-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS: Strong Jobs Gain, CPI Next in Focus

HIGHLIGHTS

- SVB BANK FAILS AS FDIC TAKES OVER, APPOINTS RECEIVER, Bbg

- TSY SEC YELLEN: TREASURY MONITORING ‘A FEW’ BANKS AMID ISSUES AT SVB

- FIRST REPUBLIC: LIQUIDITY POSITION REMAINS VERY STRONG, Bbg

- MNI US: Freedom Caucus-"US Will Not Default Unless Biden Chooses To Do So"

- US PRES BIDEN: I'M OPTIMISTIC THAT CPI NEXT WEEK WILL BE 'IN SOLID SHAPE', Bbg

- MNI MIDEAST: Reestablishment Of Iran-Saudi Relations Prompts Cautious Optimism

Late Markets Summary, Tsys Back Near Highs, Stocks Off Lows

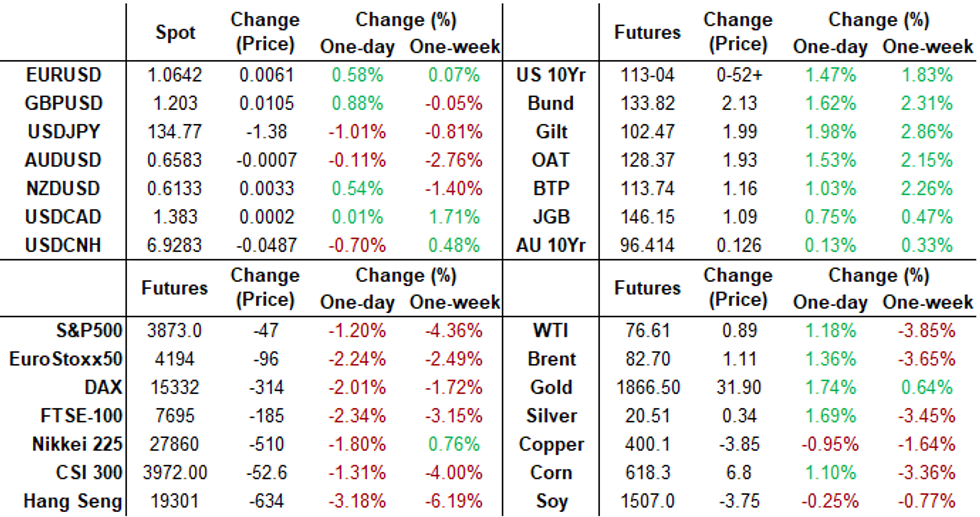

- US Treasury futures have drifted back near session highs in late trade, yield curves re-steepen with short end outperforming: 2s10s little off earlier highs of -87.579. Front-month 2Y futures back near early session high of 102-10.75 as implied rate hikes slipping lower again.

- The Fed terminal rate has now fallen back to 5.27% in July'23, down nearly 45bps from Thursday. Fed funds implied now pricing around 33bps for the March meeting.

- From a technical perspective, front month 10Y futures have extended the current corrective bull phase. Price has breached the 20- and 50-day EMA earlier, the latter at 112-31+. The clear break opens 113-15+, a Fibonacci retracement, for direction.

- US equities remain weaker in late trade, the e-mini S&P futures attempting to recover from broad based selling tied to bank stocks. While many had rebounded ahead midday, risk appetite was poor after FDIC took over failed SVIB, appointed receiver.

- Front-month SPX futures are well off midmorning high of 3937.25, currently at 3873.0, after breaching support of 3869.38 50.0% retracement of the Oct - Feb bull cycle.

- Focus turns to next Tuesday's CPI data: MoM (0.5%, 0.4%); YoY (6.4%, 6.0%) next key inflation metric for the Fed to determine policy. Reminder, Fed enters media Blackout at midnight tonight.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00400 to 4.55714% (-0.00243/wk)

- 1M -0.00743 to 4.79857% (+0.08943/wk)

- 3M -0.01557 to 5.13814% (+0.15414/wk)*/**

- 6M -0.07157 to 5.42829% (+0.11158/wk)

- 12M -0.12515 to 5.73814% (+0.04371/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.15371% on 3/9/23

- Daily Effective Fed Funds Rate: 4.57% volume: $115B

- Daily Overnight Bank Funding Rate: 4.57% volume: $305B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.120T

- Broad General Collateral Rate (BGCR): 4.51%, $469B

- Tri-Party General Collateral Rate (TGCR): 4.51%, $461B

- (rate, volume levels reflect prior session)

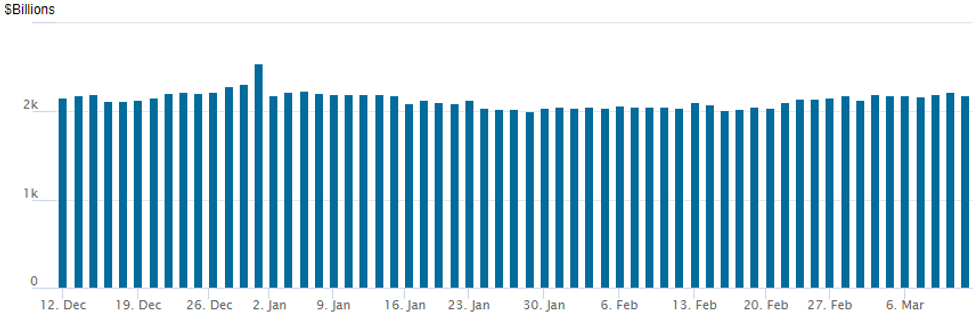

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,188.375B w/ 100 counterparties vs. prior session's $2,229.623B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Robust fixed income option volumes were fairly evenly mixed Friday. Put buyers continued apace, while call buying continued for the third consecutive session as underlying futures surged following a stronger than expected NFP jobs gain of +311k and SVIB bank takeover by the FDIC - that had a larger impact on tempering rate hike expectations.- SOFR Options:

- Block, 20,000 SFRZ3 94.00/94.87 put spds, 25.0 ref 95.13 to -.14

- Block, 20,000 SFRU 94.06/94.87 put spds, 27.0 ref 94.845 to -.84

- Block, 15,000 SFRJ3 94.87/95.06 call spds, 1.5 ref 94.675

- Block, 30,000 SFRU3 95.87/97.00 call spds, 4.0 ref 94.78

- Block, 20,000 SFRU3 94.12/94.87 put spds, 27.5 ref 94.78

- 2,000 OQH3 95.25/95.37/95.43/95.56 call condors ref 95.15

- Block, 10,000 SFRK3 94.18/94.31 put spds, 3.5 ref 94.505

- Block, 4,000 SFRM3 94.75/94.87/95.00 put flys, 1.0 ref 94.505

- Block/screen, 5,000 OQJ3 96.00/2QJ3 96.87 call spds, 1.5

- Block, 10,000 SFRK3 94.18/94.31 put spds, 3.5 ref 94.505

- Block, 10,000 SFRM3 94.75/95.00 call spds, 4.25 ref 94.505

- Block, 4,500 OQK3 94.62/95.00 put spds vs. 95.59/0.12%

- 29,000 SFRN3 94.68/94.87 call spds, 6.0 ref 94.535

- 7,000 SFRH3 95.00 calls, 0.5

- 4,500 SFRM3 95.745 calls, 1.5 ref 94.515

- Block, +5,000 SFRZ3 94.00/95.00 strangles 2.0-1.5 over 94.25/95.25 strangles

- 4,000 SFRJ3 95.25 calls, 1.25 ref 94.52

- 4,000 SFRM3 95.00 calls, 4.25-4.5 ref 94.525

- 4,000 SFRM3 95.25 calls, 2.5 ref 94.52

- Treasury Options:

- 50,000 TYM3 107/108 put spds, 9 ref 113-03 to -03.5

- 2,500 FVJ 108.75/109.25 call spds, 6

- +7,000 TYJ3 111/114 call over risk reversals, 0.0 ref 112-19

- +10.000 TYJ3 110.5/114 call over risk reversals, 0.0 vs 112-07.5

- +5,000 TYK 108/109 put spds, 8.0

- +7,500 USJ3 123/125 put spds, 25

- 16,000 TYJ/TYK 111 put calendar spd, 25 ref 112-00.5

- 15,000 TYJ3 110/111 put spds, 13 ref 112-02.5

- 25,500 TYJ3 107.5/108.5/109.5 put flys, 4.0 ref 112-00.5

- 5,000 TYJ3 112/113.25 call spds, 35 ref 112-09

- 6,500 TYJ 109 puts, 4 ref 112-10 to -09

EGBs-GILTS CASH CLOSE: US Bank Fears Drag Down European Yields

Concerns over the US banking sector rippled through Europe Friday, with German and UK yields plummeting intraday before stabilising slightly before the cash close.

- German and UK yields tested their lowest levels in the month, with short end yields leading the charge (Schatz yields were at one point set to fall by 26bp, the biggest daily drop since 2008).

- Yields came off their session lows in the last hour of cash trade with some apparent relief on the US banking front as stocks bounced, but remained firmly lower on the day, with some re-steepening after the flattening earlier in the week.

- Terminal hike pricing for the ECB and Fed pared back about 25bp in tandem with Fed rate retracement.

- BTP spreads were fairly well-contained given the circumstances, with the 10Y spread closing just above 180bp.

- Fallout from today's closure by regulators of Silicon Valley Bank - whose troubles triggered the panic - will be eyed over the weekend, with the ECB decision and US CPI coming into focus later in the week.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 18bps at 3.097%, 5-Yr is down 15.1bps at 2.643%, 10-Yr is down 13.5bps at 2.508%, and 30-Yr is down 12.1bps at 2.468%.

- UK: The 2-Yr yield is down 16.9bps at 3.642%, 5-Yr is down 16.3bps at 3.525%, 10-Yr is down 15.6bps at 3.64%, and 30-Yr is down 11bps at 4.012%.

- Italian BTP spread up 6.5bps at 181.1bps / Spanish up 3.4bps at 103.6bps

EGB Options: Entering And Exiting Schatz Call Spread

Friday's Europe rates / bond options flow included:

- RXJ3 137.00/138.50cs 1x2, bought the 1 for 3 in 4.38k

- RXK3 131.50/129.50ps, bought for 55 in 8k

- RXK3 134.50/136.00/137.50c fly 1x1.5x1, bought for 49 in 3.85k

- DUJ3 105.10/105.60 cs, bought for 10 in 30k

- DUJ3 105.10/105.60cs, sold 8 in 20k

- ERU3 96.125/96.00ps, bought for 6.75 in 12.8k

FOREX: USD Pressure Extends Following NFP, Weighed By Financial Stability Concerns

- Despite the February change in US non-farm payrolls beating estimates, a set of weaker components within the employment report was met with immediate USD selling. With financial stability concerns providing an uncomfortable backdrop, the greenback extended the post-Powell reversal with the USD index looking set to close in line with last week’s close.

- With the Silicon Valley Bank situation in the back of trader’s minds, the weak details within the payrolls report saw an immediate gap lower for USDJPY from around 136.70 to 136.00. Any bounces remained small, and the resulting hours saw the pair fall to fresh lows for the week at 134.12.

- The pair has now traded well below support at 135.37 and has briefly shown below the 50-day EMA, which intersects at 134.23. A clear break of this average would strengthen a bearish threat.

- With the flight to quality in full force, the Swiss franc was a key beneficiary in G10 FX on Friday, with USDCHF posting 1.25% losses on the day. The Euro and GBP were also able to capitalise on the softer greenback, however, the more risk sensitive Aussie relatively struggled, posting 0.14% losses against the dollar, with AUDJPY weakness mirroring the moves in equity markets.

- A further extension of this equity weakness approaching the close provided some moderate relief for the USD index, which looks set to close around 0.7% weaker on the session.

- The key risk events next week are the US CPI report on Tuesday and Thursday’s ECB meeting.

Expiries for Mar13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500-10(E1.2bln), $1.0540-50(E1.0bln), $1.0600(E1.6bln), $1.0690-00(E2.1bln)

- USD/JPY: Y133.00($570mln), Y135.00($809mln), Y136.00($711mln), Y137.00($590mln)

- GBP/USD: $1.2075-00(Gbp577mln)

- USD/CNY: Cny6.8500($1.2bln)

EQUITIES: Tsy Sec Yellen Gathers Regulators On SVB; Banks 'Resilient'

US: U.S. Treasury Secretary Janet Yellen on Friday convened leaders from the Federal Reserve and other banking regulators to assess the risks to the financial system from the collapse of Silicon Valley Bank.

- "Secretary Yellen expressed full confidence in banking regulators to take appropriate actions in response and noted that the banking system remains resilient and regulators have effective tools to address this type of event," the Treasury said in a statement.

E-MINI S&P (H3): Bear Cycle Extension

- RES 4: 4168.50 High Feb 16

- RES 3: 4100.00 Round number resistance

- RES 2: 4082.50 High Mar 6

- RES 1: 4015.27 50-day EMA

- PRICE: 3903.75 @ 14:38 GMT Mar 10

- SUP 1: 3869.38 50.0% retracement of the Oct - Feb bull cycle

- SUP 2: 3788.50 Low Dec 22 and a key support

- SUP 3: 3735.00 Low Nov 3

- SUP 4:3690.32 76.4% retracement of the Oct - Feb bull cycle

S&P E-Minis sold off Thursday and the contract is trading lower once again today. Price has cleared key short-term support at 3925.00, the Mar 2 low and this confirms a resumption of the bear cycle that has been in place since the Feb 2 reversal. The move lower signals potential for an extension towards the 3800.00 handle and support at 3788.50, the Dec 22 low. Initial firm resistance is seen at 4015.27, the 50-day EMA.

COMMODITIES: Weaker Dollar Lifts Major Prices With Gold Through Key Resistance

- Crude oil prices have benefited from a weaker dollar on regional banking stress spillover plus a commodities-friendly payrolls report in that it should further strong jobs growth but with some modestly softer internals details such as softer wage growth and a higher unemployment rate.

- The limited rise isn’t enough to offset earlier gains in the week on further macro-related drivers with recessionary/demand fears at large.

- WTI is +1.15% at $76.58, moving back nearer resistance at $78.06 (Mar 9 high) but still some way off key resistance at $80.94 (Mar 7 high).

- Brent is +1.3% at $82.62, also off $84.00 (Mar 9 high) and some way off the stronger $86.75 (Mar 7 high).

- Gold is +1.9% at $1865.79, surging for the second day as Tsy yields tumble and the dollar slips. It has cleared key short-term resistance at $1858.3 (Mar 6 high) to open $1870.5 (Feb 14 high).

- There have been wildly different moves in natural gas today, with front TTF jumping 21% above EUR 50/MWh with supply risks and potential higher demand due to French strikes, whilst US prices fall further on milder weather forecasts, sliding demand from LNG terminals and domestic stockpiles reaching a six-year high.

- Weekly moves: WTI -4.0%, Brent -3.8%, Gold +0.5%, US nat gas -19%, EU TTF nat gas +18%.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/03/2023 | - |  | EU | ECB Panetta at Eurogroup Meeting | |

| 13/03/2023 | 1230/0830 | * |  | CA | Household debt-to-disposable income |

| 13/03/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 13/03/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 13/03/2023 | 1805/1805 |  | UK | BOE Dhingra Panellist at International Women’s Day event | |

| 14/03/2023 | 0700/0700 | *** |  | UK | Labour Market Survey |

| 14/03/2023 | 0800/0900 | *** |  | ES | HICP (f) |

| 14/03/2023 | 0900/1000 | * |  | IT | Industrial Production |

| 14/03/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 14/03/2023 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 14/03/2023 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 14/03/2023 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 14/03/2023 | 1230/0830 | *** |  | US | CPI |

| 14/03/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 14/03/2023 | 1400/1000 | * |  | US | Services Revenues |

| 14/03/2023 | 2120/1720 |  | US | Fed Governor Michelle Bowman |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.