-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - PBOC Makes First Major Policy Tweak Since 2011

MNI BRIEF: China Passenger Car Sales Up In November Y/Y

MNI China Daily Summary: Monday, December 9

MNI ASIA MARKETS ANALYSIS: Pre-PPI Lvls Ahead FOMC Minutes

- MNI: TRUDEAU OPTIMISTIC BOC WILL CUT RATES LATER THIS YEAR

- MNI RUSSIA: Putin-Russia Is Against Nuclear Weapons In Space: State

- MNI US: Haley Pledges To Stay In Presidential Race Beyond South Carolina Primary

- MNI ISRAEL: US Vetoes UNSC Resolution, But Ceasefire Talk Signals Shifting Stance

- MNI US-RUSSIA: WH: New Sanctions To Target "Sources Of Revenue For Russian Economy"

- RIKSBANK BREMAN: WANTS MORE STABILITY BEFORE PLANNING RATE CUTS, Bbg

Key Links: MNI INTERVIEW: US Inflation To Linger As Fed Loosens-Warsh / MNI BOE: Most Likely Rate Cut This Year - BOE Broadbent / MNI INTERVIEW: Better ONS Data Suggest Easing UK Labour Market / MNI INTERVIEW: Investors Jump Gun On BOC Cuts- Ex Deputy Lane / MNI BRIEF: Trudeau Hopes BOC Will Cut Sooner Rather Than Later / US$ Credit Supply Pipeline

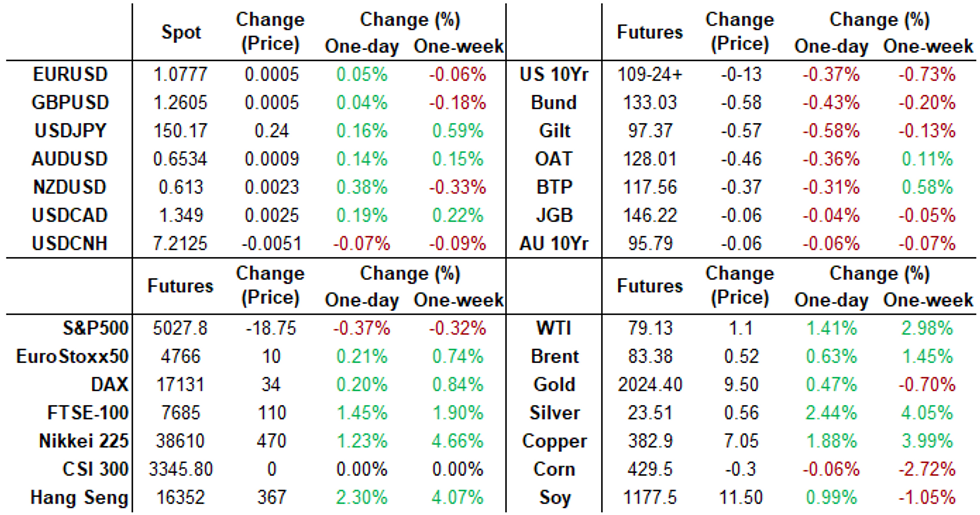

US TSYS Markets Roundup: Firmer/Narrow Range Ahead Wed's FOMC Minutes

- Treasury futures modestly firmer after the bell, off midmorning highs but holding near last Friday's pre-PPI levels: TYH4 currently +6.5 at 109-30.5 vs. 110-05 high. still below initial technical resistance at 110-17 (Feb 15 high); technical support at 109-17/15 (50.0% of Oct 19 - Dec 27 climb / Low Feb 16).

- Curves steeper but off highs: 2s10s +2.801 at -33.652 vs. -31.373 high; 10Y yield currently 4.2714%, -.0078.

- Tsys mirrored modest support in EGBs overnight following a larger than expected 25bp reduction in 5Y LPR during Asia-Pac hours, muted react to softer ECB Q4 negotiated wages to 4.5% from 4.7%.

- Tsys drew additional support after Canadian CPI data came out lower than expected (+2.9% vs. +3.2% est, +3.4% prior). Otherwise, no react to US data: JAN. Leading Indicator -0.4% M/M vs. -0.3% est, US Philly Fed Non-Mfg index -8.8 vs . -3.7 prior.

- No scheduled Fed speakers on today's docket, holding to the sidelines ahead of the Jan 31 FOMC minutes release tomorrow at 1400ET.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00443 to 5.32028 (-0.00487 total last wk)

- 3M +0.01172 to 5.32574 (+0.00497 total last wk)

- 6M +0.03525 to 5.26641 (+0.04250 total last wk)

- 12M +0.07159 to 5.0494 (+0.09765 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.30% (-0.01), volume: $1.666T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $681B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $669B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $110B

- Daily Overnight Bank Funding Rate: 5.31% (-0.01), volume: $280B

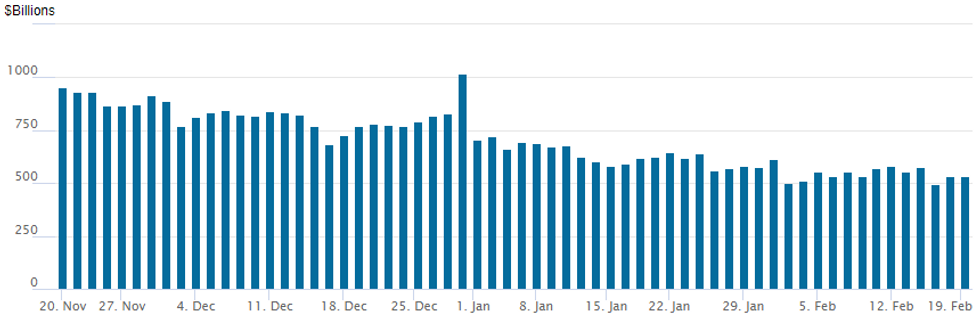

FED Reverse Repo Operation:

NY Federal Reserve/MNI

- RRP usage recedes to $530.879B vs. 532.125B last Friday; compares to $493.065B on Thursday, Feb 15 -- the lowest since early June 2021 .

- Meanwhile, the latest number of counterparties slips to 90 from 94 Friday (compares to 65 on January 16, the lowest since July 7, 2021).

SOFR/TREASURY OPTION SUMMARY

SOFR and Treasury options continued to favor low delta puts as markets returned from an extended holiday weekend Tuesday. Discounting the rebound in underlying futures back to Friday's pre-PPI levels, option accounts positioned for delayed rate cut expectations as the Fed waits stronger signs inflation is at bay. Projected rate cut pricing in late trade: March 2024 chance of 25bp rate cut currently -10.6% w/ cumulative of -2.6bp at 5.302%; May 2024 at -28.9% w/ cumulative -9.9bp at 5.230%; June 2024 -65% w/ cumulative cut -26.1bp at 5.068%. Fed terminal at 5.33% in Feb'24

- SOFR Options:

- -4,000 SFRM4 94.75/95.00 2x1 put spds 5.5 ref 94.995

- -7,500 SFRM4 95.12/95.25/95.50/95.62c condors 1.75 vs. 94.97/0.05%

- -10,000 SRZ4 94.87/95.12/95.56/95.81 Iron Condors 16.0 ref 95.66

- +3,000 SFRM4 94.87 calls vs 0QM4 96.50 calls 3.0

- +5,000 0QH4 95.75/96.00ps 2x1 put spds 3.75 ref 9593

- +6,000 SFRU4 94.87/95.00 put spds 4.5 ref 9532.5

- +5,000 SFRK4/SFRM4 95.06/95.18 call spd/spd 0.0

- Block, +5,000 SFRH5 95.00/95.62/96.25 call flys, 13.0 ref 95.93

- Block, 8,000 SFRH4 95.25 calls, .75 ref 94.715

- Block, 12,500 SFRZ4 96.00/96.75/97.25 call flys, 10.0 ref 95.66

- Block, +28,250 SFRU4 95.00 puts, 16.5-16.0 vs. 95.31/0.34, more on screen

- Block, 2,500 SFRU4 95.75/96.25/96.75/97.50 call condor on 3x3x2x2 ratio, 16.0 net ref 95.325

- +10,000 SFRM4 94.87/94.93/95.00/95.06 call condors, 1.25

- Update +12,000 SRK4 94.81/94.93/95.06 call flys, 2.25 to 2.5 ref 9498.5

- 6,000 SFRM4 95.25/95.37/95.50/96.50 call condors

- 3,000 SFRN4 94.62/94.75 2x1 put spds ref 95.315

- 4,000 SFRH4 94.75 puts, 5.5 ref 94.7125

- Block, 2,500 0QM4 95.50/96.00 put strip, 37.5 vs. 1,675 SFRM5 at 96.115

- 5,000 SFRM4 94.75/95.00 2x1 put spds ref 94.975

- 3,500 SFRJ4 94.68/94.81 put spds vs. 95.12/95.31 call spds ref 94.975

- 5,100 0QH4 96.12 calls ref 95.905

- 7,500 SFRM4 94.50/94.75 put spds ref 94.97

- 4,800 SFRM4 95.00/95.25/95.37/95.62 call condors ref 94.97

- 4,000 SFRU4 94.75/94.81 put spds

- 4,000 SFRU4 95.50/95.75/96.00 call flys ref 95.29 to -.295

- S0H 9562/9587ps 1x2 +3.75/7K, bid (9593)

- Treasury Options:

- 3,800 TYJ4 115/117/117.5 broken call flys ref 110-20 to -19.5

- +21,000 TYJ4 106.5 puts, 5

- 5,000 USH4 117/117.5 put spds, 7 ref 118-15

- 7,500 TYH4 109.25 puts, 4 ref 110-00

- 2,100 TYJ4 111/113 call spds ref 110-14.5

- 4,500 TYM4 110 puts, 123

- 1,200 TYH4 108.5/109/109.5 put flys

- over 6,000 TYM4 107 puts, 31 last ref 110-13

FOREX Greenback Firmly Off The Lows In Late Session Trade

- While the USD index remains around 0.20% lower on Tuesday, reflective of the lower US yields, the greenback is now well off session lows as we approach the APAC crossover. The greenback bid over the past few hours coincides closely with the weakness for equities with e-mini S&P briefly extending losses to 1.1% on the day.

- Major pairs have seen roughly a 30-pip adjustment which sees USDJPY claw back to the 150.00 mark and EURUSD edge back towards 1.0800. NZDUSD remains the outperformer on the day, still up 0.31%.

- Overall, today’s price action extends NZDUSD's short-term bounce, tipping the pair to print higher highs and higher lows for a fifth consecutive session. Spot briefly rose to a one-month high and notably above first key resistance at the 50-dma of 0.6183. This extends the recovery off the February lows to over 150 pips.

- Elsewhere, the Canadian dollar holds notably weaker following the lower-than-expected CPI - USD/CAD briefly showing to a new daily high of 1.3530 in the aftermath of the data but remaining short of Thursday pre-PPI highs at 1.3552.

- While the CPI was softer than expected on the headline (as well as the core metrics) there are a couple of one-offs here that may suggest this pace of disinflation will not be maintained. This potentially leaves CAD more subject to global sentiment shifts, rather than BoC policy ruminations - as flagged by a number of sell-side desks this week.

- Australian Wage Price Index data will cross first on Wednesday before the UK’s public sector net borrowing figures for January. Focus will then turn to the release of the FOMC minutes before European flash PMIs on Thursday.

FX Expiries for Feb21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0778-80(E2.4bln), $1.0815(E732mln), $1.0895-05(E1.1bln)

- USD/JPY: Y148.50-55($566mln), Y149.72-75($595mln), Y149.95-00($1.8bln)

- NZD/USD: $0.6060(N$700mln)

Late Equities Roundup: Chip Stocks Lead Laggers

- Stocks hold moderately weaker in late trade, off midday lows as IT and automakers continue to underperform. Currently, the DJIA is down 61.18 points (-0.16%) at 38567.44, S&P E-Mini Futures -31.5 points (-0.63%) at 4988.75, Nasdaq down -182.4 points (-1.2%) at 15594.12.

- Laggers: Information Technology and Consumer Discretionary sectors continue to underperform in late trade, semiconductor makers weighing on the former: well ahead of tomorrow afternoon's earnings announcement, Nvidia fell -5.8%, Applied Materials -5.68%, Advanced Micro Devices -5.39%. Meanwhile, auto and parts makers weighed on the Consumer Discretionary sector: Tesla -4.17%, Aptiv -1.82%, Borg Warner -1.37%.

- Leading gainers: Consumer Staples and Utilities continued to lead gainers in the second half, retail distribution names buoyed the former: Walmart +3.9% after beating earnings estimates this morning - support tempered by announcement to buy TV maker Vizio for $2.3B, Walgreens Boots +2.02%, Dollar Tree +1.87%. Multi energy providers supported the Utilities sector: Pinnacle West +1.63%, PG&E and Southern Company both +1.25%.

- Looking ahead: corporate earnings on tap after the close: Caesars Entertainment, Diamondback Energy, Costar, Teladoc, Palo Alto Networks and Chesapeake Energy.

E-MINI S&P TECHS: (H4) Bullish Trend Structure

- RES 4: 5170.86 2.236 proj of Nov 10 - Dec 1 - 7 price swing

- RES 3: 5110.50 2.00 proj of Nov 10 - Dec 1 - 7 price swing

- RES 2: 5100.00 Round number resistance

- RES 1: 5066.50 High Feb 12 and the bull trigger

- PRICE: 4983.0 @ 1400 ET Feb 20

- SUP 1: 4957.27 20-day EMA

- SUP 2: 4866.000/4845.11 Low Jan 31 / 50-day EMA

- SUP 3: 4702.00 Low Jan 5

- SUP 4: 4594.00 Low Nov 30

The trend condition in S&P E-Minis is unchanged and remains bullish. The pullback from Monday’s 5066.50 high is considered corrective and support to watch lies at 4957.27, the 20-day EMA. A clear break of this average would suggest potential for a deeper retracement, possibly towards the 4866.00 key support, the Jan 31 low. The trigger for a resumption of gains is 5066.50, the Feb 12 high.

COMMODITIES Recent WTI Gains Appear To Be Correction

- WTI crude futures are down over 1% on the day, having retreated to levels at Feb. 15 close. The downside stems from concerns over the sluggish pace of global demand growth, outweighing risks of supply disruptions in the Red Sea. The prompt US WTI futures time spread has reached its widest level since September, having begun its surge Feb. 13.

- In headlines on Tuesday, Russia and Venezuela agreed to broaden their oil production cooperation, Russia’s Foreign Affairs Minister Sergei Lavrov told Venezuelan state tv during a visit to Caracas.

- Recent gains in WTI futures, since Feb 5, still appear to be a technical correction. Key short-term resistance has been defined at $79.75, the Feb 16 high.

- For natural gas, Henry Hub is continuing to slide, remaining at levels not seen since mid-2020. Strong production, mild weather, high storage inventories, and curtailed LNG exports are weighing on prices. US Natgas MAR 24 is down -1.7% at 1.58$/mmbtu.

- For precious metals, spot gold is extending its most recent recovery, rising 0.35% and broadly in line with the softer US dollar. Technically significant levels on the topside remain much further out. The yellow metal needs to clear resistance at $2065.5, the Feb 1 high, to reinstate a bullish theme.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/02/2024 | 0001/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 21/02/2024 | 0030/1130 | *** |  | AU | Quarterly wage price index |

| 21/02/2024 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 21/02/2024 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 21/02/2024 | 1100/1100 | ** |  | UK | CBI Industrial Trends |

| 21/02/2024 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 21/02/2024 | 1300/0800 |  | US | Atlanta Fed's Raphael Bostic | |

| 21/02/2024 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 21/02/2024 | 1400/1400 |  | UK | BOE's Dhingra MNI Connect Event on BoE projections | |

| 21/02/2024 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 21/02/2024 | 1630/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 21/02/2024 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 21/02/2024 | 1800/1300 |  | US | Fed Governor Michelle Bowman | |

| 21/02/2024 | 1900/1400 | *** |  | US | FOMC Rate Decision |

| 22/02/2024 | 2200/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.