-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Friday, December 13

MNI US OPEN - UK Economy Contracts for Second Straight Month

MNI ASIA MARKETS ANALYSIS: Tsy Ylds at 16Y Highs Ahead FOMC

- MNI US-CHINA: Biden Says US Infra Projects, "Not About Containing Any Country"

- TSY SEC YELLEN: `ABSOLUTELY NO REASON WHY WE SHOULD HAVE' GOVT SHUTDOWN, Bbg

- TSY SEC YELLEN: `WE'RE REALLY ON A GOOD PATH TOWARD A SOFT LANDING, Bbg

cropfilter_vintageloyaltyshopping_cartdelete

US TSYS Yields Mark 16 Year Highs Ahead Wed's FOMC Rate Announcement

- Treasury futures have quietly extended session lows after the bell, yields climbing to the highest levels since November 2007 (10YY 4.367%, 5Y 4.5205%). Generally subdued in the lead-up to Wednesday's FOMC policy annc with SEP/dot projections at 1400ET.

- Traders expect the Fed to keep rates on hold with a tightener bias ahead while the median of analysts’ expectations for the Fed’s September Dot Plot rates suggest that the central expectation is for no changes from June’s projections: 5.6% for 2023, 4.6% for 2024, 3.4% for 2025, with the new entry for 2026 at 2.6%, and the Longer-Run rate at 2.5%.

- Little react to this morning's data with a brief flurry of two way trade after higher than expected Building Permits (1.543M vs. 1.440M est, 1.443M prior/rev), MoM (6.9% vs -0.2% est) while Housing Starts comes out softer (1.283M vs. 1.439M), MoM (-11.3 vs. -0.9% est, 2.0% rev/prior).

- Rates recovered some ground in the first half as early Greenback weakness reversed, only to reverse course in the second half with TYZ3 trading just above technical support of 109-03 (bear trigger).

- Little change -- Tsy futures still hold weaker levels after $13B 20Y bond auction reopen (912810TU2) draws 4.592% high yield vs. 4.592% WI; 2.74x bid-to-cover vs. prior month's 2.56x.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00075 to 5.32409 (-0.00295/wk)

- 3M -0.00083 to 5.39702 (-0.00466/wk)

- 6M +0.00251 to 5.46857 (+0.00273/wk)

- 12M +0.01140 to 5.45434 (+0.03290/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $94B

- Daily Overnight Bank Funding Rate: 5.32% volume: $259B

- Secured Overnight Financing Rate (SOFR): 5.31%, $1.565T

- Broad General Collateral Rate (BGCR): 5.30%, $574B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $561B

- (rate, volume levels reflect prior session)

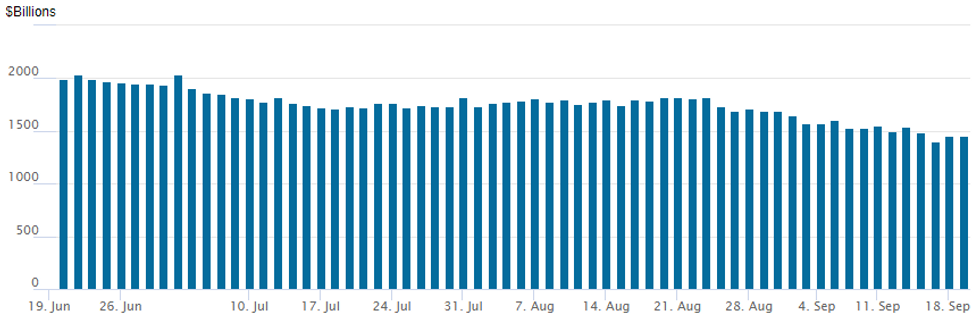

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

Repo operation inches up to: 1,453.324B w/96 counterparties, compared to $1,452.942B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

Early SOFR put structures hedging year end to early 2024 rate hike risk segued to better upside call structure buying Tuesday. Meanwhile, Treasury options saw a gradual pick-up in 10Y put buying as underlying futures held weaker in the second half in the lead-up to Wed's FOMC rate annc. Rate hike projections through year end were static: Sep 20 FOMC is 0.8% w/ implied rate change of +0.02bp to 5.333%. November cumulative of +7.4p at 5.405, December cumulative of 11.3bp at 5.443%. Fed terminal at 5.445% in Jan'24.

- SOFR Options:

- over +21,000 SFRM4 96.00/97.00 call spds, 7.5 ref 94.84 to -.83 *ongoing

- Block, 10,000 SFRZ4 98.00/98.25 call spds 2.0 vs. 95.475/0.05%

- Block, 16,000 SFRZ3 94.62/94.87/95.00 call flys, 2.5 ref 94.54

- Update, over +15,000 SFRH4 95.25/96.00 call spds, 8.5 vs. 96.125/0.35%

- +7,500 2QV3 96.25 calls, 8.5 vs. 96.125/0.35%

- 2,500 SFRH4 95.25/96.00 call spds ref 94.63

- 1,400 SFRU4 96.00/96.25/97.00/97.25 call condors, 1.5 ref 95.115

- -8,000 SFRH4 94.00/94.12/94.37 broken put flys, 4.0 net/wings over

- Block, 5,000 SFRV3 94.00/94.37 put spds, 0.5 ref 94.54

- 2,000 SFRV3 94.87 calls, 1.0 last

- Block/screen, 2,500 SFRM4 94.25/95.00 2x1 put spds, 26.5 ref 94.855

- 10,000 0QZ3 95.37/95.75 3x2 put spds ref 95.49 to -.495

- 1,000 SFRG4 93.87/94.25 2x1 put spds ref 94.64

- 9,200 2QZ3 95.75 puts, 10.0 ref 96.145

- Treasury Options:

- +7,000 TYX3 109 puts, 50 vs. 109-08/0.44%

- 2,000 TYX3 105.5/107.5 put spds 14 ref 109-11

- 2,300 TYZ3 111.5 calls, 29 ref 109-09.5

- over 8,000 TYV3 109 puts, 16 last ref 109-06

- over 9,500 weekly 10Y 110.75 puts, 136 ref 109-06

- 3,000 TYX3 110/111.5 call spds

- 3,200 TYV3 109.5 puts, 21 last

- 2,800 TYV3 110.5 calls, 3 last

EGBs-GILTS CASH CLOSE: German Yields Hit Fresh Multi-Month/Year Highs

Gilts outperformed Bunds Tuesday ahead of Wednesday's UK CPI data and the BoE decision Thursday.

- The UK curve leaned bull flatter through the 10Y tenor with Germany's marginally bear flattening.

- Despite little in the way of headline or data catalysts, German yields hit multi-month highs (2Y / 5Y since July, 10Y since March, 30Y since 2011), with weakness accelerating briefly after higher-than-expected Canadian inflation data in the European afternoon.

- ECB's Villeroy said the ECB will keep rates at 4% for as long as needed to achieve its inflation goals; ECB's Simkus told MNI that "barring any surprises, I don’t expect for us to need to think about another hike".

- Gilt yields in contrast closed near their session lows ahead of key flashpoints the next two days.

- Our Bank of England preview (PDF here) was published today: we discuss the data leading up to the expected 25bp rate hike decision Thursday, and the potential for changes to forward guidance.

- The key data of course is tomorrow morning's CPI report, for which the Services component will be key - MNI's UK inflation preview PDF here.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 3bps at 3.285%, 5-Yr is up 3.5bps at 2.77%, 10-Yr is up 3bps at 2.738%, and 30-Yr is up 2.3bps at 2.867%.

- UK: The 2-Yr yield is down 3.9bps at 4.994%, 5-Yr is down 4bps at 4.535%, 10-Yr is down 5.1bps at 4.34%, and 30-Yr is down 1.7bps at 4.714%.

- Italian BTP spread down 2.5bps at 177.9bps / Greek down 5.6bps at 139bps

EGB Options: Limited Pre-BoE/Fed Trade Consists Mainly Of Call Structures

Tuesday's Europe rates / bond options flow included:

- RXX3 132/133/134c fly, bought for 8 in 2.5k

- SFIV3 94.40/94.50 call spread & SFIX3 94.40/50/80/90 call condor, sells both (4.25 for the call spread & 4.75 for the condor).

FOREX Early Greenback Weakness Reverses, Narrow Pre-FOMC Ranges

- Initial greenback weakness on Tuesday saw the USD index fall around 0.25% ahead of NY trade. However, firmer-than expected August Building Permits data in the US sparked a reversal back to unchanged levels, keeping G10 ranges very contained ahead of Wednesday’s FOMC decision and press conference.

- The strong details of the Canadian August CPI report means that CAD is near the top of the G10 FX leaderboard, with USDCAD having briefly breached support below 1.3394 to trade as low as 1.3381. The pair has had a solid bounce along with the broad greenback reversal, however, USDCAD does remain 0.3% lower on the session. In similar vein, the Norwegian Krone is the best performing currency after yesterday’s struggles and ahead of Thursday’s Norges Bank rate decision. The overall crude oil complex continues to be supported by indications of tightening supply and more optimistic views of demand.

- Ahead of the Fed decision tomorrow, it is worth noting that USDJPY has been edging higher as we approach the APAC crossover, to trade within 5 pips of last week’s high at 147.95. Higher US yields have been unable to spark any topside momentum, however, trend conditions remain firmly in bullish territory, with sights on 148.40 next, the Nov 4 2022 high.

- UK CPI headlines the docket on Wednesday morning ahead of the Bank of England decision on Thursday. Despite a very muted session for GBPUSD, the trend needle continues to point south and the pair is trading near recent lows. The focus is on 1.2369, the Jun 5 low, and 1.2308, the May 25 low and a key support.

Late Equity Roundup

- Stocks are gradually paring losses in late trade, paring risk ahead tomorrow's policy announcement from the FOMC. Currently, S&P E-Mini futures are down 15.5 points (-0.34%) at 4485.5, Nasdaq down 31.1 points (-0.2%) at 13679.48, DJIA down 166.44 points (-0.48%) at 34459.11.

- Laggers: Shift in early price action, Energy sector shares are now underperforming as crude prices reverse early gains/trade weaker (WTI at 90.30 -1.18 vs. 93.70 high in the first half): Marathon Petroleum -3.4%, Halliburton -3.05%, EOG Resources -2.95%.

- Broadline retailers continued to weigh on Consumer Discretionary: Amazon and Bath & Body Works both -2.0%, AutoZone -1.45%, THX -1.20%. Meanwhile, electrical equipment and construction shares weighed on Industrials: Deere & Co -3.0%, Eaton Corp -2.95%, Carrier Global -2.75%.

- Leaders: Communication Services, Health Care and Information Technology outperformed, the latter bouncing in the second half as hardware makers gained traction: Seagate +1.7%, Corning Inc +1%, Western Digital +0.96%. Communication Services shares buoyed by telecom and media shares: Take Two Interactive +2.6%, Fox +0.95%, Meta +0.82%.

E-MINI S&P TECHS: (Z3) Bear Leg Extends

- RES 4: 4673.50 High Aug 1

- RES 3: 4617.40 76.4% retracement of the Jul 27 - Aug 18 sell-off

- RES 2: 4566.00/4597.50 High Sep 15 / 1 and a near-term bull trigger

- RES 1: 4521.31 20-day EMA

- PRICE: 4485.00 @ 19:28 BST Sep 19

- SUP 1: 4462.25 Intraday low

- SUP 2: 4444.89 76.4% retracement of the Aug 18 - Sep 1 bull leg

- SUP 3: 4412.25 Low Aug 25

- SUP 4: 4397.75 Low Aug 18 and a bear trigger

A bear cycle in S&P E-minis remains in play and today’s break lower reinforces current conditions. The contract has breached support at 4483.25, the Sep 7 low. This confirms a resumption of the bear leg that started Sep 1. A continuation lower would expose 4397.75, the Aug 18 low. Initial key resistance has been defined at 4566.00, the Sep 15 high. Clearance of this level would instead reinstate a bullish theme exposing 4597.50, Sep 1 high.

COMMODITIES Crude and Gold Relinquish Earlier Gains As US Dollar Recovers

- Crude prices have relinquished their earlier gains on the day to trade back within yesterday’s range, under pressure from a rebound in the US dollar after earlier losses.

- There were earlier unconfirmed reports circulating social media of a headline suggesting that Biden was willing to release more oil from the SPR credited to WSJ that appears to be false.

- US crude imports are at an 11-month high according to Kpler as they arrived at 3.5mn bpd for the week beginning 11 September.

- WTI is -0.1% at $91.39 in a notable pullback from a high of $93.70 that took another step towards $94.66 (2.236 proj of Jun 28 – Jul 13 – Jul 17 price swing).

- Brent is near unchanged at $94.44 in a strong pullback from a high of $95.94 that moved closer to $96.95 (Nov 14, 2022 high).

- Gold is -0.1% at $1931.2, easing back as the USD index found some renewed strength in the second half of the session as Treasury yields continued to climb. It’s high of $1937.44 came close to resistance at $1939.0 (Sep 5 high).

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/09/2023 | 2301/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 20/09/2023 | 0115/0915 | *** |  | CN | Loan Prime Rate |

| 20/09/2023 | 0600/0800 | ** |  | DE | PPI |

| 20/09/2023 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 20/09/2023 | 0600/0700 | *** |  | UK | Producer Prices |

| 20/09/2023 | 0600/0800 | ** |  | SE | Unemployment |

| 20/09/2023 | 0700/0900 |  | EU | ECB's Panetta Speaks at Workshop | |

| 20/09/2023 | 0900/1100 | ** |  | EU | Construction Production |

| 20/09/2023 | 0900/1100 |  | EU | ECB's Schnabel Speaks at Event | |

| 20/09/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 20/09/2023 | 1230/1430 |  | EU | ECB's Elderson Speaks at Springtji Forum | |

| 20/09/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 20/09/2023 | 1730/1330 |  | CA | BOC minutes from last rate meeting | |

| 20/09/2023 | 1800/1400 | *** |  | US | FOMC Statement |

| 21/09/2023 | 2245/0045 |  | EU | ECB's Lane Speaks at NYU |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.