major indexes continue to drift higher in late trade, Real Estate and Consumer Discretionary sectors continue to outperform. SPX eminis currently trades +38 (0.96%) at 3978.75; DJIA +206.63 (0.61%) at 33912.21; Nasdaq +137.6 (1.3%) at 10880.85.

- SPX leading/lagging sectors: Real Estate sector extended early gains (+3.29%) lead by hotel/resort, industrial and specialized real estate investment trusts. Consumer Discretionary up next (+2.13%) lead by automakers (TSLA +2.70%) and internet retailers (AMZN +4.66%, ETSY +5.32% EBAY +3.22%).

- Laggers: Consumer Staples (-0.11%), Health Care and Energy sectors both +0.35%. Staples see household/personal products underperforming food retailers, Walgreens Boots (WBA) +1.20%.

- Dow Industrials Leaders/Laggers: Goldman Sachs (GS) lead late +7.94 at 365.30, Home Depot (HD) +7.52 at 328.15, United Health (UNH) +6.49 at 492.49, Microsoft (MSFT) +5.52 at 234.37. Laggers: Salesforce.com (CRM) -3.41 at 144.03, PG -1.59 at 150.30, JNJ (-0.83 at 174.33).

E-MINI S&P (H3): Testing Resistance

- RES 4: 4180.00 High Dec 13 and the bull trigger

- RES 3: 4043.00 High Dec 15

- RES 2: 4000.00 Round number resistance

- RES 1: 3973.25 High Jan 9

- PRICE: 3955.50 @ 14:25 GMT Jan 11

- SUP 1: 3788.50/78.45 Low Dec 22 / 61.8% of Oct 13-Dec 13 uptrend

- SUP 2: 3735.00 Low Nov 3

- SUP 3: 3670.00 76.4% retracement of the Oct 13 - Dec 13 uptrend

- SUP 4: 3735.00 Low Oct 21

S&P E-Minis are trading higher today and approaching Monday’s 3973.25 high print. Key resistance at 3918.27, the 50-day EMA, has been breached. A continuation higher and a clear break of this EMA would suggest potential for a stronger recovery and highlight a possible reversal that would open 4000.00 next. On the downside, a break lower would instead confirm a resumption of the downtrend - the bear trigger is 3788.50, the Dec 22 low.

COMMODITIES: Oil Clears 20-day EMA With Demand Hopes, GS Targets $110/bbl

- Crude oil has seen sizeable gains today, holding onto gains and even extending them after a shakeout with EIA US inventory data showing a large build in crude stocks.

- GS targets $110 Brent oil by Q3 if China and other Asian countries fully reopen (whilst also targeting copper $11,500 by the end of 2023 having topped $9,000/ton for the first time since June this week).

- WTI is +2.7% at $77.14, having cleared the 20-day EMA of $76.37 to next eye $78.50 (50-day EMA).

- Brent is +2.8% at $82.33, having cleared the 20-day EMA of $81.59 to next eye $83.68 (50-day EMA).

- Gold is +0.04% at $1877.85, fluctuating through the session with little clear new trend for the US dollar index ahead of tomorrow’s US CPI report. Resistance remains at $1896.5 (61.8% retrace of the Mar-Sep bear leg).

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/01/2023 | 0030/1130 | ** |  | AU | Trade Balance |

| 12/01/2023 | 0130/0930 | *** |  | CN | Producer Price Index |

| 12/01/2023 | 0130/0930 | *** |  | CN | CPI |

| 12/01/2023 | 0700/0800 | ** |  | NO | Norway GDP |

| 12/01/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 12/01/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 12/01/2023 | 1330/0830 | *** |  | US | CPI |

| 12/01/2023 | 1345/0845 |  | US | Philadelphia Fed's Patrick Harker | |

| 12/01/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 12/01/2023 | 1630/1130 |  | US | St. Louis Fed's James Bullard | |

| 12/01/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 12/01/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 12/01/2023 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/01/2023 | 1700/1200 | ** |  | US | USDA GrainStock - NASS |

| 12/01/2023 | 1700/1200 | *** |  | US | USDA Winter Wheat |

| 12/01/2023 | 1700/1700 |  | UK | BOE Mann Lecture at University of Manchester | |

| 12/01/2023 | 1740/1240 |  | US | Richmond Fed President Tom Barkin | |

| 12/01/2023 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 12/01/2023 | 1800/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 12/01/2023 | 1900/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.