-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Policy Week Ahead: FOMC, BOE, ECB

HIGHLIGHTS

- Sichuan province in China removes all birth restrictions, Guardian

- GERMAN STATS OFFICE POSTPONES TUESDAY'S INFLATION RELEASE, Bbg

- Taiwan warnings show US military is preparing for war, Chinese analysts say, SCMP

- US OFFICE OCCUPANCY SURPASSES 50% FOR FIRST TIME POST-PANDEMIC, Bbg

- RUSSIA GOVT FORBIDS OIL EXPORTS ADHERING TO WESTERN PRICE CAP, Bbg

Key links: MNI Fed Preview: February 2023 - Analyst Views / MNI INTERVIEW:UK With Higher NAIRU More Prone To Wage Pressure / MNI FED WATCH: Slowing To 25bp Pace And Debating Terminal Rate / MNI BRIEF: US Treasury Raises Q1 Borrowing Estimate By USD353B

Tsys Hold Narrow/Weaker Range Ahead Wed's FOMC

Tsys hold weaker, inside session range at midday, relative quiet start to a FOMC week. Higher than expected Spanish CPI/HICP inflation triggered selling across the board overnight, while Tsys see-sawed inside range with no substantive data to react to.

- Tsy 30YY currently 3.6545% (+.0355), yield curves flatter: 2s10s -0.915 at -70.091, 5s10s -2.337 at -13.184. Decent volumes (TYH3 >1M) with Asia back from Lunar New Year holidays.

- Fed funds implied hike for Feb'23 steady at 26.3bp ahead Wed's FOMC annc, Mar'23 cumulative 46.9bp to 4.798%, May'23 58.5bp to 4.914%, terminal at climbs to 4.925% in Jun'23.

- Additional policy/event risk with the BOE and ECB announcing this Thu. Participants plying the sidelines ahead Fri's Jan employment data (175k est vs. 223k prior).

- Eearnings annc pick up in earnest early Tue w/: International Paper (IP), Pfizer (PFE), Philips 66 (PSX), Pulte Grp (PHM), McDonalds (MCD), Marathon Petroleum (MPC), Corning (GLW), Sysco (SYY), UPS, GM, Caterpillar (CAT), Exxon (XOM).

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00058 to 4.30529% (-0.000043 total last wk)

- 1M -0.00414 to 4.56557% (+0.04643 total last wk)

- 3M -0.01172 to 4.81357% (+0.00972 total last wk)*/**

- 6M -0.01072 to 5.09157% (+0.00029 total last wk)

- 12M +0.00986 to 5.32600% (-0.03114 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.82971% on 1/12/23

- Daily Effective Fed Funds Rate: 4.33% volume: $120B

- Daily Overnight Bank Funding Rate: 4.32% volume: $304B

- Secured Overnight Financing Rate (SOFR): 4.30%, $1.165T

- Broad General Collateral Rate (BGCR): 4.27%, $472B

- Tri-Party General Collateral Rate (TGCR): 4.27%, $454B

- (rate, volume levels reflect prior session)

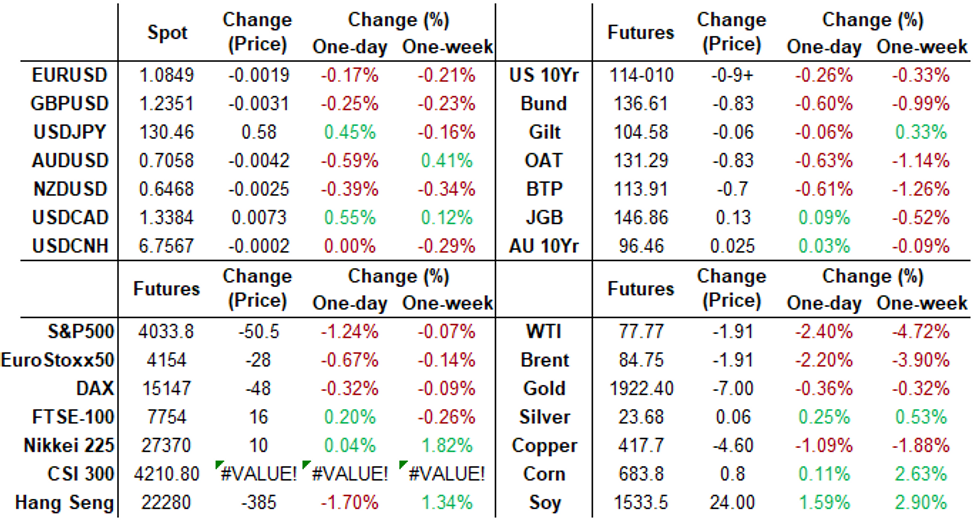

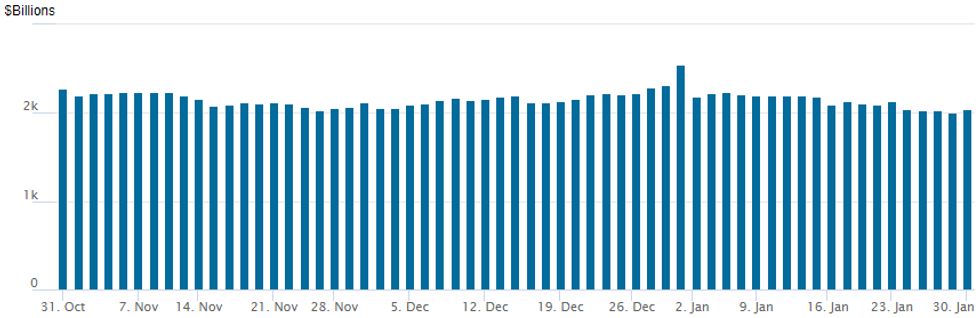

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage rebound to $2,048.714B w/ 106 counterparties vs. prior session's $2,003.634B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Rather muted volumes Monday covered mixed wing buyers (SOFR call and put flys, 5-, 10- and 30Y wings pared, vol buyers via strangles) ahead this Wed's FOMC policy annc (25bp hike widely anticipated).- SOFR Options:

- +5,000 SFRJ3 95.31/95.43 call spds, 1.25

- 1,500 SFRN3 95.12/95.31 5x4 put spds

- Block, +20,000 SFRU3 94.62/94.87 put spds, 4.5 ref 95.22

- +10,000 SFRZ3 94.68/94.93/95.18 put flys, 3.25 ref 95.55

- 1,500 SFRZ3 97.00/97.50/97.75 put flys

- 2,100 OQH3 95.37/95.62 put spds ref 96.00

- Block, total 20,000 SFRZ3 97.00/98.00 call spds, 4.0

- Block/screen, 17,000 SFRZ3 97.00/97.50/98.00 call flys, 1.5 ref 95.57

- 3,000 SFRK3 95.25/95.37 call spds ref 95.105

- 2,000 SFRH3 95.06/95.12 2x1 put spds ref 95.16

- Treasury Options:

- 2,000 TYJ 113/TYH3 113.5 put spds, 3

- 2,000 FVH3 110.5/111.25 call spds, 7 ref 109-08

- 5,000 TYH3 111/112 put spds ref 114-16

- 1,300 TYK3 115 straddles

- 2,700 TYH3 112/116 strangles, 27

- 5,000 FVH3 107.75/108.25/108.75 put flys

- 4,500 TYH 112.5/116 strangle. 32

- 1,500 TYH3 113/116 strangles 38 ref 114-14

- 4,000 USH3 126/128 put spds, 32 ref 129-28

- 2,000 USH3 121/124 put spds 10 ref 129-16

- 9,500 TYH 114 puts, 45 ref 114-11

- 3,500 TYH3 117.5 calls, 6 ref 114-13.5

- 2,000 FVH3 110.5/111.25 call spds, 7 ref 109-08

- 5,000 TYH3 111/112 put spds ref 114-15 to -16

EGBs-GILTS CASH CLOSE: Inflation Concerns

The German curve bear steepened sharply Monday, underperforming Gilts as Thursday's ECB and BoE decisions came into closer focus.

- Stronger-than-expected Spanish Jan flash inflation data was followed later by robust Belgian CPI data. Despite methodological questions as to how representative those releases were for the Eurozone as a whole, there is no doubt they set a bearish tone for European rates.

- But Wednesday's Eurozone CPI data was clouded further as Germany postponed its scheduled Tuesday release, meaning the Eurozone data will use only an estimation of German data.

- Nonetheless, today's CPI data further cemented pricing for a 50bp ECB hike Thursday; we published our meeting preview today.

- BTP spreads widened modestly. Greek bonds outperformed the space overall, following their ratings upgrade from Fitch after Friday's close.

- With German CPI delayed, attention early Tuesday is on French inflation.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 9.9bps at 2.679%, 5-Yr is up 9.5bps at 2.353%, 10-Yr is up 7.9bps at 2.318%, and 30-Yr is up 4.9bps at 2.244%.

- UK: The 2-Yr yield is down 0.3bps at 3.471%, 5-Yr is up 1.9bps at 3.22%, 10-Yr is up 1.3bps at 3.336%, and 30-Yr is up 1bps at 3.691%.

- Italian BTP spread up 2.3bps at 188.1bps / Greek down 1.9bps at 199.7bps

EGB Options: Opening A Busy Week With Mostly Downside

Monday's Europe rates / bond options flow included:

- Buys IKH3 112.50/110.50 put spread in 2.5k, Sells IKH3 115.50/116.50 call spread in 2.5k. Net paid 22

- Buys DUH3 105.50/105.00 put spread in 20k, sells DUH3 106.10/106.50 call spread in 20k. Net paid 3.5 and 3.75

- OEH3 116.75/116.25/115.75 1x1.5x0.5 put fly bought for 11 in 8k

- RXH3 138.5c/134.5p bought in 10k, receiving net 10.5 - 8.5 (bought put). Ref136.75

- ERG3 97.00/96.875/96.75 put fly, sold at 1.25 in 2k

- ERH3 97.125/97.00/96.875 put fly bought for 4.5 in 5k

- ERJ3 96.625/97.75 call spread vs 96.375 put, buys the cs and receives 1.75 in2k

- 0RH3 96.00/96.125/96.875/97.00 call condor sold at 8 in 15k (vs 96.75)

- SFIH3 96.00 call bought for 2 in 2k

FOREX: Greenback Trades Steadily North Amid Higher Core Yields

- Higher-than-expected inflation readings from both Spain and Belgium set a bearish tone for European rates early Monday and this sentiment benefitted the single currency, seeing EURUSD pop back above 1.09, weighing on the broad dollar index. However, higher core yields and the more cautious tone in equity markets eventually filtered through to a more supportive backdrop for the US dollar and the greenback has reversed steadily higher throughout Monday, extending on session highs in recent trade.

- All other G10 currencies are now in the red against the USD with dampened sentiment and lower commodity prices especially weighing on the likes of AUD and CAD, which have both shed around 0.5% to start the week. In the same vein, both SEK and NOK are the worst performers, dropping just shy of 1%.

- USDJPY has posted an impressive turnaround amid the higher yields. After printing lows of 129.21 on the back of a publication from Japan that noted the BoJ and government should commit to longer-term policy objectives around inflation, the pair has been stubbornly bid and now trades above 130.50 approaching the APAC crossover. On the topside, clearance of 131.58 would be required to indicate a meaningful bullish technical development, signalling a short-term reversal and opening 133.64, the 50-day EMA.

- Worth noting month-end tomorrow, where Barclays’ passive rebalancing model points to strong USD selling against all majors except the EUR where the signal is moderate.

- All the focus remains on major central bank decisions from the Fed, the ECB and BOE later this week.

FX: Expiries for Jan31 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700-25(E532mln), $1.0730-50(E591mln), $1.0850-55(E1.5bln), $1.0875-00(E1.7bln), $1.1100(E652mln)

- USD/JPY: Y127.50($500mln), Y130.00($511mln)

- USD/CAD: C$1.3400($1.2bln)

- USD/CNY: Cny6.8000($1.8bln)

Late Equity Roundup: Energy Sector Sells-Off Late

Major indexes extend session lows in late trade - scaling off last Fri's month highs ahead Wed's FOMC. Energy sector sold off in the second half as crude sold off (WTI -1.70 at 77.98), underperforming Communication Services and Information Technology. SPX eminis currently trades -46.25 (-1.13%) at 4037.75; DJIA -213.04 (-0.63%) at 33764.3; Nasdaq -202.7 (-1.7%) at 11418.99.

- SPX leading/lagging sectors: Energy underperformed (-1.88%) lead by O&G drillers/refiners (DVN -3.48%, MRO -3.25%, APA -3.15% Fang -2.98%) as crude sold off in the second half. Information Technology (-1.72%) and Communication Services (-1.60%) followed, interactive media and entertainment weighing on the latter (WDB -3.05%, META -2.60%, Google -2.30%).

- Leaders: Consumer Staples (+0.00%) lead by food, beverage and tobacco makers, followed by modest losses in Utilities and Financials (-0.30%).

- Dow Industrials Leaders/Laggers: JNJ -6.12 at 162.11, Microsoft (MSFT) trades -5.45 at 242.73, Chevron (CVX) -4.46 at 174.99. Leaders: United Health (UNH) +3.12 at 489.72, Goldman Sachs (GS) +4.94 at 358.64, American Express (AXP) +2.29 at 174.6.

- Reminder, earnings annc pick up in earnest early Tue w/: International Paper (IP), Pfizer (PFE), Philips 66 (PSX), Pulte Grp (PHM), McDonalds (MCD), Marathon Petroleum (MPC), Corning (GLW), Sysco (SYY), UPS, GM, Caterpillar (CAT), Exxon (XOM).

COMMODITIES: Crude Oil Helped Lower With Clearance Of Technical Support

- Crude oil extends Friday’s slump with a further 2% decline, with today’s decline partly fuelled by equities more than reversing Friday’s climb.

- It comes despite Bloomberg noting that much of the US East Coast is at risk of a gasoline shortage this summer as the EU ban of Russian oil products threatens to limit transatlantic supplies of which the US relies on during peak driving season. Separately, Russia’s government has formally banned sales of its crude to any buyers adhering to the G7 price cap.

- WTI is -2.2% at $77.96, clearing support at $78.45 (Jan 19 low) to next eye $72.74 (Jan 5 low).

- Brent is -2.1% at $84.81, clearing support at the 20-day EMA of $84.91, next eyeing $82.37 (Jan 12 low).

- Gold is -0.2% at $1924.09, faring surprisingly well against a USD and Treasury yield push higher throughout the session ahead of a flurry of central bank meetings. It sits between resistance at $1949.2 (Jan 26 high) and support at $1897.00 (20-day EMA).

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/01/2023 | 0030/1130 | ** |  | AU | Retail Trade |

| 31/01/2023 | 0130/0930 | *** |  | CN | CFLP Manufacturing PMI |

| 31/01/2023 | 0130/0930 | ** |  | CN | CFLP Non-Manufacturing PMI |

| 31/01/2023 | 0630/0730 | ** |  | FR | Consumer Spending |

| 31/01/2023 | 0630/0730 | *** |  | FR | GDP (p) |

| 31/01/2023 | 0700/0800 | ** |  | DE | Retail Sales |

| 31/01/2023 | 0730/0830 | ** |  | CH | retail sales |

| 31/01/2023 | 0745/0845 | *** |  | FR | HICP (p) |

| 31/01/2023 | 0745/0845 | ** |  | FR | PPI |

| 31/01/2023 | 0855/0955 | ** |  | DE | Unemployment |

| 31/01/2023 | 0930/0930 | ** |  | UK | BOE M4 |

| 31/01/2023 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 31/01/2023 | 1000/1100 | *** |  | IT | GDP (p) |

| 31/01/2023 | 1000/1100 | *** |  | EU | EMU Preliminary Flash GDP Q/Q |

| 31/01/2023 | 1000/1100 | *** |  | EU | EMU Preliminary Flash GDP Y/Y |

| 31/01/2023 | 1300/1400 | *** |  | DE | HICP (p) |

| 31/01/2023 | 1330/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 31/01/2023 | 1330/0830 | ** |  | US | Employment Cost Index |

| 31/01/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 31/01/2023 | 1400/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 31/01/2023 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 31/01/2023 | 1445/0945 | ** |  | US | MNI Chicago PMI |

| 31/01/2023 | 1500/1000 | *** |  | US | Conference Board Consumer Confidence |

| 31/01/2023 | 1500/1000 | ** |  | US | housing vacancies |

| 31/01/2023 | 1530/1030 | ** |  | US | Dallas Fed Services Survey |

| 01/02/2023 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.