-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

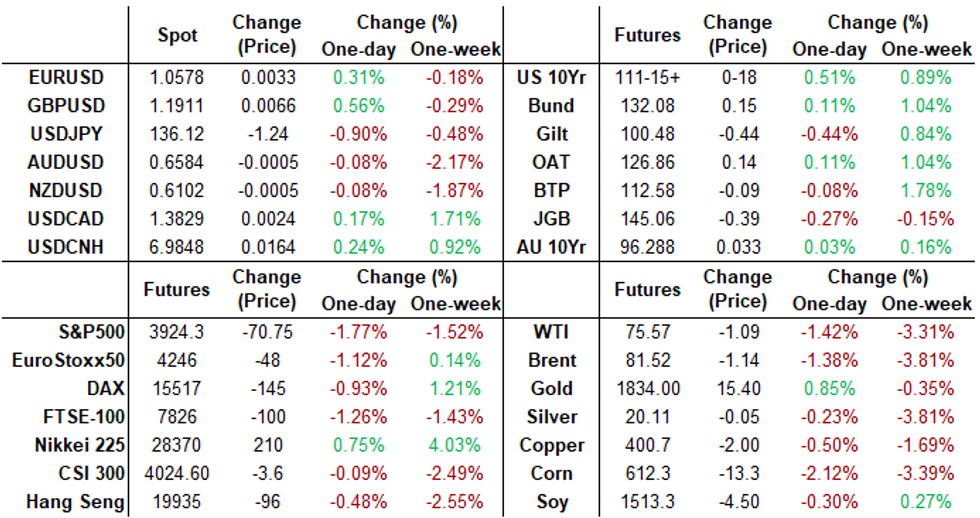

Free AccessMNI ASIA MARKETS ANALYSIS: Treasury Yield Retreats Ahead NFP

HIGHLIGHTS

- MNI ENERGY: Kazakhstan To Increase Gas Condensate Production At Karachaganak

- US: Biden Announces Challenge To GOP With "Fiscally Responsible" Budget

- US: Speaker McCarthy Attacks Tax Hikes In Biden's Budget

US TSYS Update: Yield Curves Remain Steeper, Fed Terminal Falls to 5.575%

- Treasury yield curves continue to climb steeper as short end rates match the post-30Y auction rally in the long end (despite the tail: 3.877% high yield vs. 3.870% WI).

- Treasury June'23 2Y futures: TUM3 +11.25 at 101-21.62 (2Y yield falls to 4.8784% after breaching 5.08% earlier in the week. 2s10s yield curve climbs over 11bp to -97.043 high vs. -110.917 inverted low yesterday (1981 low).

- Broad based buying/position unwinds noted ahead of Friday's key non-farm payrolls data (current mean estimate of +225k).

- Short-end metrics: Most notably Fed terminal rate has fallen to 5.54% in Sep-23-Oct'23 vs. 5.69% high overnight.

- Fed funds implied hikes recede with Mar'23 at 38.2bp (-4.5), May'23 cumulative 71.4bp (-4.7) to 5.290%, Jun'23 90.7bp (-4.5) to 5.483%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00300 to 4.56114% (+0.00157/wk)

- 1M +0.04629 to 4.80600% (+0.09686/wk)

- 3M +0.02900 to 5.15371% (+0.16971/wk)*/**

- 6M +0.02572 to 5.49986% (+0.18315/wk)

- 12M -0.01742 to 5.86329% (+0.16886/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.15371% on 3/9/23

- Daily Effective Fed Funds Rate: 4.57% volume: $107B

- Daily Overnight Bank Funding Rate: 4.56% volume: $290B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.096T

- Broad General Collateral Rate (BGCR): 4.51%, $466B

- Tri-Party General Collateral Rate (TGCR): 4.51%, $453B

- (rate, volume levels reflect prior session)

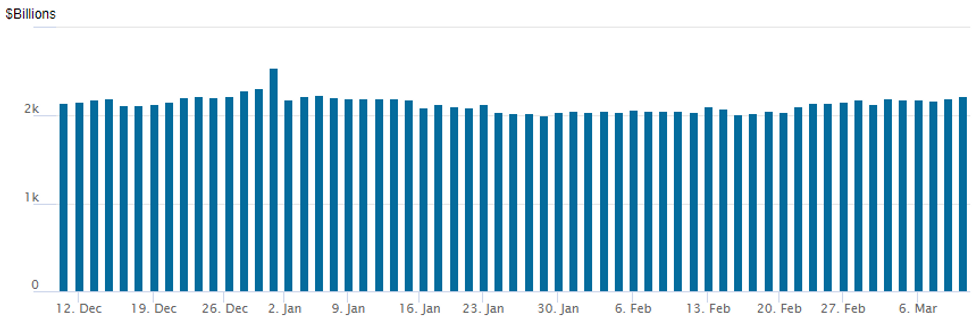

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,229.623B w/ 101 counterparties vs. prior session's $2,193.237B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Amid ongoing rate hike hedging via low delta puts Thursday, volume in upside call structure buying surged as underlying futures rebounded from week lows ahead of Friday's employment data. Tsy 2s10s curve surged over 10.60bp steeper to -97.855 as bonds trim gains into the close, while 2s continue to rise: TUM3 at 101-21.5 (+11.12) at the moment, 2Y yield falls to 4.8784% low (compares to over 5.08% earlier in week)

- SOFR Options:

- Block, 40,000 SFRJ3 94.31/94.18 put spds 0.0-0.25 over the SFRM3 94.56/94.62 put spd last few minutes, mostly .25 over ref 94.39

- 16,000 SFRZ3 97.50/97.87 call spds ref 94.55-94.545

- 5,000 SFRH4 93.75/94.87/96.00 iron flys ref 94.915

- Block/screen, over 33,000 SFRH3 94.93/95.00 call spds, 1.25

- Block, 8,500 2QM3 96.75/97.12/97.50 call flys, 5.0 ref 96.335

- Block, 4,000 OQM3 93.00/94.00 put spds, 2.5 ref 95.29

- Block, 11,000 SFRH3 94.87/95.00 put spds, 9.75

- 5,000 SFRK3 94.112/94.31 3x2 put spds ref 94.37

- Block, 15,000 3QJ3 96.00 puts, 4.5 ref 96.565

- 5,000 SFRJ3 94.62/94.75 call spds ref 94.37

- 5,000 SFRJ3 94.50/94.62 put spds ref 94.385

- Block/screen 6,000 SFRH3 94.75 puts, 1.0 ref 94.835

- Block, 5,000 SFRZ3 94.25/95.25 strangles 3.0 over SFRZ3 94.00/95.00 strangles

- 25,000 SFRN3 93.87/94.68 strangles vs. SFRN3 94.12/94.87 strangles

- Block, 13,500 SFRH3 94.87/95.00 put spds, 9.75 vs. 94.84/0.34%=

- Block, 5,000 SFRH3 95.06 calls, cab ref 94.835

- 5,000 SFRK3 94.12/94.31 3x2 put spds, ref 94.37

- Block, 15,000 3QJ3 96.00 puts, 4.5 ref 96.565

- Block, 40,000 SFRJ3 94.31/94.18 put spds 0.0-0.25 over the SFRM3 94.56/94.62 put spd last few minutes, mostly .25 over ref 94.39

- Treasury Options:

- over 26,000 TYK3 114.5 calls, 17 ref 111-18

- 2,600 TYJ3 110.75 puts at 41 vs. 3,900 FVJ3 106.25 puts 28.5

- 7,500 USJ 121/123 put spds, 26 ref 125-17

- over 15,000 TYJ3 107.5/109 put spds, ref 111-02.5

- 2,400 FVJ3 104.75/105.75 put spds, ref 106-13.75

- 3,000 TYM3 114/115/116 call flys ref 111-01

- -15,000 TYJ3 107.5/109 put spds, 8 ref 111-04 to -03

- 9,500 TYJ3 107.5/108.5/109.5 put flys, ref 110-24.5

EGBs-GILTS CASH CLOSE: Re-Steepening Ahead Of US Jobs Report

European curves partially reversed the sharp flattening of the prior two sessions on Thursday.

- After gapping lower on the open (with no discernable trigger - ECB's Villeroy reiterated his view that peak of inflation is likely to be seen in H1), US data was central to the EGB/Gilt rally.

- Weaker-than-expected US jobless claims figures providedsome relief ahead of Friday's closely-eyed jobs report.

- The German curve twist steepened, with the UK's bear steepening.

- Periphery EGB spreads tightened as risk assets rallied on the US jobless claims miss.

- MNI's Policy Team took a look ahead at the BoE's meeting in 2 weeks' time, eyeing a rate hold unless data surprises.

- Friday's European slate is highlighted by UK GDP and final German CPI. ECB's Panetta appears as well.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 5.9bps at 3.277%, 5-Yr is down 3.9bps at 2.794%, 10-Yr is down 0.3bps at 2.643%, and 30-Yr is up 4.6bps at 2.589%.

- UK: The 2-Yr yield is up 2bps at 3.811%, 5-Yr is up 1.8bps at 3.688%, 10-Yr is up 3.1bps at 3.796%, and 30-Yr is up 4.1bps at 4.122%.

- Italian BTP spread down 3.6bps at 174.6bps / Spanish down 1.5bps at 100.2bps

EGB Options: More Vol Plays In Rates Ahead Of US Payrolls

Thursday's Europe rates / bond options flow included:

- ERZ3 95.87^ sold at 70 in 4k

- ERN3 96.875 call bought for 1.5 in 3k (v 95.845)

- 0RM3 96.25/96.00ps sold at 10.5 down to 10 in 6k

FOREX: Rally In Short End Rates Having More Moderate USD Impact

- Despite US two-year yields falling as much as 16bps on Thursday following the release of softer US data, the impact on the US Dollar has been more measured, potentially offset by the weakness across equity markets. The USD index is currently showing declines of around 0.45% as we approach Friday’s APAC crossover, a move that only partially retraces the 1.5% rally from Tuesday’s open before Fed Chair Powell made his remarks.

- Understandably, given the sensitivity to yield differentials, the Japanese yen is the best performer in today’s session. USDJPY is once again attempting to breach the 136 handle, narrowing the gap with session lows at 135.95. Ahead of tomorrow’s US employment data, attention will be on initial firm support at 135.37, before the 20-day EMA that currently intersects at 135.04.

- With equities extending intra-day weakness in recent trade, antipodean currencies sit relatively softer in the G10 space, posting just moderate gains amid the broad greenback decline.

- Notably, the Chinese Yuan is also weaker on the day following the much lower-than-expected February CPI release (1.0% vs. Exp. 1.9%) overnight, reinforcing the importance of PBoC policy for H1.

- EURUSD price action has remained dull, with the pair eventually breaching yesterday’s narrow range to the topside in a slow grinding fashion. Market participants will have their attention on 1.0533, of which a sustained break would confirm a resumption of the downtrend and open 1.0484, the Jan 6 low and a key support.

- A packed docket on Friday with the BOJ decision kicking us off. Final German CPI and UK GDP highlight the European calendar before both US and Canada employment reports.

FX: Expiries for Mar10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E1.5bln), $1.0525-30(E1.4bln), $1.0550-65(E1.5bln), $1.0600-20(E1.2bln), $1.0660-65(E1.1bln), $1.0695-00(E616mln)

- USD/JPY: Y135.00($606mln), Y136.00($2.6bln)

- AUD/USD: $0.6750(A$746mln), $0.6800-20($1.0bln)

- AUD/NZD: N$1.0750(A$914mln)

- USD/CAD: C$1.3710($618mln)

- USD/CNY: Cny6.9500($573mln)

EQUITIES: Bank Shares Underperforming, S&P Through Technical Support

- While Treasury futures remain well bid on position unwinds ahead of Friday's headline employment data, stocks have not fared as well.

- Front-month e-mini S&P futures are extending session low around 3945.0 at the moment vs. midmorning high of 4018.00 appears to be tied to heavy selling in bank shares: Silicon Valley Investment Bank (SIVB) currently -54.28% to 122.61 after announcing stock sale plan of "$1.75 billion share sale to shore up its balance sheet and navigate declining deposits from startups struggling for funds amid increased spending," Reuters reported earlier.

- Other bank stocks underperforming: First Republic Banks (FRC) -14.89% to 97.78, SBNY -9.23% to 93.81.

- From a technical perspective, S&P emini futures are through initial support of 3971.5 (March 8 low) with second support at 3925.00/3901.75 (Low Mar 2 / Low Jan 19) that represent a bear trigger and a break would confirm a resumption of the bear leg that started Feb 2. For bulls, clearance of 4082.50, the Mar 6 high, is required to reinstate a bullish theme.

E-MINI S&P (H3): Bear Threat Remains Present

- RES 4: 4208.50 High Feb 2 and key resistance

- RES 3: 4141.59 61.8% retracement of the Feb 2 - Mar 2 bear leg

- RES 2: 4100.20 61.8% retracement of the Feb 2 - Mar 2 bear leg

- RES 1: 4082.50 High Mar 6

- PRICE: 3930.50 @ 1535ET Mar 9

- SUP 1: 3912.75 Low Mar 9

- SUP 2: 3901.75 Low Jan 19

- SUP 3: 3787.62 76.4% retracement of the Dec 22 - Feb 2 bull cycle

- SUP 4: 3819.00 Low Jan 6

The S&P E-Minis trend condition is bearish, despite today’s gains. Tuesday's move lower signals the end of the recent corrective bounce. An extension of weakness would pave the way for a move towards the next key support at 3925.00, Mar 2 low. This level is a bear trigger and a break would confirm a resumption of the bear leg that started Feb 2. For bulls, clearance of 4082.50, the Mar 6 high, is required to reinstate a bullish theme.

COMMODITIES: WTI Sees Key Short-Term Support Opened As Risk Sours Pre-Payrolls

- Crude oil prices have seen a sharp reversal of earlier gains as risk sentiment sours with equities sliding and Treasuries firmly bid ahead of tomorrow’s payrolls report.

- WTI is -1.25% at $75.70, pushing through support at $75.83 (Mar 3 low) to open key short-term support at $73.80 (Feb 22 low).

- Most active strikes in the CLJ3 through the day to date are currently $72/bbl and $70/bbl puts.

- Brent is -1.25% at $81.62, through $82.06 (Mar 8 low) to open $80.25 (Feb 23 low).

- Gold is +1.0% at $1831.44 as yields tumble and the dollar depreciates although holds onto more than half of Tuesday’s surge higher on Powell. Despite the solid increase, it remains off key short-term resistance at $1858.3 (Mar 6 high).

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/03/2023 | 0700/0700 | ** |  | UK | UK Monthly GDP |

| 10/03/2023 | 0700/0700 | ** |  | UK | Index of Services |

| 10/03/2023 | 0700/0700 | *** |  | UK | Index of Production |

| 10/03/2023 | 0700/0700 | ** |  | UK | Output in the Construction Industry |

| 10/03/2023 | 0700/0700 | ** |  | UK | Trade Balance |

| 10/03/2023 | 0700/0800 | * |  | NO | CPI Norway |

| 10/03/2023 | 0700/0800 | *** |  | DE | HICP (f) |

| 10/03/2023 | 0745/0845 | * |  | FR | Foreign Trade |

| 10/03/2023 | 0900/1000 | ** |  | IT | PPI |

| 10/03/2023 | 0900/1000 |  | EU | ECB Panetta Presentation on Digital Euro | |

| 10/03/2023 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 10/03/2023 | 1330/0830 | *** |  | US | Employment Report |

| 10/03/2023 | 1900/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.