-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities Lower Post CEWC

MNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

MNI ASIA MARKETS ANALYSIS: US Pres Biden Urges Bank Safeguards

HIGHLIGHTS

- MNI US: WH Urges Regulators To Reverse "Trump Admin Weakening" of Banking Safeguards

- MN FED KASHKARI: COULD TAKE A WHILE TO FULLY GET THROUGH BANK STRAINS, Bbg

- FED BARKIN: I'M COMFORTABLE HIKING RATES NOW IN 25-BP INCREMENTS, Bbg

- FED COLLINS: WAS PLANNING TO RAISE SEP RATE PROJECTION BEFORE SVB, bbg

- MNI US DATA: Real GDP Revised Down Again By Consumption In Final Q4 Release

- MNI US Schumer: GOP Hasn't Proposed Any Cuts Which Would Make Difference To Deficit

- MNI US: GOP May Be Edging Away From Rigid Position On Debt Limit

Key links: MNI: Fed's Collins Backs One More 25BP Hike, Hold Thru Yearend / MNI: Fed’s Barkin-Inflation Could Persist Despite Bank Turmoil / MNI U.S. Commercial Banking Update: Deposit Drawdown Extends / US Treasury Auction Calendar

US TSYS: Implied Cuts Cooling Ahead Month End

- Treasury futures are see-sawing around mostly higher levels after the bell, paring short hedges while front end rates hold weaker as implied rate cuts in the second half of the year continue to soften (Fed funds implied hike for Dec'23 44.8 cumulative at 4.364%).

- Modest volumes on the day on inside ranges across the board, TYM3 under 1M contracts at the moment, as accounts take a breather to consider risk profiles going into Friday's month end.

- Treasury futures mirroring weaker Bunds early in the session after German Prelim March harmonized CPI comes out higher than estimated (1.1% MoM vs. +0.8% est). A delayed sell-off followed slightly higher than expected weekly claims (+198k vs. +195k est) while second revision of Q4 GDP +2.6% vs. +2.7% est (Consumption +1.0%; Deflator +3.9%; PCE Core +4.4%)

- Additional early pressure from stocks taking another leg higher (SPX Eminis +20.0 at 4077.50) amid reports of safe haven unwinds, chatter over reallocation from rates to stocks into month-end.

- Focus turns to Friday's PCE, PMI and UofM Sentiment, Fed speakers: Williams, Cook and Waller later in the evening.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00014 to 4.81143% (+0.00257/wk)

- 1M +0.00728 to 4.84757% (+0.01700/wk)

- 3M +0.01743 to 5.17657% (+0.07514/wk)*/**

- 6M +0.06272 to 5.27229% (+0.28500/wk)

- 12M +0.07114 to 5.23157% (+0.39571/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.17657% on 3/30/23

- Daily Effective Fed Funds Rate: 4.83% volume: $97B

- Daily Overnight Bank Funding Rate: 4.82% volume: $247B

- Secured Overnight Financing Rate (SOFR): 4.83%, $1.287T

- Broad General Collateral Rate (BGCR): 4.79%, $506B

- Tri-Party General Collateral Rate (TGCR): 4.79%, $494B

- (rate, volume levels reflect prior session)

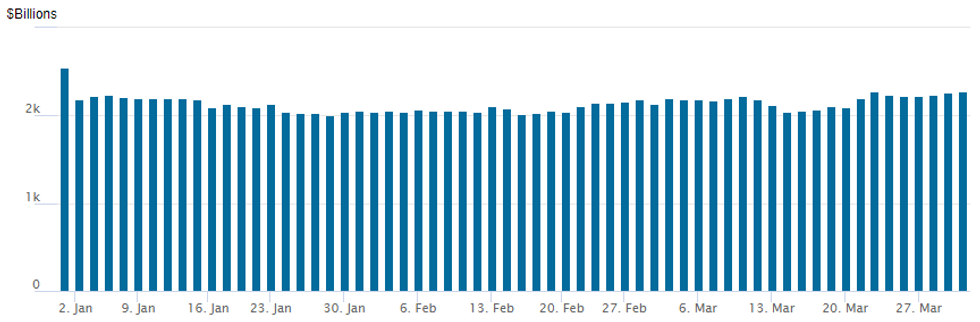

FED Reverse Repo Operation: New Second Highest in 2023

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,271.531B (second highest for 2023 after $2,279.608B on March 22) w/ 102 counterparties, compares to yesterday's $2,264.862B. Record high of $2,553.716B from December 30, 2022 remains intact.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Mixed trade going reported Thursday on muted volumes going into month end. Little new risk added, underlying futures traded mildly weaker in near expirations through year end as implied rate cuts gradually unwind.

- SOFR Options:

- Block, 5,000 SFRU3 94.25/94.37 put spds, 0.75 ref 95.41

- Block, 15,000 OQM3 94.75/95.12/95.75 broken put flys, 8.5

- Block, 5,000 SFRJ3 95.25/95.43/95.50 broken call flys on 1x ratio vs. 95.16/0.10%

- 9,500 SFRM3 94.81/94.93/95.06/95.18 call condors, ref 95.165

- Block, 2,500 SFRK3 95.06/95.18 call spds, 5.0 vs 95.18/0.11%

- 1,800 SFRK 94.75/95.00 put spds, 6.0 ref 95.175

- Block, 5,000 SFRH4 97.50/98.50/99.00 broken call flys 1.0 over 95.25/95.50 put spds ref 96.06

- Block, 15,000 OQM3 95.62/96.00 3x2 put spds, 12.0 ref 96.40

- Treasury Options:

- over 5,700 TYM3 115/117/119 call flys, 16 ref 114-16

- 3,000 TYM3 112/114 put spds, 49 ref 114-13

- 1,400 TYK3 116 calls, 36 ref 114-15.5

EGBs-GILTS CASH CLOSE: German Inflation Seen Keeping Pressure On ECB

Thursday's Euro area inflation data had been highly anticipated as a potential market-mover - and it delivered, with Bunds underperforming after trading in a wide range.

- Bunds soared on a lower-than-expected Spanish CPI print in early trade, only to reverse all gains after German state-level CPI pointed to a higher-than-expected national print.

- The latter released in early afternoon topped expectations with core looking stubbornly high, triggering the next leg of the selloff.

- Gilts outperformed on the day, with modest weakness mostly in the belly of the UK curve, contrasting with yet more bear flattening in Germany.

- For a short time, there were no ECB cuts priced in 2023, with the peak coming in December. Overall peak pricing rose over 12bp on the day (an end-year ECB depo rate of around 3.61% is now seen).

- ECB's Kazaks told MNI that more rate increases will be needed in the baseline scenario. He speaks Friday morning, with colleagues Visco, Lagarde and Vujcic later in the day.

- Friday's week/month/quarter-end session also brings more upper-tier data: Dutch/French/Italian/Eurozone CPI and UK GDP are the highlights.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 9.5bps at 2.749%, 5-Yr is up 7.8bps at 2.406%, 10-Yr is up 4.5bps at 2.374%, and 30-Yr is up 1.3bps at 2.421%.

- UK: The 2-Yr yield is up 4.3bps at 3.455%, 5-Yr is up 5bps at 3.366%, 10-Yr is up 4.6bps at 3.518%, and 30-Yr is up 1.8bps at 3.849%.

- Italian BTP spread up 4bps at 186.1bps / Spanish up 1.6bps at 103.2bps

EGB Options: Leaning To Downside

Thursday's Europe rates / bond options flow included:

- DUK3 105.20/104.80ps 1x2, bought for 2.5 in 5k

- OEM3 119/122cs, bought for 57 in 10k vs 2.4k at 117.50

- ERK3 96.625/96.50/96.375/96.125p condor, bought for 2.75 in 3k

FOREX: Greenback Weakness Resumes, German CPI Bolsters Euro

- The greenback was once again on the back foot throughout Thursday’s trading session. The USD index has declined 0.45% approaching the APAC crossover and is gravitating towards last weeks lows of 101.92. Broad greenback weakness has been aided by a firmer Euro which has been underpinned by stronger-than-expected German CPI data and an associated adjustment in ECB terminal pricing.

- EURUSD came within 4 pips of key short-term resistance at 1.0930, the Mar 23 high. A break of this level would reinstate the recent bull theme and signal scope for a climb towards 1.1033, the Feb 2 high.

- Sterling was also one of the day’s best performers. GBPUSD has recently cleared a number of resistance points, strengthening a short-term bullish condition. Sights are on resistance at 1.2401, the Feb 2 high and 1.2448, the Jan 23 high.

- For USDJPY, after multiple tests towards the 133.00 handle throughout the trading session, the pair fell around 60 pips during US hours, narrowing in on the overnight lows of 132.21. Broad USD weakness has had little impact on the pair up until this point with the firmer risk backdrop in general underpinning cross/JPY strength.

- Overall, the trend direction in USDJPY remains down and this week’s gains are considered corrective. The 20-day EMA has been tested. Firmer resistance is seen at 133.00, the March 22 high, and the 50-day EMA that intersects at 133.38. A clear break of this EMA would highlight a stronger reversal.

- Overnight, China PMIs will kick off Friday’s busy docket. Eurozone CPI Flash Estimate, US Core PCE price index and the MNI Chicago Business Barometer, will be in focus ahead of the weekend close.

FX: Expiries for Mar31 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700(E1.6bln), $1.0800(E1.7bln), $1.0850(E1.2bln), $1.0900(E648mln), $1.0950(E1.1bln), $1.1000(E532mln)

- USD/JPY: Y130.00($762mln), Y131.00($1.0bln), Y132.00($665mln), Y133.85-00($655mln), Y136.00-20($1.3bln)

- GBP/USD: $1.2000(Gbp515mln), $1.2100(Gbp693mln)

- AUD/USD: $0.6550(A$808mln)

- USD/CAD: C$1.3600($1.5bln), C$1.3900($1.2bln)

Equities Roundup: SPX Above Resistance, Financials Lagging

- US stocks holding modestly higher in the second half, SPX Eminis trading at 4077.25 above resistance of 4073.75 (Mar 22 high) after finishing above the 50-day EMA of 4021.12 in the prior session.

- A clear break of 4073.75 would strengthen bullish conditions and signal scope for a climb towards the next key resistance level of 4119.50, the Mar 6 high.

- On the downside, key short-term support lies at 3937.00, the Mar 24 low. A break of this support would be bearish. Initial support lies at 4005.39, the 20-day EMA.

- Current sector leaders are Real Estate, Information Technology and Consumer Discretionary sector shares outperforming. After rebounding the last couple sessions, Financial sector shares, particularly regional banks are trading weaker on the day

- KBW Bank index (BKX) is trading near midday low at 81.21 (-1.11) - all index components are trading weaker in the second half, M&T Bank (MTB), PNC Financial Services (PNC) and Northern Trust (NTRS) shares underperforming.

- Making headlines: The White House has published a fact sheet urging, "Regulators to reverse Trump Administration weakening of common-sense safeguards and supervision for large regional banks."

- Statement: "[Biden] is committed to 'continuing our efforts to strengthen oversight and regulation of larger banks so that we are not in this position again.'"

E-MINI S&P (M3): Climbs Above The 50-Day EMA

- RES 4: 4205.50 High Feb 16

- RES 3: 4148.48 76.4% retracement of the Feb 2 - Mar 13 downleg

- RES 2: 4119.50 High Mar 6

- RES 1: 4089.39 61.8% retracement of the Feb 2 - Mar 13 downleg

- PRICE: 4075.00 @ 1445ET Mar 30

- SUP 1: 4005.39 20-day EMA

- SUP 2: 3937.00/3897.25 Low Mar 24 / 20

- SUP 3: 3839.25 Low Mar 13

- SUP 4: 3822.00 Low Dec 22 and a key support

S&P E-Minis are trading higher. Price has pierced resistance at 4073.75, the Mar 22 high. The contract is also once again trading above the 50-day EMA - the average intersects at 4021.12. A clear break of 4073.75 would strengthen bullish conditions and signal scope for a climb towards 4119.50, the Mar 6 high. Key short-term support lies at 3937.00, the Mar 24 low. A break of this support would be bearish. Initial support lies at 4005.39, the 20-day EMA.

COMMODITIES: Crude Oil Resumes Climb To Open 50-day EMA Resistance

- Crude oil has returned to gains after yesterday’s blip lower. Gains were attributed to a weaker dollar and broader market moves, whilst low volumes and fears of rising interest rates are adding to nervous trade.

- Front WTI outperforms Brent the day after a surprise drop in US inventories. Separately, supply from Iraq’s Kurdistan region remains offline as talks between the Iraqi and Kurdish governments aren’t scheduled to resume before next week, after DNO announced it would start shutting down production fields yesterday.

- WTI is +1.8% at $74.27, pushing closer to resistance at the 50-day EMA ($75.12) after which lies $77.10 (76.4% retrace Mar 7-20 downleg).

- Brent is +1.1% at $79.16, through resistance at $79.68 (Mar 29 high) to open the 50-day EMA of $80.71.

- Gold is +0.8% at $1981.22 as it benefits from a weaker dollar index in a move that more than reversed yesterday’s push higher for the latter. It moves closer to, but doesn’t test, resistance at the bull trigger of $2009.7 (Mar 20 high).

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/03/2023 | 0130/0930 | *** |  | CN | CFLP Manufacturing PMI |

| 31/03/2023 | 0600/0700 | *** |  | UK | GDP Second Estimate |

| 31/03/2023 | 0600/0700 | * |  | UK | Quarterly current account balance |

| 31/03/2023 | 0600/0800 | ** |  | DE | Retail Sales |

| 31/03/2023 | 0630/0830 | ** |  | CH | retail sales |

| 31/03/2023 | 0645/0845 | ** |  | FR | Consumer Spending |

| 31/03/2023 | 0645/0845 | *** |  | FR | HICP (p) |

| 31/03/2023 | 0645/0845 | ** |  | FR | PPI |

| 31/03/2023 | 0755/0955 | ** |  | DE | Unemployment |

| 31/03/2023 | 0900/1100 | *** |  | IT | HICP (p) |

| 31/03/2023 | 0900/1100 | *** |  | EU | HICP (p) |

| 31/03/2023 | 0900/1100 | ** |  | EU | Unemployment |

| 31/03/2023 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 31/03/2023 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 31/03/2023 | 1342/0942 | ** |  | US | MNI Chicago PMI |

| 31/03/2023 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 31/03/2023 | 1500/1700 |  | EU | ECB Lagarde Q&A with Students | |

| 31/03/2023 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 31/03/2023 | 1600/1200 | ** |  | US | USDA GrainStock - NASS |

| 31/03/2023 | 1600/1200 | *** |  | US | USDA PROSPECTIVE PLANTINGS - NASS |

| 31/03/2023 | 1900/1500 |  | US | New York Fed's John Williams | |

| 31/03/2023 | 2145/1745 |  | US | Fed Governor Lisa Cook |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.