-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Tsy Ylds Gain, New Home Sales Dip

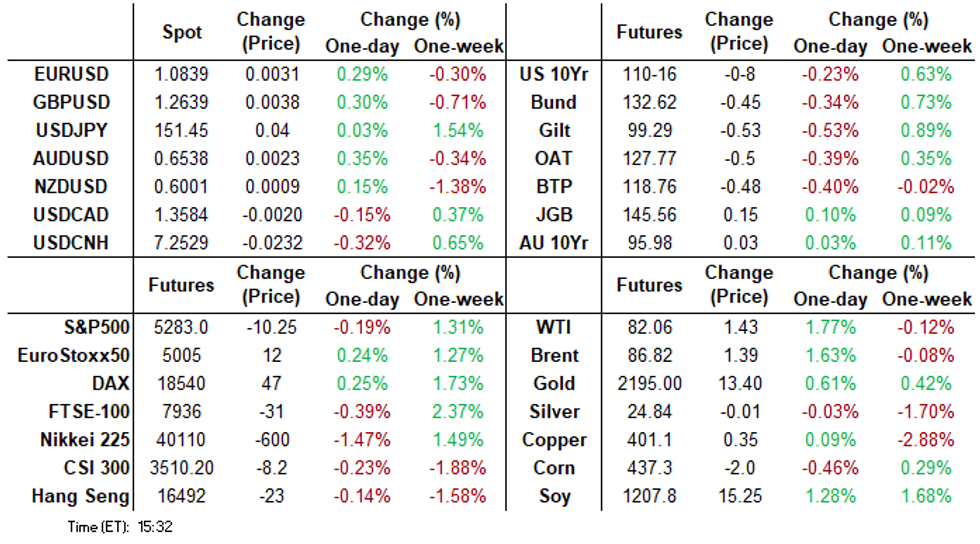

- Treasuries scaled back from early overnight highs to holding a moderately weaker range late Monday.

- Treasury curves bear steepened while projected rate cut pricing moderated from Friday highs.

- Stocks traded mildly weaker while geopolitical tensions buoyed crude prices on the week opener.

Tsy Yields Rebound, Little React to Data, Fed Speak

- Treasuries scaled back from early overnight highs, holding a moderately weaker range late Monday. Little react to this morning's lower than expected New Home Sales at 662k vs. 675k est (prior up-revised to 664k from 661k), MoM -0.3% vs. 2.1% est (prior up-revised to 1.7% from 1.5%).

- Federal Reserve Governor Lisa Cook said Monday officials must cautiously balance the risk of easing monetary policy too much or too soon, allowing inflation to linger above target, and taking too long to ease, which could harm the economy needlessly and deprive people of economic opportunities.

- Futures remain mildly weaker, near low end of narrow session range: TYM4 -7.5 at 110-16.5 vs. 110-15 low, w/ technical support well below at 109-24+ (Low Mar 18 and the bear trigger). Curves steeper: 2s10s +1.501 at -37.818.

- The Tsy $66B 2Y note auction (91282CKH3) drew 4.595% high yield vs. 4.592% WI; 2.62x bid-to-cover vs. 2.49x prior. Despite the small tail, futures drew modest short cover support on stronger peripheral support: Indirect take-up at 65.76% vs. 65.16% prior, directs took 20.88% vs. 20.11% last month, primary dealer take-up 13.36% vs. 14.73% prior.

- Projected rate cut pricing continued to cool: May 2024 at -12.9% vs. -14.5% this morning w/ cumulative -3.2bp at 5.296%; June 2024 -65.8% vs. -66.7% w/ cumulative rate cut -19.7bp at 5.132%. July'24 cumulative at -30.6bp vs. -32.0bp.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00346 to 5.33217 (-0.00004 total last wk)

- 3M -0.00493 to 5.30755 (-0.02000 total last wk)

- 6M -0.00740 to 5.22160 (-0.04614 total last wk)

- 12M -0.01086 to 4.99292 (-0.07481 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.796T

- Broad General Collateral Rate (BGCR): 5.31% (+0.01), volume: $679B

- Tri-Party General Collateral Rate (TGCR): 5.31% (+0.01), volume: $670B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $91B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $249B

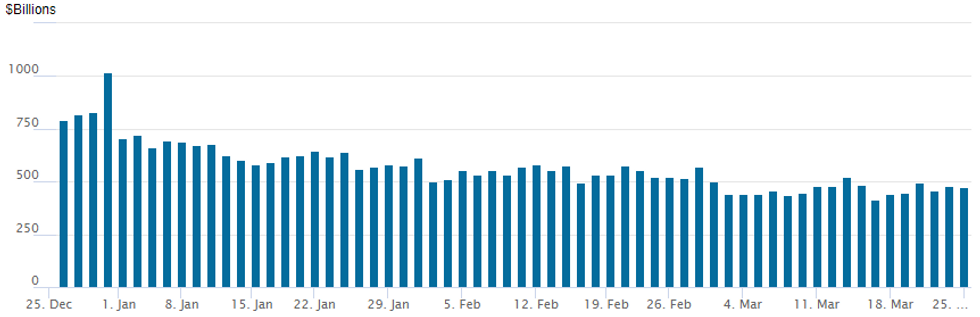

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage slips to $473.787B from $478.531B on Friday. Compares to Friday, March 15 when usage fell to $413.877B - the lowest level since May 2021.

- Meanwhile, the latest number of counterparties steady at 74 (compares to 65 on January 16, the lowest since July 7, 2021)

SOFR/TEASURY OPTION SUMMARY

SOFR and Treasury options favored low delta call structures after mixed trade on light overnight volumes, overall NY session volumes rather light on the shortened Easter Holiday week. Underlying futures moderately weaker on the day, projected rate cut pricing continued to cool: May 2024 at -12.9% vs. -14.5% this morning w/ cumulative -3.2bp at 5.296%; June 2024 -65.8% vs. -66.7% w/ cumulative rate cut -19.7bp at 5.132%. July'24 cumulative at -30.6bp vs. -32.0bp.

- SOFR Options:

- +4,000 SFRH5 99.00 calls, 2.0 ref 95.75

- +5,000 SFRH5 97.00/98.00 call spds 6.0 over 1,000 SFRH5 96.00 calls ref 95.76

- +4,000 SFRN4 94.75/95.00 put spds vs. 2QN4 96.00/96.25 put spds, 3.75 net, 2QN4 over

- +2,000 SHRH5 94.62/95.12 1x2 call spds, 1.5

- +2,000 SFRM4 94.87/95.37 call spds, 7.0 vs. 94.90/0.50%

- -4,000 SFRM4 94.87/95.75 call spds, 7.25-7.0

- 4,600 SFRM4 94.75/94.81/94.87 put flys ref 94.905

- 2,000 SFRQ4 94.93/95.12/95.18/95.37 call condors ref 95.21

- Treasury Options:

- 10,700 TYK4 116 calls, 2 ref 110-16

- 1,000 TYK4 110/111/111.5 1x3x2 broken call flys, 26

- 2,400 TYK4 108.5/110.75 put spds vs. 113.75 calls ref 110-22

- 6,000 FVK4 105 puts vs. 3,000 FVK4 108 calls ref 107-02.75

- 5,700 Wed wk4 weekly 10Y 111.75 calls ref 110-24.5 (exp 3/27)

EGBs-GILTS CASH CLOSE: Rate Cut Pricing Pared With EZ Inflation Ahead

Bunds and Gilts broke a 5-day streak of gains Monday, ahead of Eurozone inflation data later in the week.

- The pullback in core FI was fairly steady through a quiet session, with a moderate spike in oil prices in the afternoon continuing to apply pressure into the final hours of the cash session.

- An appearance by BoE's Mann - who voted for a pause with the MPC consensus last week, vs a hawkish dissent prior - brought little market reaction, with 2024 BoE cut pricing ending the session around 76bp (around 6bp less than Friday's close).

- With ECB end-2024 rate pricing also pared (around 3bp less, to 89bp), the German and UK curves bear flattened on the day amid short-end weakness.

- Periphery spreads erased earlier modest widening to finish flat/tighter to Bunds.

- Data was decidedly second-tier, with Finnish and Spanish PPI showing further disinflationary impulses ahead of flash March Eurozone CPI readings later in the week (Spain Wednesday).

- That data will be the holiday-shortened week's focus: MNI's preview will be published Tuesday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 5.8bps at 2.885%, 5-Yr is up 5.6bps at 2.389%, 10-Yr is up 4.9bps at 2.372%, and 30-Yr is up 3.2bps at 2.526%.

- UK: The 2-Yr yield is up 6.2bps at 4.184%, 5-Yr is up 5.7bps at 3.872%, 10-Yr is up 6bps at 3.988%, and 30-Yr is up 3.8bps at 4.484%.

- Italian BTP spread up 0.3bps at 132.2bps / Portuguese PGB spread down 0.7bps at 66.6bps

EGB Options: Mixed Rate Trade Monday

Monday's Europe rates/bond options flow included:

- SFIK4 95.20/95.10/95.05p ladder, bought for 1.25 and 1.5 in 7k

- SFIK4 95.10/95.25/95.30/95.45c condor bought for 3 in 4k

- SFIM4 95.20/95.30cs vs 94.90/94.80ps, bought the cs for 0.75 in 1.5k

- SFIU4 95.20/95.00/94.85/94.45p condor trades for 4.5 in 2k

- 0RH5 98.00/98.50 call spread vs 96.87 puts paper paid -0.5 (+call spread/-puts)on 5K

FOREX USD Index Loses Moderate Ground, AUD Outperforms

- Currency markets overall have been generally rangebound and trading on light volumes Monday, with CHF marginally the poorest performer and AUD & GBP the strongest. Equities have consolidated a very minor pop off the lows, and the USD index has been consolidating losses of around 0.2% on the session. While the index is softer (against the grain of higher US yields), it remains well within range of the recovery high, and while above 103.99, the short-term outlook remains bullish.

- EURUSD trades a quarter of a percent firmer despite retaining the S/T bearish outlook for the pair. A reversal lower from here would concentrate markets back on 1.0796 first, the Feb29 low and open the bear trigger further out at 1.0695.

- AUDUSD is firmer off last week's pullback low, and tech traders will be watching for the imminent formation of a death cross in the pair (50-dma < 200-dma) - the first since April last year, which should indicate short-term momentum in the pair is pointed lower. Notably, the AUD net short position continues to swell - putting AUD net positioning at a % of open interest at the largest short on CFTC records stretching back to the early 90s.

- However, AUD outperforms to start the week and alongside the Swiss Franc weakness, we highlight the bullish potential for AUDCHF here: https://roar-assets-auto.rbl.ms/files/60505/FX%20Market%20Analysis%20-%20AUDCHF.pdf

- Fed's Bostic, Goolsbee and Cook made appearances but did little to move the needle at the beginning of a shortened holiday week, largely echoing sentiment from Chair Powell’s post-meeting press conference last week.

- Second-tier data from the US on Tuesday, with durable goods and consumer confidence scheduled. Perhaps more market attention will be on emerging markets with a rate decision in Hungary tomorrow, before South Africa on Wednesday.

FX Expiries for Mar26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0785-00(E2.0bln), $1.0860-70(E4.1bln), $1.0925-35(E2.9bln)

- USD/JPY: Y151.00($529mln), Y151.25($632mln)

- GBP/USD: $1.2685-00(Gbp983mln)

- AUD/USD: $0.6500(A$726mln), $0.6545-60(A$3.2bln)

- AUD/NZD: N$1.0825(A$639mln)

- NZD/USD: $0.6170(N$695mln)

Late Equities Roundup: Oil & Gas Shares Bid With Crude

- Stocks are continue to scale back from first half lows, trading mixed late in the session with the DJIA underperforming. Currently, DJIA is down 140.36 points (-0.36%) at 39335.05, S&P E-Minis down 6 points (-0.11%) at 5287, Nasdaq up 9.3 points (0.1%) at 16437.87.

- Leading Gainers: Energy and Utilities continued to outperform in late trade, oil ang gas shares leading as geopolitical tensions drove oil priced higher (WTI +1.35 at 81.98): APA +2.7%, ConocoPhillips +2.64%, Marathon oils +1.94%. Independent power suppliers buoyed Utilities: Constellation Energy +5.53%, Next Era Energy +0.97%, NRG Energy +0.76%.

- Laggers: Industrials and Communication Services sectors underperformed in the second half, transportation and professional services shares weighed on Industrials: United Airlines -3.88%, Dayforce Inc -3.78%, Norfolk Southern -2.38%. Iinteractive media and entertainment shares weighed on Communication Services: Take-Two Interactive Software -4.61% after rumors over delay of gaming software made the rounds, Interpublic Group -1.47%, Meta -0.98% and Google -0.87%.

E-MINI S&P TECHS: (M4) Trend Needle Points North

- RES 4: 5428.25 1.00 proj of the Oct 27 - Dec 28 - May 1 price swing

- RES 3: 5400.00 Round number resistance

- RES 2: 5379.92 Bull channel top drawn from the Jan 17 low

- RES 1: 5322.75 High Mar 21

- PRICE: 5287.00 @ 1500 ET Mar 26

- SUP 1: 5227.40 Bull channel base drawn from the Jan 17 low

- SUP 2: 5206.16 20-day EMA

- SUP 3: 5157.00 Low Mar 11

- SUP 4: 5091.02 50-day EMA

The trend condition in S&P E-Minis remains bullish and last week’s extension reinforces this theme. The break of 5257.25, Mar 8 high, confirmed a resumption of the uptrend. Note that moving average studies remain in a bull-mode position reflecting positive market sentiment. Sights are on 5389.02, the top of a bull channel drawn from the Jan 17 low. Initial firm support is 5206.16, the 20-day EMA. A move lower is considered corrective.

COMMODITIES Oil End of Day Summary: Crude Holds Onto Gains

Front month WTI crude is trading higher but has slightly pulled back from an intra-day high of $82.48/bbl earlier in the session. Crude markets were supported today by increased chances that the US will reinstate sanctions on Venezuela, little hope for a ceasefire in Israel in the short term and Russia ordering oil companies to reduce oil output in Q2. Earlier upside was driven by a lower USD spot index and Ukrainian attacks on Russian energy infrastructure.

- Brent MAY 24 up 1.5% at 86.68$/bbl

- WTI MAY 24 up 1.6% at 81.91$/bbl

- Bloomberg reporting that Venezuela opposition figure, Corina Yoris, has been prevented from registering as an opposition candidate to challenge Venezuelan President Nicholas Maduro in the July 28 presidential elections.

- Russian oil companies have been ordered to reduce output in Q2 to ensure they meet a production target of 9 mn bpd by the end of June in line with its pledges to OPEC+ according to three Reuters sources on Monday.

- Ukrainian drones attacked two oil refineries in Russia’s Samara Region on Saturday morning according to Governor Dmitry Azarov.

- Israel’s PM Cancels Delegation's DC Visit After US Abstains On UN Gaza Resolution: The UN Security Council has adopted a resolution calling for an 'immediate' ceasefire in Gaza during the holy month of Ramadan, with 14 votes in favour and an abstention from the United States.

- Brent prices could test $90/bbl over the next weeks, Citigroup said in a note, cited by OPIS.

- Ineos restarted the 110kbpd CDU at the Grangemouth refinery on 24 March after shutting on 16 February according to WoodMac.

- BP restarted the 83kbpd VDU at the Rotterdam refinery on 23 March, after shutting on 1 March, ahead of planned works scheduled for early April according to WoodMac.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/03/2024 | 0700/0800 | * |  | DE | GFK Consumer Climate |

| 26/03/2024 | 0700/0800 | ** |  | SE | PPI |

| 26/03/2024 | 0800/0900 | *** |  | ES | GDP (f) |

| 26/03/2024 | 0800/0900 | ** |  | SE | Economic Tendency Indicator |

| 26/03/2024 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 26/03/2024 | 1200/0800 |  | CA | BOC Sr Deputy Rogers speaks in Halifax NS | |

| 26/03/2024 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 26/03/2024 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 26/03/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 26/03/2024 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 26/03/2024 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 26/03/2024 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 26/03/2024 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 26/03/2024 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 26/03/2024 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 26/03/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 26/03/2024 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 26/03/2024 | 1900/2000 |  | EU | ECB Lane Lecture At Trinity College Dublin |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.