-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Canada Commits To Just One Of Three Fiscal Anchors

MNI POLITICAL RISK - Thune Eyes 'Deficit-Negative' Legislation

MNI ASIA MARKETS ANALYSIS: No Debt Ceiling Break; Banks Bounce

HIGHLIGHTS

- MNI US: Schumer: If McCarthy Continues In This Direction We Are Headed For Default

- FED BARKIN: NEVER WANT TO DECLARE VICTORY ON POTENTIAL BANK STRAIN, Bbg

- However: BARKIN SAYS HE'S REASSURED BY WHAT HE'S SEEING IN BANK SECTOR

- MCCARTHY: MUST CHANGE COURSE ON GOVT SPENDING BEFORE TOO LATE, Bbg

- GM, TESLA, FORD MODELS TO QUALIFY FOR FULL $7,500 US TAX CREDIT, Bbg

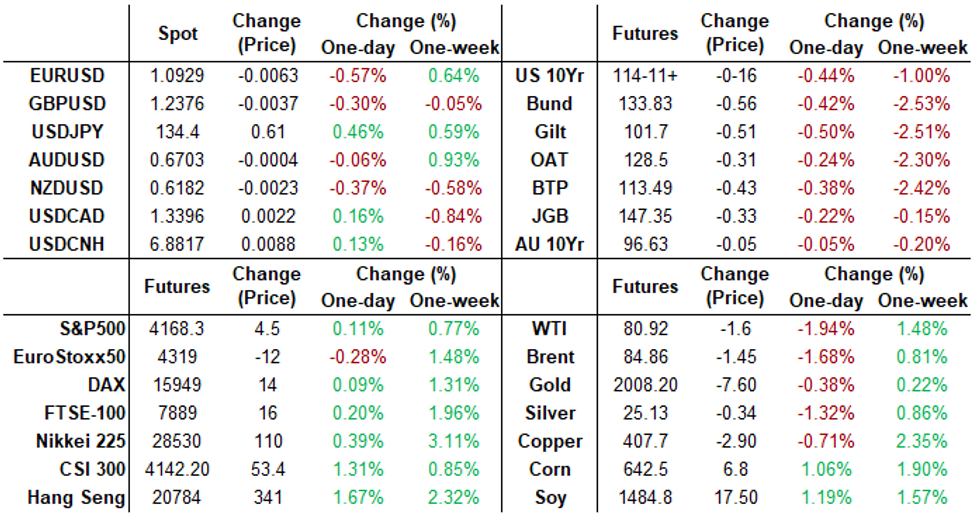

US TSYS: Holding Narrow Range Near Lows, NY MFG Index Surprise

- Treasury futures are holding a narrow range since late morning, near session lows in the aftermath of a surprising reaction to Empire State Manufacturing index release.

- The April data was far stronger than expected, bouncing from -24.6 to +10.8 (cons -18.0). The manufacturing index maintains its particularly volatile recent history, with a standard deviation of nearly 20pts since 2021, although the upside surprise does leave it at the highest since Jul’22.

- Following a period of two way trade, Treasury futures extended lows into late morning trade, front month 10Y futures breached 50-day EMA technical support of 114-14 to mark a session low of 114-09.

- Attention turned to 114-15, the 50-day EMA and 114-07, the Mar 29, 30 low. Clearance of this support zone would strengthen any developing bearish threat and expose 113.23, a Fibonacci retracement. The move lower - for now - is considered corrective.

- No breakthrough on debt ceiling: Sen Schumer maintains that House Speaker McCarthy hasn't yet presented a budget or formal list of Republican priorities which the White House has stated is a condition of negotiations.

- Look ahead: Building Permits, Housing Starts and Fed Speak Tuesday, Atlanta Fed Pres Bostic interview on CNBC at 1100ET followed by Fed Gov Bowman discussion on digital currency, text, moderated Q&A at 1300ET.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.02439 to 4.91745

- 3M +0.04597 to 5.02785

- 6M +0.07806 to 5.02108

- 12M +0.11400 to 4.79827

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00600 to 4.80871%

- 1M -0.00814 to 4.95129%

- 3M +0.00329 to 5.26500% */**

- 6M +0.08957 to 5.39486%

- 12M +0.14786 to 5.42000%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.26500% on 4/17/23

- Daily Effective Fed Funds Rate: 4.83% volume: $113B

- Daily Overnight Bank Funding Rate: 4.82% volume: $280B

- Secured Overnight Financing Rate (SOFR): 4.80%, $1.312T

- Broad General Collateral Rate (BGCR): 4.77%, $524B

- Tri-Party General Collateral Rate (TGCR): 4.77%, $516B

- (rate, volume levels reflect prior session)

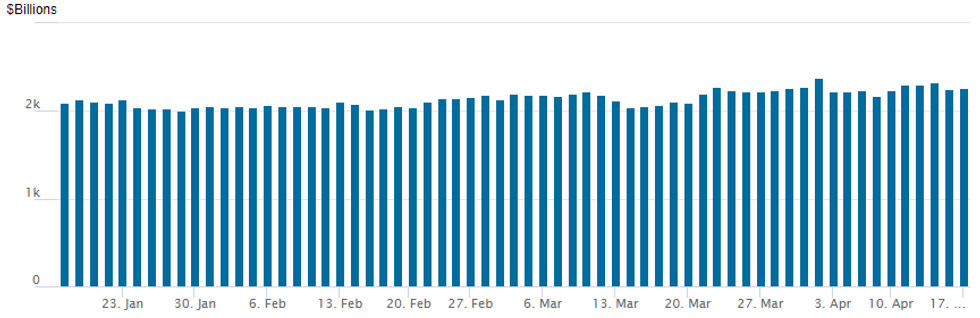

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,256.845B w/ 102 counterparties, compares to prior $2,253.786B. All-time record high of $2,553.716B reached December 30, 2022; high usage for 2023: $2,375.171B on Friday March 31, 2023

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Better limited downside put structures noted in SOFR options carried over from overnight. Early Treasury options saw better upside call trade in 5s and 10s, segued to 10Y puts by midday as underlying futures trading weaker.- SOFR Options:

- 3,400 SFRM3 94.81/94.93 put spds 6.5 ref 94.91

- +5,000 SFRK3 95.00/95.12 call spds, 1.75

- -4,000 SFRU3 95.12 straddles, 68.0-67.5 ref 95.205

- Block, 5,500 SFRH4 96.75/97.50/98.25 call flys, 6.0 ref 95.995 to 96.00

- Block, 3,000 SFRN3 94.50/94.75/95.06/95.18 put condors, 4.0 ref 95.185

- 1,750 SFRN3 94.62/94.87 put spds, ref 95.195

- Block, 4,000 OQK3 95.81/96.00/96.25 broken put flys, 4.5 vs. 96.45/0.10%

- 7,500 SFRM3 95.00/95.06/95.12/95.18 put condors

- 3,000 SFRN3 94.50/94.93/95.00/95.18 put condors

- Block, 5,000 SFRU3 94.87/94.75/95.37/95.50 iron condors vs. 95.215/0.10%

- Treasury Options:

- 4,000 TYK 113.5 puts, 6 ref 114-10.5

- 5,000 TYK3 113.5/114 put spds, 8 legged

- Block, 5,000 TYM 113.5/114.5 3x2 put spds, 12 ref 114-13

- 6,600 TYM3 113.5/114.5 put spds, 29 ref 114-12.5

- over 5,100 FVK3 111.5 calls, 1 ref 109-07.75

- Update over 12,700 TYK3 114 puts, 7 to 10 ref 114-26.5 to -15.5

- -12,000 FVK 109/109.5 put spds, 17

- 8,800 TYM3 114 puts, 50 ref 114-21.5

- 3,000 TYK3 113 puts, 2 ref 114-26.5

- 2,100 TYK3 118/119.75 1x2 call spds ref 114-29

- 2,200 TYM 113 puts, ref 114-26.5

- 5,250 FVM3 110 calls, 38 ref 109-16.5

- 1,500 FVM3 112.5 calls, 7 ref 109-15.5

- 2,000 TYM3 118 calls, 16 ref 114-30.5

- 2,000 TYK3 115 calls, 21 ref 114-29.5

EGBs-GILTS CASH CLOSE: Curves Steepen With Short-End Anchored

European curves twist steepened Monday, with short-end German and UK instruments remaining relatively anchored.

- Rate hike expectations in Europe lagged US counterparts (Fed funds peak +6bp vs flat for ECB and BoE), with few major catalysts in Europe in the session.

- The weakness in longer-dated Bunds and Gilts mirrored that of Treasuries, which took their cue from stronger-than-expected US data, and a heavy supply slate for the week.

- This meant UK and German 10Y yields rose for the 6th consecutive session.

- Periphery EGB spreads tightened slightly on the Bund move, despite weakness in equities / broader risk-off.

- After a quiet session for European data, things pick up Tuesday with UK labour market data and German ZEW. ECB's Centeno is set to speak.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.2bps at 2.879%, 5-Yr is up 2.2bps at 2.495%, 10-Yr is up 3.3bps at 2.473%, and 30-Yr is up 4.4bps at 2.551%.

- UK: The 2-Yr yield is down 0.5bps at 3.613%, 5-Yr is up 0.3bps at 3.511%, 10-Yr is up 2.4bps at 3.691%, and 30-Yr is up 2.5bps at 4.046%.

- Italian BTP spread down 2.6bps at 183.1bps / Spanish down 1.2bps at 102.5bps

EGB Options: Limited Early Week Trade Includes Euribor Upside

Monday's Europe rates / bond options flow included:

- ERQ3 96.50/96.625/97.75 call fly bought for 1 in 4k

FOREX: USD Extends On Friday Recovery Following Stronger US Data

- An impressive US Empire Manufacturing reading (+10.8 vs. Exp. -18.0) remains the initial trigger for the extension of US dollar strength to start the week. Additionally, shakier financial earnings on Monday (Charles Schwab, State Street) have underpinned the greenback’s resolve. Despite a late recovery for equities, the USD index is maintaining a 0.55% advance.

- Most G10 pairs display an expression of USD strength, as EUR/USD, GBP/USD fall between 0.3-0.6% and USD/JPY rallied to an April high of 134.57 amid the higher US yields.

- Overall, GBP/USD is extending the corrective pullback posted Friday and 1.2345, which marks the next major support, has held so far. If broken, this opens the 1.0% lower 10-dma envelope at 1.2318 - a level crossing ~1.8% below recent highs. The technical indicator has held prices since mid-March - so a show below could mark a more protracted correction in the short-term.

- For the USD index, 102.522 marks the 76.4% retracement for the April dollar downleg, of which a break above would open 103.058.

- The RBA minutes kick off Tuesday’s calendar, followed by China Q1 GDP and March monthly activity indicators. The consensus looks for improvement across the board relative to previous outcomes, as the economy emerged from lockdowns late last year. UK unemployment, German ZEW and Canadian CPI are all scheduled throughout the day.

FX: Expiries for Apr18 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0865-70(E1.3bln), $1.1000(E1.5bln), $1.1050-60(E1.4bln)

- AUD/USD: $0.6600(A$686mln), $0.6665-70(A$614mln) $0.6800(A$1.1bln)

- USD/CAD: C$1.3650($889mln)

- USD/CNY: Cny6.7375($1.6bln), Cny6.9500($1.1bln)

EQUITIES: Late Bounce, Dow Leading, Regional Banks Firming

- No obvious headline trigger to support move, but converse to earlier excuse cited for sell-off, US$ strength is cooling slightly. Front month SPX Emini futures at 4163.0, DJIA +21 at approximately 33,907.

- Communication services sector still underperforming, but off lows. Financials gaining with regional banks trading stronger: MTB +nearly 7%, Citizens Financial Grp and Zions Bancorp both +2.7%.

- Despite the earlier dip current trend condition in S&P E-minis is unchanged and remains bullish. Price has recently breached 4119.50, Mar 6 high, reinforcing a positive theme. The move higher also resulted in a break of 4148.48, 76.4% of the Feb 2 - Mar 13 downleg.

- This signals scope for an extension to 4205.50, the Feb 16 high ahead of 4244.00, the Feb 2 high and a key medium-term resistance. Firm support lies at 4065.03, the 50-day EMA.

E-MINI S&P (M3): Bull Cycle Intact

- RES 4: 4244.00 High Feb 2 and a bull trigger

- RES 3: 4223.00 High Feb 14

- RES 2: 4205.50 High Feb 16

- RES 1: 4189.00 High Apr 14

- PRICE: 4160.50 @ 14:25 BST Apr 17

- SUP 1: 4098.58 20-day EMA

- SUP 2: 4065.03 50-day EMA

- SUP 3: 3980.75 Low Mar 28

- SUP 4: 3937.00 Low Mar 24

The current trend condition in S&P E-minis is unchanged and remains bullish. Price has recently breached 4119.50, Mar 6 high, reinforcing a positive theme. The move higher also resulted in a break of 4148.48, 76.4% of the Feb 2 - Mar 13 downleg. This signals scope for an extension to 4205.50, the Feb 16 high ahead of 4244.00, the Feb 2 high and a key medium-term resistance. Firm support lies at 4065.03, the 50-day EMA.

COMMODITIES: Dollar Strength Weighs On Crude Oil and Gold

- Crude oil is off lows but nevertheless has slid today as a stronger USD trumped any perceived demand boost following a stronger than expected April reading for the Empire State manufacturing index.

- In more specific news, Iraq’s federal government and the KRG have cleared up technical issues essentially to resuming northern oil exports from the Turkish port of Ceyhan according to Reuters sources.

- Elsewhere, the US Treasury published a warning to US companies of possible evasions of the Russian oil price cap exported through the Eastern Siberia Pacific Ocean (ESPO) pipeline and ports in eastern Russia.

- WTI is -1.8% at $81.01, falling further away from key resistance at $83.53 but remaining off support at $79.00 (Apr 3 low).

- Brent is -1.6% at $84.92, moving closer to support at $83.50 (Apr 3 low).

- Gold is -0.4% at $1996.27, fading on the USD strength and higher Tsy yields but holding above support at $1981.7 (Apr 10 low).

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/04/2023 | 0200/1000 | *** |  | CN | Fixed-Asset Investment |

| 18/04/2023 | 0200/1000 | *** |  | CN | Retail Sales |

| 18/04/2023 | 0200/1000 | *** |  | CN | Industrial Output |

| 18/04/2023 | 0200/1000 | ** |  | CN | Surveyed Unemployment Rate |

| 18/04/2023 | 0200/1000 | *** |  | CN | GDP |

| 18/04/2023 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 18/04/2023 | 0900/1100 | * |  | EU | Trade Balance |

| 18/04/2023 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 18/04/2023 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 18/04/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 18/04/2023 | 1230/0830 | *** |  | CA | CPI |

| 18/04/2023 | 1230/0830 | *** |  | US | Housing Starts |

| 18/04/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 18/04/2023 | 1300/1500 |  | EU | ECB Elderson in Basel Committee on Banking Supervision | |

| 18/04/2023 | 1500/1100 |  | CA | BOC Governor testifies to House of Commons committee | |

| 18/04/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 18/04/2023 | 1700/1300 |  | US | Fed Governor Michelle Bowman |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.