-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

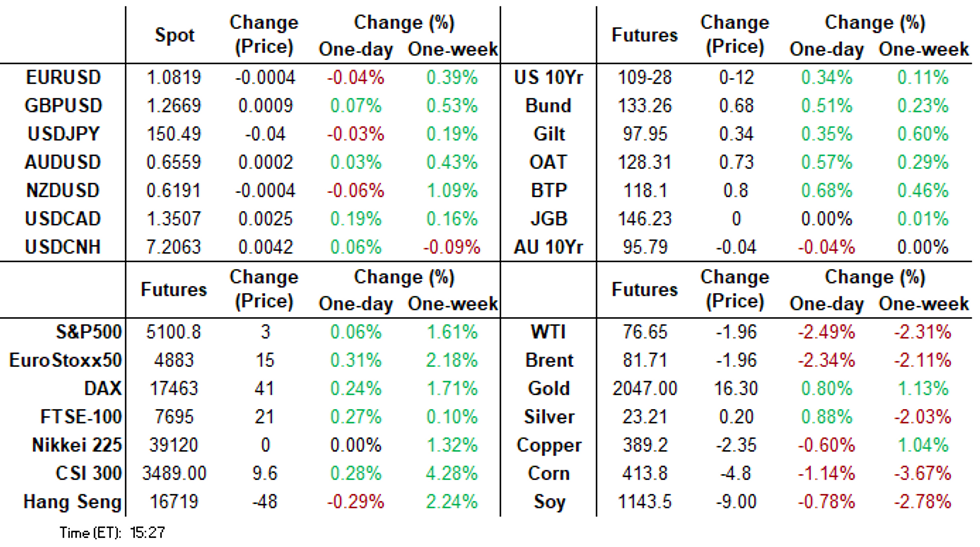

Free AccessMNI ASIA MARKETS ANALYSIS: Tsys Bounce as Stocks Pare Gains

- Treasuries drift near session highs, curves flatter ahead weekend

- Modest profit taking as S&P Emini's drift near new contract highs

- Midyear rate cut projection inches higher

US TSYS Markets Roundup: Tsys Off Lows, Risk Unwinds Into Weekend

- Not much of a change since midday where Treasury futures climbed to session highs after a weaker open where Mar'24 10Y futures tapped the lowest level since late November '23.

- Treasury curves bull flattened (2s10s -4.271 at -43.590 -- Jan 3 low) on the bounce, no obvious headline driver, though trading desks widely citied a (modest) reversal in equities off contract highs as trading accounts took profits ahead the weekend.

- Mar'24 10Y futures had tested Thursday lows overnight (109-09) neared the 110 handle in late trade, climbing to 109-31 (+15), 10Y yield -.0629 at 4.25789%. Heavy volumes (TYH4>3.8M) tied to the roll to Jun'24 contract continues. Technical resistance above at 110-15.5 (20-day EMA).

- Projected rate cut pricing holds steady for the next couple meetings while June is off this morning's lows: March 2024 chance of 25bp rate cut currently -2.0% w/ cumulative of -0.5bp at 5.324%; May 2024 at -21.2% w/ cumulative -5.8bp at 5.271%; June 2024 -62.6% vs. -55.4% earlier w/ cumulative cut -21.4bp at 5.132%. Fed terminal at 5.33% in Feb'24.

- Look ahead: Next Monday sees New Home Sales (680k est vs 664k prior), MoM (2.4% est vs. 8.0% prior) at 1000ET, followed by Dallas Fed Mfg Activity Index at 1030ET. Flurry of Treasury auctions start Monday due to the short month: $63B 2Y note and $70B 26W bills at 1130ET, followed by $79B 13W bills and $64B 5Y Note auctions.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00320 to 5.32413 (+0.00828/wk)

- 3M +0.00674 to 5.33057 (+0.01655/Wk)

- 6M +0.02078 to 5.27351 (+0.04235/wk)

- 12M +0.04738 to 5.07243 (+0.09453/wk)

- Secured Overnight Financing Rate (SOFR): 5.30% (+0.00), volume: $1.620T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $665B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $658B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $103B

- Daily Overnight Bank Funding Rate: 5.32% (+0.01), volume: $277B

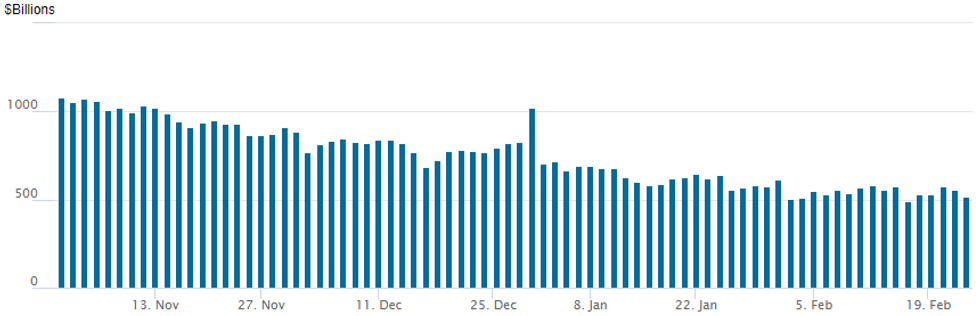

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage recedes to $520.107B vs. 553.245B Thursday; compares to $493.065B on Thursday, Feb 15 -- the lowest since early June 2021 .

- Meanwhile, the latest number of counterparties falls back to 79 from 86 yesterday (compares to 65 on January 16, the lowest since July 7, 2021).

SOFR/TREASURY OPTION SUMMARY

SOFR and Treasury option flow remained mixed Friday, call interest carried over from the prior session as some accounts continued to fade the decline in the latest rate cut projections. Projected rate cut pricing hold steady for the next couple meetings while June is off this morning's lows: March 2024 chance of 25bp rate cut currently -2.0% w/ cumulative of -0.5bp at 5.324%; May 2024 at -21.2% w/ cumulative -5.8bp at 5.271%; June 2024 -62.6% vs. -55.4% earlier w/ cumulative cut -21.4bp at 5.132%. Fed terminal at 5.33% in Feb'24.

- SOFR Options:

- Block, 5,000 SFRJ4 95.06/95.18/96.25 broken call trees, 1.0 net vs. 94.88/0.07%

- -7,500 SRZ4 96.87/97.50/97.75/98.00 call condor 4.0 vs. 95.50/0.05%

- +5,000 SRQ4 94.37/94.62 put spds 3.0 ref 95.20

- +10,000 SRM4 94.87 calls vs. 0QM4 96.50 calls 2.0

- -5,000 0QM4 96.75/97.00 call spds 3.5 vs. 96.02/0.05%

- -5,000 SRM4 95.00/95.12/95.25 call flys, 0.5 ref 94.90

- +25,000 SFRJ4 95.25/95.75 call spds, 1.75 ref 94.91/0.10%

- +10,000 SFRM4 95.00/95.12/95.25 call flys, 0.5

- +20,000 SFRZ4 94.00/94.12/94.37/94.50 put condors 1.0

- 3,000 SFRH4 94.68/94.81/94.87/94.93 put condors

- 2,000 SFRZ4 93.75/94.50 3x2 put spds ref 95.48

- 3,000 SFRZ4 96.00/96.50/96.87 broken call flysref 95.48

- 5,000 SFRZ4 96.00/96.25 call spds ref 95.475

- 8,000 0QJ4 95.50 puts ref 95.955

- 2,000 SFRJ4 94.87/95.12 put spds vs. 95.50/95.75 call spds

- 3,500 0QH4 96.12/96.25 call spds vs. 3QH4 96.50/96.62 call spds

- 1,500 SFRH4 94.25/94.37 put spds vs. 94.62/94.75 call spds ref 94.69

- 2,000 0QH4 96.00/96.12/96.31/96.43 put condors ref 95.73

- 2,000 0QM4 96.50/97.25 call spds vs. 3QM4 96.75 call

- 2,000 SFRZ4 94.87/95.12 put spds vs. 95.50/95.75 call spd ref 95.475

- Treasury Options: Reminder, March options expire today

- 5,000 TYM4 117/118/119/120 call condors

- Block, 7,500 TYJ4 108.5/110 put spds, 34 vs. 110-00/0.24%

EGBs-GILTS CASH CLOSE: BTPs Shine As Week Ends On Stronger Note

European yields pulled back Friday, partially reversing rises earlier in the week, though the recent German curve flattening trend remained intact.

- The German and UK curves bull flattened (after twist flattening Thursday and bear flattening Wednesday), amid a rebound in ECB / BoE cut pricing from recent extremes. An in-line German IFO reading and modest uptick in Eurozone consumer 1-year inflation expectations had little impact.

- As with many intraday moves this week, afternoon price action had no evident catalyst, with a rally extending into the cash close as equities pulled back from recent highs.

- The rate move defied a parade of ECB speakers who appeared to push back on near-term cut pricing in coordinated fashion. That included the typical hawks (eg Holzmann, Muller, Nagel), but the doves too (though Centeno said the ECB must be open to a March cut even if unlikely, Stournaras and Simkus ruled one out, eyeing summer as more likely).

- Periphery EGBs impressed, with 10Y Italian spreads to Germany moving to the tightest levels since 2022 amid the ongoing risk rally.

- Germany 2s10s finished the week nearly 9bp flatter (flattest close since Dec 27), while the UK equivalent was around 0.5bp flatter.

- Next week will be busy, with the main highlight being the February flash round of Eurozone inflation.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 5.2bps at 2.853%, 5-Yr is down 7.5bps at 2.373%, 10-Yr is down 7.7bps at 2.363%, and 30-Yr is down 6.4bps at 2.493%.

- UK: The 2-Yr yield is down 6bps at 4.542%, 5-Yr is down 6.5bps at 4.088%, 10-Yr is down 6.8bps at 4.037%, and 30-Yr is down 4.4bps at 4.586%.

- Italian BTP spread down 3.8bps at 143.7bps / Spanish down 1.6bps at 88.9bps

FX Options: Upside Favoured In Limited Trade To End Active Week

Friday's Europe rates/bond options flow included:

- ERH4 96.12/96.37cs 1x2 bought for 1 in 4k

- DUJ4 106.00/106.4cs 1x1.5 bought for 5 in 5k

FOREX USD Index Steps Lower On The Week Amid Optimism For Equities

- Surging equities this week weighed on the greenback overall with the USD index down -0.37%. However, the moderate downward adjustment was capped by a further uptick for front-end US yields as Fed officials continue to strike caution on premature monetary easing.

- Friday’s price action was mixed across G10 currencies, with major pairs making very limited adjustments amid a session void of meaningful data releases. Overall, NZD remains one of the best performers on the week, underpinned by the more optimistic risk backdrop.

- NZDUSD now stands around 2.6% above the February lows, with the pair set to close at its best level since mid-January and AUDNZD set to close below 1.06, levels not seen since May last year. Moves come ahead of the RBNZ decision next week, where MNI expect the RBNZ to leave rates on hold at 5.5%, even though the labour market data were stronger than expected.

- While USDJPY was unable to make a test of last week’s highs, price action this week has seen a consolidation above the 150.00 mark as cautious Fed remarks maintain the attractive carry profile.

- Recent fresh cycle highs confirm, once again, a resumption of the uptrend and note that last Tuesday’s gains resulted in a break of 149.75, the Nov 22 high. This signals scope for a climb towards 151.91/95, the Nov 13 ‘23 high and the Oct 1 ‘22 high and major resistance.

- Next week, the focus will be on the US January PCE deflator (out Thursday), which will be the last reading of the Fed's preferred inflation gauge before the March FOMC meeting. Later in the week, Eurozone February flash inflation readings begin next Thursday with France, Spain and Germany. The Eurozone-wide estimate is released on Friday.

Expiries for Feb26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0600(E631mln), $1.0700(E1.3bln), $1.0750(E1.3bln)

- EUR/GBP: Gbp0.8475(E520mln)

- USD/CAD: C$1.3490($727mln), C$1.3515($525mln)

Late Equities Roundup: Energy, Metals & Mining Outperform

- Stocks are trying to cling to firmer levels late Friday after S&P Eminis marked new contract highs Friday morning, accounts taking profits going into the weekend. Currently, S&P E-Minis are up 5.75 points (0.12%) at 5103.5 vs. 5123.5 high, DJIA up 46.65 points (0.12%) at 39113.27, Nasdaq down 19 points (-0.1%) at 16022.58.

- Leading Gainers: Utilities and Materials sectors still outperformed in late trade, multi energy providers supported the former: Dominion Energy +3.99%, Eversource +1.7%, Edison Int +1.69%. Metals and mining shares supported the Materials sector: Steel Dynamics +1.86%, Nucor Corp +1.75%, Newmont Corp +1.42%.

- Laggers: Consumer Discretionary and Energy sectors retreated from midweek gains, auto makers and consumer services weighed on the former sector: Tesla -2.44%, while Booking Holdings fell -10.01% after beating earnings but Middle East conflict weighed on room bookings. Meanwhile, Airbnb traded -2.06%. Meanwhile, oil and gas shares weighed on the Energy sector as crude prices traded weaker (WTI -2.19 at 76.42): EOG Resources -3.14%, Coterra -1.23%, Exxon-Mobil -0.86%.

- Looking ahead: While the corporate earnings cycle continues to wind down, some big names remain: Berkshire Hathaway on Saturday. On Monday: Domino's Pizza, AES, SBA Communications, iRobot, and Everbridge Inc.

E-MINI S&P TECHS: (H4) Bullish to Bullish

- RES 4: 5170.86 2.236 proj of Nov 10 - Dec 1 - 7 price swing

- RES 3: 5164.18 3.0% Bollinger Band

- RES 2: 5133.48 2.0% 10-dma envelope

- RES 1: 5123.50 High Feb 23 and bull trigger

- PRICE: 5102.00 @ 16:49 GMT Feb 23

- SUP 1: 4992.83 20-day EMA

- SUP 2: 4866.000/4841.20 Low Jan 31 / 50-day EMA

- SUP 3: 4702.00 Low Jan 5

- SUP 4: 4594.00 Low Nov 30

The trend condition in S&P E-Minis is resolutely bullish, with the upside trigger at 5066.50 giving way to new highs at 5123.50 this week. This erases the pullback off last week’s highs, confirming all S/T weakness as corrective. Support to watch lies at 4992.83, the 20-day EMA. A clear break of this average would suggest potential for a deeper retracement, possibly towards the 4866.00 key support, the Jan 31 low. The trigger for a resumption of gains is 5123.50, ahead of vol-band based resistance at 5133.48.

COMMODITIES Spot Gold Extends Bounce, Rises 0.65%

- WTI is headed for US close trading lower and with weekly losses of around 1%. The market is weighed down by concerns of slowed or delayed US interest rate cuts and difficulties for OPEC to maintain its voluntary output reductions.

- Key short-term resistance was pierced on Thursday at $78.52, the Feb 16 high - and a sustained clearance of this level would be a bullish development.

- For Natural Gas, Henry Hub front month has extended yesterday’s losses as a high storage surplus and mild weather add downside. However, Henry Hub is set for weekly gains of around 1.3%.

- For precious metals, greenback weakness this week has assisted the recovery for spot gold which briefly rose to $2041/oz before moderating a touch into the close.

- Investors are currently dramatically under positioned for a Fed cutting cycle and "we still expect gold prices to rally quite notably into the second quarter of this year", said a commodity strategist at TD Securities.

- Gold traded lower into mid-month, but is building well off lows and extended further above the 50-dma on Friday. A sustained clearance above this point and above the Feb 1 high of $2065.50 would be required to reinstate a bullish theme, with the mid-month weakness proving corrective in nature.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/02/2024 | 0800/0900 | ** |  | ES | PPI |

| 26/02/2024 | 0900/0900 |  | UK | BOE's Breeden at BOE agenda for Research Conference | |

| 26/02/2024 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 26/02/2024 | 1100/1100 |  | UK | BOE's Pill at BOE Agenda for Research conference | |

| 26/02/2024 | 1500/1000 | *** |  | US | New Home Sales |

| 26/02/2024 | 1530/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 26/02/2024 | 1600/1700 |  | EU | ECB's Lagarde participates in debate on ECB 2022 Report | |

| 26/02/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 26/02/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 26/02/2024 | 1800/1300 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 26/02/2024 | 1800/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 27/02/2024 | 2330/0830 | *** |  | JP | CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.