MNI ASIA MARKETS ANALYSIS: Safe Haven Bid on Middle East Risk

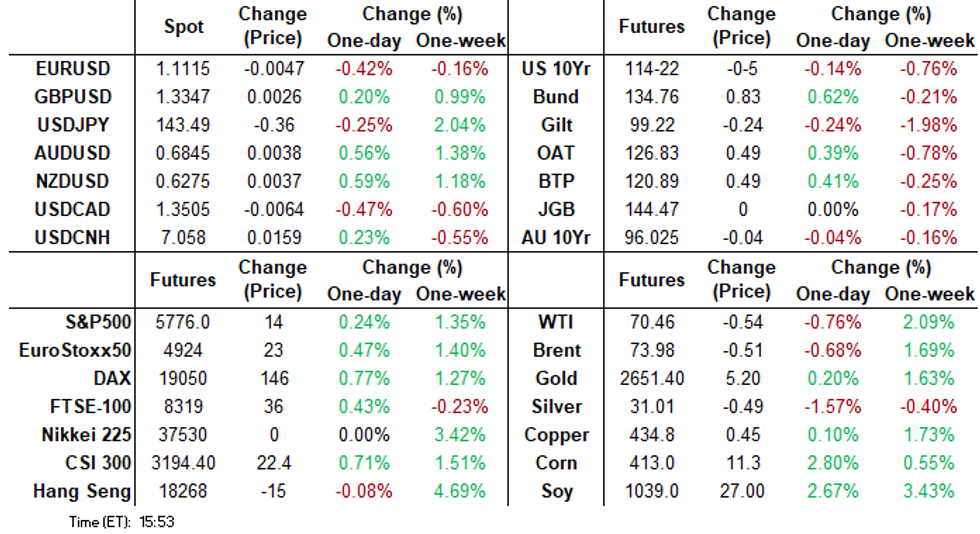

- Treasuries look to finish weaker but near the top end of Monday's range after, curves bear steepening as projected rate cuts bounced after early consolidation.

- Rates gapped lower/extended lows after Flash PMIs showed renewed price pressures but softer employment.

- After gradually pared losses into the London close, Treasuries continued to pare losses on safe haven buying tied to Israel/Hezbollah tensions while US said to send to additional troops to the region.

US TSYS: Off Flash PMI Lows, Safe Haven Bid As US To Send Troops to Middle East

- Treasuries still look to finish weaker, but well off Monday morning lows as late London unwinds segued to safe haven buying on Middle East headlines: Israel Will Launch "Large Scale" Attack Across Rural Lebanon - Ynet, followed by Newswires reporting that the US will send additional troops to the Middle East amid an escalation of hostilities between Israel and Hezbollah in Lebanon, according to a Pentagon statement.

- Treasuries gapped lower/extended lows after this morning's Flash PMIs showed renewed price pressures but softer employment. Manufacturing: 47.0 (cons 48.6) in Sept prelim after 47.9 in Aug; Services: 55.4 (cons 55.2) after 55.7; Composite: 54.4 (cons 54.3) after 54.6.

- Dec'24 10Y Tsy futures are currently -3.5 at 114-23.5 vs. 114-11.5 low -- breaching 114-23 support (20-day EMA) briefly. Curves bear steepened, 2s10s +1.494 at 16.105, 5s30s +0.190 at 58.393.

- Projected rate cuts into early 2025 rebound, latest vs. this morning's levels (*) as follows: Nov'24 cumulative -38.5bp (-36.5bp), Dec'24 -75.9bp (-72.8bp), Jan'25 -110.0bp (-107.0bp).

- Focus turns to House Price index data tomorrow including Consumer Confidence and regional Fed mfg data. US Tsy to auction $69B 2Y notes as well as $60B 42D CMB bills.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00244 to 4.85478 (-0.22551 total last wk)

- 3M -0.02330 to 4.66795 (-0.24993 total last wk)

- 6M -0.01770 to 4.33369 (-0.22753 total last wk)

- 12M -0.00799 to 3.82350 (-0.16036 total last wk)

- Secured Overnight Financing Rate (SOFR): 4.83% (+0.01), volume: $2.147T

- Broad General Collateral Rate (BGCR): 4.81% (+0.00), volume: $824B

- Tri-Party General Collateral Rate (TGCR): 4.81% (+0.00), volume: $789B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 4.83% (+0.00), volume: $93B

- Daily Overnight Bank Funding Rate: 4.83% (+0.00), volume: $284B

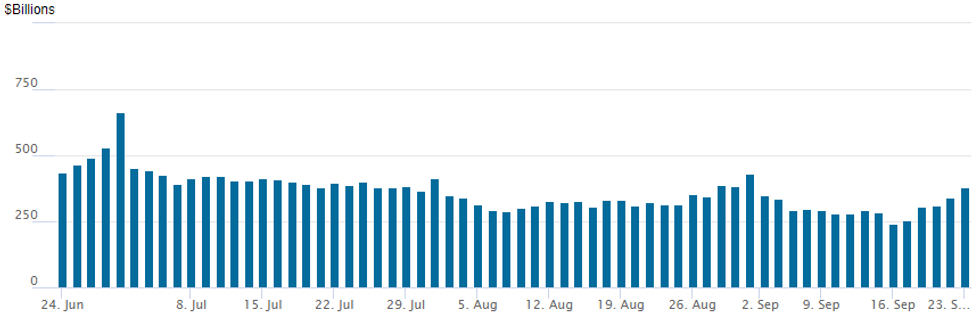

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage climbs to $380.372B this afternoon from $339.316B Friday. Compares to $239.386B last Monday -- the lowest level since early May 2021. Number of counterparties at 71 from 65 prior.

US SOFR/TREASURY OPTION SUMMARY

Option desks reported mixed trade on net Monday, SOFR call trade picking up in the second half after better put trade on the open. Underlying futures well off midmorning lows, short end outperforming while projected rate cuts into early 2025 rebound, latest vs. this morning's levels (*) as follows: Nov'24 cumulative -38.5bp (-36.5bp), Dec'24 -75.9bp (-72.8bp), Jan'25 -110.0bp (-107.0bp).- SOFR Options:

- +10,000 SFRZ4 96.37 calls, 5.0 vs. 96.025/0.20%

- +5,000 SFRX4 95.87/95.93/96.00/96.06 put condors, 1.0 ref 96.03

- -3,000 2QV4/3QV4 96.75/97.25 call spd/spd, 8.0

- +5,000 SFRZ4 95.75/96.00 put spds 2x1 8.0 ref 96.02

- +5,000 SFRH5 96.75/97.25 call spds, 12.0 vs. 96.61/0.20%

- +10,000 SFRM5 96.50/97.00/97.50 call flys vs 2QM5 97.25/97.50 call spds 3.0 net

- +5,000 SFRZ5 95.75/96.75 2x1 put spds, +15.5 ref 97.07

- -4,000 SFRV4/SFRX4 95.87/96.00 put spd spd, 1.5 net Nov over

- +5,000 SFRH5 96.75/97.00/97.50 call trees, 0.0 ref 96.62

- 6,500 SFRZ4 95.37/95.50/95.62 put trees ref 96.045

- -4,250 0QX4 96.62/96.93 put spds, 8.5

- +6,000 SFRX4 96.00/96.12 call spds vs. 95.50/95.81 put spds, 3.5

- 2,000 SFRX4 95.81/95.87/95.93 put flys ref 96.025

- Treasury Options:

- over 12,000 TYX4 114.75/115.75 1x2 call spds 0.0 ref 114-25.5

- over 26,500 wk4 TY 114 puts, 8 ref 114-24.5

- 10,000 TYX4 116.5/117.5 call spds, 6 ref 114-17.5

- Block, 10,000 TYX4 111 puts, 2 vs. 114-17.5/0.15%

- 2,500 TYX4 114.5 straddles, 133

- 2,000 wk4 TY 114.75/115.25 1x2 call spds, 3 net ref 114-16, expire Friday

- +15,000 TYX4 113.5/114.25 2x1 put spds, 3.0 ref 114-21

- +10,000 wk2 TY 114 puts, 21 ref 114-24

- +4,500 FVX4 108.5/109.25 put spds, 7

- over 3,100 FVX4 110.25 calls

BONDS: EGBs-GILTS CASH CLOSE: German 2s10s Disinverts As PMIs Come In Weak

European curves steepened Monday as weak PMIs showed a pullback in regional economic momentum.

- Eurozone (incl each of France and Germany) and UK flash September PMIs came in below expectations across the board on both Manufacturing and Services, adding further impetus to near-term ECB and BoE rate cut expectations.

- An October ECB is now priced at 10bp (40% prob of 25bp), vs 5bp prior.

- Against this backdrop, the German curve bull steepened, with 2s10s disinverting for the first time since Aug 2022. The UK's twist steepened.

- OATS underperformed again (10Y/Bund +2.5bp), weighed down by continued political uncertainty and an FT report that France has requested a further delay in submitting its budget plans to the EC.

- Periphery EGB spreads widened modestly, having reversed early session wides. Note that futures rallied through the cash close.

- Tuesday's schedule includes September German IFO data and appearances by ECB's Muller, Nagel, and Escriva.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 8.1bps at 2.149%, 5-Yr is down 6.7bps at 2%, 10-Yr is down 5.2bps at 2.156%, and 30-Yr is down 2.8bps at 2.481%.

- UK: The 2-Yr yield is down 1bps at 3.915%, 5-Yr is up 1bps at 3.754%, 10-Yr is up 2bps at 3.923%, and 30-Yr is up 2.6bps at 4.496%.

- Italian BTP spread up 0.5bps at 135.2bps / Spanish up 0.8bps at 79.7bps

EGB OPTIONS: Soft PMI Data Rekindles Upside Interest

Monday's Europe rates/bond options flow included:

- RXX4 134.50/136.50cs sold at 65.5 in 5k

- ERV4 97.00/97.12cs 1x1.5, bought for 1.75 in 5k

- ERX4 97.37c, bought for 1.5 in 35k (ref 96.99).

- ERZ4 97.12/97.25/97.37c fly, bought for 1.25 in 3k.

- 0RZ4 98.25/98.50cs vs 97.87/97.75ps, bought the cs for 3 in 5k

- 2RZ4 99.00c, bought for 0.75 in 3k.

- SFIZ4 95.60/95.70cs vs 95.35/94.95ps, bought the cs for 1 in 4k

FOREX: EUR Weaker Post PMIs, Volatile Yen Swings Persist

- The Euro remains lower on the session following a weaker set of flash PMI data for the Eurozone. In particular, the resilience for major equity benchmarks has weighed substantially on the likes of EURAUD, EURNZD and EURCAD, all falling around 0.85% on Monday.

- EURUSD is also lower but was unable to garner any momentum below the 1.1100 handle as the early greenback optimism lost steam. The pair currently resides around 1.1125 as we approach the APAC crossover.

- EURJPY is also 0.7% lower on Monday, however, the ongoing volatile swings for the Japanese yen persist, creating some tricky price action for EURJPY bears to navigate. The early weakness saw a print as low as 159.05, however, the two-way action for US yields saw a punchy recovery to 160.53 before then reverting lower once more. Moving average studies are in a bear-mode position and this continues to highlight a dominant downtrend. An extension lower would refocus attention on the key support at 154.42, the Aug 5 low.

- It's been a similar story for USDJPY, where a cluster of highs appear to be forming between 144.35/50, which will remain the short-term technical point of note.

- Today’s AUD outperformance is notable as we approach the overnight RBA decision and Wednesday’s CPI data. Key resistance at 0.6824, the Aug 29 high, has been breached. A clear break of this hurdle would confirm a resumption of the bull cycle that started Aug 5 and pave the way for a climb towards 0.6900, the Jun 16 ‘23 high. First support is 0.6726, the 20-day EMA.

- There may also be comments from BOJ’s Ueda on Tuesday, before US consumer confidence headlines the data calendar.

US STOCKS: Consumer Discretionary, Energy Sector Shares Lead Late Gainers

- Stocks continue to hold modest gains late Monday, inside narrow session ranges as stocks drift near last week's all-time highs in the Dow and S&P Eminis. Currently, the DJIA trades up 63.15 points (0.15%) at 42125.99, S&P E-Minis up 11.5 points (0.2%) at 5773.5, Nasdaq up 30 points (0.2%) at 17978.3.

- Consumer Discretionary and Utility sectors moved to the fore in the second half, a mix of auto and clothing related companies leading the Consumer Discretionary sector: Tesla +4.39% on Q3 delivery optimism, Bath & Body Works +3.93%, Tapestry +3.37%. Independent power and electricity providers buoyed the Utility sector: Vistra +4.15% after Morgan Stanley raised their target to $132 from $110, CenterPoint Energy +2.80%, NextEra Energy +2.27%.

- Meanwhile, Health Care and Information Technology sectors continued to underperform in late, pharmaceutical & biotech shares weighing on the Health Care sector: Regeneron Pharmaceuticals -3.17%, Biogen -1.41%, Incyte -1.22%. Semiconductor makers weighed on the IT sector: Crowdstrike -1.91%, Oracle -1.74%, Qualcomm -1.37%.

EQUITY TECHS: E-MINI S&P: (Z4) Northbound

- RES 4: 5868.50 1.00 proj of the Apr 19 - Jul 16 - Aug 5 price swing

- RES 3: 5818.12 0.50 proj of the Sep 6 - 17 - 8 minor price swing

- RES 2: 5800.00 Round number resistance

- RES 1: 5797.50 High Sep 19

- PRICE: 5773.75 @ 1446 ET Sep 23

- SUP 1: 5657.35 20-day EMA

- SUP 2: 5608.93 50-day EMA

- SUP 3: 5500.00 Round number support

- SUP 4: 5451.25 Low Sep 6 and a bear trigger

A bull cycle in S&P E-Minis remains in play and last week’s gains reinforce the current bullish condition. The contract has traded through a key and major resistance at 5785.00, the Jul 16 high and a bull trigger. A clear break of this hurdle would confirm a resumption of the long-term uptrend. Sights are on the 5800.00 handle next. First key support is 5608.93, the 50-day EMA. Initial support lies at 5657.35, the 20-day EMA.

COMMODITIES: WTI Slides As Optimism Fades, Gold Extends Gains

- Despite the ongoing headlines regarding rising tensions in the middle east, WTI futures turned lower on Monday, as bearish themes of the month take over.

- WTI Nov 24 is down 0.9% at $70.4/bbl.

- Iran’s seeming willingness to de-escalate tensions in the Middle East added some risk off sentiment despite greater attacks between Lebanon and Israel.

- We have noted that the recovery in WTI futures since Sep 9 has appeared up to this point to be a technical correction, with moving average studies remaining in a bear-mode set-up, highlighting a dominant downtrend.

- A reversal lower would refocus attention on $64.61, the Sep 10 low and bear trigger.

- Meanwhile, spot gold has edged up by 0.2% to $2,627/oz today, having earlier in the session reached another all-time high at $2,634.

- With a bullish structure still in place for gold, focus is on $2,642.7 next, a Fibonacci projection.

- In contrast, silver has fallen by 1.4% to $30.8/oz.

- The recent break key short-term resistance at $30.192, the Aug 26 high, signals scope for an extension towards $31.754, the Jul 11 high. Key short-term support has been defined at $27.686, the Sep 6 low.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 24/09/2024 | 0030/0930 | ** |  JP JP | Jibun Bank Flash Japan PMI |

| 24/09/2024 | 0430/1430 | *** |  AU AU | RBA Rate Decision |

| 24/09/2024 | 0800/1000 | *** |  DE DE | IFO Business Climate Index |

| 24/09/2024 | 0900/1000 | * |  GB GB | Index Linked Gilt Outright Auction Result |

| 24/09/2024 | 1230/0830 | ** |  US US | Philadelphia Fed Nonmanufacturing Index |

| 24/09/2024 | 1255/0855 | ** |  US US | Redbook Retail Sales Index |

| 24/09/2024 | 1300/0900 | ** |  US US | S&P Case-Shiller Home Price Index |

| 24/09/2024 | 1300/0900 | ** |  US US | FHFA Home Price Index |

| 24/09/2024 | 1300/1500 | ** |  BE BE | BNB Business Sentiment |

| 24/09/2024 | 1400/1000 | *** |  US US | Conference Board Consumer Confidence |

| 24/09/2024 | 1400/1000 | ** |  US US | Richmond Fed Survey |

| 24/09/2024 | 1530/1130 | * |  US US | US Treasury Auction Result for Cash Management Bill |

| 24/09/2024 | 1700/1300 | * |  US US | US Treasury Auction Result for 2 Year Note |

| 24/09/2024 | 1710/1310 |  CA CA | BOC Governor Macklem fireside chat on "Growth During Uncertainty" | |

| 24/09/2024 | 2210/1810 |  US US | New York Fed's Roberto Perli |