-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Limited React to Russia Turmoil

- MNI RUSSIA: UK Foreign Sec Claims 'Cracks Emerging' In Russian Support For War

- MNI RUSSIA: Prigozhin: "We Didn't March To Overthrow Russia's Leadership":

- MNI RUSSIA: Wagner Mutiny Leaves Putin In Weakened Position

- US PRES BIDEN: US WAS NOT INVOLVED IN RUSSIA SITUATION, Bbg

Key Links:MNI POLITICAL RISK - Long-Term Risk To Putin Increases / MNI US-RUSSIA: Biden: "Too Early To Say Where Russia Situation Is Going" / US Treasury Auction Calendar: 2Y Stops Through

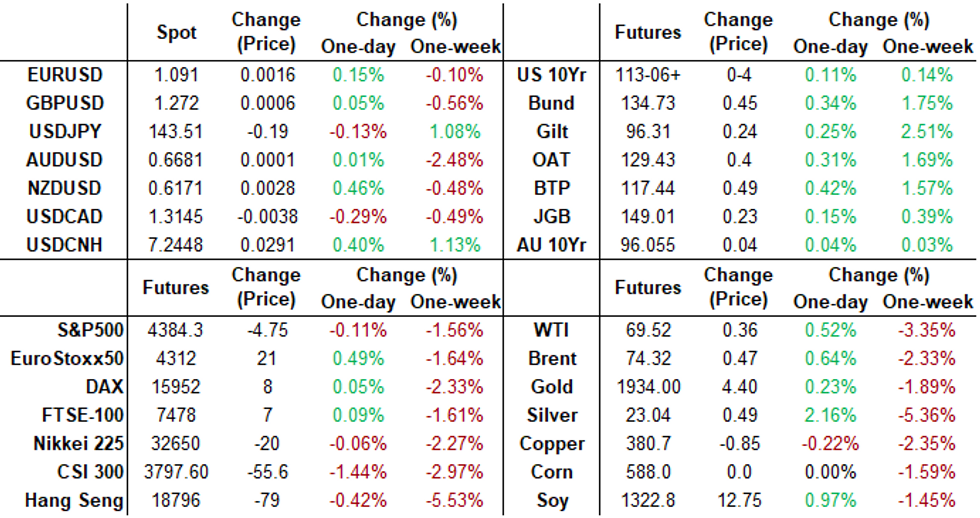

US TSYS: Firmer Ahead Tuesday Data, ECB CB Forum in Sintra, Portugal

- Treasury futures holding modestly firmer after the bell, near the lower half of a narrow session range - no particular headline driver for futures reversal off early session highs, however.

- Some factors at play. however, included incoming Treasury auctions ($65B 13W, $58B 26W bill auctions, $42B 2Y Note auction -- trades through: 4.670% high yield vs. 4.680% WI), while a pick-up in high-grade corporate debt issuance could be a factor for the dip in Treasury futures amid rate lock-hedge sales.

- Early month/quarter-end positioning also mentioned, with nascent asset allocation from Treasury futures to stocks. Underscoring this morning's retreat, the Sep'23 10Y contract trend outlook remains bearish. Recently, support at 112-29+, the May 26 / 30 low.

- Treasury curves extend inversion this morning, 2s10s taps -104.521 low, nearing March 40+ low around -111.0. “Although the cash curves are closing in on recent troughs," Goldman Sachs analysts write the "OIS and SOFR swap curves are still some distance away. Some of this weakness is likely the result of an anticipation of heavy front-end supply, but we expect it will not remain contained to front-end swap spreads as the full extent of supply increases becomes clear.”

- Economic data picks Tuesday: Durable Goods, Housing Metrics, Cons Confidence. While there is a dearth of scheduled Fed speakers Tuesday, attention will be on the ECB's forum on central banking in Sintra, Portugal that kicks off tonight with ECB Pres Lagarde. LINK.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00364 to 5.08731 (+.00738 total last wk)

- 3M -0.00399 to 5.23471 (+.03186 total last wk)

- 6M -0.00867 to 5.32042 (+.03971 total last wk)

- 12M -0.02591 to 5.25769 (+.05398 total last wk)

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00457 to 5.06300%

- 1M +0.02943 to 5.17786%

- 3M -0.02314 to 5.52100% */**

- 6M -0.01672 to 5.67357%

- 12M -0.04058 to 5.88471%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.55743% on 6/12/23

- Daily Effective Fed Funds Rate: 5.07% volume: $135B

- Daily Overnight Bank Funding Rate: 5.06% volume: $284B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.389T

- Broad General Collateral Rate (BGCR): 5.03%, $605B

- Tri-Party General Collateral Rate (TGCR): 5.03%, $592B

- (rate, volume levels reflect prior session)

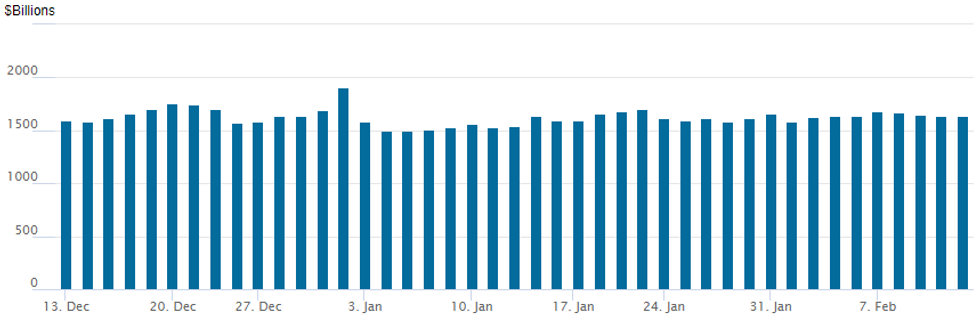

FED Reverse Repo Operation

FED Reverse Repo Operation

FED Reverse Repo OperationNY Federal Reserve/MNI

NY Fed reverse repo usage falls to $1,961.027B w/ 102 counterparties, compared to $1,969.380B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

Continued focus on upside calls in 2s, 5s and 10s reported Monday on otherwise muted volumes to start the new week. Underlying futures traded firmer all session after paring early session gains amid incoming Treasury and corporate debt issuance. SOFR Option trade proved more mixed, moderate put interest as underlying futures reversed course, traded weaker in Jun'23-Jun'24.

- SOFR Options:

- Block, 10,000 SFRU3 94.62/94.87 2x1 put spds, 8.0 ref 94.655

- over 11,600 SFRQ3 95.50 calls, ref 94.66

- Block, 9,000 SFRQ3 94.62 puts, 9.0 vs. 94.665/0.44%

- Block/screen 13,750 SFRZ3 96.00/96.50/97.00/97.50 call condors, 1.5 ref 94.80

- 1,000 OQN3 96.25/96.50/96.62/96.87 call condors, ref 95.94

- 2,000 SFRQ3 94.25/94.62/94.75 broken put flys ref 94.675

- 8,700 SFRN3 94.50/94.56/94.62 put trees, ref 94.675

- 4,200 SFRU3 95.00/95.50/96.00 call flys ref 94.675

- 2,000 SFRZ3 93.5/94.5/95.00 broken put trees ref 94.81

- 4,000 SFRQ3 94.62 puts ref 94.675

- Treasury Options:

- 1,200 TYQ3 113 straddles, 138

- 2,000 TYU 116 calls, 26 ref 113-13.5

- 1,400 FVQ3 109.5/110 call spds ref 108-00.5

- 3,500 FVQ3 109/110 call spds ref 108-00 to -00.25

- 2,000 USQ3 134/136 call spds, ref 128-16

- over 2,700 TYQ3 115 calls, 16 ref 113-11

- 2,000 TUQ3 102.5 calls, 9 ref 102-03.88

EGBs-GILTS CASH CLOSE: Greece Outperforms Post-Election

European core FI had a constructive if quiet start to a busy week Monday, with some modest flattening in both the German and UK curves.

- The German belly outperformed as a weaker-than-expected IFO reading added another piece of evidence pointing toward renewed economic deceleration.

- Bunds held those morning gains, with focus turning to the ECB's Sintra event, and of course national (starting with Italy on Wednesday) and Eurozone flash inflation prints.

- UK yields fell, led by a sharp drop at the 30Y segment as the Gilt market took a bit of a breather from last week's surprise 50bp BoE hike. Appearances by Pill and Bailey on Wednesday are the focus, with GDP on Friday.

- GGBs outperformed in the European space, with the 10Y spread vs Germany touching a post-2021 low following the ND's attainment of a parliamentary majority over the weekend as expected.

- Up next: ECB Pres Lagarde makes remarks after hours, and early Tuesday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.9bps at 3.087%, 5-Yr is down 4.6bps at 2.449%, 10-Yr is down 4.4bps at 2.309%, and 30-Yr is down 3bps at 2.374%.

- UK: The 2-Yr yield is down 1.7bps at 5.16%, 5-Yr is down 1.4bps at 4.557%, 10-Yr is down 1.9bps at 4.301%, and 30-Yr is down 6.5bps at 4.385%.

- Italian BTP spread up 1.5bps at 164.1bps / Greek down 1.4bps at 123.6bps

EGB Options: Mostly Upside Eyed With Eurozone Inflation Awaited Later This Week

Monday's Europe rates / bond options flow included:

- RXQ3 138.5/141cs, bought for 13 in 4k

- RXW 135/136cs, bought for 31 in 2.25k (weekly option, covers CPIs)

- ERZ3 97.00/98.00 call spread bought for 4 in 7.5k (v 96.025)

- SFIZ3 94.15/93.64ps, bought for 26.75 in 3k

- SFIH4 95.00/96.50cs, bought for 13.5 in 8k

FOREX: Japanese Yen Unable To Sustain Early Rally, USDCNH Extends Uptrend

- Despite an overall subdued session for global currency markets, the Norwegian krone stands out as the best performer, rising a little under 1%, whereas the Chinese Yuan has been the notable laggard.

- Initial price action on Monday saw the Japanese Yen outperform all others, receiving an early boost on the back of comments from the Japanese Chief Cabinet Secretary Matsuno, who added to recent rhetoric and stressed that "it's important for FX to move stably" and that "Japanese authorities are closely watching FX moves with a high sense of urgency".

- While USDJPY did come under pressure amid the headlines, the pair spent little time below the 143 handle before recovering well across the US open, and briefly trading back to unchanged around 143.70. The pair has edged slightly lower ahead of the APAC crossover, however, remains close to multi-month highs - last intervention phase was November 10th - as USDJPY traded around 146.50.

- USD/CNH {+0.40%) showed above 7.2300 for the first time this year, with the rally extending to highs of around 7.2450, Bulls are focused on the 28 Nov ’22 high (7.2592) after last week’s break and close above the well-defined uptrend channel resistance. Softer than pre-COVID level spending surrounding the Dragon Boat Festival holiday provided the latest batch of negative Chinese economic news. Markets will look to China’s official PMI data, due Friday, with continued focus on the need for deeper stimulus.

- Tuesday sees Canadian CPI as well as US durable goods and consumer confidence data. Later in the week, CPI data for Australia and the Eurozone will receive attention. Likely the market focus will be on the ECB Forum in Sintra, where on Wednesday Fed’s Powell, ECB’s Lagarde, BOJ’s Ueda and BoE’s Bailey all have a joint event.

FX: Expiries for Jun27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0895-15(E2.1bln), $1.1000(E603mln)

- AUD/USD: $0.6685-90(A$598mln)

- USD/CNY: Cny7.1750($860mln), Cny7.2150($686mln)

Late Equities Roundup: Paring Early Gains

- Stocks are inching lower in late trade, S&P E-Mini futures are currently trading near July 12 levels: S&P E-Mini Future down 6.75 points (-0.15%) at 4382.75, Nasdaq down 85.2 points (-0.6%) at 13407.76, while Dow shares outperformed: up 46.15 points (0.14%) at 33774.89.

- Communication Services Consumer Discretionary and Information Technology sectors underperforming. Interactive media and services shares underperformed: Goolgle -3.05%, Meta -3.00%, and Netflix -1.0% amid otherwise positive performance in Fox +1.3%, Warner Brothers +1.35% and Disney +1.3%.

- Leading gainers: Energy, Real Estate and Materials sectors outperformed Monday, oil refiners and distributor shares supported as crude prices gained slightly (WTYI +0.32 at 69.48): Maker Hughes +3.15%, Halliburton +3.1%, Hess Energy +2.3%, Occidental Petroleum +2.2%.

- The technical bull theme in S&P E-minis remains intact and last week’s pullback appears to be a correction. The move lower is allowing a recent overbought condition to unwind. Initial key support lies at the 20-day EMA, at 4359.21. A break of this average would strengthen a short-term bearish theme and signal scope for a deeper pullback. On the upside, the bull trigger is 4493.75, the Jun 16 high. A break would open 4506.23 the top of a bull channel.

SPX TECHNICALS: (U3) Latest Pullback Considered Corrective

- RES 4: 4556.71 2.382 projection of the May 4 - 19 - 24 price swing

- RES 3: 4532.08 2.236 projection of the May 4 - 19 - 24 price swing

- RES 2: 4506.23 Bull channel top drawn from the Oct 2022 low (cont)

- RES 1: 4493.75 High Jun 16 and the bull trigger

- PRICE: 4385.00 @ 14:40 ET Jun 26

- SUP 1: 4381.75/4359.21 Low Jun 13 / 20-day EMA

- SUP 2: 4274.27 50-day EMA

- SUP 3: 4154.75 Low May 24

- SUP 4: 4098.25 Low May 4 and a key support

A bull theme in S&P E-minis remains intact and last week’s pullback appears to be a correction. The move lower is allowing a recent overbought condition to unwind. Initial key support lies at the 20-day EMA, at 4359.21. A break of this average would strengthen a short-term bearish theme and signal scope for a deeper pullback. On the upside, the bull trigger is 4493.75, the Jun 16 high. A break would open 4506.23 the top of a bull channel.

COMMODITIES: Crude Holds Nudge Higher After Wagner Conflict

- Crude oil has seen a relatively narrow range for the session, with only modest gains on Friday’s close after tighter supply concerns on continued uncertainty following Wagner movements and apparent climbdown were partly offset by weaker demand concerns.

- Bloomberg scenario analysis showed that OPEC+ voluntary output cuts could deepen the oil-market deficit to about 2mbpd in 2H 2023. They see the market deficit combining with any substantial inventory depletion likely forming a constructive price backdrop assuming a deceleration in the global economy doesn’t drive a significant demand slump.

- WTI is +0.5% at $69.47 It doesn’t trouble resistance at $72.72 (Jun 21 high) whilst support remains at $66.96 (Jun 12 low) as part of its bearish technical outlook. In options space, the CLQ3 has seen heaviest trading at $75/bbl calls today.

- Brent is +0.6% at $74.26, off resistance at $77.24 (Jun 21 high) and support at $71.50 (May 31 low).

- Gold is +0.2% at $1924.24, also in relatively narrow ranges with the USD index also contained, and not troubling support at $1910.3 (Jun 23 low).

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/06/2023 | 2301/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 27/06/2023 | 0600/0800 | ** |  | SE | PPI |

| 27/06/2023 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 27/06/2023 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 27/06/2023 | 0800/1000 |  | EU | ECB Lagarde Intro at ECB Forum | |

| 27/06/2023 | 0830/0930 |  | UK | BOE Tenreyro Panels ECB Forum | |

| 27/06/2023 | 0830/1030 |  | EU | ECB Panetta Panels ECB Forum | |

| 27/06/2023 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 27/06/2023 | 0930/1130 |  | EU | ECB Elderson Panels ECB Forum | |

| 27/06/2023 | 1200/1400 |  | EU | ECB Schnabel Panels ECB Forum | |

| 27/06/2023 | 1230/0830 | *** |  | CA | CPI |

| 27/06/2023 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 27/06/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 27/06/2023 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 27/06/2023 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 27/06/2023 | 1400/1000 | *** |  | US | New Home Sales |

| 27/06/2023 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 27/06/2023 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 27/06/2023 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 27/06/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 27/06/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.