-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Short End Fades Fed Resolve

HIGHLIGHTS

- FED MESTER: NEED TO KEEP FUNDS RATE ABOVE 5% IN '23 TO CURB PRICES, Bbg

- FED DALY: SLOWER GOODS-PRICE INFLATION SHOWS SUPPLY CHAINS HEALING, Bbg

- US TO SOLICIT BIDS FOR PURCHASE OF 3M BBL OF OIL IN FEB, Bbg

- TSY SEC YELLEN DISCUSSES 2022 ANNUAL FSOC REPORT AT MEETING .. DIGITAL ASSETS ARE A FOCUS OF FSOC THIS YEAR, Bbg

Key links: MNI BRIEF: Fed Is Far From Meeting Its Price Goal, Daly Says / MNI INTERVIEW: Fed Will Resist Pressure To Cut In '23 -Blinder

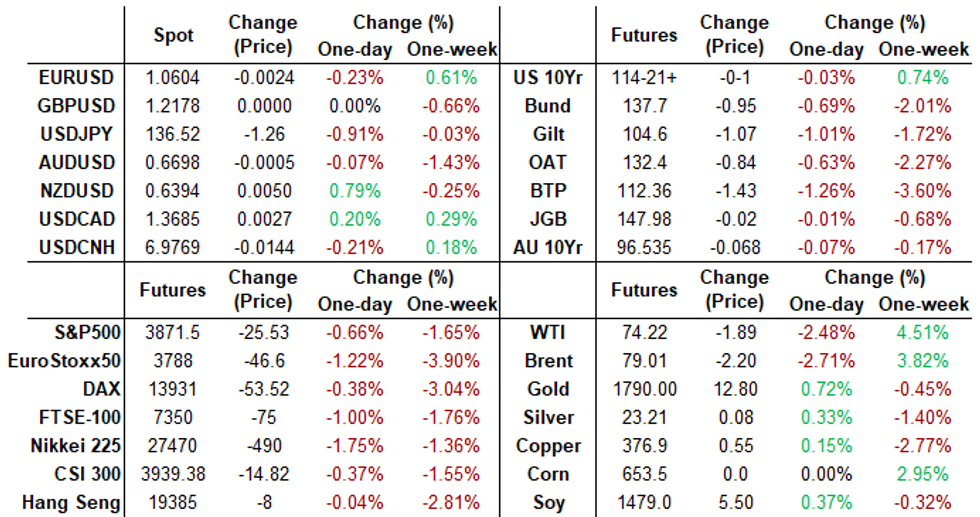

US TSYS: Yield Curves Bounce Back to Pre-FOMC Levels, 2Y Rally

Yield curves broadly steeper after the bell, short end lead rally off morning lows, 2YY at 4.1888% -.0475 after tapping 4.1531 low, 2s10s +8.518 at -70.892 -- back to pre-FOMC levels

- Market's way of discounting the week's hawkish Fed and ECB policy speak and forward guidance. Equities NOT taking a risk-on/dovish pricing view w/ SPX eminis -50.0 at 3877.25 (after bouncing off key support of 3855.13 50.0% - retracement of the Oct 13 - Dec 13 uptrend).

- Tsys bounced off lows following PMI data: The Fed will be encouraged that the crucial theme of weakening demand in the economy - leading to more modest inflation - played out further in this morning's Nov prelim US PMIs.

- The activity data overall remain contractionary, and are deteriorating: Composite at 44.6, a 4-month low), Services at 44.4 (4-month low), and Manufacturing at 47.4. (a 31-month low).

- Demand is weakening, as evidenced by the fastest decline in new orders since May 2020 with "pressure on purchasing power among customers and company balance sheets".

- Fed speak: little market react from SF Fed Daly riffing on familiar theme: Fed Still Has a ‘Long Way’ to Go to Defeat Inflation. Cleveland Fed Mester: "leaving inflation at these levels for long is costly".

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00129 to 4.31700% (+0.49900/wk)

- 1M +0.01372 to 4.35286% (+0.08257/wk)

- 3M +0.00815 to 4.74586% (+0.01372/wk)*/**

- 6M +0.03457 to 5.18686% (+0.04715/wk)

- 12M +0.01157 to 5.47886% (-0.02057/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.77857% on 11/30/22

- Daily Effective Fed Funds Rate: 4.33% volume: $104B

- Daily Overnight Bank Funding Rate: 4.32% volume: $279B

- Secured Overnight Financing Rate (SOFR): 4.32%, $1.144T

- Broad General Collateral Rate (BGCR): 4.27%, $417B

- Tri-Party General Collateral Rate (TGCR): 4.27%, $400B

- (rate, volume levels reflect prior session)

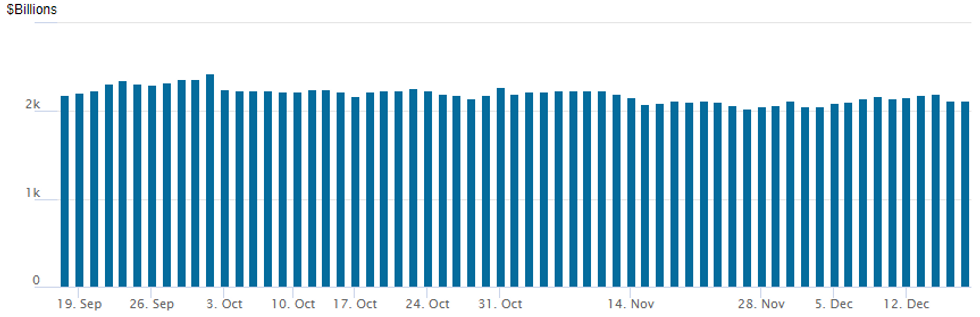

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,126.540B w/ 100 counterparties vs. $2,123.995B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Mixed trade on lighter volumes Friday, slightly better 10Y ratio put and SOFR put spreads on the day. Softer implied vol more a factor of lack of buying than concerted sellers ahead the weekend. Salient trade:- SOFR Options:

- 4,000 OQ2 95.75 straddles

- 2,750 SFRH3 95.56/95.68 call spds ref 95.195

- Block, 2,500 SFRH3 95.31/95.43/95.56 call flys, 2.0 ref 95.185

- Block, 4,000 SFRG 94.43/94.68 put spds, 0.5 ref 95.175

- Block, 3,000 SFRU3 94.50/94.87/95.25 4x9x5 put flys at 41.5

- Block, 3,000 SFRZ3 94.25/94.75/95.25 4x9x5 put flys at 42.5

- Block, 10,000 SFRG3 95.18/95.31 call spds 3.75 over 94.75 puts vs. 95.155/0.27%

- Block, 3,000 SFRG 95.37 calls, 2.75 ref 95.17

- Block, 5,000 SFRU 97.00/97.50 call spds, 1.75 on splits, ref 95.325

- Block 2,000 SFRZ3 95.12/95.25/95.50 broken put flys, 6.0 ref 95.655

- 3,750 0GH3 96.25/96.75 put spds ref 96.125

- Eurodollar Options:

- 3,600 3EZ2 96.87 straddles ref 96.87

- Treasury Options

- 10,000 FVH 112 calls, 17-17.5 ref 109-18 to -18.5

- 2,000 TYF 115.5 calls, 14 ref 114-29.5

- Block/screen, 15,000 wk1 TY 112/113.5 3x2 put spds, 27 ref 114-22

- 10,000 FVH 112 calls, 17-17.5 ref 109-18 to -18.25

- 3,000 TYF 114.5 calls, 25 ref 114-13.5

- Block, 9,000 TYF 113.25 puts, 5 ref 114-22

- 2,500 TYG 110.5/111/112/113 broken put condors

EGBs-GILTS CASH CLOSE: Yields Close Off Highs, But ECB Hawks Take Toll

European yields fell back from double-digit basis point rises seen earlier in the session, but remained sharply higher for the second consecutive session as ECB hawkishness continued to be digested.

- Yields continued rising through the morning as ECB hawks reinforced Thursday's message (Holzmann, Rehn) and mostly encouraging prelim PMI data, though fell back in the afternoon, partly after a very weak US PMI print.

- The German curve bear steepened, while the UK's bear flattened.

- Tracking a rise (and end-of-day pullback) in ECB terminal rates which soared to 3.40% vs 3% prior to the ECB meeting, periphery spreads continued widening but pulled back from the session's widest levels.

- Monday's schedule includes German IFO data and appearances by ECB's de Guindos and Simkus.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 3.8bps at 2.425%, 5-Yr is up 6bps at 2.22%, 10-Yr is up 6.9bps at 2.152%, and 30-Yr is up 9.7bps at 1.987%.

- UK: The 2-Yr yield is up 9.1bps at 3.487%, 5-Yr is up 7.7bps at 3.308%, 10-Yr is up 8.5bps at 3.329%, and 30-Yr is up 2.3bps at 3.672%.

- Italian BTP spread up 6.2bps at 214.5bps / Greek up 7.1bps at 216.6bps

EGB Options: Large Euribor Put Fly Features In Post-ECB Session

Friday's Europe rates / bond options flow included:

- RXG3 139.50/137.50/135.50p fly sold at 36 in 3.5k

- ERJ3 96.75/96.25ps sold at 17.75 in 10k

- ERH3 97.00/96.75/96.50p fly, bought for 4.5 in 20k

FOREX: AUDNZD Extends 2022 Lows, JPY Outperforms

- The USD Index is close to unchanged on Friday as global currency markets take a breather after a busy week of inflation data and major central bank policy decisions.

- Generally mixed performance across G10 with the notable move occurring in the Japanese Yen which unwound a healthy portion of Thursday’s decline, rising 1% against the greenback amid the general risk off tone and further weakness in equities.

- USDJPY tested resistance at 138.02, the 20-day EMA but has since reversed and continued to grind lower throughout Friday trade. On the downside, 134.54 (the Dec 14 low) remains the first notable support and the bear trigger remains at 133.63.

- AUD/USD has underperformed, likely weighed by lower iron ore prices, after China announced a new state-run buyer will launch in 2023 and that it will seek a discount from miners.

- Additionally, AUDNZD has now extended to fresh 2022 lows with the cross now below 1.05 for the first time since December 2021. NZD bulls will now look for the move opening up a target at the 2021 low of 1.0280 with rate differentials continuing to point to further downside for the pair.

- A lighter calendar next week as we approach the holiday season. Monday will bring German IFO data before Tuesday’s Bank of Japan meeting.

FX OPTION EXPIRY

Of note:- EURUSD 1.45bn at 1.0600, 1.37bn at 1.0650, 1.52bn at 1.0700.

- USDJPY 1.1bn at 137.00.

- AUDUSD 1.98bn at 0.6700.

- USDCAD 2.2bn at 1.3650/1.3715.

- USDCNY 3.84bn at 7.00.

- EURUSD: 1.0600 (1.45bn), 1.0650 (1.37bn), 1.0675 (300mln), 1.0700 (1.52bn).

- GBPUSD: 1.2100 (407mln), 1.2150 (477mln), 1.2200 (500mln).

- USDJPY: 136.00 (1.44bn), 137.00 (1.81bn).

- EURGBP: 0.8700 (526mln).

- USDCAD: 1.3600 (615mln), 1.3650 (439mln), 1.3690 (275mln), 1.3700 (869mln), 1.3710 (334mln), 1.3715 (289mln).

- AUDUSD: 0.6700 (1.98bn).

- NZDUSD: 0.6300 (444mln).

- USDCNY: 6.95 (550mln), 7.00 (3.84bn), 7.05 (894mln).

Late Equity Roundup: Key Support Held

Stocks weaker but well off key support of 3855.13 50.0% (retracement of the Oct 13 - Dec 13 uptrend) to 3882.50 in late trade. Real Estate, Consumer Discretionary and Utilities sectors continued to weigh on SPX eminis, currently trade -41.25 (-1.05%) at 3886.75; DJIA -268.49 (-0.81%) at 32941.94; Nasdaq -89.6 (-0.8%) at 10721.73.

- SPX leading/lagging sectors: Real Estate (-3.21%) with Prologis (PLD, Ventas (VTR), Welltower (WELL) and Iron Mountain (IRM) shares all trading more that 5% lower; Consumer Discretionary (-1.89%) weighed by auto makers: Ford -6.49%, Tesla -4.44%, GM -3.62%; Utilities (-1.63%) saw water services underperforming

- Leaders: Communication Services (-0.07%) with META, Netflixx and Fox bouncing from midweek selling, Materials (-0.41%) and Consumer Staples (-0.53%) followed.

- Dow Industrials Leaders/Laggers: United Health (UNH) off lows at 521.48 (-6.20), Home Depot (HD) -5.86 at 321.74, American Express (AXP) -5.0 at 145.22.

- Leaders: Caterpillar (CAT) +1.29 at 231.95, Amgen (AMGN) +30.0 at 266.44, Dow Ind -0.16 at 49.37.

E-MINI S&P (H3): Bearish Outlook

- RES 4: 4361.00 High Aug 16 and a key M/T resistance

- RES 3: 4250.00 High Aug 26

- RES 2: 4194.25 High Sep 13 and a key resistance

- RES 1: 4043.00/4180.00 High Dec 15 / 13 and the bull trigger

- PRICE: 3886.75 @ 1400ET Dec 16

- SUP 1: 3855.75Low Dec 16 Low

- SUP 2: 3855.13 50.0% retracement of the Oct 13 - Dec 13 uptrend

- SUP 3: 3800.00 Round number support

- SUP 4: 3778.45 61.8% retracement of the Oct 13 - Dec 13 uptrend

A rally in the S&P E-Minis Tuesday saw price trade above 4142.50, Dec 1 high. However, a strong reversal, resulted in a sharp move lower and price remains below Tuesday high. Thursday’s sell-off has reinforced a bearish threat and note that this also highlights the importance of a shooting star candle formation on Tuesday - a reversal signal. A continuation lower would open 3855.13, a Fibonacci retracement. Key resistance is 4180.00.

COMMODITIES

Oil extending losses for a second consecutive session as concerns about recession-driven demand downturn, particularly among advanced economies.- Meanwhile, the US Department Of Energy Begins Process Of Refilling Strategic Petroleum Reserve According to Bloomberg, "the Energy Department plans to solicit bids for oil that will be delivered in February," following the release of 180m barrels of oil from the US Strategic Petroleum Reserve, staggered over six months.

- In October, President Biden said that the Department of Energy would consider replenishing the SPR in tranches when the price of WTI crude dropped below USD$70 a barrel.

- White House energy security adviser Amos Hochstein qualified that statement by saying the DoE would consider purchases when oil prices were trading “consistently” around USD$70.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/12/2022 | 0800/0900 |  | EU | ECB de Guindos Speech at Economia Forum | |

| 19/12/2022 | 0900/1000 | *** |  | DE | IFO Business Climate Index |

| 19/12/2022 | 1000/1100 | ** |  | EU | Construction Production |

| 19/12/2022 | 1100/1100 | ** |  | UK | CBI Industrial Trends |

| 19/12/2022 | 1330/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 19/12/2022 | 1500/1000 | ** |  | US | NAHB Home Builder Index |

| 19/12/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 19/12/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.