-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Strong US PMIs Anchor Short End

- CHINA APPROVES ISSUANCE OF EXTRA 1T YUAN SOVEREIGN BONDS, Bbg

- JAPAN POST PLANS TO CUT FOREIGN DEBT AND INCREASE JAPAN BOND HOLDINGS, Bbg

- JAPAN WEIGHS ONE-TIME $260 TAX CUT TO EASE INFLATION'S PAIN - NIKKEI

- Blackrock's Fink "SAYS FED WILL HAVE TO RAISE INTEREST RATES FURTHER", Bbg;

- Blackstone's Schwarzman: "FED IS HAVING 'PRETTY GOOD IMPACT' ON INFLATION" Bbg.

Key Links:MNI INTERVIEW: Canada Budget To Offer Housing 'Base Hits'-Page / MNI ECB WATCH: ECB Set For First Rates Pause Since July 2022

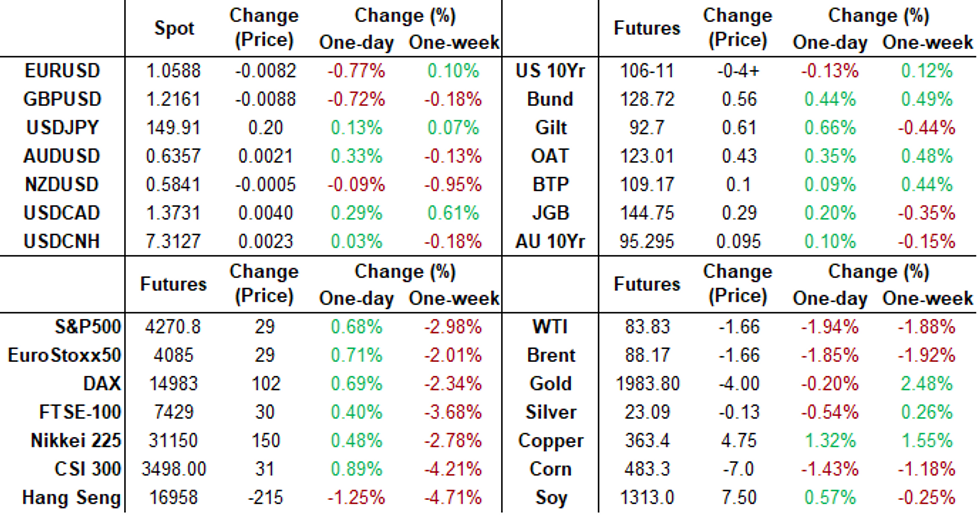

US TSYS Flash PMIs Gains Weigh on Short Rates

- Tsy futures holding mildly mixed after the bell, curves extending lows (2Y10Y -7.253 at -27.614) as Bonds inched higher early in the second half. Still off overnight highs, 30Y futures are +6 at 110-05, 10Y futures briefly trade -3 at 106-12.5 -- still well within technical levels: resistance: 107-05+ 20-day EMA, support: 105-10+ Low Oct 19.

- Futures traded soft after early China headlines of raising Yuan sovereign bond issuance an extra 1T, while raising fiscal deficit ratio to appr 3.8% from 3.0%. Tsy futures extend session lows after S&P Global US PMIs come out higher than expected:

- S&P Global US Manufacturing PMI (50.0 vs. 49.5 est, 49.8 prior)

- S&P Global US Services PMI (50.9 vs. 49.9 est, 50.1 prior)

- S&P Global US Composite PMI (51.0 vs. 50.0 est, 50.2 prior)

- Little reaction from Tsy futures after the $51B 2Y note auction (91282CJE2) trades on the screws: 5.055% high yield vs. 5.055% WI; 2.64x bid-to-cover vs. 2.73x prior.

- Stocks gained after early deluge of positive Q4 earnings announcements from PacWest Bancorp, Dow, GE, GM, Verizon and Xerox to name a few, S&P Eminis currently +34.0 at 4275.75. After market announcements include: Alphabet, Microsoft, Visa and Waste Management.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00047 to 5.32491 (-0.00674/wk)

- 3M +0.00138 to 5.37960 (-0.01887/wk)

- 6M +0.00643 to 5.44552 (-0.02396/wk)

- 12M +0.00400 to 5.38411 (-0.05424/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $88B

- Daily Overnight Bank Funding Rate: 5.32% volume: $237B

- Secured Overnight Financing Rate (SOFR): 5.30%, $1.330T

- Broad General Collateral Rate (BGCR): 5.30%, $554B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $545B

- (rate, volume levels reflect prior session)

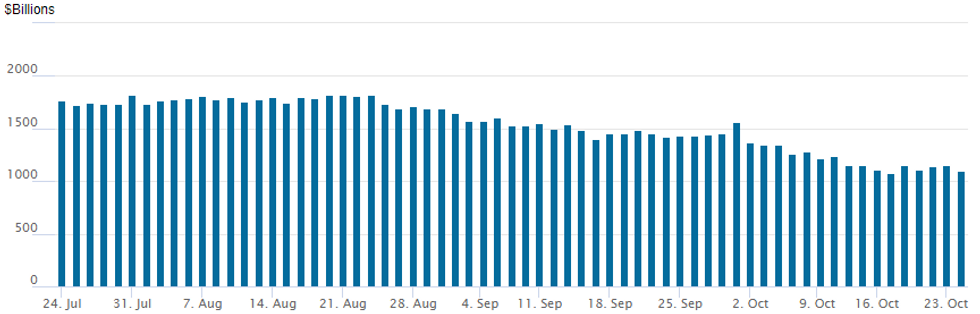

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

The NY Fed Reverse Repo operation usage falls to $1,097.875B w/97 counterparties vs. $1,157.976B in the prior session. Very close to last Tuesday's $1,082.399B - the lowest level since mid-September 2021. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

SOFR/Treasury options focused on low delta puts and put structures early Tuesday, volumes fading in the second half as underlying futures pared losses/finished mixed. Projected rate hikes static into early 2024: November holding at 1.6%, w/ implied rate change of +.4bp to 5.333%, December cumulative of 6.4bp at 5.393%, January 2024 cumulative 9.4bp at 5.423%, March 2024 at 5.3bp at 5.381%. Fed terminal at 5.425% in Feb'24.

- SOFR Options:

- -4,000 SFRH4 93.75/94.25/94.75 put fly w/ 94.00/94.50/95.00 put fly, 46.0 total on double sale

- 13,500 SFRM4 96.00/96.12 call spds ref 94.86

- +43,000 0QZ3 94.93/95.12/95.25/95.37 put condors, 2.0 ref 95.405 to -.40

- +15,000 0QZ3 94.87/95.12/95.25/95.37 put condors, 0.5 ref 95.41 to -.37

- 6,500 SFRZ3/SFRJ4 94.50 put spds

- 2,000 SFRH4 94.25/94.43 2x1 put spds ref 94.645

- 4,000 SFRZ3 94.68/94.87 call spds ref 94.565

- 3,000 0QZ3 95.50/95.87/96.25 call flys ref 95.435 to -.405

- Treasury Options:

- 2,500 TUZ3 101.5/102 1x2 call spds ref 101-06.5

- 3,000 USX3 107/109 2x1 put spds

- +45,000 TYX3 105.5 puts, 7 ref 106-09.5 to -10. Open interest only 30,168 coming into the session

- over 9,900 TYX3 106.5 puts, 25 last ref 106-12.5

- 3,000 TYZ 108 calls, 27 last ref 106-14

- 1,000 TYX3 105.5/106 3x2 put spds ref 106-17.5

- 1,000 TYX3 105.25/105.75 put spds, 3 ref 106-17.5

- 1,200 FVZ3 103.5 puts ref 104-22.5

- 4,750 TYX3 105.5/106 put spds, 7 ref 106-11 to -10.5

EGBs-GILTS CASH CLOSE: Bellies Rally On Contractionary European PMIs

European yields continued to descend from Monday morning's highs on Tuesday, with both the German and UK bellies outperforming after soft preliminary October PMI data.

- The highlight of the session was the weak German services PMI (contractionary at 48.0 vs 50.0 expected), which combined with a poor French manufacturing print (1.9 point miss) saw Eurozone-wide PMI printing below expectations in both services and manufacturing.

- The UK's figures were largely in line (Services missed by 0.1pp, manufacturing beat by 0.5pp), while the details of the ONS's experimental labour market data evidenced some softening.

- The combined effect of the data was to marginally pull back on central bank hike expectations (still 1-2bp seen left in the ECB cycle, with BoE terminal down 2bp to just 9bp left) and pushed eventual cut pricing higher - helping curve bellies outperform.

- Despite the prospects of less monetary tightening and equity gains, periphery EGB spreads widened steadily throughout the session, led by Italy.

- Wednesday sees German IFO data, with the ECB communications Thursday the week's focus now that PMIs are out of the way.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 3.8bps at 3.096%, 5-Yr is down 5.6bps at 2.724%, 10-Yr is down 4.6bps at 2.828%, and 30-Yr is down 1.6bps at 3.052%.

- UK: The 2-Yr yield is down 4.3bps at 4.789%, 5-Yr is down 6.4bps at 4.515%, 10-Yr is down 6bps at 4.539%, and 30-Yr is down 4.7bps at 5.002%.

- Italian BTP spread up 3.3bps at 199.9bps / Spanish up 1.7bps at 111bps

EGB Options: Light Rates Trade As Cuts Priced Back In

Tuesday's Europe rates/bond options flow included:

- 0NZ3 95.50/96.50 call spread v 3NZ3 96.10/97.10 call spread, pays 0.5-1 for the 3NZ3 in 1.75k

FOREX EURUSD Reverses Lower Amid Divergent PMI Data

- In a direct reversal of Monday trade, the USD index looks set to close 0.7% in the green. Gains were underpinned by higher front-end yields, the softer Euro following the weaker-than-expected PMIs and the divergent above-estimate US PMI figures.

- Despite breaching both the 20- and 50-day EMAs, EURUSD corrected lower into the Tuesday close, consolidating back below 1.06 and defying any bullish signals that emanated from the week’s early strength. Any return higher would strengthen a short-term bull cycle and signal scope for a continuation higher.

- In similar vein, GBPUSD has declined 0.75% amid UK flash October PMIs all printing in contractionary territory once again (services has been <50 for 3-consecutive months, while manufacturing has remained in contraction since August 2022). The trend remains bearish, and a resumption of weakness would open 1.2037, Oct 4 low. A break of this level would resume the downtrend that started in July and open 1.1964, a Fibonacci projection.

- The Australian dollar has outperformed other majors which has prompted an impressive 1.10% move lower for EURAUD. The move matches some moderate strength for major equity indices on Tuesday and also comes ahead of tonight’s inflation data. Earlier, AUD/USD looked through a speech from RBA's Bullock, despite a step-up in rhetoric on inflation.

- USDCAD stands 0.3% in the green ahead of tomorrow’s Bank of Canada decision. The pair hasn’t yet tested resistance at a bull trigger of 1.3786 (Oct 5 high), clearance of which would confirm a resumption of the uptrend and open 1.3862 (Mar 10 high). The BoC tomorrow could have limited impact with heightened sensitivity to geopolitical risk, but could help steer subsequent trends.

FX Expiries for Oct25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E1.0bln), $1.0550-60(E602mln), $1.0600-20(E998mln), $1.0650-55(E656mln), $1.0700(E961mln)

- USD/JPY: Y149.75($527mln), Y150.25($593mln), Y151.00($1.3bln)

- GBP/USD: $1.2125-40(Gbp911mln)

- EUR/GBP: Gbp0.8658-75(E1.0bln)

- AUD/USD: $0.6300(A$652mln)

- USD/CNY: Cny7.4000($1.4bln)

Late Equity Roundup: Utilities and Comm Services Outperform

- Stocks continue to post decent gains in late Tuesday trade. Off early session highs follow a wide array of positive Q4 earnings announcements (*) this morning: S&P E-Mini futures are currently up 28.5 points (0.67%) at 4271, Nasdaq up 105.3 points (0.8%) at 13124.74, DJIA up 242.92 points (0.74%) at 33180.24.

- Indexes trimmed early gains after bank shares come under pressure: PacWest Bancorp* -10.15% after missing Q4 earnings est (-$0.31 EPS vs. $0.06 est), Zion -1.83, US Bancorp -0.86%.

- Leaders: Utilities and Communication Services sectors continued to outperform, independent power and electricity utilities supporting the former: NextEra Energy* +7.2% ($0.94 EPS vs. $0.89 est), Edison Int +3.57%, AES +3.7. Telecom services shares continued to underpin the Communication Services sector: Verizon* +8.57% ($1.22 EPS vs. $1.18 est), AT&T +3.48%, T-Mobil +2.29%.

- Laggers: Energy, Health Care and Information Technology sectors underperformed in the second half, oil and gas shares weaker as crude traded lower (WTI -1.66 at 83.83): Haliburton* -2.47% ($0.79 EPS vs. $0.77 est), Schlumberger -2.23%, while Hess Energy trades -2.75% the day after Chevron announced $53B purchase of Hess. Insulin makers weighed on the Health Care sector: Insulet Corp -4.7%, HCA -4.2%, Molina -3.83%. Hardware makers weighed on IT sector: Corning* -0.97% (-$0.45 EPS vs. $0.47 est), Trimble and Zebra Tech -.35%, CDW -0.31%.

E-MINI S&P TECHS: (Z3) Clears Key Support

- RES 4: 4514.50 High Sep 18

- RES 3: 4476.00 Trendline resistance drawn from the Jul 27 high

- RES 2: 4404.28/4430.50 50-day EMA / High Oct 12

- RES 1: 4348.88 20-day EMA

- PRICE: 4270.00 @ 1450 ET Oct 24

- SUP 1: 4213.25 Low Oct 2

- SUP 2: 4194.75 Low May 24

- SUP 3: 4166.25 1.50 proj of the Jul 27 - Aug 18 - Sep 1 price swing

- SUP 4: 4134.00 Low May 4

S&P e-minis maintain a softer tone and the contract started the week on a bearish note. Support at 4235.50, the Oct 4 low and bear trigger, has been breached. The break of this support confirms a resumption of the downtrend and opens 4194.75, the May 24 low. Price remains below resistance at the 50-day EMA, at 4404.28. A clear breach of this average is required to strengthen bullish conditions. Initial resistance is at 4348.88, the 20-day EMA.

COMMODITIES Crude Clears 50-day EMA As USD Strength Weighs

- WTI is trading firmly lower, although has lifted from its intraday low of $82.94/b. A stronger dollar driven by the higher-than-expected US S&P global October manufacturing PMI at 50 vs 49.8 prior has weighed on crude prices.

- The key risk comes from any potential impact on Iran supply which could be greater than any boost to Venezuela production amid easing US sanctions.

- The number of vessels that loaded sanctioned Iranian and Venezuelan crude has seen a 3% increase so far this year and has increased 13% in terms of capacity according to Kpler.

- Blinken today: "In recent weeks, Iran's proxies have repeatedly attacked US personnel in Iraq and Syria... So let me say this... The United States does not seek conflict with Iran," but, "if Iran or its proxies attack US personnel anywhere make no mistake we will defend our people, we will defend our security swiftly and decisively."

- US crude oil inventories are expected to be largely stable on the week when the EIA released the data Oct. 25, based on a WSJ survey.

- The IEA World Oil Outlook released today sees oil, gas, coal demand to peak by 2030 with oil demand of 92.5mb/d, down 0.5mb/d from year's report while the 2050 oil demand projection was reduced by 2.4mb/d to 54.8mb/d.

- WTI is -1.9% at $83.84, clearing support at $84.12 (50-day EMA) to open $80.20 (Oct 6 low).

- Brent is -1.9% at $88.16, off a low of $87.42 to clear support at $88.15 (50-day EMA) to open $83.44 (Oct 6 low and bear trigger).

- Gold is near unchanged at $1973.46, after a strong recovery off a low of $1953.71 which took it back away from support at $194.3 (Oct 19 low).

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/10/2023 | 0030/1130 | *** |  | AU | CPI inflation |

| 25/10/2023 | 0030/1130 | *** |  | AU | CPI Inflation Monthly |

| 25/10/2023 | 0600/1400 | ** |  | CN | MNI China Liquidity Survey |

| 25/10/2023 | 0600/0800 | ** |  | SE | PPI |

| 25/10/2023 | 0700/0900 | ** |  | ES | PPI |

| 25/10/2023 | 0800/1000 | ** |  | EU | M3 |

| 25/10/2023 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 25/10/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 25/10/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 25/10/2023 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/10/2023 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 25/10/2023 | 1400/1000 |  | CA | Bank of Canada Monetary Policy Report | |

| 25/10/2023 | 1400/1000 | *** |  | US | New Home Sales |

| 25/10/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 25/10/2023 | 1500/1100 |  | CA | Bank of Canada Governor press conference | |

| 25/10/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 25/10/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 25/10/2023 | 2035/1635 |  | US | Fed Chair Jerome Powell |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.