-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: PacWest Slumps On Purchase Talks

- Treasuries pare losses that had been seen on stronger global growth and inflation projections as well as strong data, with news that Banc of California is in advanced talks to buy PacWest.

- Bank jitters took the edge off the previously solid climb in equities despite higher real yields, ahead of key after market earnings releases including Microsoft and Alphabet with tech outperforming.

- The euro meanwhile saw further weakness for a second session, coming alongside the ECB bank lending survey as well as the soft German IFO release.

US TSYS: Treasuries Pare Losses On BANC-PACW News, 25bp Hike Seen Locked In Tomorrow

- Cash Tsys head towards the end of the session having pared losses after news that the Banc of California is in advanced talks to buy PacWest drove the KBW banking index to session lows and saw PACW shares at one point fall 27%. Yields sit 2-3bps higher across the curve.

- Earlier cheapening pressure had been seen after upward revisions to IMF global growth and core CPI forecasts in its updated WEO plus strong data releases with house prices beating and a strong increase in the Conference Board consumer survey. These factors had helped overcome a brief bid seen after a particularly sizeable 25k block buyer in FVU3 early on.

- The 5Y auction tailing by 0.4bps with mixed internals didn’t wildly change the narrative.

- TYU3 has lifted to 111-22+ for closer to the middle of the day’s range but is still 11+ ticks lower. It’s low of 111-17+ stopped short of support at 111-11 (61.8% retrace of Jul 7-18 rally) as the corrective pullback extends.

- Ahead of tomorrow’s FOMC decision, near-term meeting implied rates are back almost unchanged, with +24.5bp for tomorrow building to a cumulative +35.5bp for the 5.44% terminal in November having very briefly printed closer to a 50/50 chance of a second additional hike. SOFR futures have pulled back off session cheaps but SFRU3/Z4 of -133bps is still on track for the smallest close since Jul 7 as it more than reverses the post-US CPI hit from Jul 12.

FOREX: Downward Pressure On EUR Crosses Extends

- In a similar theme to Monday’s trading session, Euro weakness has extended against all others in G10 on Tuesday with the most notable moves occurring against both the Chinese Yuan and the Australian dollar.

- Euro weakness comes alongside the ECB bank lending survey as well as the soft German IFO release both working against the single currency. The ECB bank lending survey showed the fastest contraction on record for corporate loan demand, and also described the tightening impact on the Eurozone so far as 'substantial'.

- Compounding the pressure on the EUR was the poorer-than-expected IFO release, with both current assessment and headline business climate releases dropping short of expectations. EUR/USD slipped to new pullback lows of 1.1021, extending the correction and moderating the previously overbought condition in the pair. The pair is now lower for the sixth consecutive session.

- The expectations of fresh measures to support domestic demand in China are continuing to stoke broader optimism for risk sentiment across currency markets. Alongside the appreciating Chinese Yuan, the consequential impact on commodities is helping support currencies such as the AUD.

- EURAUD has extended the week’s losses to around 1.6%, substantially narrowing the gap with the July lows of 1.6234 ahead of Australian CPI data due on Wednesday, the last major data point before the July FOMC decision and press conference.

- It is also worth noting that today’s developments have worked against the short-term uptrend in EURGBP, with the break of both the 20-day and 50-day EMAs signalling a stronger reversal, opening 0.8564 initially ahead of 0.8504, the key support.

EGBs-GILTS CASH CLOSE: Modest Bear Flattening

The UK and German curves bear flattened Tuesday, with Gilts largely trading sideways and Bunds recovering some losses early in the session.

- Bunds spiked at 1000CET on the simultaneous release of a weak ECB Bank Lending Survey and German IFO, but otherwise core FI largely drifted for most of the session.

- Strong US consumer confidence figures in the afternoon helped nudge yields (esp at the short end) higher into the European cash close.

- Periphery spreads widened modestly, with BTPs underperforming.

- Aside from French consumer confidence figures early in the European session Wednesday, attention is mainly on the Federal Reserve decision later.

- As for the rest of the European week, today we published previews of the ECB decision Thursday (here) and the Eurozone flash inflation readings starting Friday (here).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 2.3bps at 3.068%, 5-Yr is up 0.5bps at 2.511%, 10-Yr is unchanged at 2.425%, and 30-Yr is down 1.2bps at 2.464%.

- UK: The 2-Yr yield is up 2.8bps at 4.966%, 5-Yr is up 1.8bps at 4.361%, 10-Yr is up 1.2bps at 4.268%, and 30-Yr is up 0.7bps at 4.428%.

- Italian BTP spread up 3.5bps at 163.5bps / Spanish up 1.1bps at 102.4bps

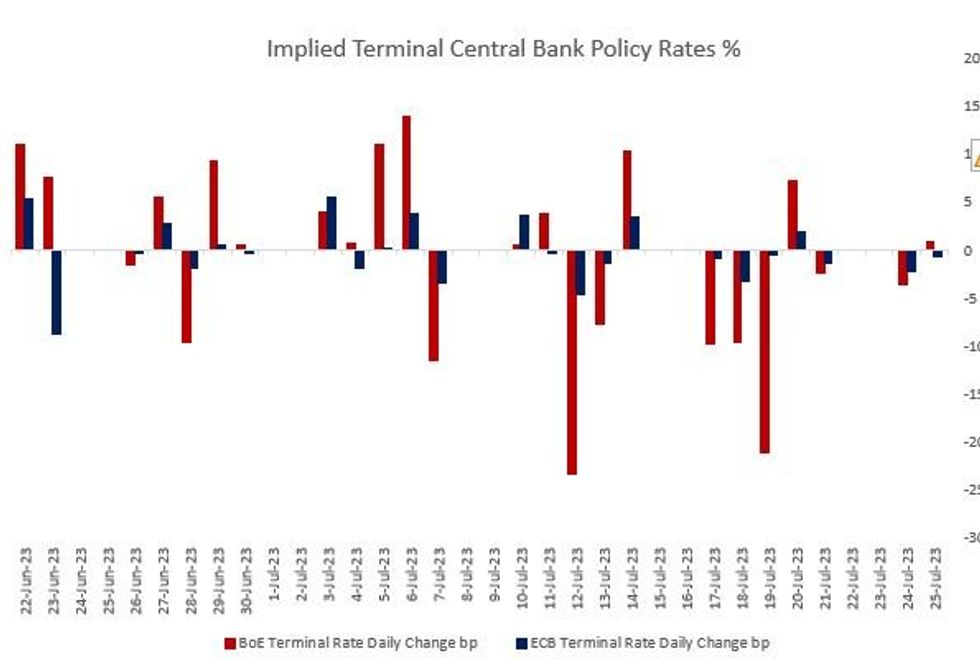

European STIR: ECB / BoE Pricing Unusually Flat Ahead Of Rising Event Risk

A soft ECB bank lending survey and weak German IFO did little to move peak pricing for the ECB and BoE Tuesday (terminal pricing had the smallest change at the close so far in July), with the Fed decision Wednesday and ECB Thursday looming later in the week.

- ECB terminal depo Rate pricing -0.7bp to 3.94% (44bp of further hikes left in the cycle to Dec 2023). Very little change in Tuesday's session, with a 25bp hike 96% priced at Thursday's meeting.

- BoE terminal Bank Rate pricing +0.8bp to 5.89% (89bp of further hikes left in the cycle to Feb 2024). There's still just under 50% probability implied for a 50bp hike at the August MPC.

US FI OPTIONS: Mixed SOFR Trade Tuesday Ahead Of FOMC

Tuesday's US rates options trade included:

- SFRH4 9575/9675cs, bought for 9.25 in 10k ref 94.85.

- SFRU3 98.50c, traded 0.25 in 5k

- SFRV3 96.12c, traded 1.5 in 2.5k

- SFRF4 94.56/94.37/94.18p fly, bought for 2.75 in 1k and 3 in 5k

- SFRM4 95.75/96.75cs, bought for 17.25 in 10k (Same cs trades in H4 for 9.25)

- 0QV3 95.75/95.37ps 1x2 traded 2 in 1.5k

- 0QZ3 95.87/ 2QZ3 96.50 p spread, traded 1.5 in 13.5k

- 0QZ3 95.50p, traded 24/22.5 in 5k

EU FI OPTIONS: More Vol And Upside Buying Tuesday

Tuesday's Europe rates / bond options flow included:

- ERX3 96.25/96.37/96.50c fly, bought for 1.5 in 4.3k

- ERM4 96.25 put v 0RZ3 96.75 put bought for 4.25 in 3k (buys the M4) (vs ERM4 96.34, ERZ4 96.74)

- ERU4 96.50^ bought for 99.5 in 0.75k

- SFIQ3 94.40/94.50 1x1.5 call spread bought for 2.5 in 2k (buys the 1)

US STOCKS: PacWest Slide Hits S&P 500 Climb, Tech Outperforms Before Key Earnings

- The S&P e-mini at 4599.5 (+0.3%) has pulled back off a session high of 4608.75 that had stopped just short of resistance despite a grinding higher in real yields, with the sell-off coming after news that Banc of California was in advanced news to buy PacWest.

- The move saw PacWest shares slide 27% and banks generally come under pressure, with the KBW index hitting session lows and currently -1.6% and with regionals -1.0%.

- Indeed, financials are joint laggards along with real estate for the SPX, both at -0.7%, within which banks are -1.4% having already been underperforming having led yesterday’s increases. Gains meanwhile are led by materials (+1.8%) and IT (+1.3%).

- Next resistance for the S&P e-mini is seen at last week’s high of 4609.25 after which lies a bull channel top drawn off the Mar 13 low with an intersection at 4622.12.

- Nasdaq outperforms (+0.8%) whilst the Dow lags (+0.1%), ahead of key earnings after the close today, including major tech companies Microsoft & Alphabet. See here: https://roar-assets-auto.rbl.ms/files/54818/MNIUSEARNINGS240723.pdf

COMMODITIES: Oil Firms Further With OPEC Supply Reductions And Potential China Support

- Crude oil firmed in the second half of the session with OPEC supply reductions and potential China economic support offsetting concerns for a US recession ahead of the expected Fed rate hike this week.

- Russia’s seaborne crude flows from Baltic and Black Sea ports slumped to the lowest in seven months according to Bloomberg vessel tracking as cuts finally filter through.

- The EU has no plans to raise the Russian oil price cap from $60/b, despite Russian crude prices crossing that threshold, according to Energy Intelligence.

- WTI is +1.0% at $79.55 off a high of $79.90 that cleared yesterday’s high to open next resistance at $80.05 (Apr 18 high) before a key resistance at $81.44 (Apr 12 high).

- Brent is +1.0% at $83.57, off a high of $83.87 that cleared yesterday’s high to open $83.77 (Apr 19 high) before a key resistance at $85.47 (Apr 12/13 highs).

- Gold is +0.5% at $1964.18, helped by a softer USD offsetting the impact from higher Treasury yields, pushing closer to the bull trigger at $1987.5 (Jul 20 high).

MNI ECB Preview - July 2023: Another 25bp Hike. September Remains Open

Another 25bp Hike in July. September Remains Open

- The ECB will hike policy rates by 25bp and leave balance sheet policies unchanged.

- Beyond indicating a willingness to tighten further if necessary, the ECB is unlikely to pre-commit to an additional policy rate hike in September.

The ECB will almost certainly hike by 25bp this week after President Lagarde guided markets to another hike at the June meeting. Although economic activity data has recently weakened and several policymakers have highlighted the lagged impact on the economy of previous policy rate hikes, the labour market remains tight and inflation is still someway from target. On balance, there is little to suggest that the ECB would feel compelled to ratchet up the hiking pace, or hit the pause button – both of which represent risk scenarios for this meeting that would be major market moving events.

For the full publication please see:

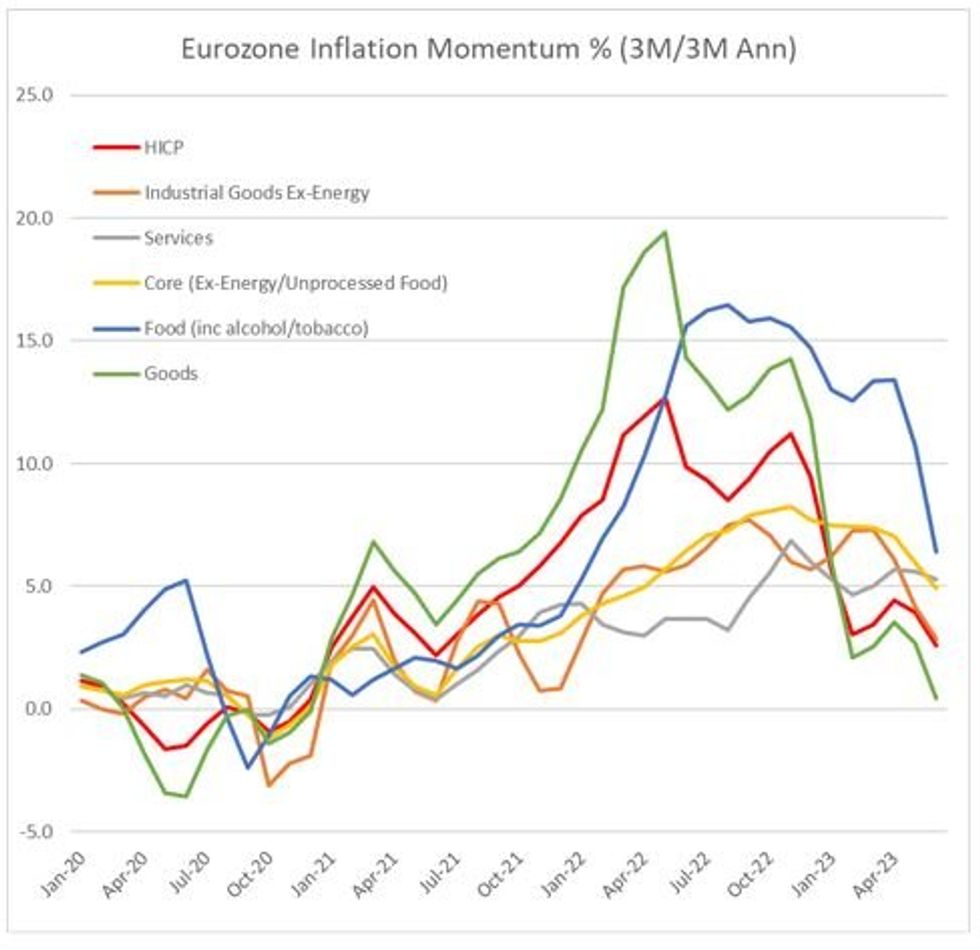

MNI Eurozone Inflation Preview – July 2023

EXECUTIVE SUMMARY

Services Stickiness Eyed In July Print

While most attention this week is on the ECB’s monetary policy decision, focus for both markets and policymakers will swiftly turn to July’s flash inflation data round which begins Friday morning.- As with June, there is a fairly wide range of estimates for core Eurozone Y/Y inflation, from 5.2% to 5.7% from the initial analyst reports we have seen, centring on a 5.4% median. That would represent limited progress from June’s 5.5% outturn. Headline is seen decelerating more sharply, to 5.2% from June’s 5.5% (with a relatively narrower range of estimates from 5.1-5.3%).

- While goods and commodity price pressures continue to subside, they remain elevated for services – the latter of which was again the second biggest contributor to June’s print.

- Our preview includes analysis of several key areas to watch, short outlooks for the national inflation prints prior to the eurozone release, and sell-side analyst previews.

FOR FULL PDF ANALYSIS:

FED: RRP Usage Resumes Decline

- RRP usage drops to $1721B, down $50B having held steady at $1771B for two days prior on likely GSE-related flow.

- It falls back to the $1725B averaged through Mon-Thu last week as part of its notable downtrend with the facility competing with high T-bill issuance.

- The number of counterparties fell by 2 to 96.

US DATA: Strong Conf Board Consumer Survey With Historically Low Jobs Hard To Get

- Conference Board consumer confidence was much stronger than expected in July at 117.0 (cons 112.0) after a slightly upward revised 110.1 (initially 109.7) in June, touching its highest since Aug’21.

- Strong increases were seen in both present situation and expectations measures.

- Notably, the labor market differential jumped higher to 37.2 from 32.8, its second monthly increase for the highest since February. It was driven by a small increase in the perception of jobs being plentiful but mainly a step lower in the rate of jobs being hard to get, from 12.6 to 9.7 for its lowest since Mar’22 and before that July 2000.

US DATA: Sizeable Beats For House Prices In May

- FHFA house prices increased 0.72% M/M (cons 0.6%) after an unrevised 0.73% M/M.

- S&P CoreLogic house prices increased 0.99% M/M (cons 0.7) after an only marginally downward revised 0.85% (initially 0.91%).

- It marks the fifth consecutive increase for FHFA and fourth for S&P, with FHFA now 2.4% higher than its Jun’22 peak and S&P quickly closing the relatively mild decline for now -2.3% lower than its Jun’22 peak.

- If these increases continue they could limit the extent that owner equivalent rent in the CPI basket slows as softer new rent leases enter BLS calculations.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.