-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: BOJ Tankan: Key Sentiment Rises, Solid Capex Plans

MNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI ASIA MARKETS ANALYSIS: YTD Yield Highs For US 2s and 5s Ahead Of BoJ

- A mild sell-off for Treasuries sees them set fresh YTD yield highs across 2- and 5-year tenors whilst TY futures test the bear trigger.

- The USD index is buoyed by higher yields, but with ranges kept in check by the upcoming BoJ decision (plus the RBA) before Wednesday's FOMC decision.

- WTI meanwhile extended gains following an escalation in attacks on Russian refineries.

US TSYS: Paring Losses After Fresh YTD Yield Highs Across The Front-End And Belly

- Treasuries have pulled back a little further off lows, with TYM4 at 109-27+ off 109-24+.

- It has seen a limited test of the bear trigger at 109-25+ (Feb 23 low), with a sustained clearance having scope to then open 109-14+ initially (Nov 28, 2023 low).

- Volumes are limited though, only nudging over 1mn for approx. 70% of recent sessions for the time of day.

- In cash space, 5Y yields touched fresh YTD highs after the 2Y did so earlier on, and 10s stopped just 0.25bps shy of their high of 4.3486%.

- As it is, cash Tsy yields currently sit 0.5-3bp higher, with 2s10s climbing 2bps to -40bps to just hold within last week's range.

- Today’s corporate issuance has been touted as a driver for the sell-off, whilst a highlight for limited flow saw FVJ4 106.00 puts targeting a ~10bp move higher in 5YY to ~4.45% by Friday’s expiry.

- Fed swaps briefly showed more than a 50% likelihood of no change in the June meeting. CME’s FedWatch currently shows 50.8% chance of a 25bp cut and 3.4% of a 50bp cut.

- Upcoming focus is on the BoJ decision overnight, with Nikkei adding to recent reports across multiple newswires that the BoJ is to end YCC and ETF purchases along with the heavily sourced exit of negative interest rates. The 20Y re-open sees some issuance focus tomorrow but with the FOMC decision on Wed looming large.

FOREX: Greenback Edges Higher As Front-End US Yields Reach YTD Highs

- The dollar index has been creeping higher across the US session, in line with the shift higher for US yields. Overall, G10 ranges have remained fairly contained ahead of significant event risk this week, however, emerging market currencies have been more negatively impacted to start the week.

- Naturally, ahead of the Bank of Japan early Tuesday, the focus will be on the Japanese Yen as the central bank debates whether to immediately terminate its negative interest rate policy or postpone such action for another month and a half. USDJPY is unchanged today in anticipation, hovering just above the 149.00 mark approaching the event.

- USDJPY is consolidating after extending its most recent bounce from 146.49, the Mar 8 / 11 low. The recovery appears to be a correction and a bear threat remains present following the recent sharp sell-off. A resumption of weakness would signal scope for a move towards 145.90, the Feb 1 low and a key support. A continuation higher would instead signal scope for gains towards 150.08, the Mar 6 high, ahead of the 150.89 key resistance, Feb 13 high.

- The most notable move in G10 today has been the Swiss Franc, with USDCHF 0.47% higher on the session as we approach the APAC crossover. Franc weakness comes ahead of the SNB decision later this week, which could go either way. Markets are currently split between a hold at 1.75% and a 25bps cut. CHF has depreciated in nominal and real terms during first months of 2024 as SNB switch to a neutral FX approach.

- As mentioned, the EM basket has been under pressure and most noticeable moves have been in ZAR and MXN, both weakening by close to 1% to start the week. The Mexican peso could likely stay in focus this week as we approach interest rate decisions in both the US and Mexico. Following Wednesday’s Fed meeting, Banxico is due to hold a key monetary policy meeting on Thursday, when it is broadly expected to start its easing cycle with a 25bp cut to 11%.

- BOJ takes focus in APAC Tuesday; however, the RBA are also meeting. Tuesday’s data highlight will be Canadian CPI for February.

US STOCKS: Holding Move Off Highs, Buy And Sell Programs Keep To Narrow Ranges

- The S&P 500 e-mini continues to hold the ~20pt pullback off earlier highs of 5240.25, but still climbs 0.7% on the day to offset Friday’s -0.7%.

- Technical analysis sees resistance at 5257.25 (Mar 8 high) after which lies the round 5300.00.

- The largest sell program of the day for the NYSE TICK index has recently rolled through with a still relatively small 806 names. Prior to that, the session was shaping up for the smallest range in the index since the day after Thanksgiving 2022.

- Nvidia has played a sizeable role in the move off highs, briefly turning negative earlier (currently +0.7%) having pared gains of as much as 5.2% at the start of its GPU Tech Conference.

- AI more broadly remains at the fore, with Alphabet gaining particularly strongly (+4.3%) followed by Meta (+2.0%) and Apple (+1.3%), but Microsoft (+0.4%) lags more notably.

- Alphabet’s strength tallies with communication services (+2.7%) clearing leading the day’s gains, followed by IT (+0.9%) and consumer discretionary (+0.85%). Health care and real estate (both +0.1%) and utilities (+0.35%) lag.

- Accordingly, the Nasdaq 100 outperforms (+1.2%), whilst the Dow (+0.4) and Russell 2000 (-0.2%) underperform.

COMMODITIES: Crude Makes Robust Gains, Spot Gold Steady Ahead Of Fed

- Crude futures rose further on Monday as an escalation in attacks on Russian refineries raised concern for oil product supplies.

- WTI is up 2.3% on the day at $82.9/bbl.

- WTI futures have now cleared the Fibonacci retracement point at $81.70, which has opened $84.66 next, the Oct 20 ‘23 high. On the downside, support to watch is $77.07, the 50-day EMA.

- Meanwhile, Henry Hub has rebounded today from the low of $1.646/mmbtu on March 15 and reversed much of the previous day’s losses. Upside comes from forecasts for colder weather across the US towards the end of March.

- US natural gas APR 24 is up 3.4% at $1.71/mmbtu.

- Spot gold rose by 0.2% on Monday to $2,160/oz, as the yellow metal remains steady ahead of Wednesday’s Fed interest rate decision.

- The recent break above $2135.4, the Dec 4 high, reinforces bullish conditions and signals scope for $2206.6 next, a Fibonacci projection. Short-term conditions are overbought and a deeper retracement would allow this set-up to unwind. Firm support is at $2112.9, the 20-day EMA.

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR FIX - Source BBG/CME

1M 5.32875

3M 5.33251

6M 5.27514

12M 5.07859

REPO REFERENCE RATES (rate, change from prev. day, volume):

* Secured Overnight Financing Rate (SOFR): 5.31%, no change, $1803B

* Broad General Collateral Rate(BGCR): 5.30%, no change, $694B

* Tri-Party General Collateral Rate (TGCR):5.30%, no change, $685B

New York Fed EFFR for prior session (rate, chg from prev day):

* Daily Effective Fed Funds Rate: 5.33%, no change, volume: $90B

* Daily Overnight Bank Funding Rate: 5.32%, no change, volume: $252B

FED: Surprisingly Limited Increase In O/N RRP Uptake

- Usage of the Fed’s O/N RRP increased $27bn to $441bn today from Friday’s new recent low of $414bn.

- It’s a relatively small increase considering expected inflows from GSEs as is typical for this time of the month.

- Wrightson ICAP had estimated an increase of circa $60bn.

- The number of counterparties increased by 2 to 70, still one of the lowest recently.

MNI BoJ Preview - March 2024: Policy Normalisation Is Here

EXECUTIVE SUMMARY

- Regarding the decision this week the primary question revolves around whether the central bank will immediately terminate its negative interest rate policy (NIRP) or postpone such action for another month and a half.

- While a move in March is not set in stone, we anticipate the BoJ to announce the attainment of its 2% price stability target and exit NIRP.

- This decision is likely to have been ‘green-lighted’ by the technical recession in 2H-23 being revised away, recent wage negotiations indicating a significant increase, and the BoJ’s preferred inflation measure expected to remain above 2% this year.

- Despite the debate in the markets over March versus April, the key takeaway from tomorrow’s meeting is that the BoJ seems to have made up its mind to act by the end of spring.

- Therefore, even if the BoJ opts to hold off in March, it would be expected to provide a clear indication that it is contemplating action at its next policy meeting scheduled for April 25th-26th

- Full preview here:

MNI Fed Preview - March 2024: Analyst Outlook

- Note to readers: This is an update to the MNI Fed preview published on Friday Mar 15. Please see Page 36-41 of this document for sell-side analysts' outlooks for the March FOMC decision and future policy.

EXECUTIVE SUMMARY:

No 2024 Dot Change Expected, But Some Longer-Run Intrigue

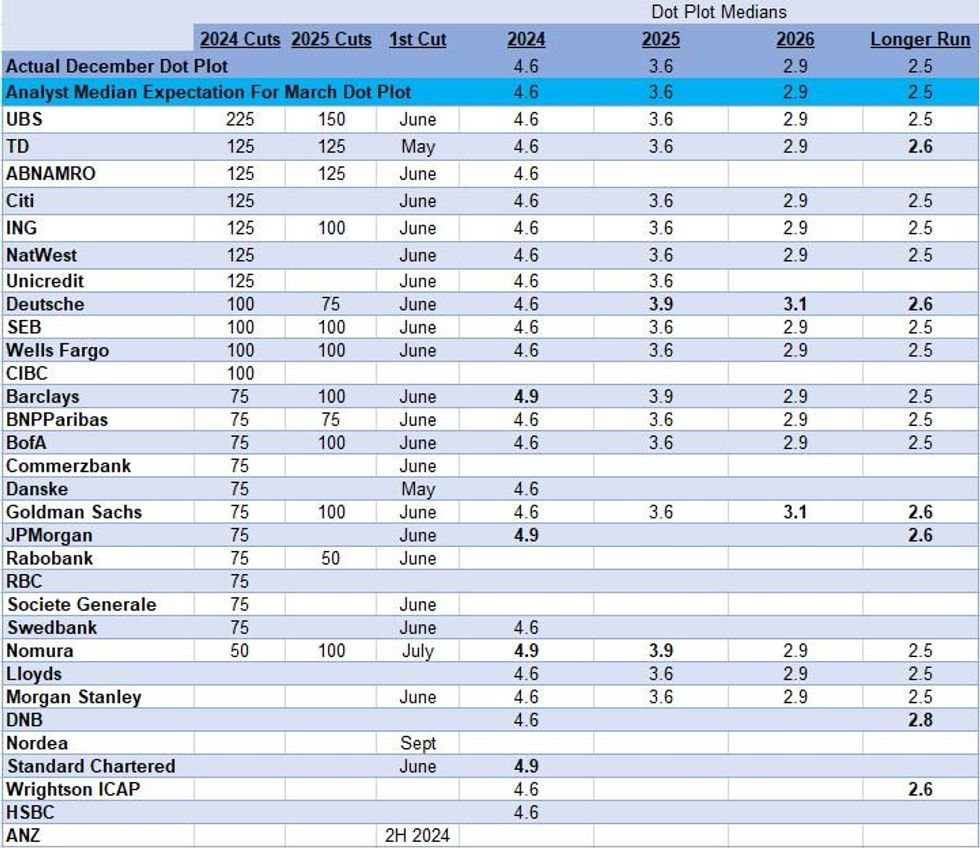

Going into the March FOMC meeting, analyst expectations for 2024 Fed rate cuts have converged firmly on June as the starting point, but there remains a wide range of expectations otherwise.

- The “median” analyst whose previews we read for this report saw 75bp of Fed funds rate cuts in 2024 compared with 125bp pre-January meeting. There is no firm consensus though, with a wide range of expectations running from 50bp to 225bp (had been 75bp to 275bp pre-January FOMC).

- The most aggressive rate cut path we have seen is from UBS, whose analysts expect 225bp of cuts in 2024 starting in June, with 150bp more in Q1 2025.

- TD and Danske see cuts starting in May; Nomura sees July while Nordea sees September.

- For the updated Dot Plot, there is firm consensus that there will be no change to the FOMC medians for rates (20 of 24 analysts see 3 cuts, or 4.6%, remaining the base case for 2024).

- Barclays, JPMorgan, Nomura, and Standard Chartered see a rise to a 4.9% 2024 median, while Deutsche, Goldman Sachs, and Nomura see increases further out (2025-26).

- Of 18 analysts who expressed an opinion on the longer-run dot, 6 see an increase from 2.5% in the December Dot Plot.

- Several analysts expect the GDP and inflation forecasts for 2024 to be revised upward slightly. No analyst expects significant changes to the Statement.

- On tapering QT, the general expectation remains that the Fed will cap Treasury runoff at $30B (vs $60B currently) around mid-year, with an announcement in May / June.

FOR THE FULL PUBLICATION PLEASE USE THE FOLLOWING LINK:

FedPrevMar2024 - With analysts.pdf

MNI SNB Preview - March 2024: Dovish Tilt on the Cards

Executive Summary:

- SNB decision could go either way, with markets split between a hold at 1.75% and a 25bps cut

- Inflation has slipped closer to the middle of the SNB target range, clearly undershooting inflation forecasts

- CHF has depreciated in nominal and real terms during first months of 2024 as SNB switch to a neutral FX approach

Market pricing and consensus views for the SNB’s March decision are on a knife-edge between a 25bps cut or a hold at 1.75%. The decision will depend on the SNB’s longer-term assessment of inflation against deflation risks, as headline CPI has printed close to the middle of the SNB’s target range in recent months. A hold would likely be accompanied with a clearly dovish tilt in communication. Markets currently price 8-9bps of easing for the meeting, corresponding to about a 2/3 implied probability of a hold, while a 25bps cut to the deposit rate would likely be accompanied with cautious language on policy ahead.

MNI Norges Bank Preview - Mar '24: Cuts Still Some Way Off

EXECUTIVE SUMMARY

The Norges Bank are unanimously expected to leave the policy rate on hold at 4.50%.

- Main interest will lie in the updated policy rate path projection within the March Monetary Policy Report, which will inform the guidance around how long rates will be held at current levels.

- The MNI Markets Team expects a small downward revision to the rate path, with key variables tracking below the December MPR forecasts.

- This will likely see the first full 25bp rate cut brought forward a little earlier in Q4 2024 than the current rate path indicates.

- However, we do not expect this be be accompanied with any pivot away from recent guidance, with the Norges Bank’s tilt still leaning hawkish on the margin

For our full preview, including a summary of 17 sell-side views, see the PDF below:

MNI Norges Bank Preview - 2024-03.pdf

US DATA: NAHB Housing Index Highest Since July

- The NAHB housing market index surprisingly increased 3pts to 51 (cons 48) in March after 48 in Feb, leaving it at its highest since Jul’23.

- Present sales (+4pts) led the latest increase, followed by prospective buyer traffic (+3pts) and then prospects for future sales (+2pts).

- The regional breakdown for the overall index was mixed. The south (largest region) increased just 2pts, the Midwest increased a very strong +11pts (largest increase since coming out of shutdowns), whilst the west (-2) and northeast (-1) both declined after strong increases the prior month.

- Despite the latest aggregate increase, there remains a large disconnect with far more elevated homebuilder price-to-book ratios on a historical basis [bottom chart].

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.