-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY227 Bln via OMO Wednesday

MNI BRIEF: Aussie Q3 GDP Prints At 0.3% Q/Q

MNI ASIA MARKETS ANALYSIS: Mkts Discount FOMC Forward Guidance

- MNI INDIA: US-WH Confirms NSA Visited Delhi As DC Bolsters Ties Ahead Of Modi Trip

- MNI US: House Appropriators To Meet Again Today As Govt Shutdown Risk Increases

- MNI US: SCOTUS Ruling On Student Loan Relief Could Comes As Soon As Today

- US Justice Department to Investigate PGA Tour-LIV Golf Pact, Bbg

- ECB SET FOR SUMMER DEBATE OVER POSSIBLE SEPTEMBER RATE HIKE, Bbg

- FED, SEC PROBING GOLDMAN SACHS'S ROLE IN SVB'S FINAL DAYS: WSJ

Key Links: MNI INTERVIEW: Fed ‘Skip’ Heralds Premature Pause-Ex-Staffer / MNI Fed Review - June 2023: Unconvinced By The Dots / MNI WATCH: ECB Signals More Hikes, Raises Inflation Projection / MNI INTERVIEW: Canada House Building Hit By Rates, Shortages

US TSYS: Risk Appetite Improved, Market Discounting Fed Forward Guidance

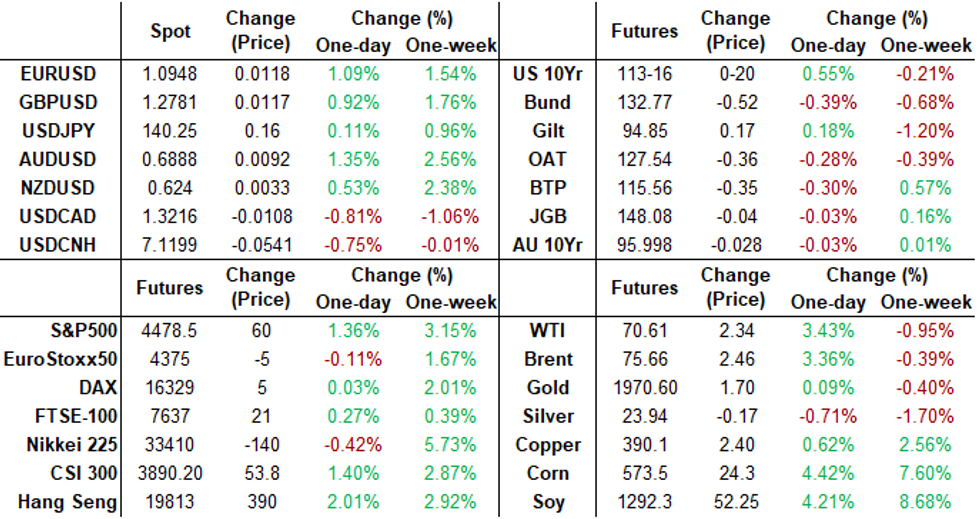

- Risk appetite improved in late trade, Treasury futures trading sideways but inching higher after the bell while equity indexes remain strong, SPX at the best levels since April 2022 as markets faded the hawkish forward guidance from Wednesday's FOMC.

- Tsy showed little reaction to an anticipated 25bp rate hike from the ECB, rallied sharply after another upside weekly jobless claims print (+262k vs. +245k est after last week's +261k), brief selling on stronger than expected retail sales print (+0.3% vs. -0.2% exp) evaporated as core comes out in-line.

- SOFR futures holding mildly weaker in the lead quarterly as Fed Chair Powell comment that "July is live" yesterday is taken seriously. Chances of a 25bp hike next at the July 26 FOMC is approximately 67% with Fed funds implied at 16.7bp. September cumulative at +20.7bp to 5.288%, November cumulative 19.7bp to 5.277%. while December cumulative recedes to 10.8bp to 5.190%. At the moment, Fed terminal at 5.280% in Oct'23.

- Treasury technicals, despite today's rally, futures remain in a downtrend and this week’s move lower confirmed a resumption of the trend. Support at 112-29+, May 26 / 30 low has been cleared. This signals scope for the 112-00 handle, the Mar 10 low. Further out, bearish price action suggests scope for a move towards 110-27+, the Mar 2 low and a key support. Gains are considered corrective - for now. Initial firm resistance is at 114-00, Tuesday’s high.

- Focus turns to Bank of Japan's policy announcement early Friday. Fed exits policy blackout tonight, Barkin, Bullard and Waller on tap tomorrow. Early NY data U. of Mich. Sentiment (59.2, 60.0) at 1000ET.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.01129 to 5.09059 (-.04811/wk)

- 3M -0.00194 to 5.21617 (-.03321/wk)

- 6M +0.02158 to 5.28853 (+.00242/wk)

- 12M +0.06656 to 5.21940 (+.07123/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.01071 to 5.07614%

- 1M -0.01185 to 5.14629%

- 3M +0.00528 to 5.51371 */**

- 6M -0.02300 to 5.62843%

- 12M +0.06000 to 5.87886%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.54443% on 6/9/23

- Daily Effective Fed Funds Rate: 5.08% volume: $128B

- Daily Overnight Bank Funding Rate: 5.06% volume: $290B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.397T

- Broad General Collateral Rate (BGCR): 5.03%, $634B

- Tri-Party General Collateral Rate (TGCR): 5.03%, $611B

- (rate, volume levels reflect prior session)

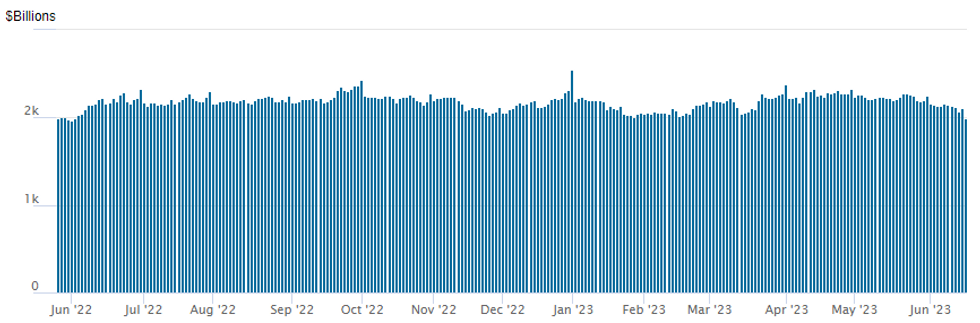

FED Reverse Repo Operation: Usage Below $2T First Time Since June '22

NY Federal Reserve/MNI

NY Fed reverse repo usage falls below $2T for first time since June 2, 2022 to $1,992.140B w/ 103 counterparties, compared to $2,109.105B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

- Heavy option volumes Thursday, early put trade evaporated as underlying futures rallied on the back of higher than expected weekly claims for the second consecutive release (+262k vs. +245k est after last week's +261k).

- Better upside call buying reported as traders faded Wednesday's forward guidance. Salient trade, scale buyer over 107,000 Dec'23 SOFR 96.50 calls from 6.5-7.5 ref 94.765 to -.77, adding to over +105k late Wednesday.

- Early Put buying: as focus shifted to July and August expirations after Wednesday's "hawkish hold" policy annc from the FOMC with 12 of 18 Fed officials expecting another 50bp later this year. "July is live, Fed Chair Powell reiterated. Aside from short end SOFR options, 5Y Tsy puts drew larger blocks.

- SOFR Options:

- 9,000 SFRU3 98.25/99.62 put spds

- 7,000 SFRU3 99.62/99.75 put spds

- 18,000 SFRU3 98.75/69.75 put spds, ref 94.695

- 4,500 SFRZ3 99.25/99.75 put spds ref 94.82

- 2,000 SFRZ3 96.50/97.50 call spds, 4.0 ref 94.84

- Update, over +102,500 (50k block) SFRZ3 96.50 calls, 6.5-7.5 ref 94.765 to -.77

- Block/screen, +15,000 SFRZ3 95.50/OQZ3 97.25 call spds, 1.5 bull steepener

- 10,000 SFRQ3 94.56/94.68 2x1 put spds ref 94.675

- 5,000 SFRZ 94.50 puts vs. OQZ3 95.00/95.50 put spds

- 4,500 SFRU3 95.50/95.62 call spds ref 94.675

- over 9,300 SFRM3 94.75 puts, 0.5 ref 94.7875

- Block, 9,000 SFRM3 94.68/94.81/94.87/95.00 call condors, 0.5 ref 94.7875

- 9,000 SFRQ3 94.56 puts, 6.0 ref 94.675 to -.68

- 4,500 OQU3 96.50/97.00 2x3 call spds ref 95.93

- 4,000 SFRQ3 94.50/94.75 3x2 put spds, ref 94.68

- 1,500 SFRN3 94.75/94.93/95.12 call flys, ref 94.675

- Block, 2,500 SFRN3 94.56/94.68/94.75/94.81 put condors, 0.5 belly over

- 1,000 SFRN3 94.43/94.50/94.62/94.68 put condors ref 94.68

- Block, 5,050 SFRM3 94.81/94.87 put spds, 5.25 ref 94.7875

- 3,000 SFRQ3 94.81/95.00/95.18 call flys ref 94.69

- 1,500 SFRZ3 93/87/94.37 put spds vs. 95.00/95.50 call spds ref 94.79

- 2,000 SFRQ3 94.37/94.62 3x2 put spds, ref 94.70

- 3,000 SFRN3 94.68/94.93/95.12/95.37 call condors ref 94.695

- 1,000 SFRZ3 96.00/96.25/96.62/96.75 call condors, ref 94.795

- 1,375 SFRU3 94.25/94.50 put spds ref 94.67

- 4,000 SFRZ3 94.31 puts, 9.5 ref 94.795

- Treasury Options:

- 1,800 TYQ3 114/116.5/117.5 1x3x2 broken call flys ref 113-14

- 2,500 FVQ3 106/107.25 put spds 17.5 ref 107-31.75

- Block, -10,000 FVQ3 107.25 puts, 29.5 vs. 107-25/0.40%

- 2,500 TYQ3 113.5 puts ref 112-24

- Block, 5,000 TYQ3 112 puts, 39 vs. 107-21/0.60%

- over 22,500 FVN3 109.25 puts, 2 ref 107-17.5

- Block, total 16,000 FVN3 109.25 puts, 147-152 vs.

- Block, total 14,000 FVN3 109.5 puts, 163-204 ref 107-17.75 to -17.5

- Block, 10,000 FVQ3 109.5 calls, 11 ref 107-23.25

EGBs-GILTS CASH CLOSE: Short End Underperforms As ECB Eyes July Hike

The German curve twist flattened Thursday as the ECB hiked by the expected 25bp and Pres Lagarde cemented expectations for a further raise in July. Gilts outperformed Bunds slightly, but the UK curve likewise twist flattened.

- Schatz sold off on the ECB decision, which included an unexpected upgrade to the 2025 inflation forecast.

- While Lagarde underpinned hike pricing for the next meeting ("very likely we will continue to increase rates in July"), unexpectedly weak US jobless claims figures helped drag global yields back down and ultimately yields finished off their session highs.

- Periphery spreads tightened with the exception of Greece, which saw widening for the 4th consecutive session following last Friday's lack of a positive ratings action from Fitch.

- Friday's morning's focus will be the final, detailed Eurozone readings, along with several ECB speakers including Holzmann, Rehn, Muller, Centeno, and Villeroy.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 11bps at 3.126%, 5-Yr is up 9.8bps at 2.605%, 10-Yr is up 5.2bps at 2.504%, and 30-Yr is down 0.4bps at 2.58%.

- UK: The 2-Yr yield is up 8.5bps at 4.907%, 5-Yr is up 6.3bps at 4.535%, 10-Yr is down 0.8bps at 4.384%, and 30-Yr is down 5.7bps at 4.502%.

- Italian BTP spread down 1bps at 162.6bps / Greek up 4.4bps at 135.7bps

EGB Options: Post-ECB Trade Includes Large Call Condor, Euribor Put Ladder Buy

Thursday's Europe rates / bond options flow included:

- ERZ3 97/98cs, bought for 4 in 20k vs 96.165

- ERU3 96.00/95.875/95.75 p ladder bought for 0.75 in 3k

- ERQ3 96.125p bought for 8.25 in 16k

Post ECB meeting:

- ERM4 95.50/96.00/96.50/97.00c condor bought for 22 and 22.5 in 50k

- ERV3 95.75/95.50/95.25 put ladder paper paid 1 on 18K

FOREX: EURUSD Closing On The Highs, Rises 1.1% As ECB Dust Settles

- EURUSD rallied sharply higher Thursday, extending the bull cycle that started at 1.0635 on May 31. A number of important retracement points have been cleared, reinforcing bullish conditions and this signals scope for an extension higher. The European Central Bank raised its deposit rate by 25bp to 3.5% on Thursday and signalled another quarter-point hike next month after revising higher its inflation forecasts.

- The renewed strength for the single currency suddenly brings the April highs of 1.1095 back into focus for EURUSD. Between here and there, 1.0986, the 76.4% retracement of the Apr 26 - May 31 swing may provide the first resistance.

- The pair has soared 1.25% on Thursday, and trades at its highest level since 2008, reaching the next objective for the rally at 153.62, a Fibonacci projection. The next topside level of note is 154.62, another projection level before 155.00, psychological round number resistance.

- The USD index has fallen 0.80% amid a strong rally for major equity benchmarks. Landing with the deluge of US data at, import prices offered a mildly weaker than expected take which may have assisted the broad greenback weakness.

- The weaker dollar and risk on tone has benefitted the likes of AUD (+1.37%), the strongest performer across G10 bar the Norwegian Krone. GBPUSD (+0.92%) also extended on its recent surge, with the pair closing in on the 1.28 handle.

- Friday will see the June BOJ decision where the broad consensus looks for no change at this meeting. Market expectations have moved away from a potential YCC tweak this week, with July now seen as a more likely window for an adjustment. The European morning's focus will be the final, detailed Eurozone readings of CPI, along with several ECB speakers including Holzmann, Rehn, Muller, Centeno, and Villeroy.

Late Equity Roundup: Strong Gains, Discounting Hawkish Fed Guidance

- Stocks trading near late session highs, SPX at the best levels since mid-April 2022 as markets discount Wednesday's "hawkish hold" policy announcement from the FOMC following this morning's higher than expected weekly claims data.

- Currently, S&P E-Mini future are up 58.25 points (1.32%) at 4477.5; Nasdaq up 174.5 points (1.3%) at 13804.18; DJIA up 433.01 points (1.27%) at 34416.05

- Shift in leading gainers: Communication Services and Information Technology sectors rallied in the second half, T-Mobile +3.75%, Meta +3.70%, Live Nation Ent +3.65%. IT supported by software makers as opposed to chip makers for once as the former also looks to benefit from AI focus, ADSK +3.8%, ORCL +3.6%, MSFT +3.45%.

- Laggers: Real Estate and Consumer Discretionary sectors continued to underperform. Management and development securities weighed on the former, Host Hotels -3.35%, Welltower -2.10%, Ventas -1.35%.

- Today's rally in S&P futures confirms a resumption of the uptrend and maintains the bullish price sequence of higher highs and higher lows, marking an extension of the bull cycle that started in October 2022. The focus is on a climb towards 4452.42, a Fibonacci projection. Firm support is at 4304.28, the 20-day EMA. Initial support is at 4348.75, the Jun 5 high.

E-MINI S&P TECHS: (U3) Trend Needle Points North

- RES 4: 4492.25 2.00 projection of the May 4 - 19 - 24 price swing

- RES 3: 4485.18 Channel top from the Oct ‘22 low (cont)

- RES 2: 4452.42 1.764 projection of the May 4 - 19 - 24 price swing

- RES 1: 4439.50 High Jun 14

- PRICE: 4410.25 @ 14:21 BST Jun 15

- SUP 1: 4348.75/4304.28 Low Jun 5 / 20-day EMA

- SUP 2: 4232.58 50-day EMA

- SUP 3: 4154.75 Low May 24

- SUP 4: 4098.25 Low May 4 and a key support

S&P E-minis traded higher again Wednesday. The move confirms a resumption of the uptrend and maintains the bullish price sequence of higher highs and higher lows, marking an extension of the bull cycle that started in October 2022. The focus is on a climb towards 4452.42, a Fibonacci projection. Firm support is at 4304.28, the 20-day EMA. Initial support is at 4348.75, the Jun 5 high.

COMMODITIES: Crude Oil Bounces On China Demand, Gold On USD Slide

- Crude oil has consistently climbed higher for large gains today as it continues a week of day-to-day fluctuations. China factors are front and centre, with optimism from refining levels, officials considering issues $140B of special bonds to help indebted local governments and boost infrastructure spending (per the WSJ) and larger crude import quotas than a year ago.

- US factors have been mixed, with Treasury yields and the USD lower offering a tailwind but in response to a non-oil friendly set of data with initial claims showing more labour market moderation than expected and other data driving a downward revision in Q2 growth estimates.

- WTI is +3.6% at $70.73 as it nears resistance at $70.85 (20-day EMA) after which lies a jump to key resistance at $75.06 (Jun 5 high). Bullish activity has seen the day’s most active strikes in the CLQ3 for $75/bbl calls.

- Brent is +3.5% at $75.76, having cleared $75.49 (Jun 14 high) to next open a bull trigger at $78.73 (Jun 5 high).

- Gold is +0.8% at $1957.75 boosted by the above Treasury and USD moves. It remains off key short-term resistance at $1985.3 (May 24 high).

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/06/2023 | 0200/1100 | *** |  | JP | BOJ policy announcement |

| 16/06/2023 | 0700/0300 |  | US | St. Louis Fed's James Bullard | |

| 16/06/2023 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 16/06/2023 | 0830/0930 | ** |  | UK | Bank of England/Ipsos Inflation Attitudes Survey |

| 16/06/2023 | 0900/1100 | *** |  | EU | HICP (f) |

| 16/06/2023 | 1145/0745 |  | US | Fed Governor Christopher Waller | |

| 16/06/2023 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 16/06/2023 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 16/06/2023 | 1230/0830 | * |  | CA | International Canadian Transaction in Securities |

| 16/06/2023 | 1300/0900 |  | US | Richmond Fed's Tom Barkin | |

| 16/06/2023 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.