-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Tsy Ylds Reverse Despite Weaker Data

- MNI US: Trump Has Largest Lead Over Biden In Hypothetical 2024 Matchup Since Dec

- MNI BRAZIL: Bolsonaro Barred From Political Office For 8 Years (Subject To Appeal)

- MNI US-CHINA: China To Restrict Gallium And Geranium Exports

- Italy’s Factories Just Had Worst Month Since Height of Pandemic, Bbg

cropfilter_vintageloyaltyshopping_cartdelete

US TSYS: Rates Back Near Lows Despite Weaker ISMs

- Treasury futures finishing the shortened pre-holiday session at/near lows, accounts scaling back support despite early session data showed disinflationary signs.

- Treasury futures extend highs slightly after S&P Global US Manufacturing PMI comes out as expected at 46.3, not a large reaction.

- Treasury futures extended highs after June ISM Manufacturing falls to 46.0 vs. 46.9 est (47.2 prior) the lowest since May 2020. Prices paid at 41.8 lower than exp 44.2, ISM Employment at 48.1 lower than expected 51.4. Meanwhile, Construction Spending MoM lower than expected at +0.9% vs. 1.2% est.

- Front month 10Y futures marked 112-17.5 high (+9) before falling back to111-29.5 after the early close. Initial technical resistance at 112-21 Jun 22 low, 113-18 June 15 High key resistance.

- Later in the week, FOMC minutes for the June meeting are released at 1400ET Wednesday, while the latest employment data is released this Friday at 0830ET, current mean est at 225k vs. 339k prior.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00162 to 5.14240 (+.05711 total last wk)

- 3M +0.00038 to 5.26874 (+.02966 total last wk)

- 6M -0.00977 to 5.38087 (+.06156 total last wk)

- 12M -0.02528 to 5.37154 (+.11322 total last wk)

- Daily Effective Fed Funds Rate: 5.08% volume: $97B

- Daily Overnight Bank Funding Rate: 5.07% volume: $181B

- Secured Overnight Financing Rate (SOFR): 5.09%, $1.549T

- Broad General Collateral Rate (BGCR): 5.05%, $556B

- Tri-Party General Collateral Rate (TGCR): 5.05%, $548B

- (rate, volume levels reflect prior session)

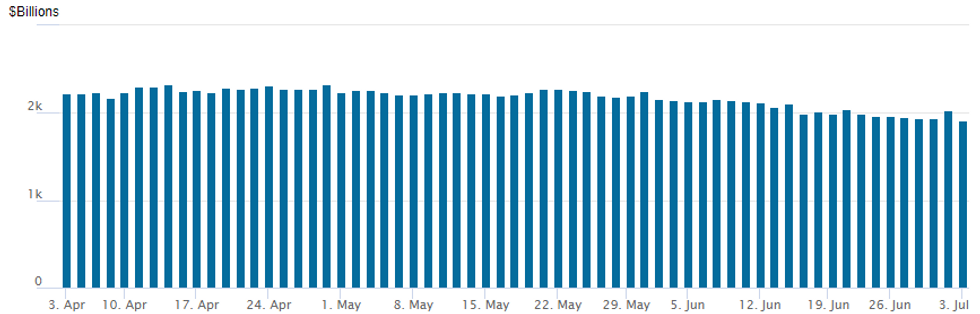

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes back to to $1,909.639B w/ 101 counterparties, compared to $2,034.319B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

- Light volumes on mixed trade continued through the NY session, many desks short staffed ahead today's "early" close and 4th of July Independence Day holiday. Underlying futures weaker, back near early lows, 10Y yield at 3.8624% vs. 3.8643% high. Salient trade:

- SOFR Options:

- Block, another 5,000 SFRM4 96.00/96.50/97.00 call flys, 2.5

- 5,000 SFRU3 98.75/99.75 put spds ref 94.60

- 4,000 SFRU3 98.25/99.75 put spds

- Block, 6,000 SFRM4 96.00/96.50/97.00 call flys, 2.5 ref 95.19

- +2,500 SFRU3 95.75 calls, 3.5 vs 94.60/0.08%

- Blocks, total 5,000 SFRZ3 93.75/94.25 put spds, 6.5 vs. SFRZ4 94.00/94.50 put spds 9.0

- 4,100 SFRH4 98.00/98.50 call spds ref 94.82 to -.825

- 1,200 OQZ3 95.50 puts, ref 95.895

- 1,500 OQQ3 96.00/96.50 call spds, ref 95.535

- 1,500 SFRN3 94.87 calls ref 94.585

- 2,100 SFRN3 94.75/94.87 1x2 call spds ref 95.585

- Treasury Options:

- 5,000 USQ3 124 puts, 22 ref 126-21

- Block, 15,000 TYU3 118 calls, 6 vs. 112-07/0.05%

- +12,000 TYU3 117 calls, 8 ref 112-01

- over 10,000 FVQ3 108.5 calls, 7 ref 107-03 to -02.25

- 7,500 FVU3 109.75 calls, 10.5 ref 107-01.25

- 1,800 TYU3 114/115 call spds, 11 ref 111-31

- 1,000 TYU3 108/110/112 put flys ref 111-30.5

- 1,000 USQ3 128/129/131/132 call condors, ref 126-24

- 1,500 TYQ3 113.5 calls, 15 ref 112-00

EGBs-GILTS CASH CLOSE: Bear Flattening Defies Manufacturing Weakness

The UK and German curves bear flattened Monday, shrugging off mostly soft Eurozone PMI data in the morning (highlighted by Italian manufacturing's worst month since April 2020).

- There was little in macro or headline developments to trigger the morning bear flattening move, which came as BoE and ECB terminal hike pricing hit 2023 highs amid thinned liquidity ahead of US market holidays starting later today through Tuesday.

- European bear flattening pulled back in the afternoon on a soft US ISM Manufacturing reading, but resumed as we headed into the close. German 2s10s closed at a fresh post-1992 inverted low (-82.8bp).

- The UK short end slightly underperformed its German counterpart, with BoE nominee Greene warning against complacency against inflation-fighting.

- Periphery EGBs were mixed, with BTPs underperforming with some modest spread widening.

- Tuesday brings some German trade and Spanish unemployment data and appearances by ECB's Nagel (who spoke today, sounding typically hawkish on the rate outlook, so not a market mover) and Stournaras. Markets are closed for the US Independence Day holiday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 6.4bps at 3.26%, 5-Yr is up 6.7bps at 2.617%, 10-Yr is up 4.5bps at 2.437%, and 30-Yr is up 0.6bps at 2.395%.

- UK: The 2-Yr yield is up 6.9bps at 5.343%, 5-Yr is up 5.4bps at 4.717%, 10-Yr is up 5.2bps at 4.44%, and 30-Yr is up 2.2bps at 4.445%.

- Italian BTP spread up 1.7bps at 169.7bps / Greek down 1bps at 126.9bps

EGB Options: Several Sellers Of Rate Spreads To Start The Week

Monday's Europe rates / bond options included:

- RXQ3 136/136.50cs, bought for 6 in 4.15k

- ERU3 96.75c, sold at 1.75 in 5k

- ERZ3 95.87/96.00/96.12c fly, bought for 1.75 in 4k

- ERH4 98.50/99.00cs, sold at 1 in 10k

FOREX

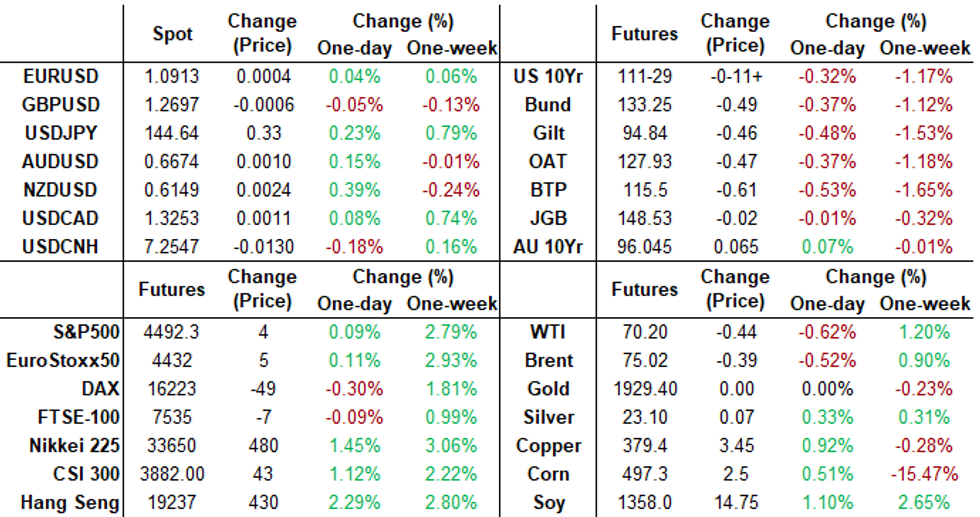

- EURUSD up 0.0044 (0.06%) at 1.0913

- USDJPY down 0.45 (0.06%) at 144.65

FX: Expiries for Jul04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0750-65(E1.1bln), $1.0785-90(E1.1bln)

Equities Roundup: Strong Auto Unit Sales Lifts Consumer Discretionary

- Stocks trading mildly lower, near the middle of a narrow range on a shortened pre-holiday session. Currently S&P E-Mini futures up 52.5 points (-0.03%) at 4489.5, DJIA up 285.18 points (-0.11%) at 34454.43, Nasdaq up 196.6 points (0.1%) at 13783.72.

- Leading gainers: Real Estate, Energy and Consumer Discretionary sectors outperforming in the first half. Consumer Discretionary sector led by auto makers after strong unit sales reports: Tesla off highs is still trading +6.23% higher ahead the early close, GM +1.25%, Ford +0.85%. Real Estate sector buoyed by a combination of hotel/resort and office real estate investment trusts.

- Laggers: Health Care and Information Technology sectors underperformed, the latter weighed by weaker software and services shares: Oracle -1.57%, Intuit -1.54%, Adobe -1.35%.

- The technical/bull theme in S&P E-minis remains intact and Friday’s gains reinforce this condition. The contract has pierced key resistance and the bull trigger at 4493.75, the Jun 16 high. A clear break of this level would confirm a resumption of the uptrend and pave the way for a climb towards 4532.08, a Fibonacci projection. On the downside, key trend support has been defined at 4368.50, the Jun 26 low.

E-MINI S&P TECHS: (U3) Pierces The Bull Trigger

- RES 4: 4556.71 2.382 projection of the May 4 - 19 - 24 price swing

- RES 3: 4535.96 Bull channel top drawn from the Mar 13 low

- RES 2: 4532.08 2.236 projection of the May 4 - 19 - 24 price swing

- RES 1: 4490.00 High Jun 30

- PRICE: 4485.00 @ 1100 ET Jul 3

- SUP 1: 4387.54/4368.50 20-day EMA / Low Jun 26 and a key support

- SUP 2: 4302.28 50-day EMA

- SUP 3: 4269.50 Low Jun 2

- SUP 4: 4216.00 Low May 31

A bull theme in S&P E-minis remains intact and Friday’s gains reinforce this condition. The contract has pierced key resistance and the bull trigger at 4493.75, the Jun 16 high. A clear break of this level would confirm a resumption of the uptrend and pave the way for a climb towards 4532.08, a Fibonacci projection. On the downside, key trend support has been defined at 4368.50, the Jun 26 low.

COMMODITIES: Oil and Gold Reverse Early Moves For Little Change Ahead Of Independence Day

- Crude oil prices are ending the session slightly lower after a bid through European hours was quashed in the US session, before a weaker than expected ISM mfg report helped reinforce the paring of gains.

- The market focuses on economic demand concerns over the tighter supplies driven by the expected Saudi production cut extension into August (with the latter and the announced Russian export cut only providing limited support to the market).

- WTI is -0.2% at $70.51 with a high of $71.77 stopping short of resistance at $72.72 (Jun 21 high). In options space, holiday-thinned trade ahead of Independence Day sees the day’s most active strikes at $75/bb/ calls for the CLQ3.

- Brent is -0.1% at $75.34 with a high of $76.60 stopping short of resistance at $77.25 (Jun 21 high).

- Gold is +0.1% at $1921.55, seeing relatively little boost from the USD index fading intra-session after the yellow metal made gains earlier in the session. A high of $1930.92 came closer to resistance at the 20-day EMA of $1935.1 after which lies the key $1985.3 (May 24 high).

TUESDAY-WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/07/2023 | 0430/1430 | *** |  | AU | RBA Rate Decision |

| 04/07/2023 | 0600/0800 | ** |  | DE | Trade Balance |

| 05/07/2023 | 2300/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

| 05/07/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 05/07/2023 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 05/07/2023 | 0645/0845 | * |  | FR | Industrial Production |

| 05/07/2023 | 0700/0900 | ** |  | ES | Industrial Production |

| 05/07/2023 | 0700/0300 | * |  | TR | Turkey CPI |

| 05/07/2023 | 0715/0915 | ** |  | ES | S&P Global Services PMI (f) |

| 05/07/2023 | 0745/0945 | ** |  | IT | S&P Global Services PMI (f) |

| 05/07/2023 | 0750/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 05/07/2023 | 0755/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 05/07/2023 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 05/07/2023 | 0830/0930 | ** |  | UK | S&P Global Services PMI (Final) |

| 05/07/2023 | 0900/1100 | ** |  | EU | PPI |

| 05/07/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 05/07/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 05/07/2023 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 05/07/2023 | 1400/1000 | ** |  | US | Factory New Orders |

| 05/07/2023 | 1800/1400 | * |  | US | FOMC Statement |

| 05/07/2023 | 2000/1600 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.