-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Rates Discount Latest Fed Speak

HIGHLIGHTS

- MNI FED Bowman: Not Seeing What We Need To See In Inflation Data

- MNI FED Barkin: I Like 25bp Path Because .. It Gives Us Flexibility to Respond as it Comes

- BANK OF AMERICA, GOLDMAN SACHS EXPECT FED HIKES THROUGH JUNE, Bbg

- CFTC to Resume Weekly Trade Report as Early as Feb. 24, Bbg

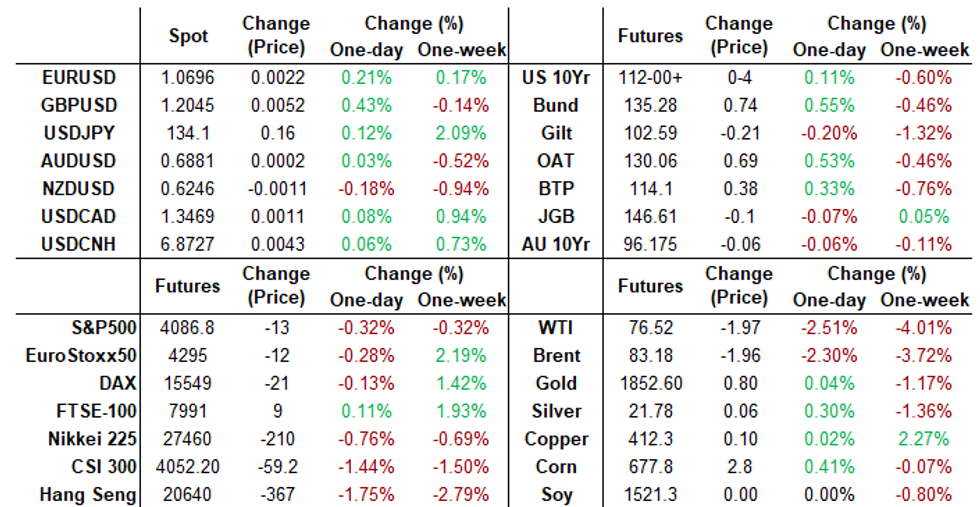

US TSYS: Tapped Out on Pricing in Hikes For Now

Tapped out on the week's hawkish Fed speak, Tsys modestly higher after the bell, well off early lows that saw 30YY tap3.9662% high, currently 3.8756% (-.0385).

Yield curves hold flatter as short end continues to underperform as central bank policy messaging got a little uncertain after Fed Governor Michelle Bowman said "Your guess as good as mine as to what happens next in the economy."

- Tsys opened weaker, carry-over from Thu's hawkish Fed comments from Mester and Bullard (don't count out 50bp hike if necessary), but whipsawed off lows after ECB Villeroy comments (ECB in restrictive territory, action after March "less urgent").

- Rates settled into higher range by midmorning after Richmond Fed Barkin said steady quarter-point interest rate increases until inflation is on a sustainable path back to 2% provides the best flexibility for the Fed to respond to incoming data.

- Fed funds implied hike for Mar'23 at 28.2bp, May'23 cumulative 52.0bp to 5.101%, Jun'23 66.4bp to 5.245%, terminal at 5.29% in Aug'23.

- Second half trade rather quiet ahead an extended holiday weekend, markets closed Monday for Presidents Day holiday, data resumes Tuesday. No scheduled Fed speakers ahead Feb FOMC minutes release on Wednesday at 1400ET.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00128 to 4.55686% (-0.00243/wk)

- 1M -0.00657 to 4.59129% (+0.01329/wk)

- 3M +0.01443 to 4.91529% (+0.04586/wk)*/**

- 6M +0.06257 to 5.24300% (+0.11586/wk)

- 12M +0.06972 to 5.64286% (+0.15829/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.91529% on 2/17/23

- Daily Effective Fed Funds Rate: 4.58% volume: $105B

- Daily Overnight Bank Funding Rate: 4.57% volume: $286B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.244T

- Broad General Collateral Rate (BGCR): 4.53%, $463B

- Tri-Party General Collateral Rate (TGCR): 4.53%, $456B

- (rate, volume levels reflect prior session)

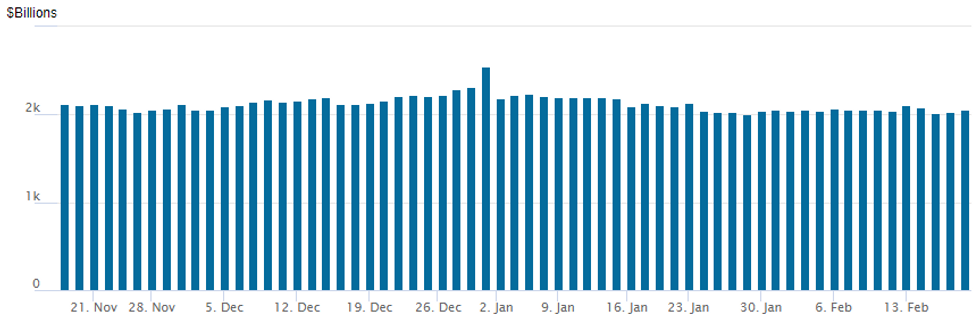

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,059.662B w/ 98 counterparties vs. prior session's $2,032.457B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Heavy option volumes centered on outright put and put spd buying, opening and position adjusts as underlying gradually prices in chance of more than 25bp hike(s).- SOFR Options:

- Block, 20,000 SFRU3 94.06/94.62 put spds, 16.5 ref 94.745

- Block, 7,500 SFRM3 94.50/94.75 3x2 put spds, 15.5 ref 94.725

- -30,000 SFRM3 95.00/95.12/95.25/95.37 call condors, 1.0 ref 94.72 (unwind, >+60k, 3.5 on Jan 19)

- Block, 20,000 SFRH3 94.81/94.93 put spds, 1.0 ref 95.0275

- Block, 20,000 SFRH3 94.75/94.93 put spds, 1.25 ref 95.0275

- Block, 10,000 SFRZ3 94.06/94.18/94.31 put flys, 0.75 net/splits ref 94.945

- Block, update 10,000 OQJ3 95.50/95.75 put spds, 10.0-9.5 ref 95.765 -.81

- Block, 10,000 SFRZ3 94.50/95.50 strangles, 39.0 ref 94.95

- Block, 7,500 2QH3 96.50 puts, 18.5 ref 96.445

- 2,000 SFRH3 94.75/94.81/94.93/95.06 put condors ref 95.0225

- 2,000 SFRZ3 94.25/94.75/95.00/95.50 put condors ref 94.93

- Block, 12,000 SFRH4 95.00/96.00 put spds, 54.5 ref 95.325

- over 6,000 SFRJ3 94.56/94.68 put spds, ref 94.71

- Block/screen, 15,000 SFRZ3 94.5/95.00 2x1 put spds, 1.5 ref 94.935

- 5,000 OQM3 95.62/96.25 strangles, check price, ref 95.775

- 4,750 SFRM3 94.37/94.62/95.06/95.12 broken put condors ref 94.70

- 1,250 SFRH3 95.00/95.06/95.18/95.25 put condors ref 95.0225

- 10,000 OQU3 94.00/94.50/95.00 put flys ref 96.075

- Block, 3,000 OQH3 95.37/95.62/95.87 1x3x2 call flys, 1.5 vs. 95.355/0.05%

- Block, 20,000 SFRU3 94.00 puts, 4.0 ref 94.71

- Block, 10,000 SFRU3 94.25 puts, 8.0 ref 94.71 to .715

- Block, 10,000 SFRU3 93.75 puts, 2.5 ref 94.71

- Block, 12,000 OQM3 94.50/95.12/95.75 put flys, 14.0 ref 95.76 to -.77

- over 6,000 SFRM3 94.50 puts, 6.0 ref 94.71

- 3,000 SFRJ3 94.37/94.62/94.87/94.93 put condors ref 94.70

- Treasury Options:

- 5,900 TYJ3 108.5/110.5 put spds, 24 ref 112-03.5

- 5,000 FVJ3 108 calls, 31.5 ref 107-17.75

- 5,000 TYH3 111.75/112.5 call spds 13 ref 111-15.5

- Over 4,200 TYH3 113 calls, 2

- 5,000 TYH3 110.5/111 put spds, 11 ref 111-13.5

- over 7,000 TYH3 110.5 puts 8-10 ref 111-11.5 to -11

- 1,000 TYH3 109.5/110/110.5/111 put condors ref 111-17

- 5,100 wk2 TY 109 puts, 6 ref 112-01.5

- 2,700 TYH3 puts, 4 ref 111-17

- over 6,000 TYJ3 110 puts 20-25 ref 112-03.5 to 111-24.5

- 2,000 TYH3 111 puts, 13 ref 111-21

EGBs-GILTS CASH CLOSE: Rally From Lows As Central Bank Hawkishness Abates

The UK curve twist steepened while Germany's bull flattened Friday, with weakness early in the session reversing in the afternoon.

- After weakening early on hawkish comments by ECB's Schnabel who said that markets may be underestimating inflationary pressures, EGBs rallied after shortly after noon GMT as Banque de France's Villeroy signalled slower hikes past March.

- The rally accelerated in the afternoon as Fed's Barkin was seen eyeing 25bp hikes, calming recent market fears over a return to 50bp US hikes.

- Stronger-than-expected UK retail sales data helped contribute to Gilt underperformance.

- A fairly thin schedule awaits Monday, with volumes likely to be limited by a US holiday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.4bps at 2.877%, 5-Yr is down 2.9bps at 2.508%, 10-Yr is down 3.8bps at 2.44%, and 30-Yr is down 4.1bps at 2.395%.

- UK: The 2-Yr yield is down 0.4bps at 3.794%, 5-Yr is up 2.3bps at 3.433%, 10-Yr is up 1.6bps at 3.515%, and 30-Yr is up 4bps at 3.936%.

- Italian BTP spread up 0.5bps at 186bps / Spanish up 0.6bps at 96.9bps

EGB Options: Session Highlighted Again By Schatz Put Spreads In Size

Friday's Europe rates / bond options flow included:

- Schatz put spreads (total since late Thursday - selling out of the 40k, new position in the 50k)

- DUJ3 105.5/105.0 put spread sold 25.25 in 40k

- DUJ3 105.2/104.7ps 1x1.25, bought for 15.5 in 50k

- OEJ3 115/113ps 1x2, bought for 20 in 2.5k

- OEK3 115.50/114.75ps, bought for 22.5 in 2.5k

- SFIJ3 95.70/95.90 1x2 call spread bought for 3 in 1.5k

- SFIK3 95.20/95.00ps, bought for 2 in 4k

FOREX: Greenback Relinquishes Intra-Day Advance Ahead Of Long Weekend

- Despite the USD index rallying roughly 0.7% in early session trade on the back of hawkish Fed rhetoric late Thursday, the greenback has reversed all of this advance throughout US hours.

- Pressure on the dollar accelerated as Fed's Barkin was seen eyeing 25bp hikes, calming recent market fears over a return to 50bp US hikes. Potential profit taking may have exacerbated the move as we approach the weekend close and factor in the US President’s Day holiday on Monday.

- GBPUSD (+0.43) is now roughly one percent off the overnight 1.1915 lows with similar price action being seen in the Japanese Yen, with USDJPY narrowing the gap with the overnight lows of 133.94 approaching the close.

- The emerging market basket is also performing very well with notable gains in high beta plays such as the BRL and ZAR.

- Also worth noting that USDMXN has traded at near-five year lows below 18.40, extending some weakness below the significant psychological/technical support at 18.50 that was breached on Thursday, potentially signalling a move down to the 2018 lows around 17.94.

- There are no major data releases on Monday, with volumes likely to be limited by the US holiday. RBA minutes and Eurozone Flash PMIs kick things off on Tuesday before Canada’s latest inflation data.

FX: Expiries for Feb20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0610(E682mln), $1.0670-75(E510lmln), $1.0682-90(E705mln), $1.0700-15(E1.2bln)

- EUR/GBP: Gbp0.9000(E809mln)

Late Equity Roundup: DOW Components Gaining Late

Stocks mixed, off midday lows with eminis looking to join firmer Dow components in late trade. Utilities, Consumer Staples and Health Care stocks extended gains while Energy sector shares held lows w/ crude prices weaker (WTI -2.16 at 76.33). SPX eminis currently trading -16.5 (-0.4%) at 4083.5; DJIA +96.22 (0.29%) at 33793.12; Nasdaq -88.7 (-0.7%) at 11767.32.

- SPX leading/lagging sectors: Energy sector (-3.56%) weighed by wide swath of O&G exploration, production, refining and shipping stocks (EOG -6.08%, DVN -4.9%, HAL -5.73%, HES -5.70%, FANG -5.17%) as market considers impact of Russia oil sanctions. Information Technology (-1.5%) sector next in line as chip stocks remain soft (ON -3.14%, SEDG -3.13%, NVDA -2.97, AMD -2.14%).

- Leaders: Utilities (+1.18%) supported by one of largest LNG providers in US, Atmos Energy (ATO +1.71%). Consumer Staples (+1.1%) and Health Care (+0.82%) next up, latter supported by bio-tech and pharmaceuticals (BIO +5.68%, OGN +5.63%, AMGN +2.55%, MRK +2.34%).

- Dow Industrials Leaders/Laggers: United Health (UNH) +9.51 at 496.86, Amgen (AMGN) +5.96 at 240.18, Travelers (TRV) +3.17 at 186.23. Laggers: Microsoft (MSFT) -4.69 at 257.46, Home Depot (HD) -3.79 at 317.45, Chevron (CVX) -3.70 at 162.87 and Salesforce (CRM) -3.74 at 164.37.

- Earnings resume next week, latest cycle should be winding down shortly. Some notable stocks announcing: WMB ($0.48 est), LPX ($0.55 est), HD ($3.27 est), WMT ($1.52 est), FANG ($5.23 est), PSA ($3.97 est), PXD ($5.87 est).

COMMODITIES: Rate Hike Induced Demand Fears Offset Prior Supply Squeeze

- Crude oil has ended the week on a soft patch, sliding as a substantial re-pricing of higher interest rate expectations are seen curtailing demand, along with the expected return to normal operations at the Ceyhan export terminal in Turkey by the end of this week.

- In doing so, front contracts are trading near levels seen early last week before the rally caused by supply outages and the announcement of a Russian production cut in March.

- WTI is -2.7% at $76.34, easily pushing through support at $76.52 (Feb 9 low) with its low of $75.06, opening $72.25 (Feb 6 low).

- Brent is -2.5% at $82.98, with a low of $81.80 clearing support at $83.05 (Feb 9 low) to open $79.10 (Feb 6 low).

- Gold is +0.3% at $1842.37, pulling back earlier notable losses on the day with a reversal in USD strength but still down on the week as a whole. A low of $1819.02 cleared support at $1827.7 (Feb 16 low) and came close to key near-term support at $1825.2 (Jan 5 low).

- Weekly moves: WTI -4.2%, Brent -3.9%, Gold -1.2%, US nat gas -9.4%, EU TTF nat gas -9.1% as gas prices tumble on mild winter weather.

Monday-Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/02/2023 | 0300/1100 |  | CN | PBOC LPR | |

| 20/02/2023 | 0700/0800 | *** |  | SE | Inflation report |

| 20/02/2023 | 1000/1100 | ** |  | EU | Construction Production |

| 20/02/2023 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 21/02/2023 | 2200/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.