-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Asia Open: Haggling Over The Federal Spending Bill

EXECUTIVE SUMMARY:

- FED FOREIGN REPO BOOST COULD DRAIN RESERVES (MNI EXCLUSIVE)

- E.U. COUNTRIES WILL OVERRULE EUROPEAN PARLIAMENT TO STOP NO DEAL BREXIT (TELEGRAPH)

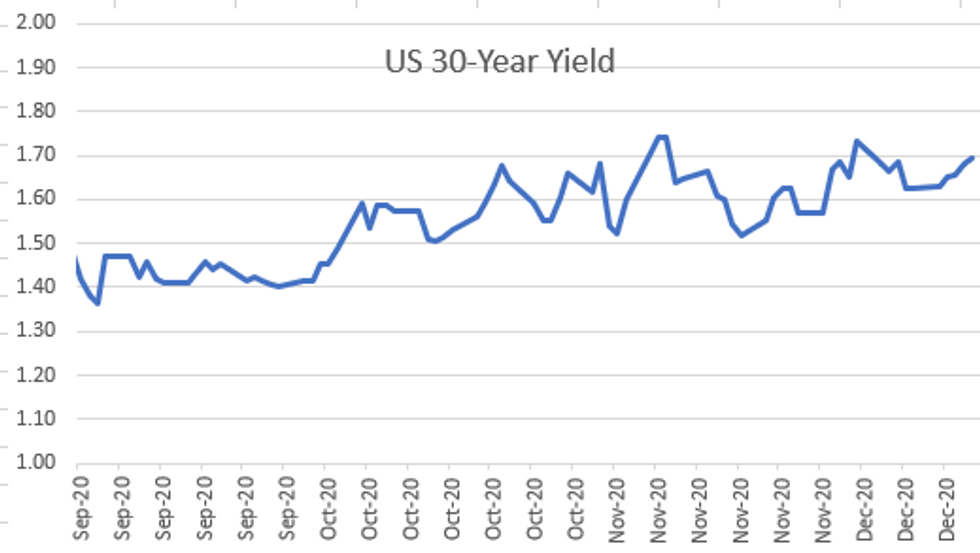

Fig. 1:

NEWS:

FED (MNI EXCLUSIVE): The Federal Reserve could explore offering higher returns on its USD190 billion foreign repo pool next year, as it seeks ways to mitigate a surge in reserves threatening distortions in overnight rates, former Fed officials told MNI. For full article contact sales@marketnews.com

EU-UK (TELEGRAPH): EU leaders will overrule the European Parliament if it refuses to ratify the Brexit trade agreement before the end of year no deal deadline, diplomatic sources in Brussels said on Friday. Senior MEPs yesterday warned they would not vote on the UK-EU deal, unless it had the full text of the agreement by midnight on Sunday. But EU diplomats said their governments would step in to prevent a no deal on January 1, if an agreement was found on fishing and state subsidies before the end of the Brexit transition period.

BOE (BBG): The Bank of England should be prepared to add monetary stimulus including negative interest rates to complete the economic recovery from the pandemic, according to policy maker Gertjan Vlieghe. While vaccines may mean current measures are enough to get through the health crisis, the hit to jobs and investment -- combined with the need to deal with Brexit "whether there is a deal or not" -- could mean the recovery peters out sooner than desired, the Monetary Policy Committee member said in a Bloomberg interview on Friday. "If we go back close to where we were before Covid hit, but not quite all the way, then that's not good enough," he said.

CHINA: China's macro economic policies will remain broadly unchanged in 2021, with proactive fiscal prudent monetary policies to continue with the necessary support for the recovery and no sharp policy turns, Xinhua News Agency reported on Friday following the conclusion of the Central Economic Work Conference, the body setting the tone of economic work for next year.

ITALY (MNI EXCLUSIVE): Attempts by Italian Prime Minister Giuseppe Conte to overcome a political squabble over tens of billions of euros in emergency European Covid funds have been only partially successful, and political sources told MNI a walk-out by the small Italia Viva party could still bring down his government in January. For full article contact sales@marketnews.com

ECB: ECB Executive Board member Frank Elderson has been proposed as Vice-Chair of the ECB's Supervisory Board, the central bank said Friday. Elderson, who joined the central bank's EB on Tuesday, would succeed Yves Mersch on the Supervisory Board. Mersch's term ended on 14 December together with his term as member of the EB.

CANADA (MNI INTERVIEW): Canadian firms are resilient to a strengthening currency and focused on bigger hurdles like rebuilding orders lost in the pandemic and U.S. and Chinese protectionism, the federal export bank's deputy chief economist told MNI, a contrast to the central bank's misgivings.

CANADA: The Bank of Canada said Friday it will make a "phased return" to standard bond auction terms by June of next year. The first change will come Jan. 11 when the competitive bidding limit will decline to 35% from 40%, according to a statement.

DATA:

* MNI: CANADIAN OCT RETAIL SALES +0.4%; SALES EX-AUTOS/PARTS -0.0%

* CANADA OCT RETAIL SALES EX-AUTOS/PARTS-GASOLINE +0.3%

* MNI: CANADA FLASH NOV SALES 'RELATIVELY UNCHANGED': STATCAN

* MNI: CANADA OCT BUDGET DEFICIT CAD18.5B VS YEAR AGO CAD3.3B

* US DATA: Q3 Current Account -USD178.5B

US TSYS SUMMARY: Haggling Over The Federal Spending Bill

- USTs lacked direction through the session and trade marginally below yesterday's closing levels. The UST curve has steepened on the back of the longer end trading weaker.

- Last yields: 2-year 0.121%, 5-year 0.3782%, 10-year 0.9429%, 30-year 1.6925%.TYH1 trades at 137-25, towards the bottom end of the day's range (L: 137-23+ / H: 137-30+).

- Congress continues to debate the terms of a federal spending bill with Republican Pat Toomey pushed to include a provision that would limit the Federal Reserve's pandemic-related lending.

- The Fed's Kaplan stated that purchasing bonds for too long could bring financial stability risks. Meanwhile, Richard Clarida suggested that while the economic recovery had someway to go, he does think there will be a double-dip recession.

- Vice President Mike Pence received the Covid vaccine today with President-elect Joe Biden reportedly following suit on Monday.

USD LIBOR FIX

- O/N 0.08438 (-0.001)

- 1W 0.10113 (-0.00025)

- 1M 0.14375 (-0.00788)

- 2M 0.19038 (-0.0035)

- 3M 0.23575 (-0.00288)

- 6M 0.25850 (-0.0015)

- 12M 0.33400 (0.00012)

New York Fed EFFR for prior session (rate, chg from prev day):

- Daily Effective Fed Funds Rate: 0.09%, no change, volume: $58B

- Daily Overnight Bank Funding Rate: 0.08%, no change, volume: $153B

REPO REFERENCE RATES (rate, change from prev. day, volume):

- Secured Overnight Financing Rate (SOFR): 0.09%, no change, $922B

- Broad General Collateral Rate (BGCR): 0.07%, no change, $355B

- Tri-Party General Collateral Rate (TGCR): 0.07%, no change, $328B

FOREX: Sterling Sloppy Into Friday Close

Having outperformed for much of the first half of the week, GBP spiraled into the Friday close as markets pondered the likelihood of a deal by the end of the weekend. Betting markets had trimmed the implied probability of a deal by year's end by a decent margin into the Friday close, mirroring the pullback in the pound - the poorest performer in G10.

- The greenback fared better, as softer equities state-side prompted some risk-off flow. The bounce in the dollar was modest, at best, however as the USD index still trades in close proximity to the multi-year lows posted Thursday at 89.730.

- Markets should thin out in the coming week, with the proximity to Christmas holidays sapping activity and volumes.

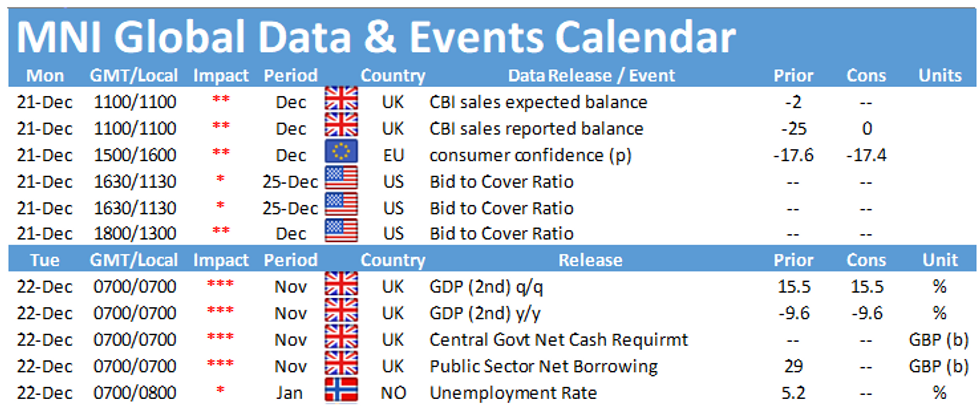

- Another read of US GDP for Q3, consumer confidence data and existing/new home sales are the only real releases. Central bank decisions come from Turkey.

EGBs-GILTS CASH CLOSE: Bull Flattening As Brexit Talks Hit "Final Hours"

Gilts rallied with bull flattening in the curve as traders took heed of warnings on both sides of the Channel that we were entering the "final hours" of talks to avert a no-deal Brexit.

- Bunds had bear steepened in the morning but this eventually reversed on Brexit's gravity.

- Periphery spreads traded wider.

- After such a busy week, it's a relatively thin schedule for the upcoming week ahead of the Christmas holiday - most attention will be on Brexit.

Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is unchanged at -0.725%, 5-Yr is up 0.2bps at -0.744%, 10-Yr is down 0.1bps at -0.571%, and 30-Yr is down 0.5bps at -0.16%.

- UK: The 2-Yr yield is down 3.3bps at -0.084%, 5-Yr is down 3.6bps at -0.042%, 10-Yr is down 3.8bps at 0.249%, and 30-Yr is down 4.1bps at 0.806%.

- Italian BTP spread up 2.6bps at 113.6bps

- Spanish bond spread up 1.7bps at 61.6bps/Portuguese spread up 2.5bps at 60.6bps

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.