-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI ASIA MARKETS ANALYSIS:ISM Prices Paid Higher Than Expected

HIGHLIGHTS

- MNI G20: Blinken To Push Ambivalent G20 For Greater Ukraine Support

- MNI SECURITY: Israeli Officials To Visit US Amid Deepening Iran Nuclear Crisis

- MNI EU: EU Countries Call For Overhaul Of Single Market To Increase Competitiveness

- ECB NAGEL: SIGNIFICANT HIKES BEYOND MARCH ARE NECESSARY .. ECB POLICY MUST BE MORE STUBBORN THAN INFLATION, Bbg

US TSYS: High ISM Prices Paid Helps Push 2YY Over 4.0%

Tsys near session lows following volatile first half. Bonds discounted a rally that followed balanced BOE Gov Bailey policy comments overnight, contrasting with more hawkish central bank stances. Tsy sell-off accelerated after midmorning ISM data, particularly jump in prices paid to 51.3 from 44.5 prior (46.5 est).

- Modest react to MN Fed Kashkari stating "overtightening policy definitely a risk", but stressed undertightening to combat inflation is worse than overtightening. Kashkari leaning toward raisng terminal dot to 5.4%.

- Federal Reserve Bank of Atlanta President Raphael Bostic said Wednesday he sees the need for more rate increases amid high inflation and then likely holding them steady well into next year. "I think we will need to raise the federal funds rate to between 5 and 5.25% and leave it there until well into 2024," he said in prepared remarks.

- Yield curves bear steepened as 2s drew technical buying after TUM3 hit 101-20.62 low (101-22.38 last), 2YY hit 4.9014% -- highest since May 2007.

- STIR: Fed funds implied hikes off earlier highs: Mar'23 30.5bp vs. 31.9bp high, May'23 cumulative 57.6bp vs. 58.5bp (+2.4) to 5.154%, Jun'23 76.9bp (+2.4) to 5.347%, terminal at 5.465% in Oct'23 vs. 5.50% earlier high.

SHORT TERM RATES

NY Federal Reserve/MNI

- O/N +0.00385 to 4.55714% (-0.00457/wk)

- 1M +0.00357 to 4.67300% (+0.03814/wk)

- 3M +0.01014 to 4.98114% (+0.02771/wk)*/**

- 6M +0.02471 to 5.28814% (+0.05300/wk)

- 12M +0.00457 to 5.68614% (+0.04743/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 4.96243% on 2/27/23

- Daily Effective Fed Funds Rate: 4.57% volume: $103B

- Daily Overnight Bank Funding Rate: 4.57% volume: $269B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.230T

- Broad General Collateral Rate (BGCR): 4.52%, $462B

- Tri-Party General Collateral Rate (TGCR): 4.52%, $444B

- (rate, volume levels reflect prior session)

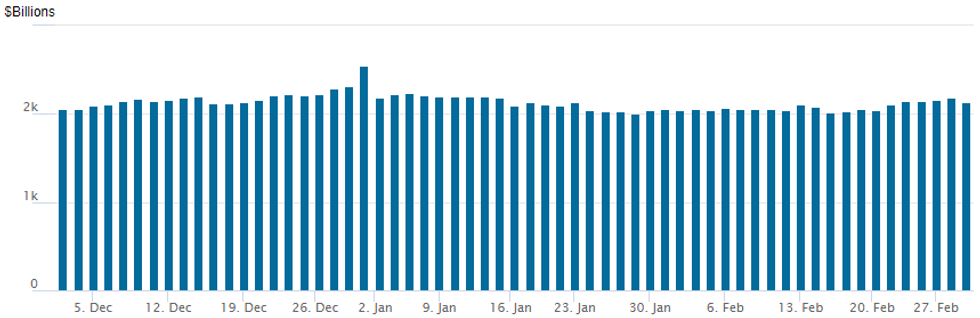

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,133.950B w/ 100 counterparties vs. prior session's $2,188.035B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Consistently better put structure trade Wednesday as underlying futures sold off as implied rate hikes rise (terminal at 5.455% in Oct'23 vs. 5.50% earlier high).- SOFR Options:

- Block, 5,000 SFRU3 94.25/94.50 2x1 put spds, 0.0 ref 94.535

- Block, 20,000 SFRU3 93.87/94.68 put spds, 28.5 ref 94.555

- Block, 7,000 SFRZ3 93.75/94.25/95.00 broken put flys, 18.0 ref 94.685

- Block, total 15,000 SFRZ3 95.00/95.25 put spds, 17.5

- Block, 15,000 OQM3 94.50/94.87/95.50 broken put flys, 18.5 ref 95.37

- Block, 10,000 SFRZ3 94.50/95.50 strangles, 37.0 ref 94.67

- Block, 15,000 SFRZ3 94.25/95.25 strangles, 32.0-33.5 ref 94.67

- Block, +10,000 SFRZ3 94.00/94.50 put spds, 15.5 ref 94.73

- Block, +10,000 SFRU3 94.00/94.50 put spds, 15.5 ref 94.575

- Block, -12,000 2QH3 96.25 puts, 8.5 ref 96.31

- Treasury Options:

- 3,500 TYJ3 110.75/111 put spds, 7 ref 111-01

- over 5,600 FVJ 107 calls, 30 ref 106-20.5

- 2,000 FVJ3 108.25/108.75/109.25 call flys ref 106-28.25

- 6,000 TYK3 114 calls, 22 ref 111-11

- 2,500 FVJ3 104.5/105.5 put spds, 8 ref 106-29

- Block, 9,000 TYJ3 109 puts, 12 vs. 111-15/0.15%

- 1,500 USK3 114/118 put spds, 22 ref 124-23

FOREX: Greenback Consolidates Early Weakness, CNH Surges

- The prices paid sub-component of the US ISM manufacturing data came in above expectations which prompted a partial recovery for the USD during early US trade. However, overarching sentiment from the Chinese PMI releases overnight are working against the greenback on Wednesday and the USD index look set to post a 0.55% daily decline as we approach the APAC crossover.

- The stronger China PMI data overnight sees USD/CNH (-1.20%) trading comfortably below 6.90, having taken out support at the 200-dma of 6.9145. Downside moves have also breached 6.8781, marking the 38.2% retracement for the Jan - Feb upleg.

- Top of the G10 leaderboard sits the New Zealand dollar, rising 1.25% and benefitting predominantly from the more optimistic China backdrop. Lagging its antipodean counterpart is AUD, relatively depressed by lower domestic GDP and CPI data overnight.

- Firmer regional CPI releases in Germany underpinned the single currency alongside further hawkish rhetoric for a few ECB officials. EURUSD is up 0.9% with initial resistance at 1.0645 now acting as immediate support for the pair.

- For now, short-term gains are considered corrective, however, a continuation higher would expose resistance at 1.0803, the Feb 14 high and a key short-term level. Clearance of this hurdle would strengthen a bullish case. On the downside, a break of 1.0533, Monday’s low, would resume the recent bear cycle and open 1.0484, Jan 6 low and key support.

- In the emerging market space, USDMXN continues to extend lower following the break of the key support at 18.50, narrowing the gap with the 18.00 mark and the 2018 lows at 17.9401.

- Thursday’s key data will be the release of Eurozone HICP where the February flash estimate is expected to fall to 8.3% from a prior reading 8.6%.

FX: Expiries for Mar02 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0545(E583mln), $1.0595-10(E2.0bln), $1.0620-25(E1.8bln), $1.0660(E797mln), $1.0800(E847mln)

- USD/JPY: Y132.00($1.1bln), Y132.50-60($1.2bln), Y136.00($770mln), Y136.65($855mln)

Late Equity Roundup: Real Estate, Utilities Weighing

Stocks inching lower in late trade, still inside relatively narrow range as opposed to the sharp post-data sell-off in Tsys as implied rate hikes rise (terminal at 5.455% in Oct'23 vs. 5.50% earlier high). SPX eminis currently trading -25 (-0.63%) at 3951; DJIA -70.32 (-0.22%) at 32588.98; Nasdaq -85.9 (-0.7%) at 11370.29.

- SPX leading/lagging sectors: Real Estate (-2.00%) reversed prior session gains as office, health care and residential REITS underperformed, Utilities (-1.85%) weighed by multi- and gas utility shares (PEG -2.85%, DTE -2.5%, CMS -2.46%). Consumer Discretionary follows (-1.70%) weighed by retailing shares (LOW -6.4%, AAP -5.17%, TGT -4.04%).

- Leaders: Energy (+1.90%) and Materials (+1.00%) continued to outperform, energy equipment and services buoyed the former (VLO +4.74%, SLB +2.97%, HAL +3.17%) while metals and mining shares supported the latter (FCX +4.91%, NUE +2.62%, NUE +2.47%).

- Dow Industrials Leaders/Laggers: Caterpillar (CAT) +7.45 at 247.00, Amgen +2.96 at 234.62, MMM +2.35 at 110.09. Laggers: Home Depot (HD) -6.25 at 290.29, Goldman Sachs (GS) -4.94 at 346.74, Microsoft (MSFT) -2.58at 246.84..

COMMODITIES

- WTI Crude Oil (front-month) up $0.62 (0.8%) at $77.66

- Gold is up $11.78 (0.64%) at $1838.51

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/03/2023 | 1000/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 02/03/2023 | 1000/1100 | *** |  | IT | HICP (p) |

| 02/03/2023 | 1000/1100 | *** |  | EU | HICP (p) |

| 02/03/2023 | 1000/1100 | ** |  | EU | Unemployment |

| 02/03/2023 | 1230/1330 |  | EU | ECB Schnabel at MMCG Meeting | |

| 02/03/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 02/03/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 02/03/2023 | 1330/0830 | ** |  | US | Non-Farm Productivity (f) |

| 02/03/2023 | 1500/1500 |  | UK | BOE Pill Speech at Wales Week | |

| 02/03/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 02/03/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 02/03/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 02/03/2023 | 2100/1600 |  | US | Fed Governor Christopher Waller | |

| 03/03/2023 | 2200/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

| 02/03/2023 | 2300/1800 |  | US | Minneapolis Fed's Neel Kashkari | |

| 03/03/2023 | 2350/0850 | ** |  | JP | Tokyo CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.