-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI EUROPEAN OPEN: A$ & Local Yields Surge Following Jobs Data

MNI ASIA MARKETS ANALYSIS: Sentiment Improves

HIGHLIGHTS

- ECDC SAYS RESTRICTIONS ON CHINA TRAVELERS NOT JUSTIFIED, Bbg

- Italy Finds No New Concerning Covid Variants in First Tests, Bbg

US TSYS: Bond-Lead Rally, Stocks Strong Too

Tsys see-sawed higher Thursday, partially driven by same factors pushing equities back to early Tuesday levels: improved market sentiment over COVID curbs on China travel as testing has not revealed new variants while "European health officials called screenings and restrictions on travelers from China unjustified" Bbg.

- Knee-jerk post-data (weekly claims in-line at 225k, continuing claims higher than est at 1.710M) 30Y Bond sale quickly reversed, 30YY falling back to 3.9479% from 3.9773% post-data high.

- Futures see-sawed higher as risk sentiment for stocks improved. Note, yield curves reversed Wed's steepening, 2s10s currently -6.416 at -53.885.

- Tsys pare gains briefly after $35B 7Y note auction (91282CGB1) tailed: 3.921% high yield vs. 3.907% WI; 2.45x bid-to-cover vs. 2.33x last month. Indirect take-up climbs to 68.08% vs. 61.89% prior; Direct take-up: 16.17% vs. 16.57% prior; Primary dealer take-up falls to 15.75% vs. 21.35% prior auction.

- Friday -- quiet end to the last trading day of 2022 w/ MNI Chicago PMI (40.0 est) release at 0945ET. FI/FX trading floor closes at 1300ET, but GLOBEX closes at 1700ET. LINK

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00457 to 4.31186% (-0.00485/wk)

- 1M -0.01486 to 4.36871% (-0.01815/wk)

- 3M +0.02490 to 4.75386% (+0.02833/wk)*/**

- 6M -0.01357 to 5.13757% (-0.01557/wk)

- 12M -0.02772 to 5.44257% (-0.00129/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.77857% on 11/30/22

- Daily Effective Fed Funds Rate: 4.33% volume: $99B

- Daily Overnight Bank Funding Rate: 4.32% volume: $255B

- Secured Overnight Financing Rate (SOFR): 4.30%, $1.005T

- Broad General Collateral Rate (BGCR): 4.26%, $379B

- Tri-Party General Collateral Rate (TGCR): 4.26%, $362B

- (rate, volume levels reflect prior session)

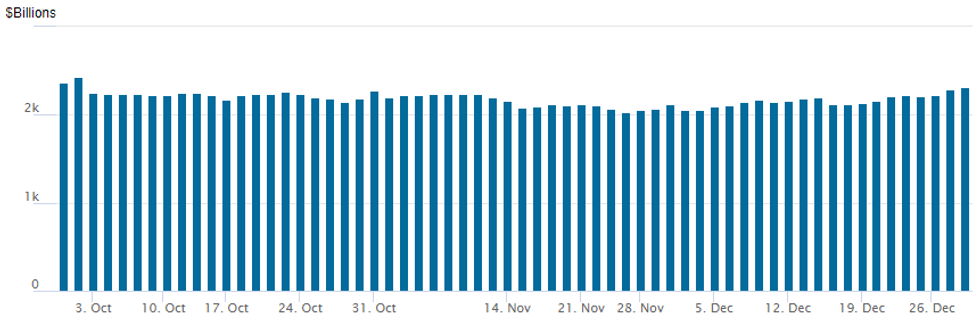

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,308.319B w/ 104 counterparties vs. $2,293.003B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Pick-up in FI option volumes Thursday, flow more mixed but leaning toward low delta calls, call spreads as underlying futures rebounded from midweek selling.- SOFR Options:

- Block, 9,750 SFRM3 94.62/95.00/95.37 put flys, 10.0

- +20,000 SFRZ3 96.50/97.50 call spds, 12.25

- +2,000 SFRZ3 95.50/96.00/96.50 call trees, 2.0 ref 95.52

- +5,000 2QH3 96.12/96.25/96.50 broken put flys, 5.25

- 2,000 OQF3 95.87 puts, 12.5 ref 95.885

- +2,500 2QF3 96.12/96.37/96.62 put flys, 4.75

- 3,800 2QG3 96.12/96.37/96.62 put flys ref 96.69

- 1,500 SFRZ3 94.81/95.00/95.18/95.37 put condors ref 95.525

- Eurodollar Options:

- Block, 10,000 EDH3 95.00 calls vs. 95.00/96.06 put spds

- 3,500 EDF3 95.25 calls, 1.25 ref 94.96

- Treasury Options:

- 12,224 wk5 TY 112/113 call spds, 30 ref 112-16.5

- Over 12,000 TYG 112.5 puts, 104-103 ref 112-10.5 to -11.5

- +3,000 wk2 TY 110.5 puts, 13 vs. 112-07.5

- 1,000 TYG 109/111 3x2 put spds, 31 ref 112-07

- 1,800 TYH 107.5/108/109 broken put flys, ref 112-14

Late Equity Roundup: Broad Based Rally, Indexes Near Highs

Major indexes look to finish higher Thursday as market sentiment improved. Latest upswing tied to Covid testing: has not revealed new variants while "European health officials called screenings and restrictions on travelers from China unjustified" Bbg.

- SPX eminis currently trade +70 (1.84%) at 3877.5; DJIA +382.05 (1.16%) at 33255.9; Nasdaq +269.8 (2.6%) at 10483.49.

- SPX leading/lagging sectors: Communication Services and Information Technology both up appr +2.85%, Consumer Discretionary (+2.48%) , latter as auto makers surged w/ Tesla +6.35% after drawing heavy selling this week - while Morgan Stanley analysts call current prices a good entry level. Laggers: Consumer Staples (+0.60%) Utilities (+0.92%), Financials (+1.30%) with diversified financials outperforming larger banks (JPM +0.20%, USB +0.23%, WFC +0.29%).

- Dow Industrials Leaders/Laggers: Microsoft (MSFT) +6.58 at 241.11, Home Depot (HD) +5.57 at 321.30, Apple (AAPL) +4.03 at 130.07. Laggers: WBA -0.01 at 37.57, Boeing (BA) -0.02 at 188.36, Merck (MRK) +0.04 at 111.12.

E-MINI S&P (H3): Trend Outlook Is Bearish

- RES 4: 4250.00 High Aug 26

- RES 3: 4194.25 High Sep 13 and a key resistance

- RES 2: 4043.00/4180.00 High Dec 15 / 13 and the bull trigger

- RES 1: 3931.32 50-day EMA and a key resistance

- PRICE: 3881.00 @ 1405ET Dec 29

- SUP 1: 3778.45 61.8% retracement of the Oct 13 - Dec 13 uptrend

- SUP 2: 3735.00 Low Nov 3

- SUP 3: 3670.00 76.4% retracement of the Oct 13 - Dec 13 uptrend

- SUP 4: 3735.00 Low Oct 21

S&P E-Minis trend signals remain bearish and recent low prints reinforce this condition. The contract is trading above its recent lows - for now. Short-term gains are considered corrective with resistance at 3931.32, the 50-day EMA. A clear break of this hurdle is required to suggest potential for a stronger recovery. On the downside, a break lower would confirm a resumption of the downtrend and open 3778.45, a Fibonacci retracement.

COMMODITIES

- WTI Crude Oil (front-month) down $0.64 (-0.81%) at $78.33

- Gold is up $12.43 (0.69%) at $1816.86

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/12/2022 | 0800/0900 | *** |  | ES | HICP (p) |

| 30/12/2022 | 0800/0900 | * |  | CH | KOF Economic Barometer |

| 30/12/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 30/12/2022 | 1445/0945 | ** |  | US | MNI Chicago PMI |

| 30/12/2022 | 1600/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 31/12/2022 | 0130/0930 | *** |  | CN | CFLP Manufacturing PMI |

| 31/12/2022 | 0130/0930 | ** |  | CN | CFLP Non-Manufacturing PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.