-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

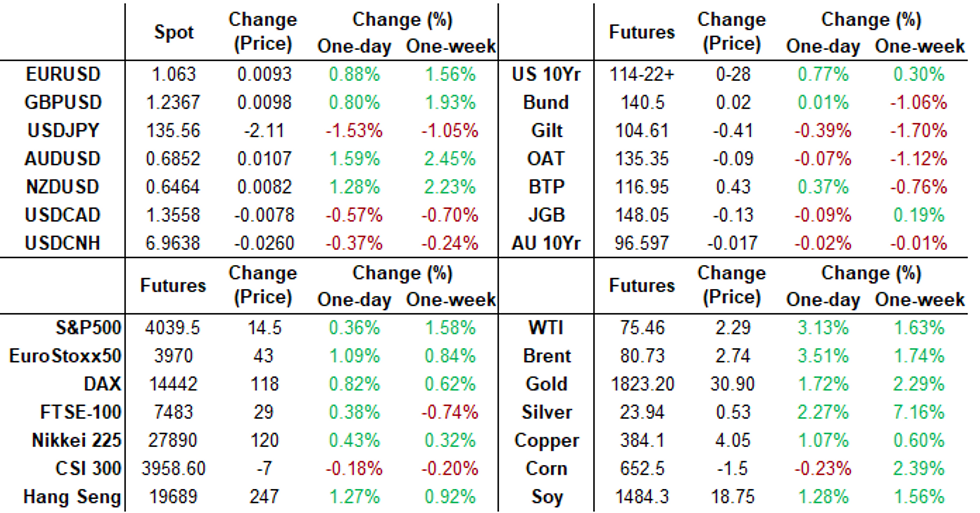

Free AccessMNI ASIA MARKETS ANALYSIS: Soft CPI Ahead FOMC

HIGHLIGHTS

- U.S. FINALIZING PLANS TO SEND PATRIOT MISSILE DEFENSE SYSTEM TO UKRAINE - CNN

- US LABOR DEPARTMENT SAYS NOT AWARE OF ANY EARLY DATA RELEASE, Bbg

- OPEC URGES CAUTION AS IT CUTS FIRST-QUARTER OIL DEMAND FORECAST, Bbg

US TSYS: CPI Deflation

Tsys well bid but off post data highs after the bell - near middle of wide session range on decent volumes (TYH3>1.7M).

- FI markets gap bid after lower than expected Nov CPI (0.1% vs. 0.3% est, core 0.2%) spurred hopes of a continued slowdown in Fed hikes in 2023 (Fed voters have until this evening to revise projections).

- Still Expecting 50Bp Hike tomorrow while mid-'23 Terminal Dips - Fed funds implied hike for Dec'22 back to 51.2bp, while Feb'23 cumulative currently 84.9bp (91.5bp earlier) to 4.674%, Mar'23 98.7bp (108.0bp earlier) to 4.813%, while Fed terminal rate for May'23-Jun'23 falls to 4.845% vs. 4.97% pre-data.

- Yield curves bull steepened (2s10s +4.943 at -72.493 late vs. -69.622 low) as core goods deflation accelerated, falling 0.5% in the month and its weakest since April 2020. Core services inflation also slowed to 0.4%, a still-robust print but one that's a four-month low.

- Heavy volumes in the well bid SOFR futures (far outpacing Eurodollar futures), w/ Reds (SFRZ3-SFRU4) trading +0.240-0.195 higher.

- Tys pare gains after $18B 30Y auction reopen (912810TL2) 3.1bp tails: 3.513% high yield vs. 3.482% WI; 2.25x bid-to-cover vs. 2.42x prior month.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00600 to 3.81786% (-0.00014/wk)

- 1M +0.02572 to 4.31786% (+0.04757/wk)

- 3M +0.01629 to 4.76900% (+0.03586/wk)*/**

- 6M +0.04471 to 5.20571% (+0.06600/wk)

- 12M +0.02572 to 5.55129% (+0.05186/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.77857% on 11/30/22

- Daily Effective Fed Funds Rate: 3.83% volume: $102B

- Daily Overnight Bank Funding Rate: 3.82% volume: $271B

- Secured Overnight Financing Rate (SOFR): 3.80%, $1.042T

- Broad General Collateral Rate (BGCR): 3.76%, $409B

- Tri-Party General Collateral Rate (TGCR): 3.76%, $392B

- (rate, volume levels reflect prior session)

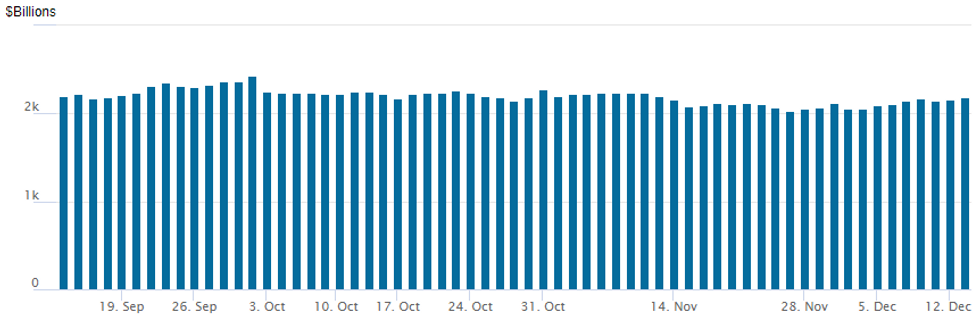

FE Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,180.676B w/ 98 counterparties vs. $2,158.517B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Varied trade on moderate volumes Tuesday - no follow through from Monday's better upside call buying even as underlying futures gapped higher following lower than expected Nov CPI data. If there was a discernible theme to option trade ahead Wed's FOMC annc it would be position unwinds, implied vol weaker as accts unwound both call and put positions. Highlight trade:- SOFR Options:

- Blocks, total -9,000 short Mar 97.50 calls, 2.5 vs. 96.15/0.10%

- +10,000 short Jun SOFR 95.00/95.50 put spds, 6.0

- +5,000 short Dec SOFR 95.62/95.75 2x1 put spds, 0.75

- Block, 2,500 SFRZ2 95.37/95.50 call spds, 11.5

- Block, 3,000 short Dec SOFR 95.87/96.00 call spds 1.5 over short Dec 95.50

- Block, total 7,750 SFRF 95.00/95.12 put spds, 3.0 ref 95.20 to .195

- Block, 3,000 short Mar SOFR 95.00/95.25 put spds, 2.0 ref 96.21

- Block, +3,500 SFRM4 93.00/94.00 put spds, 5.5 ref 96.41

- 3,000 SFRZ2 95.56 calls, cab

- Block, 5,000 short Jan 96.25 calls, 12.5 ref 95.98

- Eurodollar Options:

- +20,000 EDM395.25/95.50 call spds, 5.5 ref 94.96

- Treasury Options:

- -5,000 wk3 TY 113.5/114/114.5 iron flys, 27 vs. 114-15.5/0.05%

- 5,000 TUG/TUH 104 call spds ref 103-01.75

- 1,500 TYH 108/111 2x1 put spds, 8 ref 114-25.5

- -10,000 FVG 107.5 puts, 14-16

- -5,000 FVF 110 calls 21.5-21

- over 6,000 FVF 110 calls, 21 ref 109-21 to -21.5

- 1,750 FVF 109/109.75/110.5 call trees, 20.5

- over 8,000 TYG 111.5 puts, 17 ref 115-08 to -07

- 2,000 TYF 114.25/114.75 put spds, 13

- 4,000 TYH 120/122/124 call flys

- 5,000 USG3 122/126 put spds, ref 131-12

- 3.100 TYF 110.75 puts ref 113-30.5

- 4,000 TYF 112/113 put spds, 17

- 1,700 TYF 117 calls, ref 113-31

EGBs-GILTS CASH CLOSE: Gilts Lag As US And UK Data Set The Tone

US and UK data dominated price action in European FI Tuesday, as key central bank decisions loomed large Wednesday and Thursday.

- Global yields dropped sharply after US CPI surprised to the downside for the 2nd consecutive month.

- Gilts underperformed, lagging the post-CPI rally and then more than reversing the drop as the afternoon progressed. Bunds also faded the initial move but yields finished the session lower.

- Some of the Gilt underperformance was attributed to strong nominal UK wage growth data this morning and BoE's Bailey noting potential second-round inflation risks, ahead of Thursday's BoE decision (MNI's Preview here).

- Periphery EGB spreads finished mostly tighter, but well off the session's narrowest levels posted amid a broad post-CPI risk rally.

- UK CPI data features first thing Weds, with the Fed decision later in the day.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 5.1bps at 2.146%, 5-Yr is down 3.4bps at 1.944%, 10-Yr is down 1.4bps at 1.925%, and 30-Yr is up 3.5bps at 1.752%.

- UK: The 2-Yr yield is up 5.4bps at 3.519%, 5-Yr is up 6.5bps at 3.344%, 10-Yr is up 10bps at 3.301%, and 30-Yr is up 10.5bps at 3.716%.

- Italian BTP spread down 1.3bps at 187.6bps / Spanish down 1.6bps at 101bps

EGB Options: Outright Puts, Outright Calls In Jan Bunds

Tuesday's Europe rates/bond options flow included:

- OEF3 119.75/120.50cs, bought for 13 in 1.9k

- RXF3 138.00p, bought for 16 in 5k

- RXF3 142 calls sold at 49 and 47 in 5k

- RXG3 137.00/134.00 1x1.5 put spread bought for 33 in 6k

FOREX: Softer US CPI Sparks Broad Greenback Selloff

- Another weaker-than-expected US inflation print prompted a significant adjustment lower for the US dollar. The kneejerk reaction was roughly a 1% gap lower for the USD index with the initial surge higher for equities exacerbating the greenback weakness. Despite equities reversing substantially, the DXY has held onto the majority of the session’s fall, registering a 1.10% decline approaching the APAC crossover.

- With the front-end of the US yield curve shifting around 15 basis points lower, the Japanese Yen was one of the biggest beneficiaries following the data, with USDJPY down around 2.2% at its worst point before recovering a portion of the losses to close around 135.50. On the downside, the bear trigger is unchanged at 133.63. A break would resume the technical downtrend.

- A very resilient profile across the commodity complex (Bloomberg commodity index +2.00%), is helping the likes of AUD and NZD hold on to gains in the region of 1.5% on the session, while EUR and GBP are modestly underperforming G10 peers.

- EURUSD has however breached resistance at 1.0595, the Dec 5 high and the bull trigger. The break higher confirms a resumption of the uptrend and also cancels the recent bearish candle pattern - a shooting star. The climb sets the scene for 1.0736 next, a Fibonacci projection. On the downside, key short-term support has now been defined at 1.0443, Dec 7 low, of which a break would signal a short-term top.

- Focus turns swiftly to tomorrow’s release of UK CPI before the December FOMC meeting and summary of economic projections. A packed calendar continues Thursday, with CB decisions from the Norges Bank, the SNB, the BOE and the ECB.

FX: Expiries for Dec14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0375-80(E2.3bln), $1.0450(E1.1bln), $1.0500(E1.1bln), $1.0545-50(E940mln), $1.0640-50(E1bln), $1.0700(E1.2bln)

- USD/JPY: Y136.00($1.3bln)

- NZD/USD: $0.6400(N$1.2bln), $0.6425(N$1.2bln)

- USD/CAD: C$1.3560($1.5bln)

Late Equity Roundup: Off Early Highs Ahead Wed FOMC

Stocks firmer after the, but well off post-CPI high (ESH3 4153.5) after the lower than expected Nov CPI (0.1% vs. 0.3% est, core 0.2%) buoyed early risk appetite. Support gradually faded through the first half as accts pared risk/took profits ahead Wed's FOMC. SPX eminis currently trade +23.75 (0.59%) at 4048.25; DJIA +58.61 (0.17%) at 34061.92; Nasdaq +92.2 (0.8%) at 11235.56.

- SPX leading/lagging sectors: Energy (+1.97%) lead by equipment and services outperforming O&G (HAL +7.41%, SLB +3.81%, BKR +3.16%). Real Estate (+1.75%) and Communication Services (+1.70%) followed, interactive media underpinning the latter w/ Match Grp +7.44%, Dish +4.64%, Meta +4.08%. Laggers: Consumer Staples (-0.20%), Utilities (+0.14%) and Consumer Discretionary (+0.16%), auto makers continue to weigh on the latter w/ Tesla -4.44%.

- Dow Industrials Leaders/Laggers: Goldman Sachs (GS) +3.37 at 366.55, Chevron (CVX) +3.48 at 173.23, Home Depot (HD) +3.32 at 331.40. Laggers: United Health (UNH) -8.97 at 536.89, Amgen (AMGN) -4.84 at 271.94, McDonalds (MCD) -2.73 at 273.89.

E-MINI S&P (H3): Fresh Trend High

- RES 4: 4361.00 High Aug 16 and a key M/T resistance

- RES 3: 4250.00 High Aug 26

- RES 2: 4194.25 High Sep 13 and a key resistance

- RES 1: 4180.00 Intraday high

- PRICE: 4035.00 @ 1500ET Dec 13

- SUP 1: 3953.99/3945.75 50-day EMA / Low Dec 7 and key support

- SUP 2: 3782.750 Low Nov 9

- SUP 3: 3735.00 Low Nov 3

- SUP 4: 3670.00 Low Oct 21

A strong rally in the S&P E-Minis has resulted in a break of 4142.50, Dec 1 high. This confirms a resumption of the uptrend and marks an extension of the bullish price sequence of higher highs and higher lows. Sights are on 4194.25, Sep 13 high. A breach of this hurdle would strengthen bullish conditions and open 4250.00, Aug 26 high. Key support has been defined at 3945.75, Dec 7 low. This is just below the 50-day EMA, at 3953.99.

COMMODITIES: CPI Miss and Adverse Weather Drives Oil, Gold Higher

- A sharply more supportive macro backdrop with US CPI inflation surprising to the downside plus cold weather forecasts support commodities today. Weather has additional specific implications for oil as well, with TC Energy’s effects to restart a segment of its Keystone pipeline delayed by bad weather, with the cleanup expected to last weeks.

- WTI is +3.3% at $75.55, clearing resistance at $75.44 (Dec 8 high) to open the 20-day EMA of $77.74.

- Brent is +3.6% at $80.80, earlier clearing resistance at $80.81 (Nov 28 low) to open the 20-day EMA of $83.33.

- Gold is +1.7% at $1811.14 benefiting strongly from dollar weakness and US Tsy yields sliding, clearing key resistance at $1807.9 (Aug 10 high) to open $1833.0 (Jun 29 high).

- In gas space, EU energy ministers are struggling to agree on a Russia gas price cap as the meeting ran past its scheduled finish according to Reuters.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/12/2022 | 0001/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 14/12/2022 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 14/12/2022 | 0700/0800 | *** |  | SE | Inflation report |

| 14/12/2022 | 0800/0900 | *** |  | ES | HICP (f) |

| 14/12/2022 | 0930/0930 | * |  | UK | Halifax House Price Index |

| 14/12/2022 | 1000/1100 | ** |  | EU | Industrial Production |

| 14/12/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 14/12/2022 | 1330/0830 | ** |  | US | Import/Export Price Index |

| 14/12/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 14/12/2022 | 1900/1400 | *** |  | US | FOMC Statement |

| 15/12/2022 | 2145/1045 | *** |  | NZ | GDP |

| 14/12/2022 | 2230/2330 |  | EU | ECB Elderson Pre-recorded Speech at COP15 |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.