-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Risk-On Ahead Friday Employ Data

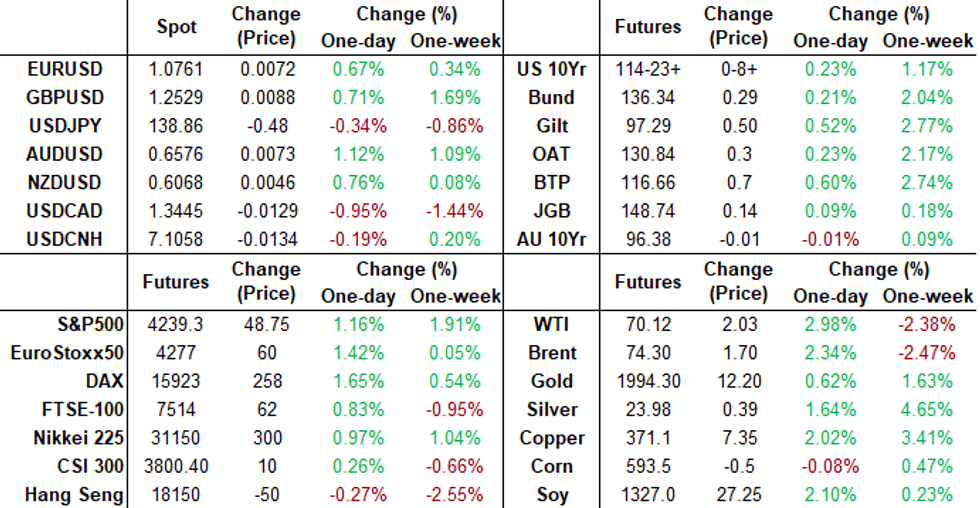

- MNI Fed Harker: “Disinflation is under way, but it is doing so at a disappointingly slow pace"

- ECB VILLEROY: REMAINING RATE HIKES TO BE 'RELATIVELY MARGINAL, Bbg

- ECB LAGARDE: NO CLEAR EVIDENCE UNDERLYING INFLATION HAS PEAKED .. RATE HIKES ARE BEING TRANSMITTED FORCEFULLY TO CREDIT, Bbg

Key Links:MNI US Payrolls Preview: Watching Hike, Skip Or Pause Clues / MNI INTERVIEW: Soft Landing Could Turn Hard, Says ISM Chief / MNI POLICY: Fed Most Divided Since Start Of Hikes, More Loom / MNI: Fed’s Harker Says Close To Point Of Holding Rates Steady / MNI INTERVIEW: Canada Export Windfall Over, Dollar Weakens-EDC

US TSYS: Holding Near Highs, Projected Year-End Rate Cut Back In Play

- Treasury futures holding moderate gains late in the second half, holding relatively narrow range near highs as focus turned to US data ahead Friday's NFP employment release (default concerns cooled slightly after the Fiscal Responsibility Act passed the House yesterday, currently debated in Senate.

- Whippy two-way trade tied to first half data: stronger than expected ADP private employment data of +278k vs. +170k est, saw futures trade lower but quickly recovered half the move in 10s. Treasuries rallied further after lower than expected 1Q Unit Labor Cost (4.2% vs. 6.0%) while Weekly Claims gained only 2k to 232k.

- Treasury futures gapped higher yet again (10s breached 20D EMA resistance on way to 115-00 session high) after ISM data showed a large drop in Factory prices paid (44.2 from 53.2 prior, 52.3 exp) slightly lower than expected Mfg figure (46.9 vs. 47.0 est).

- The ISM-tied rally saw short end rates fully price in a 25bp rate CUT in December before scaling back to appr 94% of a projected cut.

- Fed speak proved mixed ahead Blackout at midnight Friday. Non-voter StL Fed pres Bullard commented on need for further hikes, while Philly Fed Harker reprised his dovish comments from Wed.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00197 to 5.17424 (+.02080/wk)

- 3M -0.01644 to 5.27638 (+.01264/wk)

- 6M -0.03543 to 5.28528 (-.01308/wk)

- 12M -0.07580 to 5.06270 (-.09544/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00100 to 5.06471%

- 1M -0.03000 to 5.16300%

- 3M -0.01814 to 5.49857 */**

- 6M +0.00172 to 5.64743%

- 12M +0.00986 to 5.72543%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.51671% on 5/31/23

- Daily Effective Fed Funds Rate: 5.08% volume: $118B

- Daily Overnight Bank Funding Rate: 5.07% volume: $250B

- Secured Overnight Financing Rate (SOFR): 5.08%, $1.623T

- Broad General Collateral Rate (BGCR): 5.05%, $596B

- Tri-Party General Collateral Rate (TGCR): 5.05%, $577B

- (rate, volume levels reflect prior session)

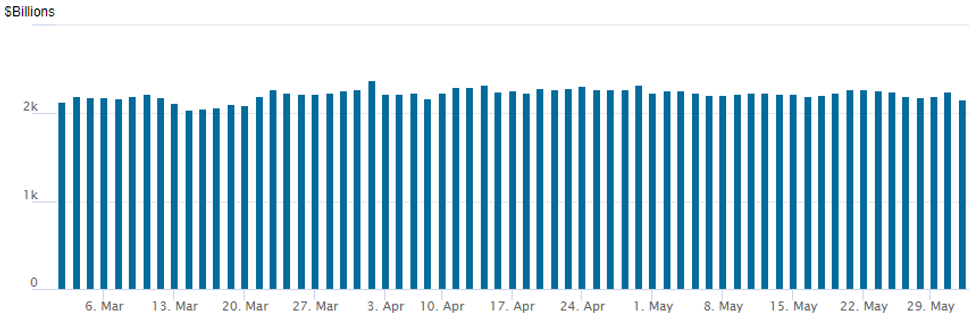

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage falls back to $2,160.055B w/ 102 counterparties, compares to prior $2,254.859B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

Predominantly low delta put and put structures traded Thursday, carry over from overnight amid positioning in June SOFR options that expire two days after the next FOMC on June 14. Post-data put buyers continued through the session, fading the post-data rally. In the meantime, implied vol recedes as debt ceiling concerns ebb after the Fiscal Responsibility Act passed the House yesterday, focus on Friday's employ data as bill heads to the Senate.- SOFR Options:

- Block, 20,000 SFRU3 95.12/95.25 put spds, 10.0 ref 94.87

- Block, 20,000 SFRU3 94.43/94.68/94.75/94.81 broken put condors, 12.0 net ref 94.86

- Block, 5,000 SFRZ3 94.00/94.25 put spds, 2.5

- Block, 5,000 SFRM3 94.75/94.87/95.00 put flys, 3.5 ref 94.7475

- Block, 5,000 SFRM3 94.68/94.81/94.93 put flys, 4.75 ref 94.7525

- Update, 22,000 pit/screen SFRM3 94.68/94.75/94.81 put flys, 1.0 ref 94.725

- +7,500 SFRZ4 94.00 puts, 9.0 ref 96.785

- +10,000 SFRM3 94.43/94.56 put spds, 0.5

- 3,000 SFRZ3 94.18/94.68 put spds vs. 95.37/95.93 call spds ref 95.11

- 2,000 SFRM3 94.84/95.12 call spds vs. 94.00/94.56/94.62/94.68 broken put condors

- 6,000 SFRM3 94.93 calls, 0.5 ref 94.725

- 2,000 SFRM3 94.75/94.81/94.87 put flys ref 94.7225

- 2,250 SFRM3 SFRM3 94.62/94.75 2x1 put spds, ref 94.7225

- 1,000 SFRM3 94.68/94.75/94.81 2x3x1 put flys ref 94.7125

- Block/screen, 15,000 SFRM3 94.68/94.75/94.81 put flys, 1.0 ref 94.71 to -.7125

- 9,000 SFRM3 94.68/94.75/94.81/84.87 put condors ref 94.71 to -.7175

- Treasury Options:

- over 9,600 TYU3 112 puts, 45 ref 114-23.5

- 6,000 USN3 125/127 put spds, 24

- 5,000 TYN3 113 puts, 20 ref 114-25

- 4,000 TYN3 112 puts, 17 ref 114-04.5

- 9,600 FVN3 108 puts, 25-25.5 ref 108-27 to -26.75

- 6,900 FVN3 108.25/109.75 call spds, 44.5 ref 108-27.75

- Block, -10,000 FVN3 108/110 put over risk reversal, 5.5 net ref 108-25.5

- 2,000 TYN3 113.5 puts, 40 ref 114-06

- 2,700 TYU3 110/110.5/111 put trees ref 114-13

EGBs-GILTS CASH CLOSE: Bull Flatter As Eurozone Disinflation Confirmed

Gilts outperformed Bunds Thursday, with curves leaning bull flatter.

- 10Y Gilt yields closed at the lowest since May 23rd; Bunds since the 12th as further data pointed to potential central bank restraint amid softer price pressures.

- Eurozone flash CPI reflected the deceleration seen in most national prints this week, with core pulling back; EGBs and Gilts extended their gains in the afternoon as US labour cost data was revised sharply downward.

- We saw an uptick in inflation expectations in the latest BoE DMP survey, but it did not heavily influence Gilts.

- BoE and ECB terminal hike pricing was flat on the day, though had fallen a few bp intraday at one point before recovering higher.

- Friday sees French industrial production data and an appearance by ECB's Vasle, but most attention will be on the US nonfarm payrolls report.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.1bps at 2.718%, 5-Yr is down 3.3bps at 2.245%, 10-Yr is down 3.3bps at 2.249%, and 30-Yr is down 0.5bps at 2.456%.

- UK: The 2-Yr yield is down 4.4bps at 4.291%, 5-Yr is down 5.1bps at 4.05%, 10-Yr is down 6.7bps at 4.116%, and 30-Yr is down 5.6bps at 4.459%.

- Italian BTP spread up 4bps at 183.9bps / Spanish down 1.4bps at 103.6bps

EGB Options: Both Downside And Upside In Rates Thursday

Thursday's Europe rates / bond options flow included:

- ERM3 96.625/96.75 call spread 10K given at 0.5 vs 96.465.

- ERU3 97/98cs bought for 3 in 20k

- SFIM3 95.15/95.00ps, bought for 5 in 2k (ref 95.135)

FOREX: USD Index Extends Pullback Ahead Of US Employment Data

- Despite some initial strength during APAC hours on Thursday, the greenback has steadily edged lower, extending on the prior day’s move that was kickstarted by relatively dovish remarks from Fed officials who appear open to pausing rate hikes in June.

- The USD weakness has persisted through the London close, and the Bloomberg USD Index sits close to session lows, having pulled back around 1% from Wednesday’s cycle high. The move was initially triggered by the markdown in Unit Labour Costs with price action gaining momentum following the ISM prices paid registering at 44.2 versus a 52.3 estimate.

- The move has favoured high beta currencies in G10 with a further tailwind provided by the boost to the commodity complex. This has tipped AUD/USD through to the week's best levels, rising 1.15% on the day, closely followed by the likes of CAD and GBP.

- GBPUSD’s short-term rally has extended, and this week’s recovery has resulted in a move above the 20- and 50-day EMAs. The break provided strong impetus for a continuation higher, significantly narrowing the gap to 1.2547, the May 16 high. Above here, attention will turn back to 1.2680, the May 10 high and the bull trigger.

- USDCAD also sharply extended the reversal from the May 26 high of 1.3655. Today’s 1.3437 low, as of writing, places the pair in close proximity to the next support to watch at 1.3404, the May 16 low. A break of this level would highlight a stronger reversal.

- All focus on tomorrow’s NFP release where Bloomberg consensus looks for further moderation in payrolls growth in May to +195k versus a prior read of +253k.

FX Expiries for Jun02 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0690-05(E2.0bln), $1.0725-35(E614mln), $1.0750(E570mln)

- USD/JPY: Y135.00-10($1.4bln), Y138.25-30($831mln), Y139.15-30($596mln)

- NZD/USD: $0.5950(N$770mln)

- USD/CAD: C$1.3580($644mln) C$1.3600-15($1.4bln)

- USD/CNY: Cny7.0400($580mln)

LATE EQUITIES ROUNDUP: Extending Late Session Highs Ahead Friday's Data Risk

- Stocks continued to march higher in late Thursday trade, robust risk appetite ahead of Friday's key employment data and the Fed entering policy blackout at midnight Friday.

- The broad based rally across multiple sectors has pushed SPX futures near Tuesday's highs (4241.75) to 4238.0 (+47.5) just shy of medium-term bull trigger resistance of 4244.00 High Feb 2. The next resistance level is 4288.00 High Aug 19 2022. Nasdaq up 203.6 points (1.6%) at 13138.54; DJIA DJIA up 251.47 points (0.76%) at 33160.01.

- Leading gainers: Energy sector leads with modest bounce in crude prices (WTI +2.07 at 70.16), Schlumberger +5.86%, Haliburton +5.41%, Baker Hughes +5.21%. Information Technology and Consumer Discretionary sectors a close second an third, semiconductor shares leading the former (Nvidia +5.65%). Laggers: Utilities and Consumer Staples sectors continued to underperform.

E-MINI S&P TECHS: (M3) Pullback Considered Corrective

- RES 4: 4327.50 High Aug 16 2022 (cont)

- RES 3: 4300.00 Round number resistance

- RES 2: 4288.00 High Aug 19 2022

- RES 1: 4244.00 High Feb 2 and a medium-term bull trigger

- PRICE: 4238.00 @ 1505ET Jun 1

- SUP 1: 4165.17/4114.00 20-day EMA / Low May 24

- SUP 2: 4062.25 Low May 4 and key support

- SUP 3: 4052.50 Low Mar 30

- SUP 4: 4022.75 50.0% retracement of the Mar 13 - May 1 bull leg

S&P E-minis trend conditions remain bullish and the latest pullback is, for now, considered corrective. Last week’s bounce from 4114.00, May 24 low, means that support around the 50-day EMA remains intact. The average intersects at 4134.83 and a clear break of it is required to signal a reversal. Key resistance is at 4244.00, the Feb 2 high. Clearance of this hurdle would resume the uptrend that started on Mar 13.

COMMODITIES: Crude Oil Bounces Back After EIA Data, OPEC+ Looms Ahead

- Crude oil prices have moved off highs but nevertheless hold sizeable gains after the EIA weekly data whilst also being buoyed by a sliding US dollar.

- EIA weekly data showed a 4.5mn bbl increase in crude stocks – which were supported by a net 1mn bbl increase in imports. Gasoline stocks saw a small decline while implied demand on a four-week average reached 9.2mn bpd - the highest four-week average since late 2021 and on a seasonal basis since 2019.

- Crude’s gains come ahead of this weekend's OPEC+ meeting which many analysts thought would lean more heavily towards extending cuts if Brent goes sub-$70/bbl this week – a move now looking less likely.

- WTI is +3.0% at $70.12, unwinding yesteday’s slide but not making much ground into Tuesday’s decline, with resistance seen at $73.82 (50-day EMA).

- There have been heavy volumes in the CLN3 today at $75/bbl calls (14.4k cumulative at typing), whilst $60/bbl strikes (9.2k) lead activity for puts.

- Brent is +2.3% at $74.28, also off resistance at the 20-day EMA of $76.10.

- Gold is +0.7% at $1976.95 off a high of $1983.10 that punched through resistance at the 50-day EAM of $1975.4 with USD weakness and lower Treasury yields

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/06/2023 | 0130/1130 | ** |  | AU | Lending Finance Details |

| 02/06/2023 | 0645/0845 | * |  | FR | Industrial Production |

| 02/06/2023 | 1230/0830 | *** |  | US | Employment Report |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.