-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: 2025 Rate Cut Projections Abate

MNI BRIEF: Canada Says Has Leverage Against Trump Tariffs

MNI US MARKETS ANALYSIS - BoE Pricing on Knifeedge

MNI (LONDON) - Highlights:

- BoE pricing on a knifeedge, options markets see sizeable GBP swing

- Treasuries eye weekly claims, ISM for NFP clues

- Harris tips Trump to become betting market's favourite

US TSYS: Only Marginal Lift In 10Y Yields After Lows Since Early February Post-Powell

- Treasuries have moved a little off yesterday’s post-Powell highs but hold the bulk of the rally.

- TYU4 trades at 112-04+ off yesterday’s high of 112-10+, amidst heavy cumulative volumes already above 500k as Asia and European investors reacted to yesterday’s Fed communications.

- The push higher surged through resistance levels including a notable 111-31 whilst testing 112-10 (1.5% Fibo proj of the Apr 25 – May 16 – May 29 price swing). It opens 112-20+ (Fibo proj of the same swing).

- Cash yields are 1.5-2.2bp higher across the curve, with the belly leading the increase.

- 10Y yields at 4.049% are off yesterday’s low of 4.0296%, which cleared the Mar 8 low (4.0344%). They were last sub-4% in early February.

- 2s10s is near unchanged on the day at -22.3bps, within the week’s range.

- Data: Challenger job cuts Jul (0730ET), Weekly jobless claims (0830ET), Nonfarm productivity/ULCs Q2 prelim (0830ET), S&P Global US mfg PMI Jul final (0945ET), ISM mfg Jul (1000ET), Construction spending Jun (1000ET)

- Bill issuance: US Tsy $90B 4W, $85B 8W bill auctions (1130ET)

STIR: Fed Rates Hold Post-Powell Decline, Labor-Heavy Docket Amidst Dual Mandate Focus

- Fed Funds implied rates hold yesterday’s sizeable decline seen on Powell’s press conference where the language and tone provided sufficient dovish assurances that the bar to cuts in the near future is low, and he explicitly noted that easing "could be on the table as soon as September". See the MNI Fed Review here.

- Cumulative cuts from 5.33% effective: 29.5bp Sept, 48bp Nov, 73bp Dec and 92bp Jan.

- Today sees potential driving forces from a slew of labor market releases along with final PMIs and the ISM manufacturing survey for Jul, all with an eye on tomorrow’s NFP report. Preview here.

STIR: OI Points To Net Long Setting Dominating In SOFR Futures During Powell-Driven Rally

OI data points to net long setting dominating in SOFR futures beyond SFRU4 on Wednesday, with some dovish repricing seen after Fed Chair Powell opened the door to a September rate cut.

- Fed Funds futures now price 29bp of cuts for the Sep FOMC vs. ~28bp ahead of yesterday’s decision, while 72bp of cuts are priced through year end vs. ~68bp ahead of the decision.

| 31-Jul-24 | 30-Jul-24 | Daily OI Change | |

| SFRM4 | 1,131,823 | 1,134,039 | -2,216 |

| SFRU4 | 1,091,989 | 1,068,168 | +23,821 |

| SFRZ4 | 1,157,227 | 1,176,335 | -19,108 |

| SFRH5 | 921,969 | 896,662 | +25,307 |

| SFRM5 | 841,358 | 828,085 | +13,273 |

| SFRU5 | 652,801 | 660,885 | -8,084 |

| SFRZ5 | 912,531 | 894,396 | +18,135 |

| SFRH6 | 595,792 | 567,123 | +28,669 |

| SFRM6 | 545,267 | 527,514 | +17,753 |

| SFRU6 | 488,876 | 475,505 | +13,371 |

| SFRZ6 | 392,873 | 393,139 | -266 |

| SFRH7 | 244,847 | 235,380 | +9,467 |

| SFRM7 | 263,804 | 250,628 | +13,176 |

| SFRU7 | 203,801 | 200,919 | +2,882 |

| SFRZ7 | 228,897 | 220,025 | +8,872 |

| SFRH8 | 145,511 | 139,744 | +5,767 |

MNI: US Payrolls Preview: Hurricane Beryl To Add A Layer Of Confusion

- We have published and e-mailed to subscribers the MNI US Payrolls Preview.

- Please find the full report including MNI analysis and views from 19 analysts here: https://roar-assets-auto.rbl.ms/files/65559/USNFPAug2024Preview.pdf

BOE: How could the guidance change if there is a cut?

- We think that large chunks of the guidance can remain even with a cut to Bank Rate. On a cut, the penultimate sentence of the MPC could be tweaked to something like:

- “The MPC has judged that the risks from inflation persistence have receded somewhat and it would be appropriate to reduce the degree of restrictiveness of monetary policy. However, monetary policy continues to remain restrictive and will need to remain restrictive for sufficiently long to return inflation to the 2% target sustainably in the medium term.”

- The final paragraph will of course need to change somewhat to remove the reference to the August forecast round. One option here would be to reference the November forecast round – which would in effect guide expectations that Bank Rate was unlikely to be altered at the September meeting. A more open option would be to replace this reference with wording such as “At forthcoming meetings.”

- We also think it is likely that the statement will not point towards further cuts at this stage – keeping the language around how long Bank Rate should be maintained at its current level would be less risky for the MPC than changing the language indicating that future meetings would consider rate cuts – wording that may see markets get a little more overexcited about future rate cuts than the MPC would be hoping for.

- For the full MNI BOE Preview click here.

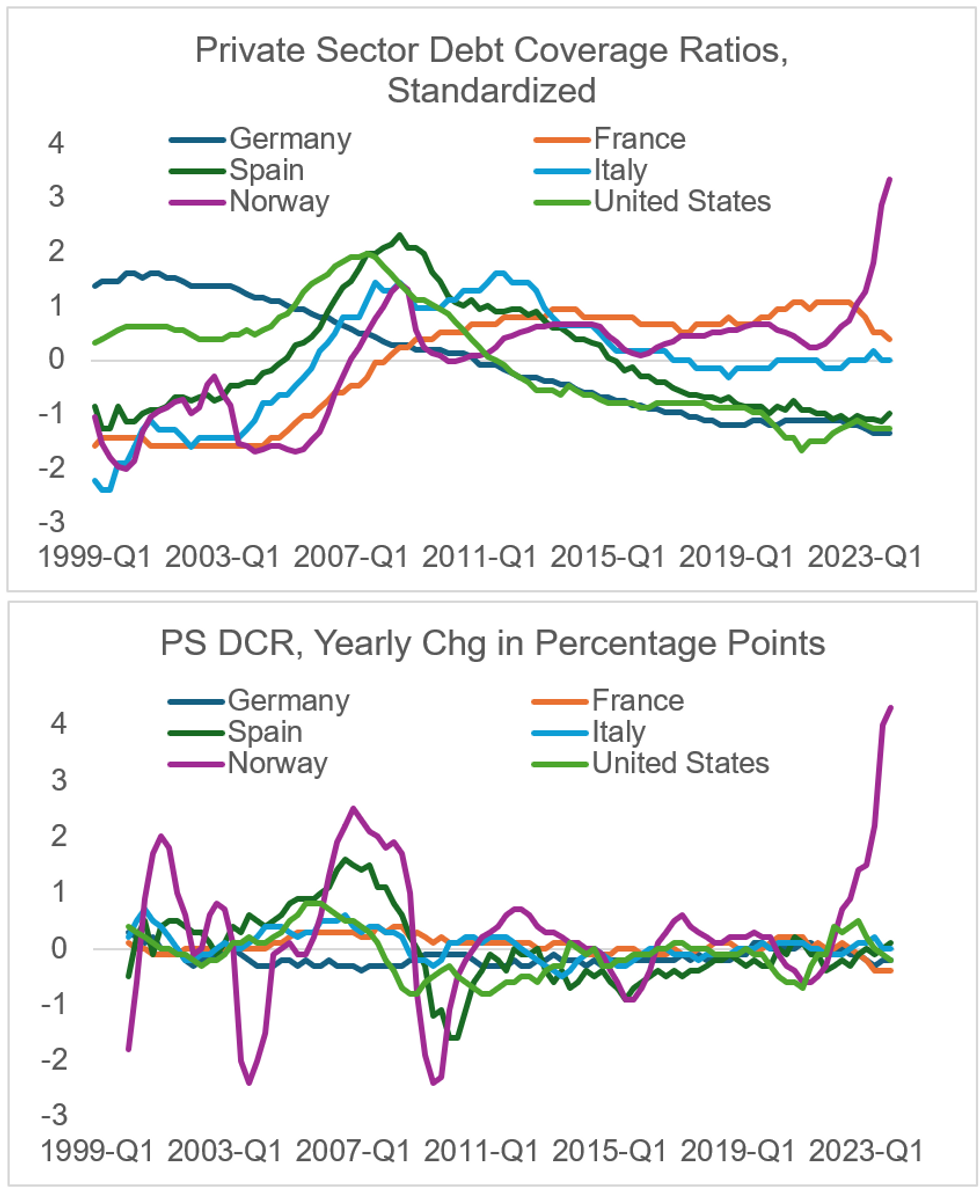

MACRO ANALYSIS: Jumps in Norway's Household Debt Service Ratio

Household debt service ratios (DSRs) have remained relatively stable over recent quarters in a set of large Eurozone countries as well as the US, while having spiked in other countries, notably Norway.

- The debt service ratio is defined as the ratio of interest payments plus amortisations to income.

- While the absolute level of the ratio is tough to compare across countries, BIS, who publishes the data, notes, a comparison over time can be more meaningful. Norway's ratio rose by 4.3pp Y/Y to 20.4% in Q4 2023 (latest data available) - an all time high from both a change and flow perspective - which also is apparent looking at the respective z-score, standing at above 3.3.

- Rising household debt service ratios can be followed by a housing sector correction, as was the case in Spain and the US after a DSR rise in the mid-00s.

- One potential driver behind the recent strong incline in the respective ratio in Norway and its historical volatility could be the large share of floating-rate mortgages in the country.

- The fact that Norway already saw a strong DSR spike in the late 00's, to which the housing sector only slightly corrected, might point towards resilience in that regard.

MNI, BIS

MNI, BIS

EUROPE ISSUANCE UPDATE:

Spain auction results

* E1.83bln of the 2.50% May-27 Bono. Avg yield 2.701% (bid-to-cover 1.71x).

* E2.862bln of the 3.45% Oct-34 Obli. Avg yield 3.107% (bid-to-cover 1.51x).

* E1.176bln of the 5.15% Oct-44 Obli. Avg yield 3.566% (bid-to-cover 1.73x).

* E766mln of the 0.65% Nov-27 Obli-Ei. Avg yield 0.892% (bid-to-cover 1.98x).

France auction results

* E4.956bln of the 3.00% Nov-34 OAT. Avg yield 3.01% (bid-to-cover 2.25x).

* E1.856bln of the 1.25% May-38 OAT. Avg yield 3.21% (bid-to-cover 2.35x).

* E1.676bln of the 2.50% May-43 OAT. Avg yield 3.36% (bid-to-cover 2.71x).

* E2.009bln of the 4.00% Apr-55 OAT. Avg yield 3.49% (bid-to-cover 2.02x).

FOREX: GBP/USD Vols Price Double the Average Overnight Swing on BoE

- With GBP/USD backtracking ahead of the BoE decision today, vols are well bid. Overnight GBP/USD implied has just crossed 15 points for the first time this year, hitting the highest level mid-December and the confluence of central bank decisions pre-Christmas.

- Surging vols tip the break-even on an overnight straddle to ~80 pips, well over the double the YTD average - suggesting markets anticipate a sharp swing in GBP on the BoE decision today.

- A leg lower of this magnitude would confirm a clean break of the 50-dma support, not convincingly broken since April, and would go further in erasing the rally off the early July low. Meanwhile, the options pipeline today eyes strikes at somewhat higher levels, with £498mln rolling off at 1.2798-00 and £633mln at $1.2850.

- We wrote yesterday that GBP/CAD provides an extreme example of positioning, with markets acutely net long GBP, and net short CAD, keeping 2021 highs of 1.7887 in sight. GBP has the highest net position as a percentage of open interest at 49.2%, which stands in stark contrast to the Canadian dollar (-51.2%), well evidenced by the strong bullish trend conditions in place for GBPCAD.

- Pressure on the Canadian dollar has been bolstered by the BOC cutting rates twice already this year and 2-year CA/UK yield differentials remaining in negative territory, currently at -33bps and bolstering the underlying trend for the cross.

GBP Vols Surge, JPY Extends Post-Fed Bid

- GBP is the currency in focus Thursday, trading lower against all others in G10 as markets await the BoE decision at 1200BST. Pricing remains evenly split on whether the BoE cut rates now, or hold until later in the year, leaving options markets well priced for high levels of volatility later today. Overnight GBP/USD implied vols have just crossed 15 points for the first time this year, hitting the highest level mid-December and the confluence of central bank decisions pre-Christmas.

- This tips the break-even on an overnight straddle to ~80 pips, well over the double the YTD average - suggesting markets anticipate a sharp swing on the BoE decision today.

- JPY trades well, extending the post-Fed move and pressing USD/JPY to new pullback lows of 148.51. The pair is more stable headed into the NY crossover, but the sell-on-rallies theme clearly remains. Continued weakness in the pair over the coming weeks will bring key support and the next downside level of note into play at 146.49 the mid-March lows.

- Outside of the BoE, weekly US jobless claims are due as well as the July manufacturing ISM - both of which will be carefully watched for clues ahead of tomorrow's NFP, at which markets anticipate the US adding 175k jobs over the month.

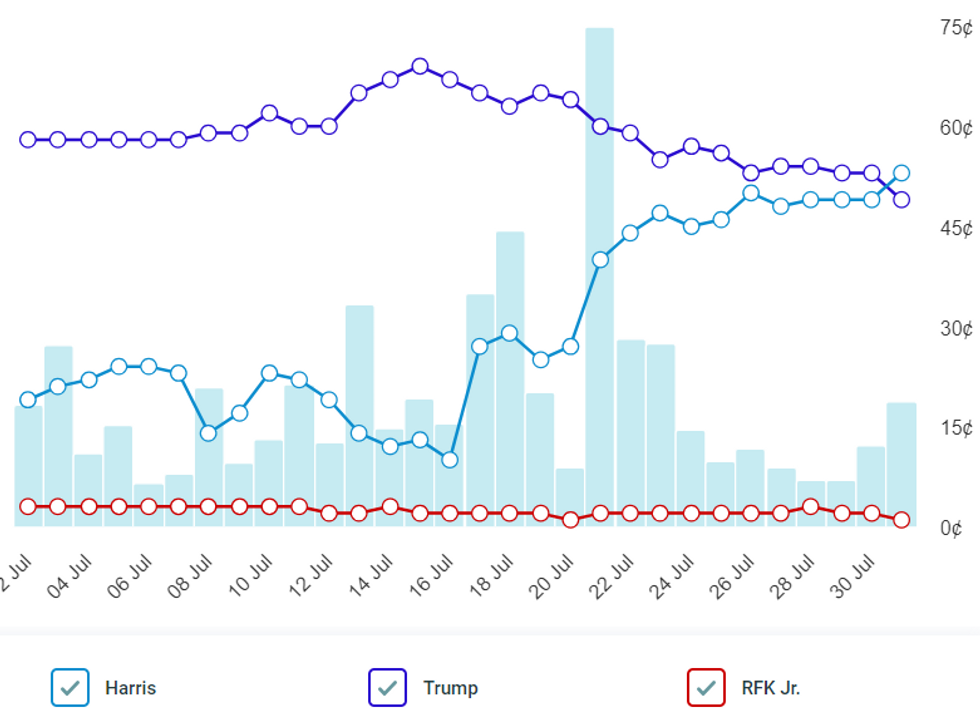

WHITE HOUSE: Harris Overtakes Trump In PredictIt Election Odds

Political share-trading site PredictIt shows Vice President and likely Democratic presidential nominee overtaking Republican nominee former President Donald Trump for the first time as nationwide swing-state polling has indicated increasing support for Harris (albeit with the outcome still too-close-to-call).

- PredictIt assigns a 53% implied probability of winning the election, compared to 49% for Trump (sums to more than 100 due to rounding).

- Political betting markets at Smarkets and Polymarket continue to show Trump as the favourite, leading with implied probabilities of 54.4% to 43.5% (Smarkets) and 55% to 43% (Polymarket). In both markets, Trump's implied probability of winning has fallen since Biden dropped out of the race from a peak of around 70%.

- Today, Trump speaks at a rally in Harrisburg, PA with focus on the fallout to hiscontroversial comments regarding Harris' racial profile made at the National Association of Black Journalist's rountable in Chicago, IL on 31 July. Harris will speak at a rally in Houston, TX, with GOP VP candidate JD Vance in Glendale, AZ.

Chart 1. Implied Probability of US Presidential Election Winner, (US cents = %)

Source: PredictIt

Source: PredictIt

Expiries for Aug01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0750-70(E1.7bln), $1.0785-00(E1.3bln), $1.0850(E1.6bln), $1.0875-80(E1.5bln)

- USD/JPY: Y151.00($1.0bln), Y154.00-05($1.5bln)

- GBP/USD: $1.2850(Gbp502mln)

- EUR/GBP: Gbp0.8420(E731mln)

- EUR/JPY: Y167.00(E601mln)

- AUD/USD: $0.6450(A$1.2bln)

- USD/CAD: C$1.4000($621mln)

- USD/CNY: Cny7.2500($1.2bln)

E-Mini S&P Extends Bounce Off This Week's Lows

A bear threat in Eurostoxx 50 futures remains present and recent gains are considered corrective. The contract has recently breached 4846.00, the Apr 19 low. A clear break of this level would pave the way for an extension towards 4738.18, the 200 day MA (cont). Moving average studies are in a bear-mode set-up, highlighting a downtrend. Initial firm resistance to watch is 4980.00, Jul 23 high. S&P E-Minis traded lower last week and this resulted in a break of the 20- and 50-day EMAs. The breach does highlight a short-term bearish corrective cycle and a resumption of weakness would open 5370.62, a Fibonacci retracement. For bulls, this week’s gains are a positive development. Resistance to watch is 5629.75, the Jul 23 high. Clearance of this level would highlight a bullish break and signal the end of the recent correction.

- Japan's NIKKEI closed lower by 975.49 pts or -2.49% at 38126.33 and the TOPIX ended 90.57 pts lower or -3.24% at 2703.69.

- Elsewhere, in China the SHANGHAI closed lower by 6.362 pts or -0.22% at 2932.387 and the HANG SENG ended 39.64 pts lower or -0.23% at 17304.96.

- Across Europe, Germany's DAX trades lower by 224 pts or -1.21% at 18284.9, FTSE 100 lower by 11.57 pts or -0.14% at 8356.64, CAC 40 down 93.73 pts or -1.24% at 7437.76 and Euro Stoxx 50 down 54.77 pts or -1.12% at 4818.17.

- Dow Jones mini down 32 pts or -0.08% at 41041, S&P 500 mini up 7.75 pts or +0.14% at 5566, NASDAQ mini up 38 pts or +0.19% at 19544.25.

Recovery in WTI Futures Deemed Technically Corrective For Now

A bear threat in WTI futures remains present and yesterday’s strong bounce is considered corrective - for now. The recent breach of both the 20- and 50-day EMAs, reinforces a bear theme. A continuation lower would open $72.23, the Jun 4 low and the next key support. For bulls, a reversal higher would instead refocus attention on the key resistance points at $83.58, the Jul 5 high, and $84.36, the Apr 12 high. The recent move down in Gold is considered corrective. The yellow metal did manage to pierce support at the 50-day EMA - at $2367.2. A clear break of this average would signal scope for a deeper retracement towards $2277.4, the May 3 low and a key support. For bulls, this week’s gains are constructive. A continuation higher would expose $2483.7, the Jul 17 high, and a bull trigger. Clearance of this hurdle resumes the uptrend.

- WTI Crude up $0.6 or +0.77% at $78.47

- Natural Gas up $0.02 or +1.18% at $2.062

- Gold spot down $13.6 or -0.56% at $2434.29

- Copper down $5.15 or -1.23% at $412.55

- Silver down $0.24 or -0.84% at $28.7634

- Platinum down $13.66 or -1.4% at $965.5

| Date | GMT/Local | Impact | Country | Event |

| 01/08/2024 | 1100/1200 | *** | Bank Of England Interest Rate | |

| 01/08/2024 | 1130/1230 | BoE Press Conference | ||

| 01/08/2024 | - | *** | Domestic-Made Vehicle Sales | |

| 01/08/2024 | 1230/0830 | *** | Jobless Claims | |

| 01/08/2024 | 1230/0830 | ** | WASDE Weekly Import/Export | |

| 01/08/2024 | 1230/0830 | ** | Preliminary Non-Farm Productivity | |

| 01/08/2024 | 1300/1400 | BOE Monthly Decision Maker Panel Data | ||

| 01/08/2024 | 1345/0945 | *** | S&P Global Manufacturing Index (final) | |

| 01/08/2024 | 1400/1000 | *** | ISM Manufacturing Index | |

| 01/08/2024 | 1400/1000 | * | Construction Spending | |

| 01/08/2024 | 1430/1030 | ** | Natural Gas Stocks | |

| 01/08/2024 | 1530/1130 | * | US Bill 08 Week Treasury Auction Result | |

| 01/08/2024 | 1530/1130 | ** | US Bill 04 Week Treasury Auction Result | |

| 01/08/2024 | 1615/1715 | BOE's Pill MPR virtual Q&A | ||

| 02/08/2024 | 0130/1130 | ** | Lending Finance Details | |

| 02/08/2024 | 0630/0830 | *** | CPI | |

| 02/08/2024 | 0645/0845 | * | Industrial Production | |

| 02/08/2024 | 0800/1000 | * | Industrial Production | |

| 02/08/2024 | 0900/1100 | * | Retail Sales | |

| 02/08/2024 | 1115/1215 | BOE's Pill at National MPC Agency Briefing | ||

| 02/08/2024 | 1230/0830 | *** | Employment Report | |

| 02/08/2024 | 1400/1000 | ** | Factory New Orders | |

| 02/08/2024 | 1430/1030 | BOC market participants survey | ||

| 02/08/2024 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.