-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Soft Data Spurs Sub 4% 10Y Yield

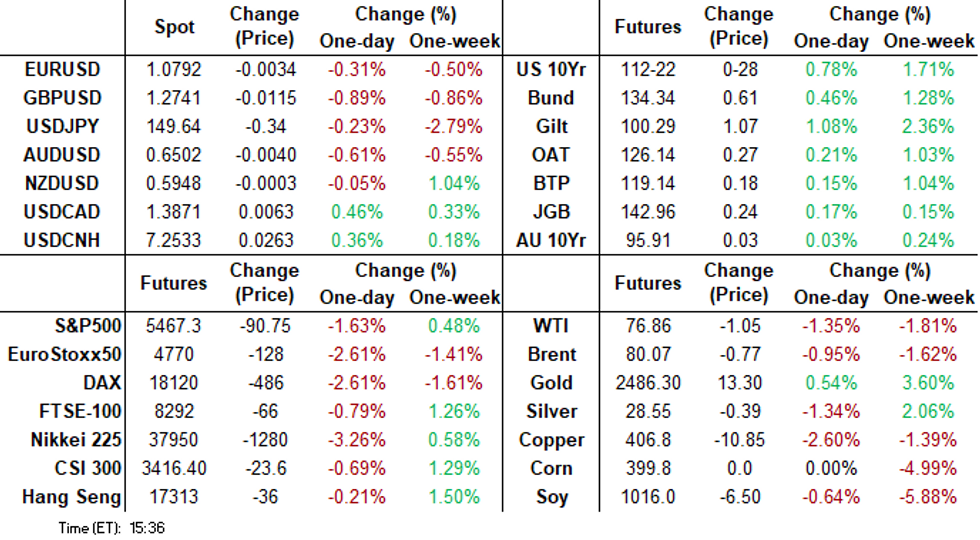

- Treasuries climb to early February highs Thursday, initially on soft economic data, then on safe have/risk off support tied to ongoing geopolitical tension in the Middle East.

- Heavy volumes through the session as 10Y yield falls below 4% to 3.9627% low last seen in early February.

- Short end rates now fully projected 25bp rate cut at each of the next three FOMC meetings by year end.

US TSYS 10Y Yield Falls Below 4% Heading Into Friday's July Jobs Data

- Treasury futures continued to climb higher Thursday, Sep'24 10Y back at early February levels (112-26, +1-00) while 10Y yield fell below 4% to 3.9627% low for the same period.

- Weaker economic data followed the midweek dovish hold from the FOMC, while continued geopolitical risk in the Middle East provided additional safe haven support.

- Initial jobless claims were notably higher than expected in the week to Jul 27, at a seasonally adjusted 249k (cons 236k) after an unrevised 235k.

- Building on dovish implications from yesterday’s softer than expected employment cost growth, labor productivity was also stronger than expected as it increased 2.3% annualized (cons 1.8) in preliminary Q2 data

- The S&P Global US manufacturing PMI was revised only 0.1pt higher as expected in the final July print to 49.6 (initial 49.5) as it held the sizeable drop from the 51.6 in June.

- Heavy short end buying helped curves bull steepen on the day: 2s10s +4.526 at -18.466, 5s30s +3.515 at 42.398. in turn, projected rate cut pricing into year end have gained slightly vs. late Wednesday levels (*): Sep'24 cumulative -29.0bp (-28.4bp), Nov'24 cumulative -47.9bp (-46.9bp), Dec'24 -73.2bp (-72.4bp).

- Focus turns to Friday's employment report for July. Nonfarm payrolls are expected to moderate further in July after the slight beat in June was more than offset by large negative revisions to the prior two months. • Hurricane Beryl is likely to have the largest impact on the establishment survey, clouding the underlying trends with expected negative impacts on payrolls and hours worked but some upside for AHE growth.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00770 to 5.35025 (+0.00355/wk)

- 3M +0.00102 to 5.24212 (-0.01315/wk)

- 6M -0.00901 to 5.06657 (-0.02488/wk)

- 12M -0.02027 to 4.71520 (-0.03770/wk)

- Secured Overnight Financing Rate (SOFR): 5.38% (+0.05), volume: $2.185T

- Broad General Collateral Rate (BGCR): 5.34% (+0.02), volume: $820B

- Tri-Party General Collateral Rate (TGCR): 5.34% (+0.02), volume: $797B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $78B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $220B

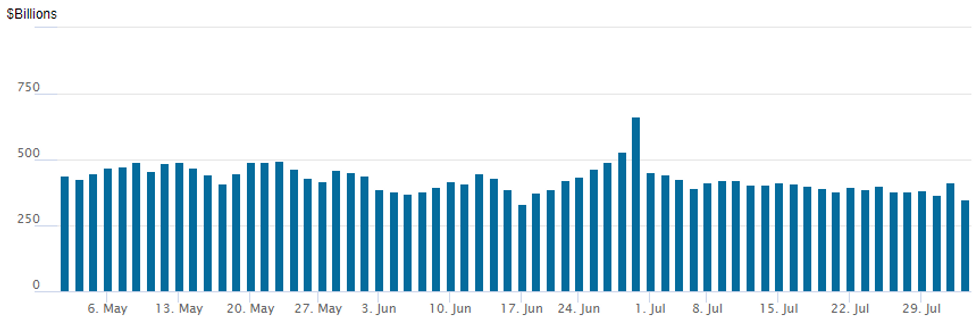

FED Reverse Repo Operation

NY Federal Reserve/MNI

Reversing course at the start of the new month, RRP usage falls back to $348.885B from $413.200B on Wednesday. Number of counterparties steady at 66. Today's usage compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

SOFR/TEASURY OPTION SUMMARY

Carry-over SOFR and Treasury put interest overnight after gaining traction late Wednesday, discounting the underlying rally after the Fed left rates steady while Chairman Powell left door open to first cut in September. Current option volume a little muted as desks reevaluate this morning's post-data underlying support. Projected rate cut pricing into year end have gained slightly vs. late Wednesday levels (*): Sep'24 cumulative -29.0bp (-28.4bp), Nov'24 cumulative -47.9bp (-46.9bp), Dec'24 -73.2bp (-72.4bp).- SOFR Options:

- Block, 15,800 SFRV4 96.00/96.50 call spds, 2.75 ref 95.52

- Blocks, 15,000 0QU4 96.25 puts, 8.0 vs. 96.50/0.28%

- Block, 20,000 SFRM5 96.25/97.00 call spds 23.5 ref 96.31

- Block, 5,000 SFRZ4 95.75/96.25 call spds, 5.5

- Block, 13,000 SFRZ4 95.87/96.00 call spds 1.5 ref 95.49

- -3,000 SFRZ4 94.93/95.12/95.25/95.31 put condor 0.75 ref 95.44

- -5,000 SFRU4 95.12/95.25 call spds vs 94.87 puts 0.25 ref 94.975

- +4,000 SFRU4 94.75/94.81/94.87 put flys 0.25 ref 94.975

- -5,000 SFRH5 95.81/96.00 call spds, 7.25 ref 95.895

- Block, 4,400 SFRU4 94.81 puts, 1.5

- over 7,100 SFRZ4 95.12 puts ref 95.42

- 2,500 SFRH5 95.87 straddles ref 95.845

- Block, 7,500 SFRU4 94.68/94.81/94.87/94.93 put condors, 1.0 vs. 94.945/0.04%

- Block/screen -5,000 SFRU4 95.00/95.18 call spds, 3.25

- Block/screen -5,000 SFRQ4 95.00/95.12 call spds, 2.0

- Block, 3,000 SFRU4 94.81 puts, 1.5 ref 94.965

- 1,500 0QQ4 96.18/96.43 call spds vs. 0QU4 96.18/96.43 call spds ref 96.36

- 4,000 SFRZ4 95.12/95.87 strangles vs. 2,000 0QU4 96.75/97.12 strangles

- -4,000 SFRQ4 95.00/95.12/95.25 call flys, 1.0 ref 94.965

- +4,000 SFRH5 95.50//95.87/96.25 call flys, 8.0

- 3,000 SFRU4 94.81/94.87 put spds ref 94.965

- 2,000 SFRU4 94.87/94.93 3x2 put spds ref 94.97

- 2,000 0QU4/3QU4 97.00 call spd

- Treasury Options:

- 2,000 FVV4 106.5/109.5 strangles, 30

- 4,500 TYU4 113.5 calls, 25 ref 112-22.5

- 6,000 FVV4 106/107 put spds, 3.5 ref 109-00.5

- -5,500 TYV4 111/115 strangles, 45

- +10,000 FVU4 107/107.5 2x1 put spds 1.5 ref 108-09.5

- 2,000 TYU4 113/TYV4 114 call spds, 7 net Oct over

- 2,500 TYU4 112.75/113.5 1x2 call spds, 5 net ref 112-11

- 1,200 TYU4 111/112 straddle spd ref 112-03.5

- +5,000 wk1 TY 112 straddles, 44-45

- over 9,100 FVU4 107.5 puts, 15 ref 108-04.25

- Block, 5,000 FVU4 107.75/108.75/109 broken call tree, 16 ref 108-03.25

- over -21,300 TYU4 111.5 puts, 27-29

EGBs-GILTS CASH CLOSE: UK Short-End Leads Gains As BoE Narrowly Cuts

Core European yields closed sharply lower Thursday, as the BoE delivered a rate cut and data spurred concern over slowing growth.

- Following on from the dovish impulse from Wednesday's Fed press conference, 2Y UK yields saw their 3rd biggest daily drop of the year Thursday with the BoE opting by a 5-4 vote to cut rates by 25bp. The UK and German curves both bull steepened.

- Soft data was a theme all day: German unemployment unexpectedly ticked higher, while US initial jobless claims pushed higher and the ISM Manufacturing report was weaker than expected, particularly in the employment component - all of which is in increased focus ahead of Friday's US payrolls report.

- Safe-haven bonds gained for most of the session as equities dropped in the European afternoon, with the evaporation in risk appetite seeing periphery EGB spreads move wider.

- Apart from US nonfarm payrolls which is the main global event, Friday's data schedule includes Euro national industrial production and retail sales prints, while BoE Chief Economist Pill makes an appearance.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 7.5bps at 2.456%, 5-Yr is down 6.7bps at 2.165%, 10-Yr is down 5.8bps at 2.246%, and 30-Yr is down 4.7bps at 2.467%.

- UK: The 2-Yr yield is down 10.4bps at 3.722%, 5-Yr is down 9.6bps at 3.669%, 10-Yr is down 8.7bps at 3.883%, and 30-Yr is down 5.6bps at 4.48%.

- Italian BTP spread up 5.5bps at 140.1bps / Spanish up 3.6bps at 84.8bps

EGB Options: Put Structures Come Back Into Play As Yields Tumble

Thursday's Europe rates/bond options flow included:

- OEU4 117.75/118.25/118.75c fly, bought for 7.5 in 5k

- DUU4 105.80/105.60/105.40p fly, bought for for 1.75 in 5k and 2 in 2.5k

- RXV4 139.50c, bought for 10 in 1.22k

- ERZ4 96.62/96.75/96.87/97.00c condor, bought for 5 in 5k

- Nov/Dec put spread strip: SFIX4 95.15/95.05ps 1x2, bought for 0.25 in 5k / SFIZ4 95.15/95.05ps 1x2 bought for 0.25 in 8.88k

- SFIZ4 95.50/95.40/95.30/95.10p condor, bought for 1.5 in 2.5k

- SFIZ4 95.15/95.05ps 1x2 bought again for 0.25 in 11.88k total

FOREX Weakness for Equities Boosts Greenback, GBP Pressured Post BOE Cut

- A particularly soft ISM manufacturing report in the US prompted an extension lower for US yields and notable pressure on risk/equities across Thursday’s session. The employment complement saw a very substantial miss: 43.4 (cons 49.2) after 49.3, the lowest since Jul 2020. Pre-pandemic, that’s the lowest since 2009 and has likely exacerbated the risk off flows.

- Despite the impressive moves in rates and equities, the USD index stands just 0.25% in the green, with the Swiss Franc outperforming on the safe haven demand. EURCHF sits 0.90% in the red at the lowest level since February, just ahead of the 0.94 handle.

- The Yen’s daily price adjustment is masked by an extremely volatile overnight session, where the pair fell to a four-month low of 148.51, closely matching touted support, the 61.8% retracement of the Dec 28 ‘23 - Jul 3 upleg.

- Subsequently the pair bounced very firmly, rising as high as 150.89 and so the soft US data and late equity weakness has only brought the pair back to flat, residing just below 1.5000 ahead of the APAC crossover.

- GBP sits lower on the session, consolidating an early move lower ahead of the Bank of England. The BOE's Monetary Policy Committee delivered a 25 basis point rate cut at its August meeting on the narrowest of margins, a five-to-four vote in favour, with even some of those who voted for it saying that their decision was "finely balanced."

- Despite price action remaining choppy for sterling in the aftermath of the decision, GBPUSD sits 0.70% lower on the session, with the poorer risk sentiment likely weighing.

- Note that support has been established just below the 50-day EMA - at 1.2792 - and a trendline at 1.2752, drawn from the Apr 22 low. A clear break of these points would suggest scope for an extension towards the 1.2700. Initial resistance to watch is at 1.2863, today’s high.

- For the cross, EURGBP (+0.40%) has narrowed in on firm resistance which is seen at 0.8458, the 50-day EMA.

- All focus turns to Friday’s US employment report where nonfarm payrolls are expected to moderate further in July. Swiss CPI will also cross during the European session.

FX OPTIONS: Expiries for Aug02 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0770(E557mln), $1.0800(E533mln), $1.0850(E617mln)

- USD/JPY: Y151.00($871mln), Y151.41($2.0bln), Y153.00($798mln), Y155.00($2.6bln)

- EUR/GBP: Gbp0.8420-25(E819mln), Gbp0.8460(E723mln)

- AUD/NZD: N$1.1025(A$545mln)

- USD/CAD: C$1.3895-00($638mln)

- USD/CNY: Cny7.2600($549mln)

Late Equities Roundup: Risk-Off, Profit Taking, Position Squaring

- A confluence of factors continue to weigh on stocks that are at or near session lows in late trade. This morning's softer data helped get the profit taking/position squaring ball rolling ahead of Friday's employment data risk. Similar to late Wednesday's sell-off after Iran called for retribution against Israel for the killing of political leader Haniyeh, early support for stocks evaporates after Hezbollah said they want to "WANT TO RESPOND IN A REAL WAY, NO THEATRICS" Bbg.

- Currently, the DJIA is down 700.31 points (-1.71%) at 40140.58, S&P E-Minis down 106.25 points (-1.91%) at 5451.25, Nasdaq down 519.3 points (-3%) at 17078.64.

- Information Technology and Energy sectors continued to underperform in late trade, semiconductors reversing midweek gains: Qualcomm -9.13% despite strong EPS, Lam Research -10.77%, Advanced Micro Devices -8.26%. Oil and Gas shares also pared midweek gains as crude pared midweek gains (WTI -1.35 at 76.56): Hess -7.91%, Devon Energy -5.0%, Chevron -4.96%.

- On the flipside, Utilities and Real Estate sectors outperformed, multi-energy providers buoyed the Utility sector: Entergy +3.90%, Dominion +3.85%, Southern Co +3.8%. Meanwhile, investment trusts, particularly Specialty and Residential REITS supported the latter: Iron Mountain +6.32%, Mid-America Apartment +4.75%, American Tower +3.24%.

- Heavy earnings announcement schedule continues after today's close:Amazon, Roku Inc, GoDaddy, DoorDash, DraftKings Inc, Floor & Decor Holdings, Block Inc, Ventas, Booking Holdings Inc, Coinbase, Clorox, US Steel, Mettler-Toledo Int, EOG Resources, AES Corp, Vertex Pharmaceuticals, Bio-Rad Laboratories, Cable One, Intel, Twilio Inc, Apple Inc, Cloudflare, Microchip Technology, Monolithic Power and Motorola Solutions Inc.

E-MINI S&P TECHS: (U4) Short-Term Resistance Remains Intact For Now

- RES 4: 5741.34 3.382 proj of the Apr 19 - 29 - May 2 price swing

- RES 3: 5721.25 High Jul 16 and the bull trigger

- RES 2: 5629.75 High Jul 23

- RES 1: 5599.00 Intraday high

- PRICE: 5455.50 @ 1515 ET Aug 1

- SUP 1: 5432.50 Low Jul 25

- SUP 2: 5370.62 50.0% retracement of the Apr 19 - Jul 16 bull leg

- SUP 3: 5364.49 3.0% 10-dma envelope

- SUP 4: 5267.75 Low May 31 and key support

S&P E-Minis traded lower between Jul 16 - 25, resulting in a break of the 20- and 50-day EMAs. The breach does highlight a short-term bearish threat (a correction) and a resumption of weakness would open 5370.62, a Fibonacci retracement. For bulls, this week’s gains are a positive development. Resistance to watch is 5629.75, the Jul 23 high. Clearance of this level would highlight a bullish break and signal the end of the recent correction.

COMMODITIES Crude Pulls Back, Gold Steady, Copper Falls Again

- Oil prices erased earlier gains to be trading lower on the day, likely driven by a rebound in the USD after lower-than-expected ISM manufacturing data.

- WTI Sep 24 is down 1.1% at $77.1/bbl.

- A bear threat in WTI futures remains present and yesterday’s strong bounce is considered corrective, for now.

- A continuation lower would open $72.23, the Jun 4 low and the next key support. A reversal higher would instead refocus attention on key resistance at $83.58, the Jul 5 high.

- Spot gold has edged down by 0.1% to $2,444/oz.

- For bulls, this week’s gains are constructive. A continuation higher would expose $2483.7, the Jul 17 high.

- On the downside, initial support $2,401.3, the 20-day EMA.

- Meanwhile, copper is down 2.3% today to $408/lb, unwinding yesterday’s gains.

- A bear cycle in Copper futures remains intact and a clear break of $405.57, 76.4% of the Feb 9 - May 20 bull cycle, would open $372.35, the Feb 9 low. Initial firm resistance is $438.0 the 50-day EMA.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/08/2024 | 0130/1130 | ** |  | AU | Lending Finance Details |

| 02/08/2024 | 0630/0830 | *** |  | CH | CPI |

| 02/08/2024 | 0645/0845 | * |  | FR | Industrial Production |

| 02/08/2024 | 0800/1000 | * |  | IT | Industrial Production |

| 02/08/2024 | 0900/1100 | * |  | IT | Retail Sales |

| 02/08/2024 | 1115/1215 |  | UK | BOE's Pill at National MPC Agency Briefing | |

| 02/08/2024 | 1230/0830 | *** |  | US | Employment Report |

| 02/08/2024 | 1400/1000 | ** |  | US | Factory New Orders |

| 02/08/2024 | 1430/1030 |  | CA | BOC market participants survey | |

| 02/08/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.