-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Canada Says Has Leverage Against Trump Tariffs

MNI ASIA MARKETS ANALYSIS: Projected Rate Cut Pricing Subdued

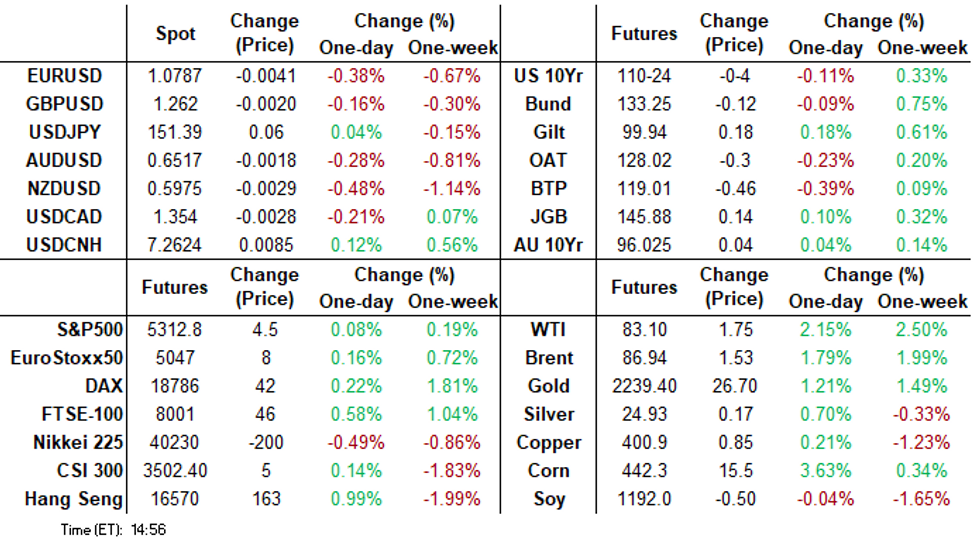

- Treasuries see-sawed off lows on Thursday, mixed data helped soften Fed Gov Waller's hawkish Wed comments.

- Waller said the Fed should wait a "couple months" to get a better understanding of the trajectory of inflation.

- Surprise March final UofM consumer survey release showed Softer inflation expectations.

- Markets closed for Good Friday tomorrow, while data and Fed speak continues, including Chairman Powell.

US TSYS Fed Gov Waller Left Mark on Short End, Rate Cut Projections Soft

- Treasury were modestly mixed into the early close: pit at 1300ET, cash closes an hour later at 1400ET while Globex closes at normal time of 1700ET. Carry-over weakness in the short end after Fed Gov Waller said late Wednesday the Fed should wait a "couple months" to get a better understanding of the trajectory of inflation. That said, Waller still expects the central bank to begin reducing the target range for the federal funds rate this year.

- Yields 5bp higher in the short end, curves bear flattening: 2s10s -4.182 at -42.381.

- Projected rate cut pricing retreats (post-Waller): May 2024 at -9.8bp from -15% late Wednesday w/ cumulative -2.5bp at 5.302%; June 2024 -56.9% vs. -63.1% w/ cumulative rate cut -16.7bp at 5.159%. July'24 cumulative at -26.4bp vs. -30.06bp, Sep'24 cumulative -43.9bp from -49.3bp.

- Mixed data did help rates pare losses on the day: TYM4 hitting session high of 110-28.5 just ahead of noon. Surprise March final UofM consumer survey release showed softer inflation expectations. Real GDP was revised up by 0.2pp in the final reading for 4Q23, with quarterly annualized growth of 3.4%. The internals of the revision were broad-based, including a very strong gross domestic income reading. The Chicago Business BarometerTM, produced with MNI declined 2.6 points to 41.4 in March.

- Despite tomorrow's close, there are several data points and Fed speakers scheduled: Personal Income/Spending, PCE Deflator, Adv Trade Balance, Retail/Wholesale Inventories, KC Fed Services. SF Fed Daly open remarks at policy conf at 1115ET while Fed Chairman Powell speaks at a moderated discussion at 1130ET.

- US markets resume normal trade Monday (Globex opens Sunday evening at 1800ET) while Europe markets closed for Easter Monday.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00140 to 5.32874 (+0.00003/wk)

- 3M -0.00368 to 5.29823 (-0.01425/wk)

- 6M -0.00623 to 5.21781 (-0.01119/wk)

- 12M -0.01232 to 4.99982 (-0.00396/wk)

- Secured Overnight Financing Rate (SOFR): 5.33% (+0.01), volume: $1.807T

- Broad General Collateral Rate (BGCR): 5.33% (+0.02), volume: $656B

- Tri-Party General Collateral Rate (TGCR): 5.33% (+0.02), volume: $644B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $82B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $218B

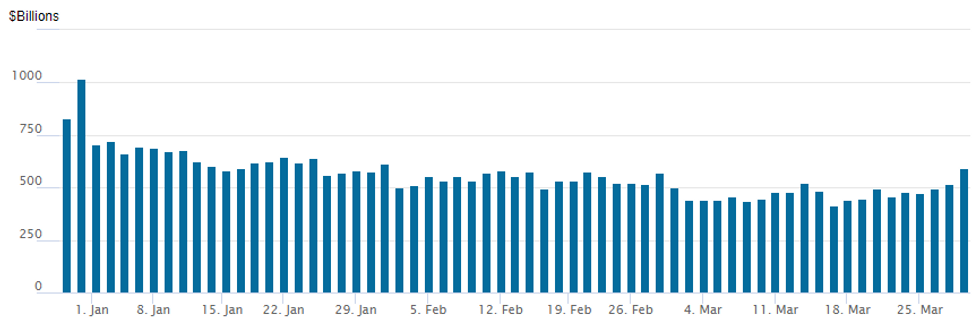

FED Reverse Repo Operation: Usage Surged to Nearly $600B

NY Federal Reserve/MNI

- RRP usage surged to nearly $600B today: $594.428B today vs. $518.357B on Wednesday. Compares to Friday, March 15 when usage fell to $413.877B - the lowest level since May 2021.

- Meanwhile, the latest number of counterparties climbed to 90 vs. 83 yesterday (compares to 65 on January 16, the lowest since July 7, 2021)

SOFR/TEASURY OPTION SUMMARY

Modest option volumes on Thursday's shortened pre-Easter holiday session (Friday closed, US markets resume Monday). Option trade tended toward puts as short end rates remained under pressure after Fed Gov Waller's hawkish rate comments late Wednesday. Projected rate cut pricing retreats (post-Waller): May 2024 at -9.8bp from -15% late Wednesday w/ cumulative -2.5bp at 5.302%; June 2024 -56.9% vs. -63.1% w/ cumulative rate cut -16.7bp at 5.159%. July'24 cumulative at -26.4bp vs. -30.06bp, Sep'24 cumulative -43.9bp from -49.3bp.- SOFR Options:

- 6,000 SFRH5 96.00/96.87 1x2 call spds ref 95.70

- -3,000 SFRZ4 95.00/95.25/95.50/95.75 put condors, 7.75 ref 96.225

- +4,000 SFRZ4 95.00/95.25/95.50/95.62 broken put condor, 0.0

- 2,000 SFRM4 94.87/95.00/95.25 broken call trees ref 94.86

- 2,000 SFRM4 94.75/94.87 call spds vs. SFRM4 94.37/94.50 put spds

- 3,400 SFRM4 94.93 calls ref 94.855

- -4,000 SFRJ4 94.81/94.87/94.93/95.00 iron condor, 3.0

- +2,000 SFRM4 94.81/94.87/94.93/95.00 call condors, 2.5

- 2,800 SFRJ4 94.93/95.00 call spds vs. SFRJ4 94.81/94.87 put spds

- +2,000 SFRK4 94.62/94.75/94.81 1x3x2 broken put flys, 2.75 vs. 94.85/0.10%

- 2,000 SFRU4 94.75/94.87 put spds vs. SFRU4 95.37/95.50 call spds ref 95.135

- Treasury Options:

- 5,000 USK4 114 puts, 4 total volume over 14,600

- -1,500 TYM4 107.5/109 3x2 put spds 21-22

- +2,000 TYM4 111/114.5 call spds vs. TYM4 107.5 puts, 45

- +5,000 wk2 TY 108.75/109.5 put spds, 3

EGBs-GILTS CASH CLOSE: Peripheries Underperform To Conclude Short Week

European FI closed a holiday-shortened week Thursday with a flat-to-softer performance in which periphery spreads noticeably widened.

- Hawkish commentary from the Fed's Waller and BoE's Haskel set a negative tone for global core FI, and helped spur underperformance in periphery EGBs.

- Bunds and Gilts pared losses in the afternoon, helped by softer-than-expected US data (including MNI Chicago PMI), with some support potentially coming from month-end extensions.

- The German curve twist flattened on the day, with the UK's bear flattening.

- 10Y BTP spreads to Bunds closed at their widest level in 3 weeks, having now widened by over 21bp from the March lows.

- While markets are closed Friday, there are still key data releases, namely flash March inflation prints for France and Italy, ahead of next week's German and Eurozone-wide reports.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.9bps at 2.848%, 5-Yr is up 0.8bps at 2.321%, 10-Yr is up 0.6bps at 2.298%, and 30-Yr is down 0.1bps at 2.455%.

- UK: The 2-Yr yield is up 2.8bps at 4.172%, 5-Yr is up 0.6bps at 3.823%, 10-Yr is up 0.1bps at 3.933%, and 30-Yr is up 0.2bps at 4.424%.

- Italian BTP spread up 6.2bps at 138.3bps / Spanish bond up 2.1bps at 86.4bps

EGB Options: May Sonia Structures Feature To Conclude Shortened Week

Thursday's Europe rates/bond options flow included:

- SFIK4 95.25/95.45/95.65c fly, bought for 1 in 4k

- SFIK4 95.20/95.10/95.05p ladder, bought for 1 in 1k

- SFIK4 95.10/95.20/95.30/95.40c condor vs 94.90p, bought the condor for 1 in 2k

- ERN4 96.75/96.62/96.50/96.37p condor bought for 4.75 ion 10k

- 2RM4 97.00/96.75ps bought for half in 2k

FOREX CAD Rebuffs S/T Bearish Theme, as GDP Lends Support

- Both CAD and CHF pushed back against previous bearish price action to trade higher through the Thursday close, as window-dressing and month-end flows worked against S/T trends evident in the price action across the past two weeks.

- USD/CAD headed through the London close at the session's lowest levels, extending the post-GDP data losses and pushing back against the bullish outlook. For now, the outlook remains positive above first support at 1.3456 and the bear trigger at 1.3420.

- Key short-term resistance is at 1.3614, the Mar 19 high and a recent congestion level. A clear break of this hurdle would confirm a resumption of the uptrend that began on Dec 27. This would expose 1.3623, a Fibonacci retracement, and 1.3661, the Nov 27 high.

- The USD Index started the Thursday session among the session's best performer, before giving back gains across US hours. Most sell-side models had seen moderate dollar sales as part of month-end rebalancing flow - and a small part of these flows may have played out, with modestly soft Q4 PCE numbers adding to the weight on the currency.

- Focus in the coming week turns to Eurozone inflation numbers, the 1-yr, 3-yr inflation expectations survey as well as the March jobs report rounding off the week on Friday. Markets currently expect the US to have added 215k jobs over March, down from 275k in February.

Late Equities Roundup: Energy and Utility Sectors Outperform

- Stocks are trimming gains in late Thursday trade, near steady to mixed with the DJIA narrowly outperforming. Still some time for month-end positioning ahead the extended Easter Holiday (markets closed Friday).

- Currently, DJIA is up 20.76 points (0.05%) at 39780.58, S&P E-Minis up 2 points (0.04%) at 5310, Nasdaq down 14.3 points (-0.1%) at 16384.75.

- Leading Gainers: Energy and Utility sectors outperformed in late trade, oil and gas shares buoyed the former as crude prices traded higher (WTI +1.68 at 83.03): EQT Corp +3.58%, Phillips66 +2.33%, APA +2.24%. Independent power and multi-energy utility shares supported the latter: AES Corp +2.81%, Edison International +1.47%, Dominion Energy +1.40%.

- Laggers: Media and entertainment shares continued to weigh on the Communication Services sector: Charter -2.01%, Netflix -1.28%, Meta -1.14%. Meanwhile, hardware makers weighed on the Information Technology sector: Seagate -1.74%, Super Micro -1.66%, Jabil -1.38%.

E-MINI S&P TECHS: (M4) Trend Needle Points North

- RES 4: 5428.25 1.00 proj of the Oct 27 - Dec 28 - May 1 price swing

- RES 3: 5416.33 Bull channel top drawn from the Jan 17 low

- RES 2: 5400.00 Round number resistance

- RES 1: 5322.75 High Mar 21 and the bull trigger

- PRICE: 5309.00 @ 13:43 GMT Mar 28

- SUP 1: 5254.71 Bull channel base drawn from the Jan 17 low

- SUP 2: 5226.59 20-day EMA

- SUP 3: 5157.00 Low Mar 11

- SUP 4: 5104.90 50-day EMA

The trend condition in S&P E-Minis is unchanged and remains bullish. Recent gains reinforce this theme and the break of 5257.25, Mar 8 high, confirmed a resumption of the uptrend. Note that moving average studies remain in a bull-mode position reflecting positive market sentiment. Sights are on 5416.33, the top of a bull channel drawn from the Jan 17 low. Initial firm support is 5226.59, the 20-day EMA. A move lower is considered corrective.

COMMODITIES: Spot Gold Reaches All-time High

- Spot gold rose to a new all-time high Thursday, reaching $2,225.5/oz, before paring gains slightly. The yellow metal is currently up 1.2% on the day at $2,220/oz.

- The trend condition in gold remains bullish and moving average studies are in a bull-mode condition, reflecting positive market sentiment. This signals scope for a climb towards $2230.1, a Fibonacci projection. Key short-term trend support has been defined at $2146.2, the Mar 18 low.

- Crude oil markets ticked higher Thursday, riding support this week from Russian/Ukraine escalation, a lack of Middle East peace talks as well as struggling Venezuelan political progression.

- WTI MAY 24 is up 2.2% at $83.1/bbl.

- Next week’s OPEC JMMC is expected to recommend the group stays on the current trajectory as its members hold the path to shore up production and keep prices high.

- Meanwhile, US henry Hub prices slipped back after the EIA gas storage release, before recovering to new highs for the day.

- US Natgas MAY 24 is up 1.9% at $1.75/mmbtu.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/03/2024 | 0745/0845 | *** |  | FR | HICP (p) |

| 29/03/2024 | 0745/0845 | ** |  | FR | PPI |

| 29/03/2024 | 0745/0845 | ** |  | FR | Consumer Spending |

| 29/03/2024 | 1000/1100 | *** |  | IT | HICP (p) |

| 29/03/2024 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 29/03/2024 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 29/03/2024 | 1515/1115 |  | US | San Francisco Fed's Mary Daly | |

| 29/03/2024 | 1530/1130 |  | US | Fed Chair Jerome Powell | |

| 29/03/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.