-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - RBA Holds, Communication Turns Slightly Dovish

MNI China Daily Summary: Tuesday, December 10

MNI ASIA MARKETS ANALYSIS: Tsy Ylds Bounce Ahead Fed Blackout

- MNI US: House Passes Defense Bill With Raft Of Conservative Amendments

- MNI US-CHINA: Blinken: US Prepared Will Work China On Challenges Affecting Relations

- MNI US-RUSSIA: Blinken Says Russia Is Weaponizing Food, Grain Deal Hangs In Balance

- CHICAGO FED GOOLSBEE: WEAKER INFLATION DATA SHOW FED IS MAKING PROGRESS .. `THERE IS A PATH' TO CURB INFLATION WITHOUT RECESSION, Bbg

Key Links: MNI INTERVIEW: Simple Rules Suggest Fed No Longer Behind Curve / MNI INTERVIEW: Fed’s Athreya-Real Rates Might Still Be Too Low / MNI INTERVIEW: ECB Rate Hikes, German Downturn Threat To CESEE / MNI EGB Issuance, Redemption and Cash Flow Matrix - W/C Jul 17 / MNI TV: Key Exclusive Highlights For Week 28

US TSYS Markets Roundup: Treasury Yields Bounce Ahead Fed Blackout

- Treasury futures drifting near session lows after a higher open Friday. Quiet second half trade after US rates mirrored moves in EGBs as Bunds and Gilts also reversed gains into the European close.

- Early volatility FI markets saw fast two-way trade after Import Prices fell 0.2% vs. -0.1 est, while Export Prices receded -0.9% vs. -0.1% est. Bonds lead a reversal to lower levels after initially trading higher.

- Treasury futures extend lows after preliminary July University of Michigan survey came out stronger than expected across the board: 1Y inflation surprisingly increased to 3.4% (cons 3.1) after 3.3%; 5-10Y inflation increased a tenth to 3.1% (3.0), back at the top end of the 2.9-3.1% range seen since Aug’21 and one tenth off a high since 2011; sentiment also increased to 72.6 (cons 65.6) from 64.4.

- Curves held mostly flatter, with the exception of 3M10Y +4.050 at -159.157 after flattening sharply Thu. Tsy 2s10s bear flattened over 6bp to -93.643, after climbing to -82.676 high in the prior session.

- Year end rate hike projections firmed up on the heavy short end selling, November cumulative of 32.3bp (vs. 27.2 low Thu) at 5.399%, December cumulative 26.3bp (vs. 19.9bp Thu) at 5.339%. Fed terminal holding at 5.395% in Nov'23.

- Reminder, the Federal Reserve enters policy blackout at midnight tonight, runs through July 27, the day after the next rate announcement.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00830 to 5.22994 (+.05293/wk)

- 3M +0.00193 to 5.30989 (+.01451/wk)

- 6M -0.01726 to 5.37554 (-.03946/wk)

- 12M -0.07252 to 5.25401 (-.20041/wk)

- Daily Effective Fed Funds Rate: 5.08% volume: $122B

- Daily Overnight Bank Funding Rate: 5.07% volume: $269B

- Secured Overnight Financing Rate (SOFR): 5.06%, $1.445T

- Broad General Collateral Rate (BGCR): 5.04%, $607B

- Tri-Party General Collateral Rate (TGCR): 5.04%, $591B

- (rate, volume levels reflect prior session)

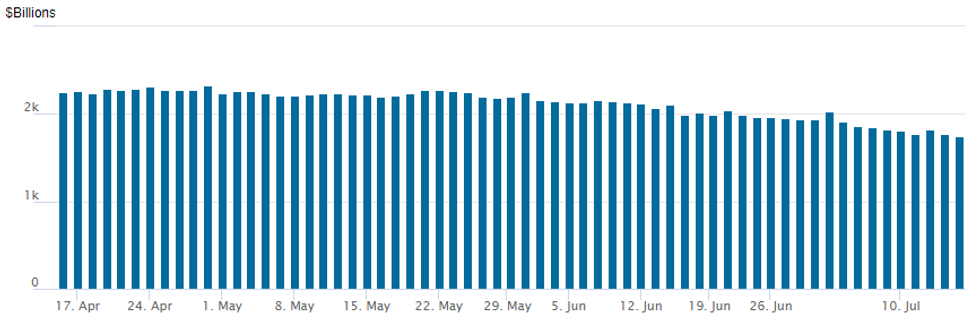

FED Reverse Repo Operation

NY Federal Reserve/MNI

The latest operation falls to $1,740.777B (lowest since early May'22), w/ 98 counterparties, compared to $1,767.432B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

Mixed option trade carried over from overnight, lighter volume as futures gave back a portion of Thu's rally. Rate hike projections through year end firm slightly but remain off mid-week highs. Fed funds currently pricing in 91.2% chance of a 25bp hike at the July 26 FOMC, while December cumulative running 26.5bp (31.7bp on Wed) at 5.341%. Traders alert for more Dec'23 upside call spd buying after paper +70k 9487/9500 call spds at 2.5 Thu.

- SOFR Options:

- 10,000 SFRZ3 96.00/97.00 call spds

- 2,300 SFRZ3 96.00/97.00 call spds vs. SFRH4 95.50/96.50 call spds

- --2,000 SFRV3 94.00/94.75/95.50 iron flys, 28.75

- Block, 5,000 SFRU3 94.87/95.00/95.12 put flys, .25

- 4,000 SFRZ3 94.12/94.25/94.37 put flys ref 94.715

- 5,750 SFRU3 94.62/94.68/94.75 call flys

- 7,000 SFRU3 94.68/95.00 call spds 2.5 ref 94.615

- 1,000 SFRZ3 94.00/94.12/94.25 put flys vs. 94.25/94.37/94.50 put flys

- +5,000 SFRZ3 94.87/95.00 call spds, 2.5 ref 94.72, ongoing, appr +100k/wk

- 1,000 SFRZ5 96.75/97.75/98.25/99.25 call condors ref 96.73

- 2,000 OQN3 96.00 calls ref 95.95

- 2,000 SFRU3 94.31/94.43/94.50/94.62 put condors ref 94.61

- 4,000 SFRZ3 95.00/95.25/95.50 call flys, 1.0 ref 94.71 to -.715

- 7,000 OQU3 97.00 calls, 3.5 ref 95.94

- 4,000 SFRH4 94.50 puts ref 95.065

- Treasury Options:

- 6,000 FVU3 107.25/107.5 put spds ref 107-22.75

- over 9,500 TYQ3 112 puts, 9 last

- 2,000 TYU3 111 puts, 28 ref 112-22.5

- 2,000 TYQ3 109 puts ref 112-20.5

- 2,500 FVU3 104 puts, 3.5

- over 14,500 FVU3 109 calls, 1.5 ref 107-25.75

- 3,100 TYQ3 115 calls ref 112-19.5

- 2,000 USU3 131 calls, ref 126-26

- 4,900 FVQ3 107 puts, 6 last

- 3,500 TYU3 115.5 calls ref 112-23.5

- 4,000 TYQ3 113.5/114 call spds

- over 7,800 TYU3 111.5 puts over TYU3 113/114.5 call spds ref 112-25.5

EGBs-GILTS CASH CLOSE: Rally Reverses, UK CPI Eyed Next Week

Gilts and Bunds sold off Friday as the US inflation data-induced rally of the prior two sessions partially reversed ahead of the weekend.

- Core FI yields opened sharply higher, in part on hawkish comments by Fed Gov Waller overnight, but began rallying anew, with Gilt yields moving to fresh lows for the week.

- The rally lost steam in the afternoon though, with the reversal accelerating toward the cash close after the University of Michigan survey showed unexpectedly strong US consumer confidence and an uptick in inflation expectations.

- The UK short end underperformed Germany's as BoE hike pricing rebounded, possibly with a focus on inflation data next week; further down the curve (5s-10s), German instruments underperformed.

- Greece underperformed on the periphery, with spreads widening on the week despite a broader risk rally. Moody's review of Spain is the highlight of the ratings schedule after hours Friday.

- Next week's main event is UK CPI on Wednesday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 5.8bps at 3.21%, 5-Yr is up 4.6bps at 2.611%, 10-Yr is up 2.7bps at 2.512%, and 30-Yr is up 0.4bps at 2.533%.

- UK: The 2-Yr yield is up 6.9bps at 5.206%, 5-Yr is up 2.1bps at 4.587%, 10-Yr is up 2.2bps at 4.444%, and 30-Yr is up 1.7bps at 4.556%.

- Italian BTP spread up 0.5bps at 165.9bps / Greek up 3.1bps at 145.2bps

EGB Options: Mostly Call Structures Bought To End The Week

Friday's Europe rates / bond options flow included:

- RXQ3 135.50/137.00 call spread 7K given at 4.

- ERH4 95.87/96.25/96.62 call fly paper paid 7.75 on 5K

- ERU3 96.12/25/37/50 call condor paper paid 2.25 on 2K

- 0RZ3 97.00/97.50/98.00 call fly paper paid 6 on 2K

FOREX USD Index Consolidates Impressive Weekly Decline Below 100.00

- The greenback halted the week’s significant selloff on Friday, with the USD index 0.15% higher on the Friday. However, the index has been consolidating below 100 having slipped 2.3% this week with the primary driver being the weaker-than-expected US inflation data on Wednesday.

- Most G10 currencies weakened against the USD on Friday, with the likes of CAD and AUD underperforming, posting declines of around 0.75%. The greenback was underpinned by some firmer data from the University of Michigan. As well as stronger sentiment figures, inflation expectations also edged higher. However, the overall mood for risk will unlikely be affected given the survey period barely crossed over with this week's US CPI read - leaving markets with the assumption that the final sentiment reading will be revised lower.

- This appears the case in EURUSD, which has notably risen again on Friday, albeit a meagre 0.08%. Nonetheless, the pair continues to extend the move above 1.1095, the Apr 26 high and key resistance. The break has confirmed a resumption of the medium-term uptrend and the focus is on 1.1274 next, a retracement point.

- Conversely, lower core yields have weighed on the Japanese Yen on Friday, with USDJPY half a percent higher on the session, having staged a solid 150-pip bounce from the overnight lows of 137.25. However, the moderate improvement pales in comparison to the impressive six big figure sell-off from the post NFP highs last Friday.

- Monday sees GDP and activity data out of China which will likely set the early mood for global markets. Inflation data from Canada, New Zealand and the UK will highlight next week’s docket as well retail sales figures from the US.

FX Expiries for Jul17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1050(E1.9bln), $1.1500(E539mln)

- USD/JPY: Y137.00($604mln), Y140.00($680mln)

- USD/CNY: Cny7.2000($1.8bln)

LATE EQUITIES Roundup: Paring Early Gains, Health Care Sector Outperforms

- Stocks are trading mildly mixed into the FI close, Dow components outperforming at the moment while SPX eminis trades mildly weaker after climbing to the highest levels since mid-April 2022 Friday morning. S&P E-Mini Future are down 2.25 points (-0.05%) at 4540.75, DJIA up 135.45 points (0.39%) at 34529.73, Nasdaq down 19.8 points (-0.1%) at 14115.99.

- BlackRock, JP Morgan, Wells Fargo, State Street and Citigroup all beat estimates this morning. Financial sector shares lagged gains in Health Care after UnitedHealth Grp also beat estimates this morning (2Q adj $6.14 vs. $5.95 est), UNH shares up 7.2% in late trade. Other health services share gains included Elevance Health +5.3%, Cigna +4.80% and Humana +2.7%.

- Laggers: Energy and Materials sectors underperformed, partly due to decline in crude (WTI -1.48 at 75.41) and Gold on the day (-2.19 at 1958.32). APA -4.7%, Marathon and Devon Energy -4.15%; Miners: Nucor -1.8, Freeport McMoRan -2.1%.

- Look ahead: Banks announcing next week: Bank of New York Mellon, Bank of America, Charles Schwab, Morgan Stanley, Citizens Financial, M&T Bank, Northern Trust, US Bancorp, Goldman Sachs, Discover Financial, Fifth Third Bancorp, KeyCorp, Truist Financial, Capital One, Comerica, Huntington Bancshares and American Express.

E-MINI S&P TECHS: (U3) Bulls Remain In The Driver’s Seat

- RES 4: 4584.42 Bull channel top drawn from the Mar 13 low

- RES 3: 4576.62 2.50 projection of the May 4 - 19 - 24 price swing

- RES 2: 4556.71 2.382 projection of the May 4 - 19 - 24 price swing

- RES 1: 4551.50 High Jul 13

- PRICE: 4549.25 @ 14:11 BST Jul 14

- SUP 1: 4439.81/4368.50 20-day EMA / Low Jun 26 and a key support

- SUP 2: 4351.02 50-day EMA

- SUP 3: 4337.83 Bull channel base drawn from the Mar 13 low

- SUP 4: 4269.50 Low Jun 2

A bull theme in S&P E-minis remains intact. This week’s rally has resulted in a break of resistance at 4498.00, the Jun 30 high. The break confirms a resumption of the uptrend and maintains a bullish price sequence of higher highs and higher lows. The contract has also traded through 4500.00 and this opens 4556.71, a Fibonacci projection. First support lies at 4439.81, the 20-day EMA. Clearance of this level would highlight a S/T bearish threat.

COMMODITIES Higher Yields Slash Latest Supply-Driven Oil Rise, Gold Consolidates Push Higher

- Crude oil is closing the week on a soft note with an almost -2% decline but still holding 2%+ higher on the week from gains earlier in the week with a theme being tighter supply.

- Front month Brent crude pulled back to a low of $79.64/bbl after a notably stronger than expected US consumer survey sparked higher Treasury yields. Crude had earlier been consolidating yesterday’s supply disruptions in Libya and Nigeria supporting prices.

- A total of 530kbbls of open August 23 options positions on CME and ICE are due to expire against the July future close on Monday. Current aggregate open interest is 279k calls and 251k puts. The open interest across all WTI options on both exchanges is currently 1.69m calls and 1.13m puts. Most of the significant options positions around the current market prices are on the calls side with the biggest strikes of interest just below the current price at 76$/bbl and 75$/bbl.

- WTI is -1.7% at $75.56 off a low of $75.11. Support is seen at $72.31 (20-day EMA) and resisatance at $78.03 (76.4% retrace of Apr12-May4 bear leg).

- Brent is -1.7% at $80.04 off the aforementioned low of $79.64. Support is seen at $76.98 (20-day EMA), resistance at $82.06 (76.4% retrace of Apr12-May4 bear leg).

- Gold is near unchanged at $1960.15 on a milder day for the USD having surged earlier in the week on the USD weakness after the soft CPI report. It continues to sit close to resistance at $1968.0 (Jun 16 higher) after which sits a key $1985.3 (May 24 high).

- Shown below, EU nat gas has had a torrid week and falls to the lowest since Jun 7 amid recovering supplies from Norway, healthy storage levels and a sluggish recovery in European industrial gas demand.

- Weekly moves: WTI +2.2%, Brent +1.9%, Gold +1.8%, US nat gas -2%, EU nat gas -22.5%

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/07/2023 | - |  | EU | ECB Panetta at G20 Finance/Central Bank meeting | |

| 17/07/2023 | 0200/1000 | *** |  | CN | Retail Sales |

| 17/07/2023 | 0200/1000 | *** |  | CN | Industrial Output |

| 17/07/2023 | 0200/1000 | ** |  | CN | Surveyed Unemployment Rate M/M |

| 17/07/2023 | 0200/1000 | *** |  | CN | GDP |

| 17/07/2023 | 0200/1000 | *** |  | CN | Fixed-Asset Investment |

| 17/07/2023 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 17/07/2023 | 0815/1015 |  | EU | ECB Lagarde speaks at ECB CESEE conference | |

| 17/07/2023 | 0830/1030 |  | EU | ECB Lane chairs session at ECB CESEE conference | |

| 17/07/2023 | - |  | EU | ECB Panetta at G20 Finance/Central Bank meeting | |

| 17/07/2023 | 1215/1415 |  | EU | ECB Elderson chairs session at ECB CESEE conference | |

| 17/07/2023 | 1230/0830 | * |  | CA | International Canadian Transaction in Securities |

| 17/07/2023 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 17/07/2023 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 17/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 17/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.