-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Surprise Flash PMI Lower Than Exp

- Lower than expected flash PMI data helped Treasuries gap higher early Tuesday

- New Home Sales beat expectations while supply weighed on prices earlier, little notice to Retail Sales Revisions

- Weaker US$ helped support stocks with S&P Eminis climbing to one-week highs.

US TSYS Rates Higher, Curves Steeper on Lower Than Expected Flash PMIs

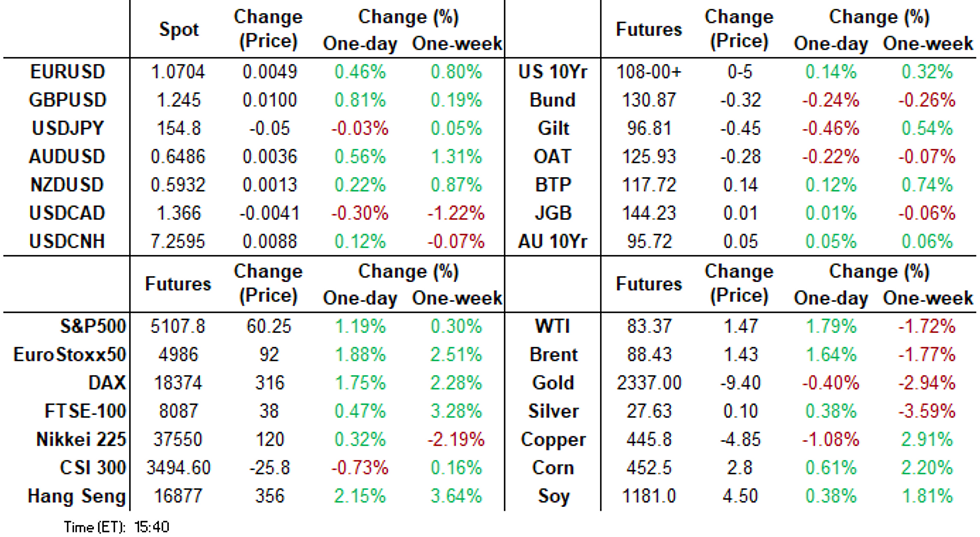

- Treasury futures hold moderately higher after the bell, curves near session highs with the short end outperforming late (2s10s +3.870 at -32.625). Currently, Jun'24 10Y futures are trading 108-01 (+5.5) vs. 108-08 post-auction high, still well below initial technical resistance of 108-22.5 (High Apr 19).

- Lower than expected flash PMI data helped Treasuries gap higher early Tuesday while a strong 2Y note auction saw futures extend session highs early in the second half. S&P Global US PMIs were softer than expected in preliminary April data, with mfg at 49.9 (cons 52.0) after 51.9 and services at 50.9 (cons 52.0) after 51.7. Stronger than expected new home sales tempered rate support as March marked 693k saar vs 668k prior.

- In-line with firmer rates and steeper curves, projected rate cut pricing moved off recent lows: May 2024 -2.6% w/ cumulative -0.6bp at 5.322%; June 2024 at -16.2% vs. -13.6% this morning w/ cumulative rate cut -4.7bp at 5.282%. July'24 cumulative at -13.6bp vs. -11.1bp earlier, Sep'24 cumulative -25.6bp vs. -21.1bp.

- Look ahead: Wednesday data calendar includes Durable/Capital Goods, Tsy Auctions.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00114 to 5.31685 (-0.00125/wk)

- 3M +0.00061 to 5.32355 (-0.00055/wk)

- 6M -0.00033 to 5.29770 (-0.00080/wk)

- 12M -0.00543 to 5.21061 (+0.02280/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.01), volume: $1.746T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $697B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $687B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $79B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $255B

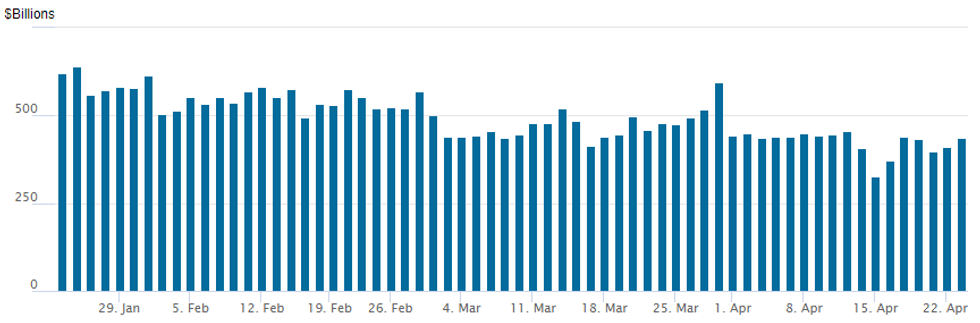

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage climbs to $435.880B vs. $409.816B Monday. Compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

- Meanwhile, the latest number of counterparties recedes to 71 vs. 73 prior.

SOFR/TEASURY OPTION SUMMARY

SOFR option volumes far outweighed Treasury option volume Tuesday. Mixed trade appeared to favor upside call buying and unwinding or adjusting low delta put positions as underlying futures rallied off lows following weaker than expected flash PMI data. In turn, projected rate cut pricing moved off recent lows: May 2024 -2.6% w/ cumulative -0.6bp at 5.322%; June 2024 at -16.2% vs. -13.6% this morning w/ cumulative rate cut -4.7bp at 5.282%. July'24 cumulative at -13.6bp vs. -11.1bp earlier, Sep'24 cumulative -25.6bp vs. -21.1bp.

- SOFR Options:

- +3,000 SFRM4 94.62/94.68/94.75 put trees, 3.75

- +10,000 0QZ4 96.25/96.75 call spds, vs. 2QZ4 96.37/96.75 call spds, 2.0

- +5,000 SFRM5 99.50 calls 1.5 vs. 95.535/.20%

- +5,000 SFRZ5 96.00/96.50 call spds 17.5 ref 95.745

- +15,000 SFRU4 94.81/95.25 call spds vs. 94.89.5 to -90.5/0.34

- +8,000 SFRU4 94.81/95.25 call spds 11.0 vs. 94.895/0.34%

- Block, +5,000 SFRZ4 95.56/95.68 call spds, 2.5 vs. 95.16/0.05%

- Block, +10,000 SFRK4 94.75/94.87 2x1 call spds, 1.0 ref 94.725

- Block, +10,000 SFRZ5/SFRH6 93.75/94.25/94.75 put fly strip, paying 8.5 to buy both limited downside structures. Paper bought an additional 5,000 in pit

- -4,000 2QV4 95.37/96.37 put over risk reversals, 0.5 vs. 95.87/0.50%

- -5,000 0QU4 95.50 straddles, 65.0 ref 95.55

- -3,000 SFRZ4 94.62 puts vs 0QZ4 96.50/97.00 call spds, 1.75

- -10,000 SfRM5 94.62/95.12 2x1 put spds, 3.5-4.0 ref 9539

- +3,000 SfRM4 94.68/94.75 2x1 put spds 2.25 ref 94.725

- +4,000 SfRU4 95.25/95.75/96.25 call flys 2.0 ref 94.87

- 10,500 SFRZ4 93.87/94.37 3x2 put spds ref 95.045 to -.04

- 1,500 SFRM4 94.81/94.93/95.06 call flys vs. SFRU4 94.87 calls

- 9,600 SFRM4 94.81/94.93/95.00/95.12 call condors ref 94.725

- 7,800 SFRK4/SFRM4 94.56/94.68 put spd spd ref 94.7

- 2,000 0QM4 95.62/96.00 call spds ref 95.41

- Treasury Options: Reminder, May options expire Friday

- -6,000 USM4 110 puts, 19 ref 114-26

- +5,000 TYK4 109 calls, 2 ref 108-06.5

- over 44,000 TYM4 105/106.5 put spds 19 ref 107-22

- 1,700 FVM4 108 calls ref 105-00.75

- 2,000 FVK4 104.5 puts ref 105-01

FOREX Weak US Data Prompts Dollar Pullback, GBP & MXN Outperform

- The USD index slipped to the lowest level since April 12 on the back of US PMI data releases - with the step lower in the US yields reflecting the poorer-than-expected data. Bolstered risk sentiment filtered through to a strong bid for equities, which in turn benefitted the likes of EUR, AUD and NZD.

- EURUSD's rally puts the pair back at the prior support level around 1.0700, and will likely place pressure on fresh shorts that had been accumulated in recent sessions.

- GBPUSD outperforms having already risen to the best levels of the session ahead of the US data, helped by a moderate turn lower for the broader USD index and slightly more hawkish comments from Bank of England’s Pill.

- Price action after the US PMIs extended the bounce from yesterday’s five-month lows to around 150 pips, with cable consolidating around 1.2450 ahead of the APAC crossover. Overall, the trend condition in GBPUSD remains bearish and moving average studies are in a bear-mode set-up, reinforcing a bearish theme. Sights are on 1.2266, the Nov 14 2023 low. Initial firm resistance comes down to 1.2524, the 20-day EMA.

- The renewed sensitivity to moves in US yields and broader risk sentiment in recent sessions has bolstered the Mexican peso on Tuesday, which outperforms in the EM FX space. USDMXN (-0.80%) has slipped back below the 17.00 handle, briefly printing a low of 16.9717.

- Australia CPI highlights Wednesday’s docket overnight, before German IFO, Canada retail sales and US durable goods are scheduled. Focus will then turn to US GDP figures due Thursday.

FX Expiries for Apr24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0600-10(E1.5bln), $1.0650(E889mln), $1.0700-05(E2.0bln), $1.0725(E647mln), $1.0830-35(E1.4bln), $1.0880-90(E2.2bln)

- USD/JPY: Y153.50($1.4bln), Y154.00($652mln), Y154.10-25($827mln), Y155.40($1.1bln)

- GBP/USD: $1.2645-65(Gbp1.1bln)

- AUD/USD: $0.6400(A$622mln)

- USD/CAD: C$1.3565-76($1.3bln), C$1.3680($771mln)

- USD/CNY: Cny7.2530($758mln), Cny7.2600($1.1bln)

Late Equities Roundup: Interactive Media, Chip Stocks Remain Strong

- Modest profit taking sees stocks paring gains late Tuesday after this morning's lower than expected flash PMI data underpinned stocks as rates rallied and projected rate cut pricing climbed off recent lows. Currently, DJIA is up 244.98 points (0.64%) at 38481.71, S&P E-Minis up 57 points (1.13%) at 5104.5, Nasdaq up 250.9 points (1.6%) at 15700.71.

- Communication Services and Information Technology sectors continued to lead gainers in late trade, interactive media and telecommunications shares buoyed the former: Netflix +4.06%, Verizon +3.32% after selling off Monday despite announcing better than expected 1Q profits, Meta +3.20%. Chip stocks continued to support the IT sector: Enphase, Microchip Technology +4.07%, +4.26%, Nvidia +3.71%.

- Laggers: Materials and Consumer Staples shares underperformed in late trade, metals and mining stocks weighed on the former as Gold prices remained weaker after falling over $60.0 Monday: Nucor -7.38%, Freeport McMoRan -2.05%. Meanwhile, distribution/retail names weighed on the Consumer Staples sector: Kroger -2.30%, Walmart -1.90%.

- Corporate earnings expected after the close: Tesla, Enphase, Seagate, Texas Instrument, Baker Hughes, Steel Dynamics, Visa. Link to MNI's earning's calendar.

E-MINI S&P TECHS: (M4) Corrective Bounce

- RES 4: 5400.00 Round number resistance

- RES 3: 5285.00/5333.50 High Apr 10 / 1 and the bull trigger

- RES 2: 5153.25 20-day EMA

- RES 1: 5095.25/5137.54 High Apr 18 / 50-day EMA

- PRICE: 5105.75 @ 1230 ET Apr 23

- SUP 1: 4963.50 Low Apr 19

- SUP 2: 4907.57 50.0% retracement of the Oct 27 ‘23 - Apr 1 bull leg

- SUP 3: 4863.75 Low Jan 19

- SUP 4: 4799.50 Low Jan 17

The short-term trend condition in S&P E-Minis is unchanged and remains bearish. Gains are considered corrective - for now. Friday’s bearish extension reinforces current short-term conditions. The contract has recently cleared 50-day EMA, signalling scope for a continuation lower. Sights are on 4907.57 next, a Fibonacci retracement. Firm resistance is 5153.25, the 20-day EMA. A clear break of the average would signal a possible reversal.

COMMODITIES Crude Rises, Spot Gold Recovers On Softer USD

- WTI is approaching the US close trading higher on the day, boosted by a fall in the US dollar on the back of softer US PMI data.

- WTI Jun 24 is up 1.8% at $83.4/bbl.

- The US extended sanctions on Iran’s oil sector to include foreign ports, vessels and refineries that knowingly process or ship Iranian crude. Analysts don’t expect the new measures to have a material impact on Iran’s crude exports.

- For WTI futures, key resistance and the bull trigger has been defined at $86.97, the Apr 12 high. On the downside, key short-term support is at the 50-day EMA, at $80.75.

- Spot gold has recovered to be broadly unchanged at $2,327/oz, helped by the pullback in the dollar, having dipped to an intraday low of $2,292 earlier in the session.

- The yellow metal breached the 20-day EMA earlier, signalling the start of a corrective cycle. A continuation would signal scope for an extension towards $2217.4, the 50-day EMA. Note that a short-term bear cycle would allow a significant overbought trend condition to unwind.

- Key resistance and the bull trigger has been defined at $2431.5, the recent Apr 12 high.

- Meanwhile, silver is up 0.6% on the day at $27.4/oz.

- By contrast, copper is down 0.9% to $443/lb, leaving the metal 2.5% off the near two-year high reached early in yesterday’s session.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/04/2024 | 2301/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 24/04/2024 | 0130/1130 | *** |  | AU | CPI Inflation Monthly |

| 24/04/2024 | 0130/1130 | *** |  | AU | CPI inflation |

| 24/04/2024 | 0600/0800 | ** |  | SE | Unemployment |

| 24/04/2024 | 0600/1400 | ** |  | CN | MNI China Liquidity Index (CLI) |

| 24/04/2024 | 0735/0935 |  | EU | ECB's Cipollone speech at ECB retail payments conference | |

| 24/04/2024 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 24/04/2024 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 24/04/2024 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 24/04/2024 | 0910/1110 |  | EU | ECB's Cipollone panel at ECB Retail Payments Conference | |

| 24/04/2024 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 24/04/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 24/04/2024 | 1230/0830 | ** |  | CA | Retail Trade |

| 24/04/2024 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 24/04/2024 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 24/04/2024 | 1400/1600 |  | EU | ECB's Schnabel remarks at '"Frankfurt liest ein Buch" | |

| 24/04/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 24/04/2024 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 24/04/2024 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 24/04/2024 | 1730/1330 |  | CA | BOC Minutes (Summary of Deliberations) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.