-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: BOJ Tankan: Key Sentiment Rises, Solid Capex Plans

MNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI ASIA MARKETS ANALYSIS - Three Fed Cuts Priced For 2024 With FOMC Ahead

- Treasury yields climb a little further with signs of additional inflationary pressures, extending the large sell-off for the week. Fed Funds hold a push to just three 25bp cuts priced for 2024 per the December SEP ahead of next week's dot plot.

- Equities come under pressure for the second day running but it only slightly more than reverses gains from earlier in the week. Today's shunt lower for the S&P 500 e-mini stopped short of support at the 20-day EMA.

- Against this backdrop, the USD index has seen further, albeit more modest gains, yet crude oil holds a strong increase for the week despite this headwind.

- The upcoming week is headlined by the BoJ's well-touted potential exit from negative interest rates before the FOMC decision with chance of a hawkish dot plot surprise, rounded out with a flurry of other central bank decisions.

US TSYS: U.Mich Helps A Mild Move Off Latest Lows, 10s Holding 4.3%

- Cash Tsys trade twist flatter on the day, with 3s still leading the sell-off (+3.7bps) and only 30s rallying (-0.7bps).

- Losses extended after non-oil import price data showed some additional inflationary pressure at the margin after the week’s stronger CPI and PPI releases, although pared some of those lows with a slightly softer than expected U.Mich survey.

- Further BoJ headlines, this time Nikkei explicitly seeing the BoJ guiding the short-term rate to 0-0.1% had little impact after already contributing to sell-offs this week, especially JiJi’s piece after PPI yesterday.

- 10Y yields currently hover at ~4.30% having earlier touched 4.3182% in another step closer to YtD highs of 4.3486%. They started the week at 4.08%.

- Similarly, TYM4 at 110-02+ is off earlier lows of 109-31 vs the bear trigger at 109-25+ (Feb 23 low). Volumes of 1.4m at typing have faded compared to recent sessions.

- At the very front end and ahead of next week’s FOMC, Fed Funds implied rates are back consistent with the December dot plot with 74bp of cuts for the year. Near-term cumulative cuts: 0.5bp Mar, 3bp May, 16bp Jun and 27bp Jul.

US 10Y Tsy yieldSource: Bloomberg

US 10Y Tsy yieldSource: Bloomberg

EGBs-GILTS CASH CLOSE: Global Developments Weigh

Core European FI continued to weaken Friday, with Bunds marginally underperforming Gilts.

- With the European data docket relatively light once again (UK inflation expectations edged lower but this wasn't a market mover), global developments weighed.

- The results of Japanese union wage agreements overnight were seen as likely to tilt the Bank of Japan toward exiting negative rates next week, helping apply some pressure to global core FI this morning.

- Yields edged lower by late morning on light headline flow, but ticked up in early afternoon with above-expected core US import price data and a solid outlook component within the Empire State survey.

- The German curve bear flattened on the day, with the UK's fairly flat with the belly underperforming.

- Periphery spreads finished mostly tighter, with BTPs recovering some of Thursday's late outsized widening.

- Next week's schedule is replete with central bank decisions, including the BoE next Thursday (and the BOJ and Fed earlier in the week), while key data will also feature (including flash PMIs and UK CPI).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 3bps at 2.946%, 5-Yr is up 1.8bps at 2.468%, 10-Yr is up 1.6bps at 2.442%, and 30-Yr is up 0.6bps at 2.58%.

- UK: The 2-Yr yield is up 1.1bps at 4.331%, 5-Yr is up 1.9bps at 4.017%, 10-Yr is up 1.2bps at 4.102%, and 30-Yr is up 0.3bps at 4.531%.

- Italian BTP spread down 1.9bps at 125.7bps / Spanish down 0.8bps at 80.2bps

EU FI OPTIONS: German Call Structures In Favour Friday

Friday's Europe rates/bond options flow included:

- DUJ4 105.60/105.70/105.80/105.90c condor bought for 2.5 in 3k

- DUK4 105.90/106.50cs, bought for 7.5 and 8 in 5k

- RXK4 135/136cs bought for 11 in 5k

- RXJ4 134/135cs vs RXK4 134/135cs, trades 15 for the May in 2k

- RXJ4 133/134cs, bought for 9.5 in 5k

FOREX: Greenback Continues Grind Higher, NZD Underperforms

- Greenback strength this week has been a function of higher yields in the US, with the roughly 20bp shift higher in the US 10-yr resulting in a 0.72% advance for the USD index. With both BOJ and Fed decisions next week, USDJPY has rallied 1.35% this week as we approach the close. During today’s session, the New Zealand dollar has underperformed, falling three quarters of a percent against the dollar.

- The final Rengo union pay tally in Japan took focus this morning, with the pay deal demand of 5.28% coming in ahead of expectations and allowing another piece of the BoJ puzzle to land in favour of a hike next week. Given the well-trailed intentions of the central bank (a JiJi report yesterday pointed heavily to the Bank preparing to exit NIRP next week), JPY failed to materially strengthen - with an expected commitment to continued bond-buying seen stabilising markets through the first potential Japanese rate hike for decades.

- Instead, USD/JPY printed new weekly highs in response, briefly printing up at 149.17. This extends the recovery off the early March base, with the pair printing higher lows for five consecutive sessions and the pair breaching 148.82, the 20-day EMA. As we await next week’s BOJ and Fed decisions, a clear break and close above this average could suggest scope for a move towards 150.08, the Mar 6 high.

- As mentioned, NZD is the poorest performing currency which has helped aid EUR/NZD through the 200-dma and nearing the YTD highs of 1.7937. Additionally, NZDJPY's corrective pullback off the late February highs hit a new pullback low earlier today at 90.37 and narrowing the gap with key trend support at the 90.30 100-dma. This level has helped mark the end of corrective pullbacks in the longer-term uptrend on several occasions over the past 12 months - in early Feb most recently.

- China activity data kicks off next week’s docket before the plethora of developed and emerging market central bank decisions.

FX OPTION EXPIRIES

Expiries for Mar18 NY cut 1000ET (Source DTCC)

* EUR/USD: $1.0600(E1.5bln), $1.0700(E1.3bln), $1.0770-90(E2.6bln), $1.0875(E505mln), $1.0900(E3.2bln), $1.1000(E3.0bln), $1.1015(E823mln)

* USD/JPY: Y146.50-60($1.3bln), Y147.00($1.4bln), Y147.35-50($2.4bln), Y148.00($634mln), Y148.30-50($1.2bln), Y149.00($965mln), Y149.50-55($750mln), Y149.70-75($600mln), Y150.00-20($986mln)

* EUR/GBP: Gbp0.8550(E502mln)

* AUD/USD: $0.6425(A$515mln), $0.6500(A$600mln)

* USD/CNY: Cny7.2000($1.1bln)

EQUITIES: Move Away From Support Aided By Largest Buy Program Since Tuesday

- The S&P e-mini (M4) has lifted 15-20 points from fresh session lows of 5167.75.

- The increase has been buoyed in part by the largest buy program since Tuesday with 986 names as we move towards the weekend.

- The earlier decline came close to support at 5161.33 (20-day EMA), a clear break of which would open 5046.03 (50-day EMA).

- It still sees solid -0.65% losses on the day though, under pressure from a further push higher in Treasury yields. That includes the 10Y hovering at 4.30%, only a small 1bp increase on the day now but consolidating a large sell-off for the week having started at 4.08%.

- E-minis: S&P 500 (-0.65%), Nasdaq 100 (-1.1%), Dow (-0.5%) and Russell 2000 (+0.3%).

- Nasdaq underperformance weighed by sizeable declines for some megacaps, including Microsoft (-2.3%), Amazon (-2.0%), Alphabet (-1.3%) and Meta (-1.5%), all of whom have pared earlier losses. Nvidia (+1.4%) stands out.

- Those moves weigh in S&P 500 sectors, with losses led by IT (-1.2%), communications (-1.1%) and consumer discretionary (-1.0%) whilst energy (+0.3%) and materials (+0.2%) lead.

COMMODITIES: Crude Rangebound Friday, But Up 4% On Week

- Crude futures have been rangebound Friday but are on track for gains of around 4% since the start of the week. Forecasts for higher global demand, attacks on Russian energy infrastructure, and continued geopolitical tensions in the Middle East have provided upside this week.

- WTI is down 0.2% on the day at $81.1/bbl.

- After breaking resistance at $80.85, the Mar 1 high, sights for WTI futures are on $81.70 next, a Fibonacci retracement point. On the downside, support to watch is $76.91, the 50-day EMA.

- Meanwhile, Henry Hub has sunk on the day, relinquishing gains seen yesterday when higher-than-expected US stock draws added support. Weak demand and stable production are adding pressure, despite in an up-tick in LNG feedgas demand.

- US natural gas APR 24 is down 5.2% on Friday at $1.65/mmbtu, putting it on course for losses of over 8% on the week.

- Spot gold fell by 0.2% on Friday to $2,158/oz, leaving the yellow metal 1.0% lower on the week, which would be the first weekly decline in four.

- Gold remains near record highs, however, and the trend condition is still bullish. The break above resistance at $2135.4, the Dec 4 high, signals scope for $2206.6 next, a Fibonacci projection. Firm support is at $2108.4, the 20-day EMA.

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR FIX - Source BBG/CME

1M 5.32632

3M 5.32968

6M 5.26556

12M 5.05951

REPO REFERENCE RATES (rate, change from prev. day, volume):

* Secured Overnight Financing Rate (SOFR): 5.31%, no change, $1782B

* Broad General Collateral Rate (BGCR): 5.30%, no change, $688B

* Tri-Party General Collateral Rate (TGCR): 5.30%, no change, $677B

SOFR volumes almost unchanged from the $1784bn in the previous session, relatively high but within ranges.

New York Fed EFFR for prior session (rate, chg from prev day):

* Daily Effective Fed Funds Rate: 5.33%, no change, volume: $95B

* Daily Overnight Bank Funding Rate: 5.32%, no change, volume: $260B

Fed Funds volumes lift $6bn from $89bn, still rangebound.

FED: O/N RRP Uptake Sees A New Recent Low

- Usage of the Fed’s O/N Reverse Repo Facility fell $70B to $413.9B today, a new low since May 2021.

- Some attribute the move to maturing SOMA securities.

- The number of counterparties dipped by 6 to 68, a joint recent low seen last week.

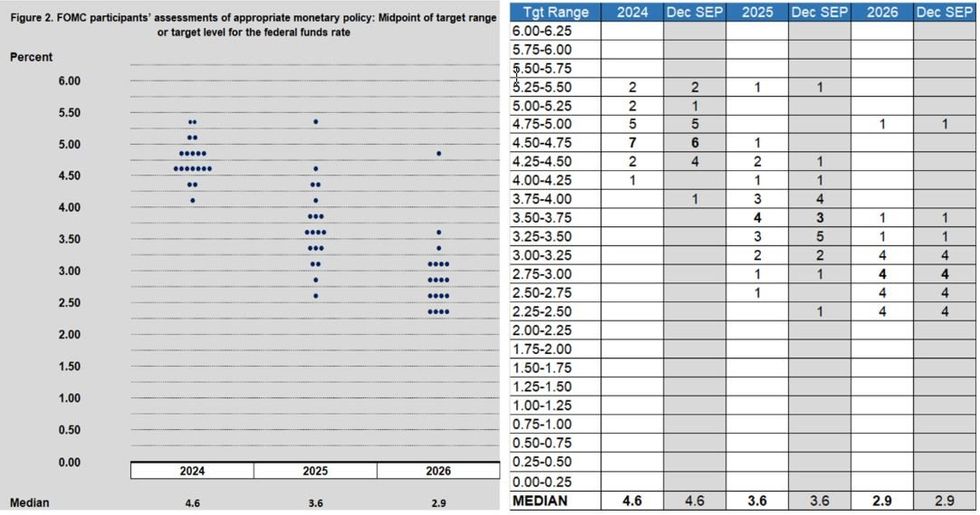

MNI Fed Preview - Mar 2024: Countdown To Confidence

EXECUTIVE SUMMARY:

- The FOMC will hold rates at the presumed peak of 5.25-5.50% at its March 19-20 meeting, while reiterating its cut-leaning forward guidance. Incoming data provides the FOMC with both the justification and the flexibility to be patient before making the first cut.

- It’s unlikely the signal provided by the Dot Plot / economic projections will be much different to the last edition in December, while the Statement will be little changed after January’s overhaul.

- It would only take two participants getting slightly more hawkish on 2024 rate prospects to move the median dot from 3 cuts to 2. While a close call, we think the median will stay unchanged, leaving focus on Chair Powell's Q&A and how recent above-expected inflation data squares with his stated requirement of "a little more" evidence before having the confidence to initiate rate cuts.

- The FOMC is also expected to discuss plans to slow the pace of quantitative tightening later this year, though we will probably have to wait for the meeting minutes for details on the Committee’s current thinking.

FOR THE FULL PUBLICATION PLEASE USE THE FOLLOWING LINK:

US DATA: Non-Oil Import Prices Add To Recent Inflationary Pressures

- The Terms of Trade saw a favorable surprise in February, with export prices beating expectations by rising 0.8% M/M (cons 0.4) after an upward revised 0.9% M/M in Jan, whilst import prices were in line at 0.3% M/M after 0.8% M/M.

- Within the import details, non-oil prices offered some surprise additional inflationary pressure, rising 0.2% M/M (cons -0.2) after the +0.65% in Jan.

- The non-oil import price data are noisy but it marks another month with prices no longer falling and follows yesterday’s upside surprise in core PPI measures. The latter helped see PPI ex food, energy & trade services accelerate to 3.6% annualized over the past six months for its highest in a year.

US DATA: U.Mich Sentiment Dips Slightly, Inflation Expectations Unchanged

- U.Mich consumer sentiment was slightly lower than expected in the preliminary March release at 76.5 (cons 77.1) after 76.9 in Feb. It’s a little further off the 79.0 in January that had marked the highest since Jul’21.

- “Sentiment remained almost 25% above November 2023 and is currently halfway between the historic low reached during the peak of inflation in June 2022 and pre-pandemic readings.”

- The decline relative to Feb was led by expectations (74.6 after 75.2) whilst current conditions were unchanged (79.4).

- “Consumer views have stabilized into a holding pattern […] many are withholding judgment about the trajectory of the economy, particularly in the long term, pending the results of this November’s election.”

- No significant change/surprises in inflation expectations:

- 1Y: 3.0 (cons 3.1) in Mar prelim after 3.0% in Feb

- 5-10Y: 2.9 (cons 2.9) in Mar prelim after 2.9% in Feb

US DATA: Production Trends Remain Mildly Contractionary

- Industrial production increased 0.1% M/M in Feb, a small beat for consensus despite utilities sliding -7.5% M/M although that in turn follows +7.4% in Jan.

- As such, manufacturing production increased a strong 0.8% M/M (cons 0.3) but it followed a heavily downward revised -1.1% (initial -0.5).

- 3m/3m annualized trends remain in modest contraction territory, at -2% for overall IP and -1% for manufacturing.

- Capacity utilization meanwhile came in a little lower than expected in Feb, unchanged from a downward revised 78.3% (cons 78.5).

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.