-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net injects CNY102 Bln via OMO Friday

MNI: PBOC Sets Yuan Parity Lower At 7.1738 Fri; -0.99% Y/Y

MNI BRIEF: BOJ's Uchida Sees Strong JGB Stock Effect

MNI ASIA MARKETS ANALYSIS: Sep 50bp Cut Bar Raised Post-CPI

- Treasuries experienced a brief spike in volatility, miss in Core CPI saw futures gap higher, but quickly reversed/extended lows on above average Core rents.

- Tsy Futures gradually climbed back near opening level (mid-range of post-data move) as markets deemed rental inflation.

- Curves twisted flatter as short end rates traded weaker, reflecting modest repricing of projected rate cuts by year end

Early Volatility After Core-CPI Miss, Rental Inflation Rise

- Treasuries are looking mostly higher after the bell -- very near the middle of this morning's wide post-data range. Curves twist flatter, however, with short end rates underperforming as projected rate cut pricing gradually cooled post-CPI.

- Early volatility: Treasury futures gapped higher - extended highs after the modest miss on a core CPI unrounded basis and Y/Y also missing. Tsy Sep'24 10Y traded up to 114-02 high -- nearly breaching technical resistance at 114-03/115-03+ (High Aug 6 / 5 and the bull trigger).

- Futures quickly reversed lower/extending session low to 113-13.5 as markets focused on above-expected including core services (+0.32%), OER and Rents. The reversal didn't last long, however, futures recovering to near midrange as rental inflation deemed more localized.

- Earlier data, MBA composite mortgage applications jumped a seasonally adjusted 16.8% last week. It was again driven by particularly strong refinancing activity (34.5% after 16%) which has jumped higher on the almost 50bp decline in 30Y mortgage rates over the past month (although the rate only dipped 1bp to 6.54% in the latest week).

- Short end rates finish weaker as CPI raises the bar for 50bp cut in Sep. Current projected rate cuts vs. early morning levels (*) post-CPI: Sep'24 cumulative -37.2bp (-39.7bp), Nov'24 cumulative -72.4bp (-74.2bp), Dec'24 -106.2bp (-108.1bp).

- Looking ahead, deluge of early data Thursday includes Weekly Claims, Retail Sales, Import/Export Prices, IP and Cap-U.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00088 to 5.33689 (+0.00337/wk)

- 3M +0.00207 to 5.11809 (+0.00540/wk)

- 6M +0.00133 to 4.80564 (-0.00033/wk)

- 12M +0.01501 to 4.36296 (+0.00688/Wk)

- Secured Overnight Financing Rate (SOFR): 5.34% (+0.00), volume: $2.082T

- Broad General Collateral Rate (BGCR): 5.34% (+0.01), volume: $808B

- Tri-Party General Collateral Rate (TGCR): 5.34% (+0.01), volume: $780B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $100B

- Daily Overnight Bank Funding Rate: 5.33% (+0.01), volume: $237B

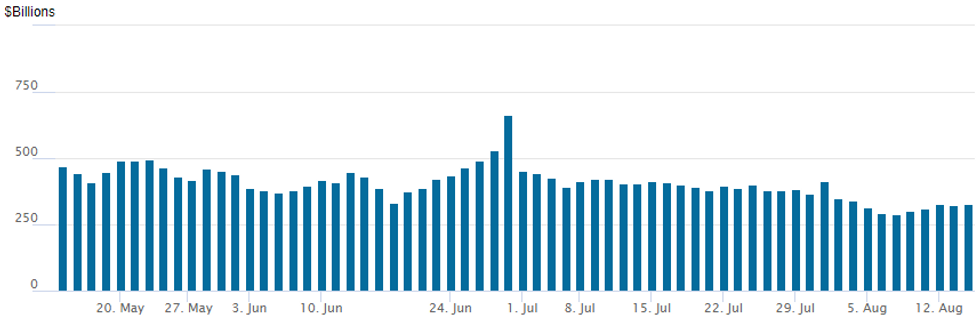

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage inches up to $328.472B from $324.494B Tuesday -- compares to $286.660B on Wednesday, Aug 7 -- the lowest since mid-May 2021. Number of counterparties climbs up to 66 from 62 prior.

Mid-Morning SOFR Option Roundup

SOFR options trade looks rather mixed following this morning's post-CPI gap bid/offer that extended both session highs then lows. Volumes are improving, however, as underlying futures have inched back near mid-range. The very short end is another story, however, SFRU4-SFRZ4 trade weaker as CPI raises the bar for 50bp cut in Sep. Current projected rate cuts vs. early morning levels (*) post-CPI: Sep'24 cumulative -37.2bp (-39.7bp), Nov'24 cumulative -72.4bp (-74.2bp), Dec'24 -106.2bp (-108.1bp).

- Salient trade:

- 5,000 0QH4/3QH4 96.00 put spd, 0.5 conditional steepener

- +5,000 2QQ4 96.87 calls, 8.5 vs. 96.935/0.65%

- +6,000 SFRZ5 95.75/96.00/96.25/96.50 put condors, 4.0 ref 96.89

- +10,000 SFRZ4 95.62/95.75/95.87 calls, 1.5 vs. 95.72/0.05%

- +30,000 SFRH5 95.12/95.43 put spd w/ SFRU4 94.87/95.12 call spd vs. SFRH5 95.81/96.00 call spds 7.75-8.25 net

- +10,000 SFRX4 95.75/96.00/96.25 call flys, 4.0 ref 95.81

- +10,000 SFRV4 95.37/95.50/95.56/95.68 put condor 3.0 ref 95.805

- -5,000 SFRU4 95.18/95.31/95.43 call flys 2.25 ref 9.513

- -7,000 SFRU4 95.12 straddles 16. ref 95.125

- +5,000 SFRM5 97.50/98.00 call spds, 7.0 vs. 96.595/0.08%

- +5,000 SFRU4 95.00/95.25 call spds 10.0 ref 95.115

- -10,000 SFRU4 94.87/95.00/95.12 call flys 5.0-4.75 ref 95.115

- +6,000 SFRZ4 95.12/95.25/95.37 put trees 1.5 ref 95.77

- 3,500 SFRU4 95.31/95.43 call spds ref 95.155

- 3,500 2QQ4 97.00/97.12 1x2 call spds ref 96.965

- Block, 3,000 SFRZ4 94.75/95.00 put spds, 0.5

- 3,000 0QU4 96.37/96.56/96.87 broken call trees

- 2,000 SFRZ4 95.75/96.00 3x2 put spds ref 95.81

- 2,000 SFRU4 94.93/95.00/95.06/95.12 call condors

- 3,000 SFRU4 95.37/95.50 call spds ref 95.155

- Treasury Options:

- 12,500 wk3 TY 114/114.5 call spds ref 113-24.5, expire Fri

- 5,000 TYV4 114/116.5 1x2 call spds ref 114-08

- 15,000 wk3 FV 109.75/110.25 call spds ref 109-07.25, expire Fri

- 10,000 TYU4 112.75/113.25 2x1 put spds, ref 113-19.5

EGBs-GILTS CASH CLOSE: Gilts Outperform After UK CPI Miss

Gilts outperformed global peers Wednesday as UK inflation data came in softer than expected.

- Core instruments strengthened in early trade after UK July CPI aggregates came in lower than expected, though the print didn't look as soft once volatile components (eg airfares) were excluded, and the initial rally faded.

- Later on in the session, US CPI came in largely in line with expectations, initially triggering a dovish reaction in global core FI which quickly reversed, but overall its impact on price action was neutral.

- The German curve twist flattened, with the UK curve bull flattening. 10Y Gilt yields saw their lowest close since Feb 1.

- Periphery EGB spreads closed mixed, with BTPs outperforming and GGBs underperforming in a fairly directionless day for risk assets.

- The UK data parade continues Thursday with Q2 GDP data; the schedule also includes the Norges Bank decision.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.4bps at 2.354%, 5-Yr is up 0.1bps at 2.092%, 10-Yr is down 0.6bps at 2.18%, and 30-Yr is down 0.5bps at 2.423%.

- UK: The 2-Yr yield is down 3.9bps at 3.566%, 5-Yr is down 6.3bps at 3.617%, 10-Yr is down 6.3bps at 3.825%, and 30-Yr is down 6.7bps at 4.402%.

- Italian BTP spread down 0.6bps at 138.4bps / Spanish down 0.4bps at 84bps

EGB Options Sonia Trades Pick Up After UK CPI Wednesday

Wednesday's Europe rates/bond options flow included:

- IKU4 118.50/117.50/117.00p ladder, bought for 6 in 1k

- OEV4 120/121/122c ladder, bought for 13.5 in 3.4k

- RXU4 135/136.50cs 1x2, bought for 23.5 in 2k

- ERX4 97.00/97.12/97.25c fly, bought for 2 in 6.5k

- ERH5 97/98 RR, bought the call for 2.25 in 4k

- ERM5 97.62/98.12cs 1x2, bought for 2.5 in 8k

- SFIU4 95.20/95.10/95.00p fly traded for 2 in 1k

- SFIX4 95.65/95.45/95.25p fly trades for 5.75 in 3k

- SFIF5 95.80/96.50 RR, trades 7.25 for the put in 1k

- 2RU4 97.87/97.62ps vs 98.12c, trades 4 for the ps in 1.65k

FOREX: Greenback Treads Water Post-CPI, NZD Remains Under Pressure

- The July US CPI data failed to ignite momentum in currency markets, with slightly weaker headline prints unable to move the dial for short-term Fed pricing and this is well reflected in a broadly unchanged dollar index on Wednesday.

- There was an impressive 100 pip swing for USDJPY in the aftermath of the data, however this remained an outlier across G10, with most pairs holding modest ranges.

- Overall, the New Zealand dollar is the worst performing G10 currency on Wednesday, with the overnight dovish turn from the RBNZ continuing to drive the price action. NZDUSD (-1.3%) continues to plumb fresh session lows as we approach the APAC crossover, notably through the 20-day EMA and the psychological 0.6000 mark.

- The solid backdrop of recent equities outperformance could point to this being a corrective pullback for the pair. However, protracted weakness might signal scope for a move back to key medium-term support of 0.5852.

- GBP has also weakened on Wednesday following softer-than-expected inflation data in the UK. Despite the dip lower for cable, price remains above the 20-day EMA and a resumption of strength would highlight a more significant trend reversal and signal scope for a climb towards 1.2955, a Fibonacci retracement.

- EURUSD resistance at 1.1008, the Aug 5 high, has been cleared and this confirms a resumption of the uptrend. Spot has been contained by 1.1046, the Jan 2 high, and a breach of this level would place the focus on 1.1084, the Dec 29 ‘23 high. Note moving average studies remain in a bull-mode set-up, highlighting a rising trend.

- Focus swiftly turns to another session packed full of US data, highlighted by July retail sales and weekly jobless claims.

Late Equities Roundup: Off Midday Highs, Financials, O&G Still Ahead

- Stocks are mostly higher in late Wednesday trade, off midday highs with the Nasdaq underperforming after this morning's post-CPI related volatility. Financials continue to lead gainers while Energy sector shares outpace IT stocks in the second half.

- Currently, the DJIA trades up 219.66 points (0.55%) at 39985.26, S&P E-Minis up 13.5 points (0.25%) at 5472.5, Nasdaq down 28.3 points (-0.2%) at 17159.55.

- Financials sectors lead gainers in late morning trade, Insurance and services names outpaced banks: Progressive +4.88%, Charles Schwab +4.37% and Allstate +4.36%. Oil and gas stocks buoyed Energy sector shares: Phillips66 +1.89%, Marathon Petroleum +1.51%, Targa Resources +1.46%.

- Conversely, Communication Services and Consumer Discretionary sectors continued to underperform in late trade, interactive media & entertainment weighed on the former: Google -3.02%, Warner Bro's -1.7%, Charter Comm -1.29%. Autos and Broadline retailers weighed on the Consumer Discretionary sector: Etsy -3.76%, Tesla -3.76%, Deckers -2.58. Meanwhile, Starbucks bounced off earlier lows to -1.99% after surging more than 20% yesterday after acquiring Chipotle's CEO.

- Note, late earnings announcements expected this week: Brinker Int, Samsonite and Cisco late Wednesday; Walmart, Applied Materials and Deere & Co on Thursday.

EQUITY TECHS: E-MINI S&P: (U4) Pierces The 50-Day EMA

- RES 4: 5721.25 High Jul 16 and Key resistance

- RES 3: 5664.00 High Jul 18

- RES 2: 5579.35 76.4% retracement of the Jul 16 - Aug 5 bear leg

- RES 1: 5491.57 61.8% retracement of the Jul 16 - Aug 5 bear leg

- PRICE: 5465.75 @ 14:14 BST Aug 14

- SUP 1: 5319.50 Low Aug 9

- SUP 2: 5182.0/5120.00 Low Aug 8 / 5 and the bear trigger

- SUP 3: 5092.00 Low May 2

- SUP 4: 5020 Low Apr 19 and a key support

Short-term gains in S&P E-Minis are - for now - considered corrective. However, yesterday’s strong rally delivered a print above the 50-day EMA, at 5453.80. A clear break of this average would undermine the recent bearish theme and instead signal scope for a stronger recovery. This would open 5579.35, a Fibonacci retracement. A reversal lower would refocus attention on the bear trigger at 5120.00, the Aug 5 low.

COMMODITIES: Crude Futures Extend Losses Amid Unexpected Inventory Build

- Crude markets are headed for another losing session as we approach the US close with additional pressure emanating from an unexpected build in US crude inventories according to the EIA weekly data.

- Front-month WTI is down 1.6% at 77.12$/bbl and the contract has erased the entirety of the initial advance this week. On the downside, support doesn’t come in until $74.60, the Aug 8 low and key support at $71.67, the Aug 5 low.

- For Natural Gas, Henry Hub is ending the day trading higher, although has moderated its gains and reverted to the previous three-day range. Slightly lower production levels, strong export flows to Mexico, and warmer weather have all been supportive.

- In precious metals, spot gold was unable to make a fresh all-time high, having respected the July peak around $2,483 so far. Clearance of this hurdle would resume the technical uptrend.

- The yellow metal sits 0.85% lower on the session as further clues on upcoming Fed policy and the health of the US economy are awaited. Spot silver sits 1.5% lower on the session.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/08/2024 | 2350/0850 | *** |  | JP | Japan GDP 1st Estimate |

| 15/08/2024 | 0130/1130 | *** |  | AU | Labor Force Survey |

| 15/08/2024 | 0200/1000 | *** |  | CN | Fixed-Asset Investment |

| 15/08/2024 | 0200/1000 | *** |  | CN | Retail Sales |

| 15/08/2024 | 0200/1000 | *** |  | CN | Industrial Output |

| 15/08/2024 | 0200/1000 | ** |  | CN | Surveyed Unemployment Rate M/M |

| 15/08/2024 | 0430/1330 | ** |  | JP | Industrial Production |

| 15/08/2024 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 15/08/2024 | 0600/0700 | ** |  | UK | Trade Balance |

| 15/08/2024 | 0600/0700 | *** |  | UK | GDP First Estimate |

| 15/08/2024 | 0600/0700 | ** |  | UK | Index of Services |

| 15/08/2024 | 0600/0700 | *** |  | UK | Index of Production |

| 15/08/2024 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 15/08/2024 | 0800/1000 | *** |  | NO | Norges Bank Rate Decision |

| 15/08/2024 | - |  | NO | Norges Bank Meeting | |

| 15/08/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 15/08/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 15/08/2024 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 15/08/2024 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 15/08/2024 | 1230/0830 | *** |  | US | Retail Sales |

| 15/08/2024 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/08/2024 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 15/08/2024 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 15/08/2024 | 1310/0910 |  | US | St. Louis Fed's Alberto Musalem | |

| 15/08/2024 | 1315/0915 | *** |  | US | Industrial Production |

| 15/08/2024 | 1400/1000 | * |  | US | Business Inventories |

| 15/08/2024 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 15/08/2024 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 15/08/2024 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 15/08/2024 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 15/08/2024 | 1710/1310 |  | US | Philly Fed's Pat Harker | |

| 15/08/2024 | 2000/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.