-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI ASIA MARKETS ANALYSIS:Surprise Flash PMI Tempers Early Bid

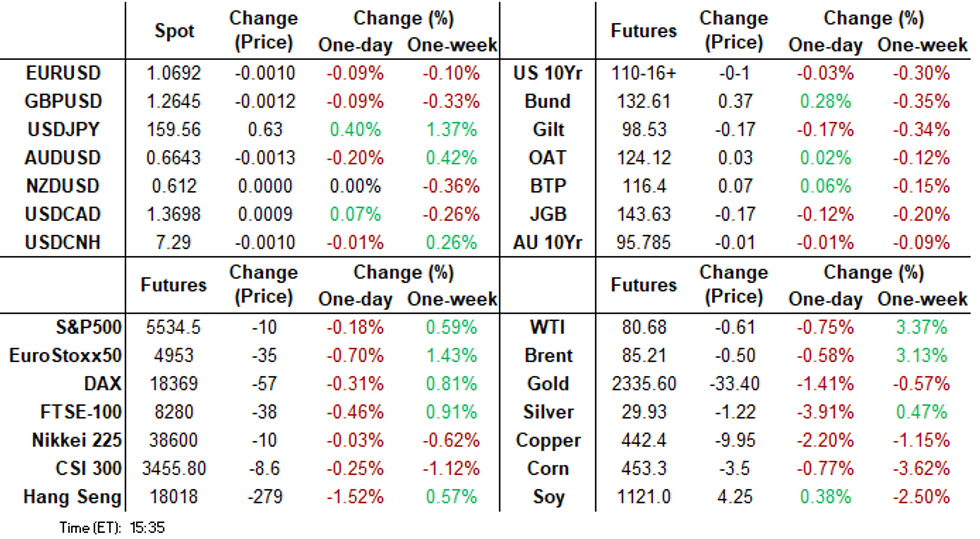

- Treasuries reversed early support after surprise higher than expected flash PMIs, at odds vs. soft French, German and Eurozone composite flash PMIs during early London hours.

- Sell-off limited, while the headline readings improved, price components offered a partly offsetting dovish takeaway.

- Equity markets held narrow ranges ahead of the "triple witching" expiration of stock options, index futures and options.

US TSYS Off Post-Flash PMI Lows, Triple Witching Ahead

- Treasuries are mildly weaker - back near early overnight levels following mixed global PMI levels. Treasuries extended support after soft French, German and Eurozone composite flash PMIs during early London hours -- but gapped lower after slightly higher than expected US flash PMIs in Mfg (51.7 vs. 51.0 est), Services (55.1 vs. 54.0) and Composite (54.6 vs. 53.5 est).

- Little reaction to a dip in May Existing Home Sales to 4.11m (cons 4.10m) after an unrevised 4.14m.

- Session lows were marked at midmorning (Sep'24 10Y at 110-11.5) and spent the rest of the session see-sawing off lows to 110-16.5 (-1), 10Y yield -.0098 at 4.2496%.

- Projected rate cut pricing remains steady to mildly lower vs. this morning's levels (*): July'24 at -10% w/ cumulative at -2.5bp at 5.302%, Sep'24 cumulative -17.6bp (-18.4bp), Nov'24 cumulative -26.6bp (-27.8bp), Dec'24 -46.7bp (-47.2bp).

- Cross asset focus on equity market triple witching expiration of quarterly stock options, index futures and index options and Nvidia swapping ETF weighting with Apple late Friday.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00159 to 5.34523 (+0.01331/wk)

- 3M -0.00291 to 5.34455 (+0.00052/wk)

- 6M -0.00214 to 5.27558 (-0.00044/wk)

- 12M +0.00490 to 5.05165 (+0.00193/wk)

- Secured Overnight Financing Rate (SOFR): 5.32% (-0.01), volume: $2.052T

- Broad General Collateral Rate (BGCR): 5.31% (-0.01), volume: $767B

- Tri-Party General Collateral Rate (TGCR): 5.31% (-0.01), volume: $749B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $85B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $259B

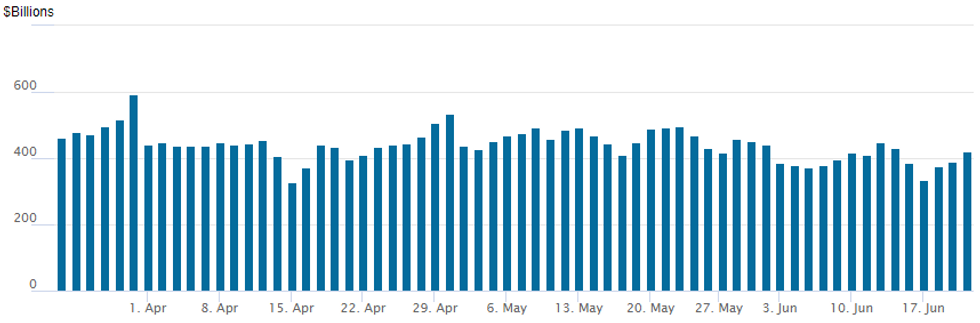

FED Reverse Repo Operation

- RRP usage climbs back over $400B to $421.040B Friday from $388.841B yesterday; number of counterparties holds at 74. Today's usage compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

SOFR/TEASURY OPTION SUMMARY

Trading desks reported better Treasury and SOFR call buying despite this morning's post-flash PMI sell-off in underlying FI futures. Carry-over buying in Aug'24 10Y 111.5 calls adds to +70k late Thursday at 27 vs. 110-14/0.31%. Reminder, July Tsy options expire today. SOFR call buying picked up with buyer of over 60,000 Mar'25 96.75/97.75 call spds. Projected rate cut pricing remains steady to mildly lower vs. this morning's levels (*): July'24 at -10% w/ cumulative at -2.5bp at 5.302%, Sep'24 cumulative -17.6bp (-18.4bp), Nov'24 cumulative -26.6bp (-27.8bp), Dec'24 -46.7bp (-47.2bp).

- Treasury Options: Reminder, July options expire today

- Update, over 69,000 TYQ4 111.5 calls from 27-29, ref 110-15.5 (adds to +70k Thu at 27 vs. 110-14/0.31%, OI +40k)

- over 4,100 TYQ4 111 calls, 46

- 1,000 FVQ4 104.5/106/107 put flys ref 106-31.75

- 3,300 USQ4 114 puts, 12 ref 120-07

- over 12,600 TYN4 111 calls, 2 last

- over 6,700 TYN4 110.25 puts, 1 last

- 3,200 TYU4 111/113.5 call spds ref 110-15.5

- over 6,500 FVN4 107 calls 1-4

- 1,200 FVN4 106.75 straddles ref 106-30.75

- 1,500 TUQ4 101.87/102/102.12 put trees ref 12-07.38

- SOFR Options:

- Over +60,000 SFRH5 96.75/97.75 call spds, 4.5-4.75

- Block, 10,000 SFRH5 96.00/0QH5 97.00 call spds, 0.0 net, front March over

- 4,000 TYN4 110.5 calls, 1 ref 110-14.5

- 3,000 Wednesday weekly 10Y 109.25/109.5/109.75/110 put condors (expire June 26)

- +8,000 SFRQ4 94.37/94.43 put strip 0.5 vs. 94.84/0.05

- +15,000 0QU4 95.50/95.75 2x1 put spds 1.0 ref 95.94

- -10,000 SFRU4 94.75 puts, 3.25 vs. 94.88/0.05%

- +5,000 2QQ4 96.37/96.87/97.25 call flys, 11.25 ref 96.365

- -20,000 SFRZ5 97.50/98.50 call spds, 9.75 vs. 96.125/0.10%

- -13,000 SFRN4/SFRQ4 95.12/95.37 call spd strip, 0.5

- 1,750 SFRZ4 95.00/95.12/95.25/95.37 call condors ref 95.145

EGBs-GILTS CASH CLOSE: Bunds Outperform Gilts As Euro PMIs Disappoint

Core EGBs and Gilts rallied Friday, after surprisingly poor European PMIs cast doubt on whether economic growth momentum could be sustained.

- French and German Services and Manufacturing PMIs unexpectedly decelerated in the June flash readings, which saw Bund yields test the week's lowest levels.

- UK PMIs were more mixed, with Manufacturing slightly stronger than expected but Services disappointing. Earlier, UK retail sales data were solid, but were seen to have only limited implications for BoE policy.

- Yields rebounded in afternoon trade as US PMI data was unexpectedly strong, including the best Services reading in 2 years, though inflation softness noted in the report helped take the hawkish edge off.

- Bunds outperformed Gilts, with the German curve twist steepening with a short-end rally, and the UK's bear steepening. EGB periphery spreads widened modestly.

- Apart from German IFO Monday, scheduled events and data are relatively light early next week (multiple ECB speakers including Schnabel and Villeroy), but pick up later including France/Spain/Italy June inflation data on Friday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 3.9bps at 2.789%, 5-Yr is down 3.2bps at 2.415%, 10-Yr is down 1.9bps at 2.412%, and 30-Yr is up 0.6bps at 2.6%.

- UK: The 2-Yr yield is up 1.4bps at 4.17%, 5-Yr is up 2.8bps at 3.932%, 10-Yr is up 2.6bps at 4.083%, and 30-Yr is up 2.4bps at 4.589%.

- Italian BTP spread up 1.2bps at 152.9bps / Spanish up 0.9bps at 87.5bps

EGB Options: Mixed Rates Trade With Sonia Call Structures Featuring Friday

Friday's Europe rates/bond options flow included:

- DUQ4 105.60/105.30/105.00p fly sold at 5.75 in 3.6k

- DUQ4 105.70/105.20ps 1x2 sold at 11 and 10 in 8.25k

- RXQ4 132.5/131/129.5 p fly bought for 28 in 2.5k

- ERZ4 96.75p, sold at 17 in 10k (ref 96.71)

- ERZ4 96.87/97.00cs sold at 2.25 in 10k

- SFIQ4 95.10/95.20/95.25c ladder, bought for 1.75 in 3k

- SFIU4 95.10/95.20/95.30c fly bought for 2 in 2k

- SFIZ4 95.40/95.65/96.15/96.40c condor, bought for 6.5 in 9k

FOREX: Stronger US PMI Data Assists USDJPY Firmly Back Above 159.00

- Stronger than expected US PMI data boosted the greenback on Friday, most notably for USDJPY which was able to establish itself firmly back above the 159.00 handle, continuing to post new post intervention highs. In terms of resistance, next upside targets are at 159.63 1.236 projection of the May 3 - 14 - 16 price swing, followed by 160.17 High Apr 29 and the bull trigger.

- This post-PMI USD strength kept the pressure on GBPUSD to touch a new pullback low, extending the move seen following the dovish tilt to the Bank of England meeting on Thursday. The 50-dma offered intraday support, containing the selloff at 1.2624.

- Despite weak European PMI releases early Friday and the late greenback strength, EURUSD trades very resiliently into the close, down just 0.1% on the session. Stability for equities may be helping here, alongside an unwillingness to chase the single currency lower into the weekend, and political headlines expected to still drive volatility.

- In emerging markets, the Mexican peso outperforms as markets mull some moderate cabinet picks from President-Elect Sheinbaum and the dust settles on a post-election impulsive period for local assets. USDMXN trades down 1% around 18.19 as we approach the close.

- Next week, German IFO kicks off the data calendar on Monday, with potential comments from Fed’s Waller and BOC Governor Macklem also scheduled.

Expiries for Jun24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700-10(E1.2bln), $1.0720-30(E1.0bln)

- USD/JPY: Y160.00($967mln)

- USD/CAD: C$1.3695-00($1.0bln)

Late Equities Roundup: Chip Stocks Weigh on IT Ahead Triple Witch Exp

- Equity markets remain alert for late session volatility ahead the "triple witching" expiration of quarterly stock options, index futures and index options today.

- Currently, the DJIA is down 5.85 points (0.01%) at 39142.69, S&P E-Minis down 13 points (-0.23%) at 5531.25, Nasdaq down 28 points (-0.2%) at 17689.96.

- Focus on the SPDR S&P U.S. Technology Select Sector UCITS ETF (XLK) reweighting swap of Nvidia from approximately 5% to 20% while Apple will drop from 20% to 5% today -- roughly a $10B swap in stocks between the two. At the moment, Nvidia trades -3.44% while Apple trades +0.46%.

- Communication Services and Consumer Discretionary sectors continued to lead gainers in late trade, interactive media and entertainment shares supported the former: Match Group +2.49%, Take Two Interactive +2.42%, Google +2.33%.

- Consumer durables and services buoyed the Discretionary sector with Hasbro +2.03%, Nike +1.36%, Las Vegas Sands +2.33%.

- On the flipside, Information Technology and Financials underperformed, semiconductor shares faltering late: Aside from Nvidia lagging ahead of it's reweighting, Micron traded -3.59%, Broadcom -2.61%, Enhpase -2.32%.

- Bank shares weighing on the former: JPM -1.25%, Citigroup -1.11%, Wells Fargo -1.02%.

E-MINI S&P TECHS: (U4) Trend Needle Points North

- RES 4: 5622.69 2.764 proj of the Apr 19 - 29 - May 2 price swing

- RES 3: 5600.00 Round number resistance

- RES 2: 5594.66 2.618 proj of the Apr 19 - 29 - May 2 price swing

- RES 1: 5588.00 High Jun 20

- PRICE: 5530 @ 1500 ET Jun 21

- SUP 1: 5443.53/5353.46 20- and 50-day EMA values

- SUP 2: 5267.75 Low May 31 and key support

- SUP 3: 5213.25 Low May 6

- SUP 4: 5155.75 Low May 3

The uptrend in S&P E-Minis remains intact, despite weakness off Thursday’s high. Price has recently cleared 5430.75, the May 23 high and bull trigger. This confirmed a resumption of the uptrend. Note that moving average studies are in a bull-mode position too, highlighting positive market sentiment. Sights are on 5594.66 next, a Fibonacci projection. Initial support lies at 5443.73, the 20-day EMA.

COMMODITIES Spot Gold Losses Extend Following Robust US PMI Data

- WTI has traded around 3% higher on the week, despite falling back on the day. A stronger USD has added some pressure Friday, although signs of improved summer demand and falling US stocks will be supportive.

- WTI Aug 24 is down 0.9% at $80.6/bbl.

- WTI futures have traded higher this week, extending the current bull phase. The climb has resulted in a break of $80.11, the May 29 high, opening $82.24, a Fibonacci retracement point.

- Initial firm support to watch is $78.32, the 20-day EMA.

- Meanwhile, spot gold has fallen by 1.6% today to $2,322/oz, with losses extending following the stronger-than-expected US PMI data, which in turn provided a USD bid.

- Over the week, the yellow metal has fallen by 0.5%.

- For gold, the sharp sell-off on Jun 7 reinforced a short-term bearish theme. The yellow metal recently pierced the 50-day EMA, at $2,317.69, a clear break of which would open $2,277.4, the May 3 low.

- Initial firm resistance is $2,387.8, the Jun 7 high.

- Silver has fallen by 3.9% to $29.5/oz on Friday, leaving it unchanged on the week.

- For silver, key resistance remains at $32.518, the May 20 high, while support to watch lies at the 50-day EMA, at $29.001.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/06/2024 | 0700/0300 |  | US | Fed Governor Christopher Waller | |

| 24/06/2024 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 24/06/2024 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 24/06/2024 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 24/06/2024 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 24/06/2024 | 1530/1730 |  | EU | ECB's Schnabel in panel on 'Investing in Sovereignty" | |

| 24/06/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 24/06/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 24/06/2024 | 1730/1330 |  | CA | BOC Governor Macklem speech in Winnipeg. | |

| 24/06/2024 | 1800/1400 |  | US | San Francisco Fed's Mary Daly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.