-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Rates Trim Losses

EXECUTIVE SUMMARY

- MNI EXCLUSIVE: Fed May Boost QE In Months If Fiscal Talks Fail

- MNI INTERVIEW: BOC May Bring More Vaccine Optimism in January

- MNI SOURCES: Rule of Law Assurance May End EU Budget Standoff

- US: Liability Portion Of Stimulus Proposal Could Come Today: Senators

- MNI: BANK OF CANADA OVERNIGHT INTEREST RATE TARGET +0.25%

- PFIZER: EUROPEAN MEDICINES AGENCY HIT BY CYBERATTACK, Bbg

- PFIZER: SAYS SOME VACCINE DOCUMENTS ACCESSED IN EMA CYBERATTACK, Bbg

- US: MCCONNELL SAYS SCHUMER, PELOSI BRUSHING OFF GOP AID PROPOSALS, Bbg

US

FED: The Federal Reserve may step up the pace of its bond buys early next year if fiscal talks in Congress fail and economic growth slows further in the difficult months before the widespread delivery of a coronavirus vaccine, current and former central bank officials tell MNI. For more see MNI Policy MainWire at 1102ET.

US: Sen Angus King (independent but caucuses w Democrats) says he hopes today to unveil provisions on liability protection in the bipartisan COVID relief proposal, CNN reports.- For context, King has been working w Lindsey Graham (Republican) on the text of the liability protections as part of the bipartisan negotiations.

- BBG reporting Democratic Sen Chris Coons also says a liability plan will be released today, and it will include a six-month moratorium on COVID lawsuits and will provid and affirmative defense for defendants.

- Worth watching today as this is a key point of contention to a final stimulus agreement, with Republicans insisting on some sort of protection for businesses from COVID-related lawsuits.

- Not much market reaction, equities still near lows - the details of the liability clauses will be important.

CANADA

BOC: The Bank of Canada may be saving some of its optimism about Covid vaccine breakthroughs for the next policy meeting in January, when it will also deliver a wider forecast paper, CIBC Senior Economist and former central bank researcher Royce Mendes told MNI. For more see MNI Policy MainWire at 1438ET.BOC: As expected, the Bank of Canada left the target rate on hold at 0.25%, while holding QE steady after extending duration/reducing size of purchases at the October policy annc. Covid vaccine developments provided some positive news but inventory and distribution remains uncertain -- keeping a lid on forward expectations.

EUROPE

EU: European Union leaders look set to discuss a possible resolution of the spat with Poland and Hungary over the bloc's budget and Covid recovery fund at Thursday's summit meeting, an EU source told MNI. For more see MNI Policy MainWire at 0739ET.

OVERNIGHT DATA

U.S. OCT. WHOLESALE SALES UP 1.8 %

U.S. OCT. WHOLESALE INVENTORIES RISE 1.1 %

October Job Openings and Labor Turnover Survey (JOLTS):

- Job Openings: In October there were 6.652 million job openings, up from 6.494 the month before; it is the highest since July.

- Hires: There were 5.812 million hires in October, down 74k from the month before; it is the lowest level of hiring since April.

- Separations: There were 5.107 million separations in October, up 263k from the month before; it is the highest level of job separations since April.

- Quit Rate: The Quit Rate held steady at 2.2%; it was up at 2.3% in February.

US MBA: MARKET COMPOSITE -1.2% SA THRU DEC 04 WK

US EIA: CRUDE OIL STOCKS EX SPR +15.19M TO 503.2M DEC 04 WK

US EIA: DISTILLATE STOCKS +5.22M TO 151.1M IN DEC 04 WK

US EIA: GASOLINE STOCKS +4.22M TO 237.9M IN DEC 04 WK

MARKETS SNAPSHOT

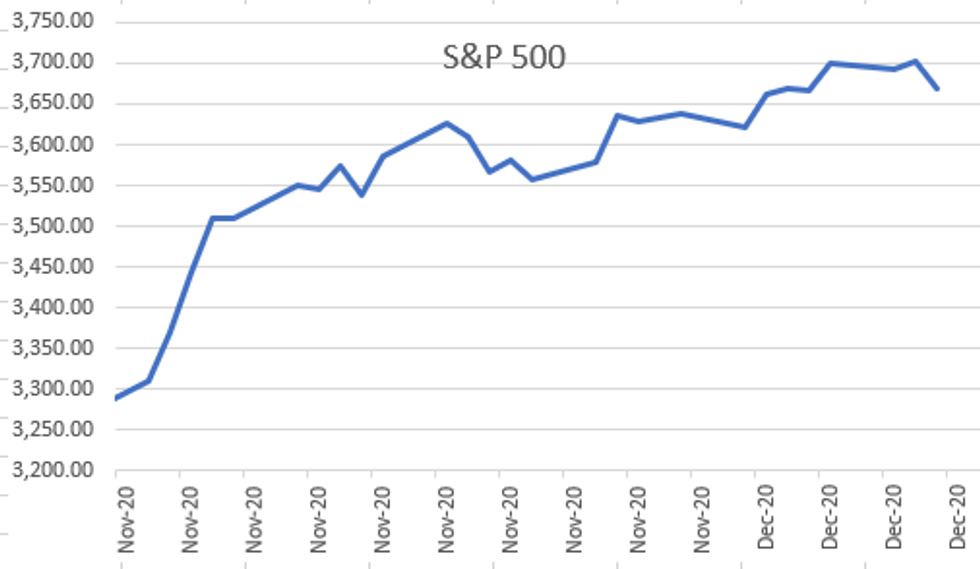

- DJIA down 171.72 points (-0.57%) at 30036.62

- S&P E-Mini Future down 38.75 points (-1.05%) at 3672.75

- Nasdaq down 265.8 points (-2.1%) at 12368.12

- US 10-Yr yield is up 1.5 bps at 0.9328%

- US Mar 10Y are down 4.5/32 at 137-21.5

- EURUSD down 0.0032 (-0.26%) at 1.2067

- USDJPY up 0.07 (0.07%) at 104.26

- WTI Crude Oil (front-month) down $0.17 (-0.37%) at $45.59

- Gold is down $39 (-2.08%) at $1836.04

- European bourses closing levels:

- EuroStoxx 50 up 3.15 points (0.09%) at 3529.02

- FTSE 100 up 5.47 points (0.08%) at 6564.29

- German DAX up 61.77 points (0.47%) at 13340.26

- French CAC 40 down 13.85 points (-0.25%) at 5546.82

US TSY SUMMARY: Paring Risk

Treasuries held weaker levels all session, starting off with a tentative risk-on tone as equities managed modest early gains on hopes of some Covid relief package. Overall volumes rather muted, however, delivering some real vol on choppy moves.

- Tsy bounced off midmorning lows, stocks reversed gains after Sen McConnell's headlines: "MCCONNELL SAYS SCHUMER, PELOSI BRUSHING OFF GOP AID PROPOSALS; SAYS DEMOCRATS MOVING GOALPOSTS ON AID BILL," Bbg

- Spurring a second rebound in rates/weakness in equities amid headlines that Pfizer hit by cyberattack in Europe: PFIZER: EUROPEAN MEDICINES AGENCY HIT BY CYBERATTACK; SAYS SOME VACCINE DOCUMENTS ACCESSED IN EMA CYBERATTACK," Bbg.

- Another Tail To Tell: US Tsy $38B 10Y note auction re-open (91282CAV3) drew 0.951% high yield (0.960% last month) vs. 0.947% WI; 2.33 bid/cover (2.32 previous).

- Heavy volumes in Eurodollar futures, Whites generating nearly 950,000 by the close, flow mixed/varied in outrights (EDZ0>418k) and spds (>40k EDZ1=EDH2). Reminder, Dec Eurodollar futures, options expire Fri/Mon.

- The 2-Yr yield is unchanged at 0.1508%, 5-Yr is up 1.3bps at 0.4052%, 10-Yr is up 2bps at 0.9377%, and 30-Yr is up 2.4bps at 1.6863%.

US TSY FUTURES CLOSE: Weaker, Off Lows

Treasuries held weaker levels all session, starting off with a tentative risk-on tone on hopes of some Covid relief package. Levels see-sawed off midmorning lows as equities reversed course, traded weaker amid rancorous relief bill chatter. Overall volumes rather muted, however, delivering some real vol on choppy moves. Latest levels:

- 3M10Y +1.988, 86.169 (L: 84.501 / H: 88.159)

- 2Y10Y +2.182, 78.497 (L: 76.911 / H: 80.288)

- 2Y30Y +2.54, 153.289 (L: 151.344 / H: 155.385)

- 5Y30Y +0.848, 127.664 (L: 126.807 / H: 129.253)

- Current futures levels:

- Mar 2Y -0.12/32 at 110-12.87 (L: 110-12.37 / H: 110-13.12)

- Mar 5Y -2.75/32 at 125-26.25 (L: 125-24.5 / H: 125-28.25)

- Mar 10Y -6.5/32 at 137-19.5 (L: 137-15 / H: 137-24)

- Mar 30Y -19/32 at 172-15 (L: 171-30 / H: 172-28)

- Mar Ultra 30Y down 1-4/32 at 211-20 (L: 210-20 / H: 212-12)

US EURODLR FUTURES CLOSE: Heavy Volumes, Whites Near 950k/Day

Futures trade mixed levels throughout the session, short end outperforming on heavy volumes, Whites generating nearly 950,000 by the close, flow mixed/varied in outrights (EDZ0>418k) and spds (>40k EDZ1=EDH2). Reminder, Dec Eurodollar futures, options expire Fri/Mon. Lead quarterly held surged higher after 3M LIBOR settled -0.00937 to 0.22063% (-0.00525/wk).

- Dec 20 +0.020 at 99.773

- Mar 21 +0.005 at 99.80

- Jun 21 +0.010 at 99.810

- Sep 21 +0.005 at 99.80

- Red Pack (Dec 21-Sep 22) -0.005 to steady

- Green Pack (Dec 22-Sep 23) -0.025 to -0.01

- Blue Pack (Dec 23-Sep 24) -0.035 to -0.025

- Gold Pack (Dec 24-Sep 25) -0.04 to -0.035

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N +0.00013 at 0.08263% (-0.00062/wk)

- 1 Month -0.00087 to 0.14788% (-0.00417/wk)

- 3 Month -0.00937 to 0.22063% (-0.00525/wk)

- 6 Month -0.00263 to 0.25075% (-0.00500/wk)

- 1 Year -0.00137 to 0.33588% (-0.00087/wk)

- Daily Effective Fed Funds Rate: 0.09% volume: $57B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $158B

- Secured Overnight Financing Rate (SOFR): 0.07%, $939B

- Broad General Collateral Rate (BGCR): 0.06%, $360B

- Tri-Party General Collateral Rate (TGCR): 0.06%, $341B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, $1.734B accepted vs. $4.230B submission

- Next scheduled purchases:

- Thu 12/10 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Fri 12/11 1010-1030ET: Tsy 0Y-2.25Y, appr $12.825B

- Fri 12/11 Next forward schedule release at 1500ET

FOREX: GBP Hopeful Ahead of Pivotal Dinner

After several sessions of volatility, GBP traded solidly Wednesday, with the currency rising against most others in G10 as markets took an optimistic stance ahead of a key dinner meeting between UK PM Johnson, EC President vdL and both sides of Brexit negotiators. No real breakthroughs are expected at Wednesday evening's dinner, however markets will be looking for a political impetus to be added to proceedings in order to get some form of deal over the line.

- The USD erased early weakness to trade firmly into the London close. This put most major pairs under pressure and took some of the shine off EUR/USD, which hit new weekly lows just above 1.2050. AUD was the outperformer, with NOK the weakest in G10.

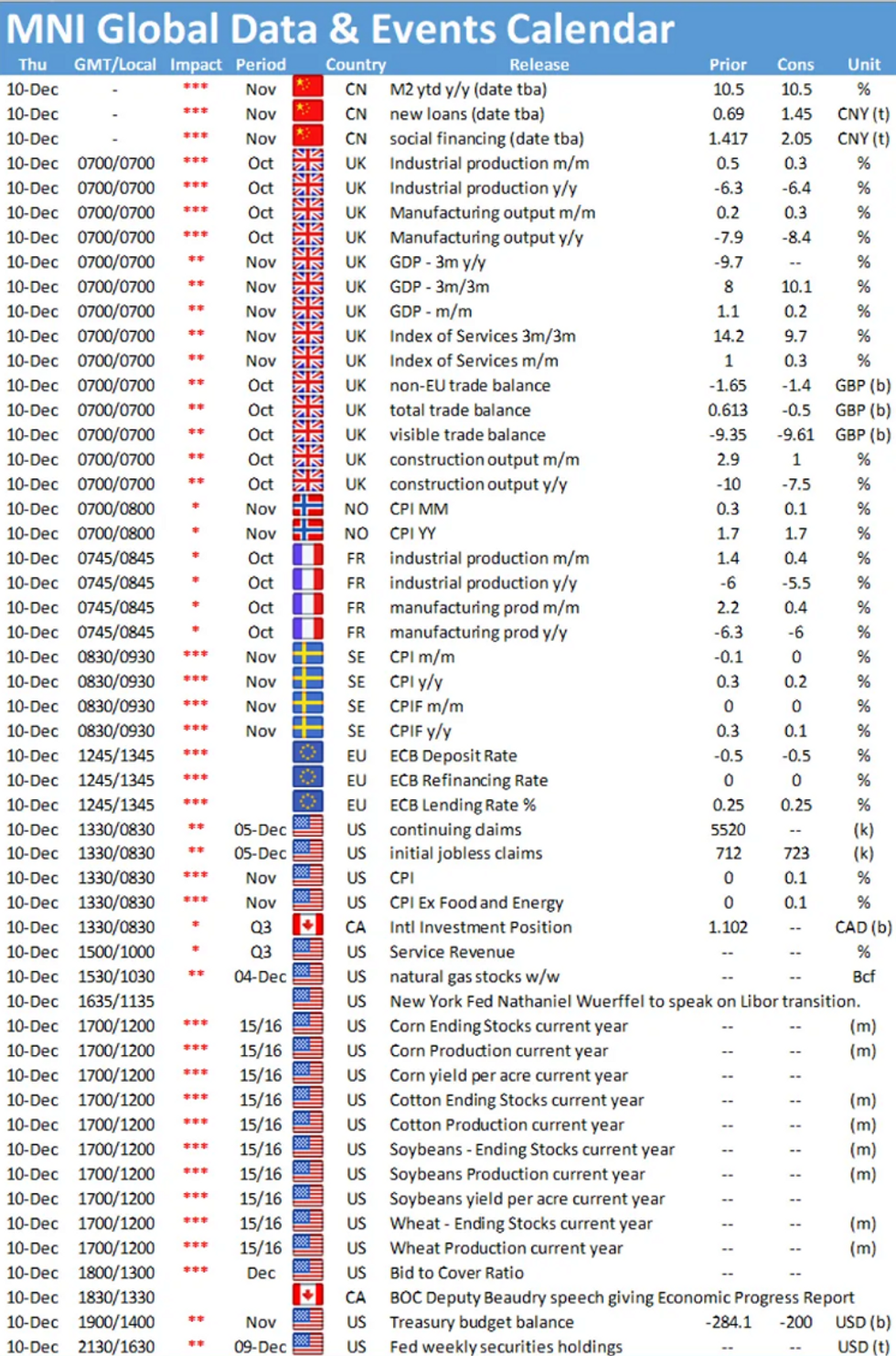

- Focus Thursday turns to the ECB rate decision, at which the bank are expected to 'recalibrate' their policy approach with some sort of tweak to their asset purchase scheme. Weekly US jobless claims and November CPI data are also due.

EGBs-GILTS CASH CLOSE: Yields Pare Rise Ahead Of Brussels Summits, ECB

Bund and Gilt yields descended from highs toward the end of Wednesday's session, having earlier climbed on apparent optimism over a Brexit breakthrough at tonight's dinner between UK's Johnson and EU's von der Leyen.

- Curves flat-to-steeper, periphery spreads a little tighter.

- Of course markets also await the ECB decision Thursday - expected to expand/extend PEPP (contact us if you haven't seen our preview). 2-day European summit starts Thurs, though threat of budget being vetoed looks to have been averted.

- Apart from that, UK GDP and BTP supply the main points on Thursday's docket.

- Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is down 0.1bps at -0.774%, 5-Yr is up 0.1bps at -0.793%, 10-Yr is up 0.2bps at -0.605%, and 30-Yr is up 0.6bps at -0.179%.

- UK: The 2-Yr yield is up 0.1bps at -0.08%, 5-Yr is unchanged at -0.04%, 10-Yr is up 0.4bps at 0.261%, and 30-Yr is up 0.9bps at 0.808%.

- Italian BTP spread down 1bps at 118.7bps

- Spanish bond spread down 1bps at 62.6bps

- Portuguese down 1.3bps at 58.8bps

UP TODAY

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.