-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI DATA TABLE: MNI China Interbank Liquidity Index (Jul) - 1

MNI DATA TABLE: MNI China Interbank Liquidity Index (Jul) - 2

MNI DATA TABLE: MNI China Interbank Liquidity Index (Jul) - 3

MNI ASIA MARKETS ANALYSIS: More Hikes As Inflation Exp Climb

HIGHLIGHTS

- KWARTENG IS BEING SACKED AS CHANCELLOR: TIMES' SWINFORD, Bbg

- TRUSS: WILL DO WHATEVER NECESSARY TO REDUCE DEBT MEDIUM-TERM, Bbg

- UK TO REVERSE PLANNED FREEZE ON CORPORATION TAX, Bbg

- PUTIN: NO PLANS FOR ADDITIONAL MILITARY MOBILIZATION IN RUSSIA, Bbg

- PUTIN: NO NEED FOR MASSIVE STRIKES ON UKRAINE NOW, Bbg

- FED'S DALY: LATEST CPI WAS VERY DISAPPOINTING, NOT SURPRISING, Bbg

US TSYS: Early Bond Rout Levels Out, Inflation Concerns Remain

Tsys and equity markets extending session lows in late morning trade after posting decent gains on the open.

- Several factors contributing to early reversal off highs: bonds initially followed Gilts after UK PM Liz Truss televised conf re: mini-budget comments, reversing planned freeze on corporate tax, comments on sacking of Chancellor Kwarteng (more on that shortly).

- Bonds gapped lower/extend session lows after U-Mich 1Y inflation exp climbed to 5.1% vs. 4.6% est - first time since March. Yield curves bounced off deepest inversion since April 2000 (2s10s -55.877) briefly before short end support waned.

- Lead quarterly EDZ2 futures extending session lows (-0.055 at 94.900) as KC Fed George and VC Cook express need for ongoing rate hikes to combat inflation, SF Fed Daly sees Fed "likely to raise interest rates as high as 5% to tackle stubborn inflation and keep restrictive policy for some time, some of her most hawkish comments to date." Chances of 75bp hikes at both Nov and Dec FOMC meeting gaining.

- Bond yields leveled out in the second half while equities continued to march lower. Currently, 2-Yr yield is up 3.5bps at 4.4981%, 5-Yr is up 6bps at 4.2606%, 10-Yr is up 5.8bps at 4.0019%, and 30-Yr is up 5.3bps at 3.9691%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00443 to 3.06614% (-0.01043/wk)

- 1M +0.03086 to 3.44300% (+0.12943/wk)

- 3M +0.11457 to 4.19371% (+0.28814/wk) * / **

- 6M +0.14672 to 4.68529% (+0.30058/wk)

- 12M +0.17714 to 5.28314% (+0.28685/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.19371% on 10/14/22

- Daily Effective Fed Funds Rate: 3.08% volume: $110B

- Daily Overnight Bank Funding Rate: 3.07% volume: $285B

- Secured Overnight Financing Rate (SOFR): 3.04%, $1.0T

- Broad General Collateral Rate (BGCR): 3.00%, $398B

- Tri-Party General Collateral Rate (TGCR): 3.00%, $378B

- (rate, volume levels reflect prior session)

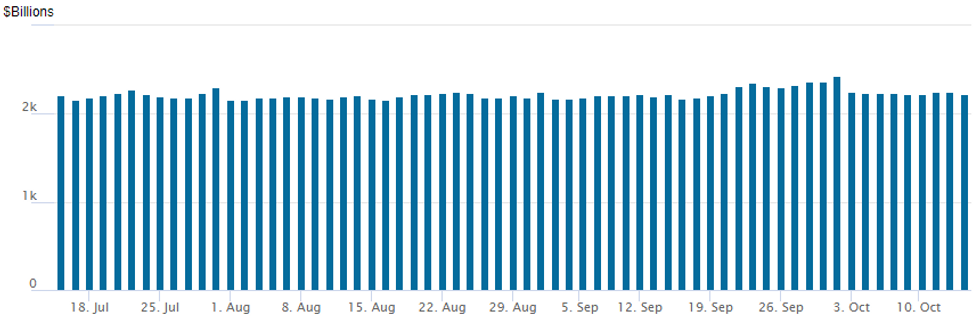

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,222.052B w/ 95 counterparties vs. $2,244.100B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Prior to the underlying sell-off, option trade was primarily two-way with unwinds apparent. Put selling evaporated as futures continued to price in increased chances of 75bp hikes at both the November and December.- SOFR Options:

- Block, 10,000 SFRF3 94.75 puts, 12.0 ref 95.12

- Block, 4,000 SFRF3 94.56/94.68/94.93 put flys, 5.0

- 6,700 SFRZ2 95.00 puts

- 6,000 short Dec 94.62/94.87 put spds

- Block, +10,000 SFRZ2 94.87 puts, 14.5

- Block, 4,000 SFRF 94.75/94.87 put spds, 0.5 over SFRX2 95.62 calls

- Block, 7,500 SFRm2 94.25/94.50/95.00 broken put flys

- Eurodollar Options:

- -30,000 Mar 95.75/95.87/96.12 put flys, 11.75

- +15,000 Jan 95.25/95.43/95.81 call trees, 0.0

- 2,500 Dec 95.75/96.75 call spds

- Treasury Options:

- 6,300 FVZ 111 calls, 3.5

- 7,400 TYX2 115.5 calls, 11

- 4,000 TUZ2 104 calls, 2

- 8,000 TYX 109.25 puts, 10

- 7,500 TYX2 110 puts, 15 ref 111-05.5

- 3,000 TYZ2 108/110 put spds, 31

- 7,800 FVZ2 106.25 puts, 40.5

- 20,000 TYX2 108/109 put spds,

- Block, -10,000 FVZ 106.25 puts, 44 ref 106-30.75, another -7.5k at 41-40.5

- Block, 10,000 TYX 109.5 puts, 13-10

- Block, 10,000 TYZ2 110.5 puts, 110

EGBs-GILTS CASH CLOSE: Weaker After Intraday Reversal

A volatile week closed with a characteristically volatile session, with early gains fully reversed across EGBs and Gilts, and bear steepening across the space.

- Once again, US data and UK politics were the driver. Gilts rallied in the morning as news filtered in that Chancellor Kwarteng would be replaced and a fiscal "U-Turn" announced.

- But yields reversed higher in the afternoon in a combination of "buy the rumour, sell the fact" and profit-taking, with robust US retail sales and surprisingly high UMichigan inflation expectations adding fuel to the fire.

- Though short-end yields remained relatively anchored (next BoE pricing remained around 100bp), long-end Gilts underperformed, with 30Y yields jumping 60bp off the lows.

- Bunds outperformed Gilts easily, while BTP spreads widened sharply in the afternoon after the US data.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 3.5bps at 1.956%, 5-Yr is up 3.3bps at 2.114%, 10-Yr is up 5.9bps at 2.346%, and 30-Yr is up 9.8bps at 2.399%.

- UK: The 2-Yr yield is up 11.6bps at 3.916%, 5-Yr is up 7.4bps at 4.318%, 10-Yr is up 13.7bps at 4.335%, and 30-Yr is up 23.4bps at 4.784%.

- Italian BTP spread up 5.1bps at 244.4bps / Spanish up 1.2bps at 117.1bps

FOREX: Tsy Sec Yellen Says Market-Determined FX is Best for Dollar

Treasury Secretary Janet Yellen said Friday the appreciation of the dollar this year is a reflection of economic fundamentals and market-determined exchange rates are best for the dollar.

- "My position would be that market-determined exchange rates are the best regime for the dollar," said Yellen, a former chair of the Federal Reserve. "I think that exchange rate movements by and large have been a response to economic shocks and other fundamentals. Nevertheless, there are spillovers from tightening monetary policy." Earlier this week the G7 issued a statement recognizing that many currencies have moved significantly this year with increased volatility, and reaffirmed its exchange rate commitments as elaborated in May 2017. (See: MNI SOURCES: G7 To Repeat Commitment To Market-Determined FX).

- The IMF earlier in the day, however, said in a blog the strengthening of the dollar in a matter of months has sizable macroeconomic implications for almost all countries, given the U.S. currency's dominance in international trade and finance. The international body said temporary foreign exchange intervention may be appropriate in some instances to help prevent adverse financial amplification if a large depreciation increases financial stability risks.

FX Option expiration for October 17

- EURUSD: 0.9700 (216mln), 0.9750 (374mln), 0.9765 (391mln), 0.9800 (249mln)

- USDCAD; 1.3900 (285mln), 1.3905 (395mln)

- AUDUSD: 0.6250 (464mln)

- USDCNY: 7.20 (627mln)

Late Equity Roundup: Extending Lows

Well off opening highs, stock indexes extend session lows in late trade - continued

negative reaction to a rise of inflation expectations via U-Mich sentiment reporting. As such, short end rates remain under renewed pressure as chances of a 75bp rate hike in the next two FOMC meeting climbed higher.

- Health Care and Financials sector continues to outperform while Financials give way to Utilities and Communication Services. Currently, SPX eminis trade -75.75 (-2.06%) at 3606 (vs. 3732.75 high); DJIA -363.21 (-1.21%) at 29674.63; Nasdaq -274.2 (-2.6%) at 10375.23.

- SPX leading/lagging sectors: Health Care (-0.75%) followed by Utilities (-1.45%) and Communication Services (-1.52%). Laggers: Energy (-3.55%), Consumer Discretionary (-3.40%) and Materials (-3.28%).

- Dow Industrials Leaders/Laggers: United Health (UNH) making strong gains after earnings beat ($5.79 vs. $5.429 est) currently +5.05 at 514.96, JP Morgan +2.45 at 111.82, Boeing (BA) +1.03 at 133.43. Laggers: Goldman Sachs (GS) -7.35 at 299.72, Home Depot (HD) -6..21 at 276.62, Microsoft (MSFT) -4.99 at 229.25.

EQUITIES: Citigroup Earnings Beat

Citigroup earnings $1.63 beats est of $1.434, a nice start to Q3 earnings cycle. Next Monday sees Bank of NY Mellon (BK) $1.01 est, Bank of America (BAC) $0.779 est and Charles Schwab (SCHW) $1.054 est announcing. Recap of today's annc:

- Citigroup (C): $1.63 vs. $1.434 est

- PNC Financial: $3.78 vs. $3.697 est

- Wells Fargo (WFC): $1.30 vs. 1.086 est

- JP Morgan (JPM): $3.12 vs. $2.878 est

- US Bancorp (USB): $1.161 vs. $1.158 est

- Morgan Stanley (MS) $1.53 vs. $1.511 est

- First Republic Bank (FRC): $2.21 vs. $2.185 est

- United Health (UNH) announced: $5.79 vs. $5.429 est

E-MINI S&P (Z2): Oversold Trend Condition Begins to Unwind

- RES 4: 4023.44 61.8% retracement of the Aug 16 - Oct 13 downleg

- RES 3: 3923.88 50.0% retracement of the Aug 16 - Oct 13 downleg

- RES 2: 3867.00 50-day EMA

- RES 1: 3737.94/3820.00 20-day EMA / High Oct 5

- PRICE: 3704.00 @ 14:36 BST Oct 14

- SUP 1: 3502.00 Low Oct 13 and the bear trigger

- SUP 2: 3491.13 50.0% retracement of the 2020 - 2022 bull cycle

- SUP 3: 3453.78 1.618 proj of the Aug 16 - Sep 7 - 13 price swing

- SUP 4: 3388.70 1.764 proj of the Aug 16 - Sep 7 - 13 price swing

A volatile session on Thursday in S&P E-Minis resulted in a strong bounce from the day low as well as the trend low of 3502.00. The recovery suggests that the contract has entered a corrective phase and if correct, this will allow an oversold trend condition to unwind. Attention is on 3737.94, the 20-day EMA. A break would reinforce a bullish theme and open 3820.00, the Oct 5 high. Key support and the bear trigger lies at 3502.00.

COMMODITIES: Weaker Demand Fears Take Hold As Yields and Dollar Surge

- Crude oil sees a largely one-way slide with a return of dollar strength and higher Tsy yields seen weighing on activity, driving further by a surprise increase in US inflation expectations.

- WTI is -3.9% at $85.63 having briefly traded through support at $85.56 (Oct 13 low) to open $84.94 (50% retrace of Sep 26 – Oct 10 rally).

- Brent is -3.0% at $91.72, coming close to support at $91.08 (Oct 13 low) and then $90.59 (50% of Sep 26-Oct 10 rally).

- Gold is -1.45% at $1642.30 to continue a poor week with the cranking higher in yields after various inflation surprises. It has cleared the Oct 13 low of $1642.5 on the snap move lower after US CPI, opening the bear trigger at $1615.0 (Sep 28 low).

- Weekly moves; WTI -7.5%, Brent -6.3%, Gold -3.1%, US Nat Gas -7.6%, TTF Nat Gas -9.1%

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/10/2022 | 2301/0001 | * |  | UK | Rightmove House Prices Index |

| 17/10/2022 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 17/10/2022 | 0800/1000 |  | EU | ECB de Guindos Speaks on Euro Anniversary | |

| 17/10/2022 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 17/10/2022 | 1430/1030 | ** |  | CA | BOC Business Outlook Survey |

| 17/10/2022 | 1500/1700 |  | EU | ECB Lane at Bocconi Uni & Deutsche Bank Roundtable | |

| 17/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 17/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 17/10/2022 | 2000/1600 |  | CA | BOC Deputy Rogers panel talk at Toronto Centre |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.