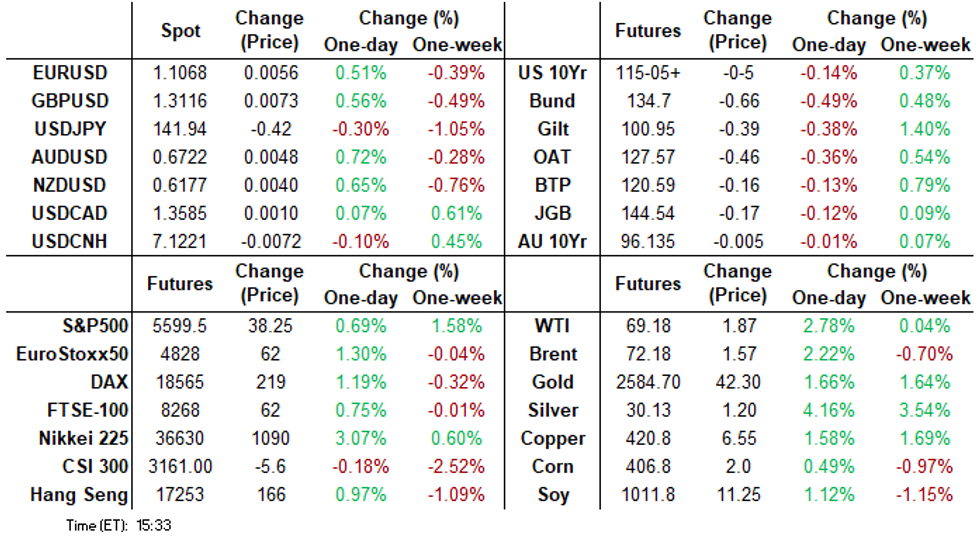

MNI ASIA MARKETS ANALYSIS: Rate Cut Speculation Rekindled

- Treasuries look to finish weaker, short end paring losses/curves rebounding to steeper after a WSJ article rekindled some hope over a 50bp rate cut next week.

- Stocks rallied on the late move in rates, also supported by strong gains in interactive media and semiconductor shares.

- Spot gold rose 1.7% to a new record high at $2,555/oz following this morning's ECB rate cut (expected) and latest US data which reinforced expectations for a first Fed cut next week.

- Weekly jobless claims again ruled out a sharper labor market deterioration, especially with continuing claims holding a shift away from recent highs. PPI mixed with down-revisions to prior.

US TSYS: Rate Cut Speculation Alive and Well

- Interesting day on net - Short end rates pared losses in late trade, after a WSJ article rekindled hope over a debatable 50bp rate cut at next week's FOMC meeting. Short end SOFR futures gapped higher (SFRU4 +.0425 at 95.095).

- Still off early week highs projected rate hikes have drifted off morning lows (*) : Sep'24 cumulative -31.5bp (-29.4bp), Nov'24 cumulative -68.6bp (-65.9bp), Dec'24 -107.5bp (-104.5bp).

- Earlier, Treasuries showed little reaction to expected ECB deposit rate cut, drawing brief two way flow as futures hold inside narrow overnight range.

- Fast two-way trade reported as Treasury futures gapped higher (TYZ4 to 115-17.5, +7) then quickly reverse to mildly lower pre-data levels following latest PPI data w/down-revisions to prior, weekly claims slightly higher than expected: 230k (sa, cons 227k) in the week to Sep 7 after a marginally upward revised 228k (initial 227k).

- Treasury futures drifted near lows (USZ4 126-04, -21) after the $22B 30Y auction re-open (912810UC0) tails slightly: 4.015% high yield vs. 4.000% WI; 2.38x bid-to-cover vs. 2.31x in the prior month.

- Focus turns to Friday's Import/Export prices data and UofM Inflation Expectations.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00059 to 5.09651 (-0.01333/wk)

- 3M +0.01535 to 4.94664 (-0.00800/wk)

- 6M +0.01691 to 4.57048 (-0.02151/wk)

- 12M +0.01890 to 3.97243 (-0.08117/wk)

- Secured Overnight Financing Rate (SOFR): 5.32% (-0.01), volume: $2.308T

- Broad General Collateral Rate (BGCR): 5.31% (+0.00), volume: $805B

- Tri-Party General Collateral Rate (TGCR): 5.31% (+0.00), volume: $769B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $95B

- Daily Overnight Bank Funding Rate: 5.33% (+0.00), volume: $243B

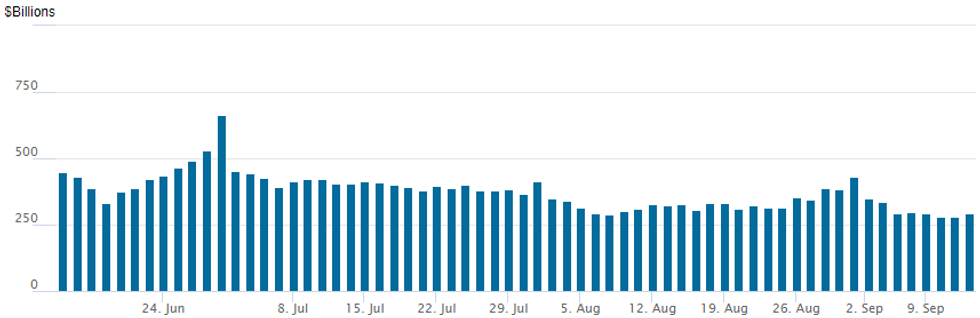

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage inches up to $294.464B from yesterday's multi-year low of $279.215B (early May 2021 levels). Number of counterparties steady at 58.

US SOFR/TREASURY OPTION SUMMARY

Mixed SOFR and Treasury options segued yet again to better upside call buying Thursday, well before a debatable WSJ article rekindled some hope over a 50bp cut at next week's meeting as short end SOFR futures gapped higher (SFRU4 +.0425 at 95.095). Still off early week highs projected rate hikes have drifted off morning lows (*) : Sep'24 cumulative -31.5bp (-29.4bp), Nov'24 cumulative -68.6bp (-65.9bp), Dec'24 -107.5bp (-104.5bp). Note, overall volumes were much better than noted below, much of which were September options that expire Friday.- SOFR Options:

- +15,000 SFRH5 95.75/96.00/96.25 call flys ref 96.50

- +10,000 SRZ4 95.87/96.00/96.12/96.25 call condors 2.5 vs. 95.87.5 to -86.5/.05%

- Block, another +10,000 SFRZ5 95.25/96.00/96.75 put flys 12.5 ref 97.19

- Block, 3,000 0QV4 96.50/96.87 put spds 0.5 over 2QV4 96.56/96.93 put spds

- Block, 20,000 SFRU4 95.00 puts, cab

- Block, +22,500 SFRZ5 95.25/96.00/96.75 put flys 12.5 ref 97.135 to -.14

- Block/screen 7,500 0QV4 97.00/97.50 2x3 call spds, 31.0 ref 97.14

- Block, 9,000 SFRH5 95.50/95.75/96.25/96.50 iron condors, 9.0

- 3,000 SFRZ4 95.25/95.37/95.50/95.62 call condors ref 95.835

- 3,000 0QV4 97.12/97.37 call spds ref 97.145

- over 20,000 SFRU4 95.00/95.12/95.25 call flys, 4.25 on screen/Block

- Treasury Options:

- 5,000 TYX4 115 calls, 106 ref 115-04.5

- 2,750 TUV4 104.5/TUX4 104.75 call diagonal

- 2,000 TYV 116/TYX 117 call diagonals, 16

- 2,000 TYX4 115/115.5 call spds, 11

- 2,200 TYV4 111.25/112/113 put trees ref 115-06.5

- 2,500 TYV4 114/115 put spds, 17 ref 115-06.5

BONDS: EGBs-GILTS CASH CLOSE: Curves Bear Flatten With ECB October Cut Fading

Core European yields rose for the first time in 8 sessions Thursday, as the ECB meeting outcome was seen as a little less dovish than expected.

- Bunds had posted nascent gains going into the as-expected ECB decision to cut the depo rate by 25bp, but had reached session lows by the end of the press conference.

- Lagarde noted downside growth risks but did not convey any urgency to cut rates again in October, highlighting data dependence, while her commentary on Eurozone wages was read somewhat hawkish.

- October ECB cut pricing dipped to 5bp from 8bp, and cumulative in the remaining meetings through March 2025 to 86bp from 91bp.

- The German curve bear flattened on the day, underperforming Gilts (the UK curve bear flattened in sympathy).

- Periphery EGB spreads tightened amid the pronounced backup in Bund yields and a stabilisation in equities.

- Friday's calendar is highlighted by multiple ECB speakers (Nagel, Rehn, Lagarde), but data-wise is fairly light, with French final CPI and Q2 wages, and UK BoE/Ipsos inflation expectations.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 7.3bps at 2.225%, 5-Yr is up 5.4bps at 2.025%, 10-Yr is up 3.8bps at 2.15%, and 30-Yr is up 3bps at 2.425%.

- UK: The 2-Yr yield is up 2.7bps at 3.818%, 5-Yr is up 2.5bps at 3.64%, 10-Yr is up 2bps at 3.781%, and 30-Yr is up 0.4bps at 4.376%.

- Italian BTP spread down 3.9bps at 139.1bps / Spanish down 1.4bps at 81.1bps

FOREX: Equity Sentiment Boosts AUD, Higher Core Yields Weigh on CHF

- Major equity indices continue to consolidate at their weekly highs and this is providing a more stable backdrop across currency markets. This is allowing risk sensitive pairs to outperform with the likes of GBP, AUD and NZD are all rising around 0.4% against the greenback on Thursday.

- Despite bearish conditions prevailing for AUDUSD, price action this week narrows the gap to initial firm resistance, which has been defined at 0.6767, the Jun 6 high. Clearance of this level is required to highlight a stronger reversal and expose key resistance at 0.6824, the Aug 29 high.

- Comparatively, firmer sentiment combined with higher core yields is weighing on the likes of JPY and CHF, with the latter the poorest performing major. EURCHF looks to extend its recovery from the 0.93 handle, a level the cross has been unable to close below since January.

- EURUSD is also firmer, following a central bank meeting that failed to rock the boat. The European Central Bank cut its key interest rate by 25bps on Thursday but said it was not committing to a predetermined rate path. A more optimistic global backdrop allowed EURUSD to rise around 30 pips to 1.1050, although daily ranges remain contained. Initial resistance is not seen until 1.1091, the Sep 9 high.

- In emerging markets, the Mexican peso has continued to rally through Thursday’s session, supported by the rebound in commodities and buoyant equities. USDMXN dipped as low as 19.5416 in recent trade, below initial support at 19.5897, the 20-day EMA, leaving the pair over 1.3% lower on the day.

- The data calendar is light on Friday, with US UMich sentiment and inflation expectations the highlight to round off the week.

Late Session Rebound on Debatable Rate Cut Hopes

- Stocks have rallied, extending session highs in late trade -- coinciding with a debatable WSJ article that has nevertheless rekindled some hope over a 50bp cut at next week's meeting.

- Currently, the DJIA trades up 189.37 points (0.46%) at 41052.11, S&P E-Minis up 43 points (0.77%) at 5604.25, Nasdaq up 201.2 points (1.2%) at 17596.48.

- Communication Services sector shares continue to lead gainers in late trade, interactive media and entertainment gaining with Warner Brothers +872%, Charter Communications +3.23%, Meta (formerly Facebook) +2.84%.

- Information technology sector has rallied on the back of renewed buying in semiconductor shares: Broadcom +4.54%, Nvidia +3.06%, Hewlett Packard +2.80%.

- On the flipside, Financials and Real Estate sectors underperformed in the second half, Banks turning lower late with Wells Fargo -3.63%,Charles Schwab -3.03%, US Bancorp -2.23%. Management & development shares weighed on the Real Estate sector: CoStar Group -2.09%, American Tower -1.10%.

- Of note, pharmaceuticals weighed on the Health Care sector earlier, led by Moderna falling nearly -18% amid plans to cut costs by $1.1B including research. Moderna has recovered some ground, trades -12% late.

EQUITY TECHS: E-MINI S&P: (U4) Bullish Recovery

- RES 4: 5821.25 1.00 proj of the Apr 19 - Jul 16 - Aug 5 price swing

- RES 3: 5800.00 Round number resistance

- RES 2: 5721.25 High Jul 16 and key resistance

- RES 1: 5669.75 High Sep 3

- PRICE: 5605.50 @ 1440 ET Sep 12

- SUP 1: 5515.90/5394.00 50-day EMA / Low Sep 6 and a bear trigger

- SUP 2: 5367.50 Low Aug 13

- SUP 3: 5330.00 61.8% retracement of the Aug 5 - Sep 3 bull leg

- SUP 4: 5249.74 76.4% retracement of the Aug 5 - Sep 3 bull leg

A volatile and bullish session in S&P E-Minis yesterday, highlights a possible bullish reversal and the end of the corrective cycle between Sep 3 - 6. The contract is trading above the 20- and 50-day EMAs and a continuation higher would signal scope for a climb towards 5669.75, the Sep 3 high. On the downside, a reversal lower and a breach of 5394.00, the Sep 6 low, would reinstate a bearish theme.

COMMODITIES: Spot Gold Hits Fresh All-Time High, Crude Climbs

- Spot gold rose 1.7% to a new record high at $2,555/oz today, following the ECB rate cut and latest US data which reinforced expectations for a first Fed cut next week.

- A bullish structure in gold remains intact, reinforced by today’s gains, which ended the recent consolidation. The focus next is on $2,565.75, a Fibonacci projection.

- Meanwhile, silver has outperformed, rising by 3.9% to $29.8/oz, its highest level since Aug 28.

- For silver, however, a medium-term bearish cycle remains intact and short-term gains are considered corrective.

- Key short-term resistance has been defined at $30.192, the Aug 26 high. A breach of this hurdle would cancel the bearish theme and expose $30.502, a Fibonacci retracement.

- Copper is also up by 1.3% at $419/lb, having earlier in the session risen towards $424, its highest level since end-August.

- WTI is headed for its highest close since Sep. 5. Support comes from a weaker USD and better risk sentiment. Crude has continued its rebound after Brent reached a low of $68.68/bbl earlier this week.

- WTI Oct 24 is up 2.7% at $69.1/bbl.

- From a technical perspective, WTI futures remain in a bearish condition and short-term gains are considered corrective. A renewed move lower would open $63.93 next, a Fibonacci projection point, while on the upside firm resistance is at $71.56, the 20-day EMA.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 13/09/2024 | 0430/1330 | ** |  | Industrial Production |

| 13/09/2024 | 0645/0845 | *** |  | HICP (f) |

| 13/09/2024 | 0830/0930 | ** |  | Bank of England/Ipsos Inflation Attitudes Survey |

| 13/09/2024 | 0900/1100 | ** |  | Industrial Production |

| 13/09/2024 | - |  | ECB's Lagarde in Eurogroup meeting | |

| 13/09/2024 | 1230/0830 | ** |  | Import/Export Price Index |

| 13/09/2024 | 1230/0830 | ** |  | Wholesale Trade |

| 13/09/2024 | 1400/1000 | ** |  | U. Mich. Survey of Consumers |

| 13/09/2024 | 1700/1300 | ** |  | Baker Hughes Rig Count Overview - Weekly |

| 14/09/2024 | 0200/1000 | *** |  | Fixed-Asset Investment |

| 14/09/2024 | 0200/1000 | *** |  | Retail Sales |

| 14/09/2024 | 0200/1000 | *** |  | Industrial Output |

| 14/09/2024 | 0200/1000 | ** |  | Surveyed Unemployment Rate M/M |