-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Hopes of A US Fiscal Deal

MNI ASIA MARKETS ANALYSIS - Hopes of A US Fiscal Deal

US TSYS SUMMARY: Hopes of A Fiscal Deal Rising

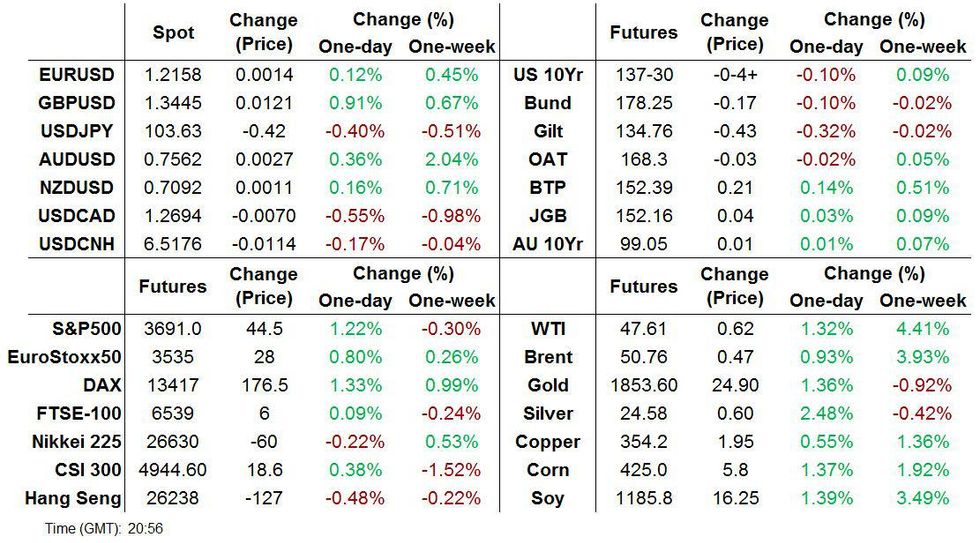

Improving sentiment on the prospect of a US fiscal spending bill, coupled with a positive shift in global tailwinds (rising optimism on the Covid vaccine rollout and an orderly Brexit deal), has propelled equities higher and underpinned the bear steepening of the UST curve.

- Equities started the session on the weak footing, but soon gained ground with momentum building through the afternoon.

- UST yields are up to 3bp higher on the day with the long end of the curve underperforming. The 2s30s spread is 2bp wider. Last yields: 2-year 0.1190%, 5-year 0.3670%, 10-year 0.9113%, 30-year 1.6529%.

- TYH1 hit a session low of 137-26 in the afternoon before pulling back to 137-30.

- Today's data slate was relatively uneventful. Industrial production for November was a touch stronger than expected (0.4% M/M vs 03% survey), while the Empire Manufacturing print for December missed (4.9 vs 6.3).

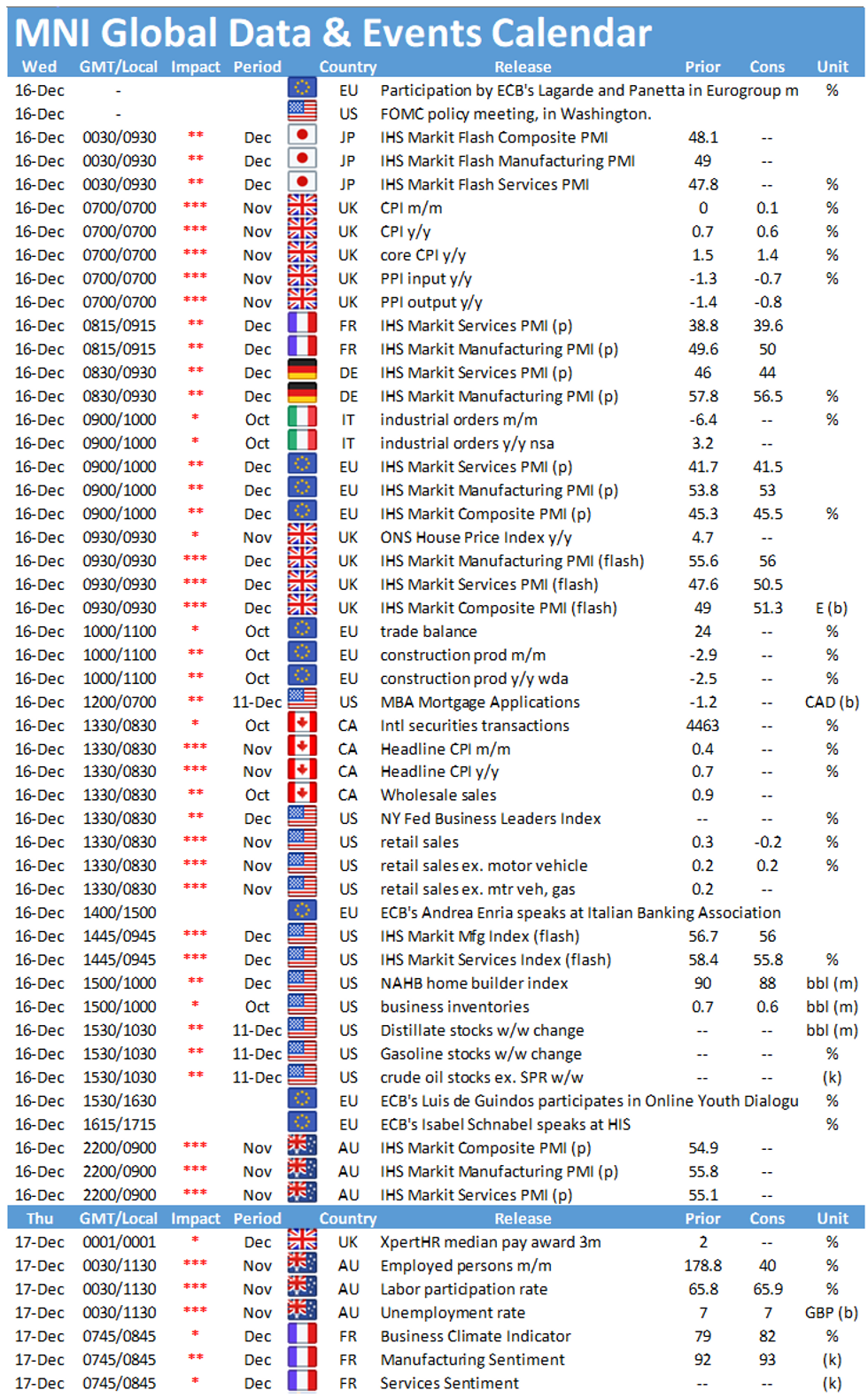

- Looking ahead, tomorrow sees the release of November retail sales data and the flash PMI prints for December.

USD LIBOR FIX

O/N 0.08200 (-0.0005)

1W 0.10200 (0.00375)

1M 0.15250 (-0.00063)

2M 0.17925 (0.00587)

3M 0.22875 (0.0095)

6M 0.25175 (0.00462)

12M 0.33125 (-0.00363)

New York Fed EFFR for prior session (rate, chg from prev day):

- Daily Effective Fed Funds Rate: 0.09%, no change, volume: $51B

- Daily Overnight Bank Funding Rate: 0.08%, no change, volume: $143B

REPO REFERENCE RATES (rate, change from prev. day, volume):

- Secured Overnight Financing Rate (SOFR): 0.08%, no change, $907B

- Broad General Collateral Rate (BGCR): 0.06%, no change, $355B

- Tri-Party General Collateral Rate (TGCR): 0.06%, no change, $331B

NY Fed Operational Purchase (1st of 2)

Fed buys $8.801bn of 2.25-4.5Y Tsys, of $27.675bn submitted.

Next operation later today (1100-1120ET):- 7-20Y Tsys, ~$3.625bn

NY Fed Operational Purchase (2nd of 2)

Fed buys $3.601bn of 7-20Y Tsys, of $7.496bn submitted.

Next operations (both Thursday, skipping Weds due to FOMC):

- Thu 12/17: 20-30Y, ~$1.750bn (1010-1030ET)

- Thu 12/17: 1-7.5Y TIPS, ~$2.424bn (1100-1120ET)

US TSY/ED SUMMARY

Tuesday's options flow included:

- TYF1 137.5p, bought for 09 In 10k

- EDH1 99.87c, bought for 0.75 in 15k

- 0EJ1 100/99.87ps, bought for 1 in 6k

- EDH1 99.82/99.75ps, 1x2, bought for 0.5 in 5k

- EDH1 99.875c, bought for 0.75 in 10k

- EDM2 99.50p x3 vs EDU2 99.75p, bought the Sep2 for 2.5 in 1k

- 2EM1 9962/99.75 vs 3EH1 99.37/99.50 strangle, sold the blue at 1.5 in 1.5k

- 0EH1/3RH1 99.75/99.875 c/s spread sold at 4.5 in 4k (v 99.79, 10d)

EGBs-GILTS CASH CLOSE: A "Big Buzz" On Brexit Sinks Gilts

Gilts had already been having a weak day (in part due to a poor BoE APF result), but plummeted to session lows on a BBC political editor's tweet claiming a "big buzz" among Conservative MPs of a Brexit deal being reached this week.

- This exaggerated the bear steepening move in Gilts (5s30s shot 5bps higher between the 1445GMT APF result and the close). Periphery spreads tighter too as equities rose. In contrast, German curve fairly flat.

- Flash Dec PMIs and UK Nov CPI in focus on Wednesday.

Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is up 1.5bps at -0.756%, 5-Yr is up 1.1bps at -0.787%, 10-Yr is up 0.9bps at -0.611%, and 30-Yr is up 1.1bps at -0.201%.

- UK: The 2-Yr yield is up 3.5bps at -0.054%, 5-Yr is up 3.2bps at -0.029%, 10-Yr is up 3.8bps at 0.26%, and 30-Yr is up 6.4bps at 0.826%.

- Italian BTP spread down 3.1bps at 113bps

- Spanish bond spread down 2.9bps at 59.4bps / Portuguese down 2.6bps at 55.5bps

EUROPE OPTIONS SUMMARY: Short Sterling Upside In Size

Tuesday's options flow included:

- RXG1 177p, bought for 35.5 in 2k

- DUG1 112.30/112.20ps, bought for 2 in 2.5k

- ERH1/ERM1 100.25p calendar, sold the June at 0.25 in 5k

- LM1 100.12/100.25/100.37c fly, bought for1.25 in 10k

- LH1 100p, sold at 5 in circa 21k

- 2RM1 100.62/100.37 RR, sold the call at 2 in 4k (ref 100.55)

- 0LU1 100.12/99.62 RR, bought the call for 4.75 in 10k

- 0LK1 99.87/100/100.25 broken c fly, bought for 1.75 in 2k

- LM1 100.00/100.125/100.25/100.375 call condor bought for 2.5 in 2k

FX OPTIONS: Expiries for Dec16 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1950(E970mln-EUR calls), $1.2000(E1.2bln), $1.2070(E820mln-EUR calls), $1.2100(E1.1bln), $1.2150(E450mln), $1.2200-15(E683mln)

- USD/JPY: Y103.50-60($510mln), Y103.90-104.00($580mln)

- GBP/USD: $1.3190-1.3200(Gbp508mln), $1.3300(Gbp566mln)

- EUR/GBP: Gbp0.9000(E616mln)

- AUD/USD: $0.7450-60(A$1.2bln), $0.7500(A$1.2bln)

- AUD/JPY: Y78.30-35(A$664mln-AUD puts)

- USD/TRY: Try8.50($500mln-USD puts)

EQUITIES: Holding On To Gains

Equity gains have been building steadily through the day, supported by rising optimism on the prospects of a US fiscal bill being agreed.

- The e-mini S&P last traded at 3, 684 off a recent session high of 3,688. The Down Jones has similarly held on to most of the day's gains - last trading at 30,182 off a high of 30,243.

- While the combined US fiscal bill/Covid vaccine rollout/Brexit optimism will keep global risk sentiment supported in the near term, tomorrow's flash PMI estimates are next obvious catalyst for price action.

COMMODITIES: Gaining Ground

Oil continues to grind higher and trades near best levels on the day as markets position for a tentative recovery in global demand. Brent crude trades at USD 50.73/bbl, up from a session low of USD49.78/bbl.

- Copper has similarly rallied on global tailwinds. HGH1 has inched up to USD354/lb up from a low of USD350/lb

- Precious metals have also posted gains through the day with gold trading a touch below the day's high of USD1855/t oz

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.