-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA OPEN: Stimulus Bill Details Posted, Vote Monday Night

EXECUTIVE SUMMARY

- MNI POLICY: U.S. Credit Access, Demand Plunge- NY Fed Survey

- MNI INTERVIEW: Business Scarring Under Way, Minn. Fed Analyst

- EU GRANTS MARKET AUTHORIZATION TO PFIZER-BIONTECH VACCINE, Bbg

- VON DER LEYEN: EU VACCINATIONS BEGIN DECEMBER 27, 28, 29, Bbg

- WHO'S TEDROS: NO SIGNS NEW VARIANT CAUSES MORE SEVERE DISEASE, Bbg

US

US Congress stimulus spending bill text released, Link:https://docs.house.gov/floor/Default.aspx?date=202...

US: Stimulus Bill Details, From Washington Post:

- The legislation includes stimulus checks for millions of Americans of up to $600 per person.

- The size of that benefit would be reduced for people who earned more than $75,000 in 2019 and disappear altogether for those who earned more than $99,000.

- The stimulus checks would provide $600 per adult and child, meaning a family of four would receive $2,400 up to a certain income.

- Congress would also extend federal unemployment benefits of up to $300 per week, which could start as early as Dec. 27.

- "I don't think there's any question there is scarring going on. We don't have a great handle on how many businesses have gone out of business," Wirtz said in an interview on Friday. "Exactly where the scarring is, we're going to learn over time." For more see MNI Policy MainWire at 1320ET.

- Application rates for any kind of credit dropped to a new series low in the latest figures covering October. The most recent rate of 34.6% is down 11 percentage points since the pandemic struck. For more see MNI Policy MainWire at 1100ET.

OVERNIGHT DATA

US DATA: Chicago Fed November Nat'l Activity Index Weaker-Than-Expected

- Chicago Fed National Activity Index comes in at +0.27 in November, vs +1.01 in October (revised from +0.83) and +0.75 expected. The 3-month moving average decreased to +0.56 from +0.85.

- Chicago Fed notes that the CFNAI Diffusion index fell to +0.53 in Nov from +0.62 in Oct: "Forty-nine of the 85 individual indicators made positive contributions to the CFNAI in November, while 36 made negative contributions. Twenty indicators improved from October to November, 64 indicators deteriorated, and one was unchanged. Of the indicators that improved, five made negative contributions."

- "The increase reflects widespread growth, particularly in the motor vehicle and motor vehicle parts and accessories, and the building material and supplies subsectors"

- Survey had a weighted response rate of 55% vs average of 89% over last 12m

- Statistics Canada gave report Monday from Ottawa

- The official sales figure for Oct was also +1.0%, which was the 6th straight increase, and 3.3% greater than pre-pandemic level

MARKETS SNAPSHOT

- DJIA up 28.48 points (0.09%) at 30193.52

- S&P E-Mini Future down 24 points (-0.65%) at 3680

- Nasdaq down 38.3 points (-0.3%) at 12711.51

- US 10-Yr yield is down 0.8 bps at 0.9379%

- US Mar 10Y are up 1/32 at 137-25

- EURUSD down 0.0013 (-0.11%) at 1.2247

- USDJPY up 0.07 (0.07%) at 103.35

- WTI Crude Oil (front-month) down $1.36 (-2.77%) at $47.74

- Gold is down $5.37 (-0.29%) at $1876.77

- European bourses closing levels:

- EuroStoxx 50 down 97.06 points (-2.74%) at 3448.68

- FTSE 100 down 112.86 points (-1.73%) at 6416.32

- German DAX down 384.21 points (-2.82%) at 13246.3

- French CAC 40 down 134.5 points (-2.43%) at 5393.34

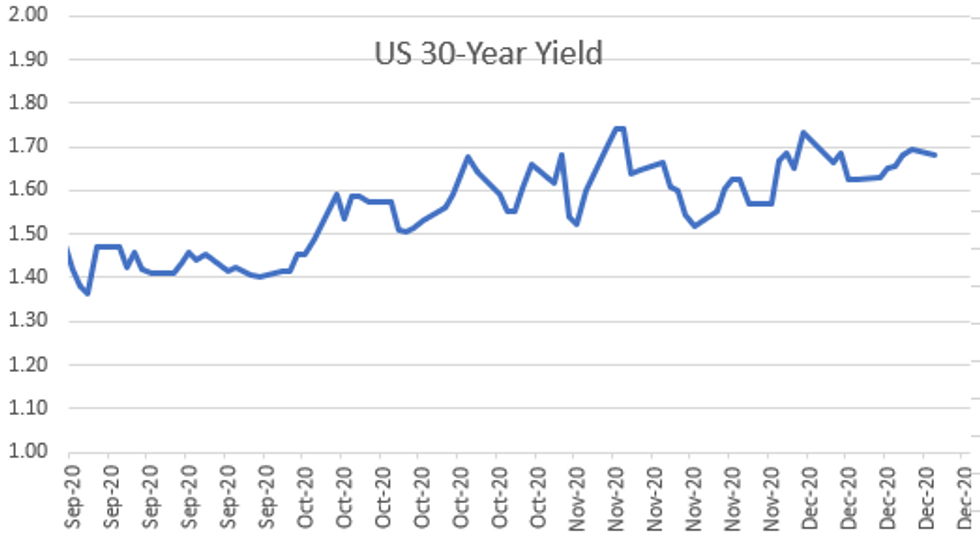

US TSY SUMMARY: Rates Well Off Pre-Open Highs

Rates surged higher in the lead-up to the NY open, risk-off largely driven by a new new virulent strain of COVID-19 reported in in south-east England and London, coupled w/lack of substantive progress in BREXIT negotiations.

- Tsys held well off late overnight highs while equities reacted negatively to midmorning headline: "U.S. MISSILE-FIRING SUBMARINE ENTERS PERSIAN GULF, NAVY".

- That said, risk-off bid for rates gradually evaporated, extending session lows into late trade after Congress released details of stimulus spending bill to be voted on Monday night. Yield curves held flatter levels amid moderate buying/position squaring after the bell.

- Better 20Y Bond Auction Re-Open: US Tsy $24B 20Y bond auction re-open (912810ST6) stopped through with high yield of 1.470% (1.422% last month) vs. 1.478% WI, on a bid/cover 2.39% (2.27% previous).

- The 2-Yr yield is unchanged at 0.121%, 5-Yr is down 0.2bps at 0.3798%, 10-Yr is down 0.8bps at 0.9379%, and 30-Yr is down 1.3bps at 1.679%.

US TSY FUTURES CLOSE: Early Risk-Off Bid Evaporates

Tsys held mostly higher levels after the bell, but well off pre-open highs, perhaps a short-sighted risk-off unwind amid expectations the stimulus bill will be passed in Congress later Monday. Early risk-off bid tied to new virulent COVID strain reported in London overnight (not to mention no progress in BREXIT talks).

Yld curves flatter after the bell:

- 3M10Y -1.415, 84.842 (L: 79.121 / H: 86.172)

- 2Y10Y -1.162, 81.163 (L: 76.833 / H: 82.292)

- 2Y30Y -1.815, 155.064 (L: 150.613 / H: 156.678)

- 5Y30Y -1.337, 129.383 (L: 127.568 / H: 131.072)

- Current futures levels:

- Mar 2Y up 0.12/32 at 110-15.125 (L: 110-14.87 / H: 110-16)

- Mar 5Y down 0.25/32 at 125-31.25 (L: 125-30.5 / H: 126-06)

- Mar 10Y up 1.5/32 at 137-25.5 (L: 137-23 / H: 138-08)

- Mar 30Y up 13/32 at 172-17 (L: 172-05 / H: 173-24)

- Mar Ultra 30Y up 1-1/32 at212-7 (L: 211-12 / H: 214-13)

US EURODOLLAR FUTURES CLOSE: Well Off Early Session Highs

Whites through Reds held largely steady after the bell, Greens-Golds steady to marginally higher -- well off broadly higher levels heading into the open (Golds were as much as +0.080). New lead quarterly EDH1 remained offered after 3M LIBOR set' +0.00913 to 0.24488% (+0.01925 net last wk). Current levels:

- Mar 21 -0.005 at 99.825

- Jun 21 steady at 99.830

- Sep 21 -0.005 at 99.820

- Dec 21 steady at 99.785

- Red Pack (Mar 22-Dec 22) -0.005 to +0.005

- Green Pack (Mar 23-Dec 23) +0.005 to +0.010

- Blue Pack (Mar 24-Dec 24) steady to +0.005

- Gold Pack (Mar 25-Dec 25) steady to +0.005

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N +0.00025 at 0.08463% (+0.00113 net last wk)

- 1 Month +0.00150 to 0.14525% (-0.01488 net last wk)

- 3 Month +0.00913 to 0.24488% (+0.01925 net last wk)

- 6 Month +0.00200 to 0.26050% (+0.00975 net last wk)

- 1 Year -0.00150 to 0.33250% (-0.00188 net last wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $57B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $145B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.09%, $943B

- Broad General Collateral Rate (BGCR): 0.07%, $356B

- Tri-Party General Collateral Rate (TGCR): 0.07%, $332B

- (rate, volume levels reflect prior session)

FED: NY Fed Operational Purchase

- TIPS 7.5Y-30Y, $1.199B accepted vs. $1.878B submitted

- Next scheduled purchases:

- Tue 12/22 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Wed 12/23 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Mon 12/28 Next forward schedule release at 1500ET

PIPELINE: Issuance Grinding To Halt Into Year End

- Date $MM Issuer (Priced *, Launch #)

- 12/21 No new issuance Monday; $52.24B total for month

- -

- 12/18-16 No new issuance Wed-Fri, $1.15B/wk

- $750M Priced Tuesday

- 12/15 $750M *Berry Global 5Y +120-

- $1.4B Priced Monday

- 12/14 $1.4B *Microchip 3Y +80

FOREX: Sterling Slides as Border Risks, COVID Threat Circle

GBP was comfortably the poorest performer in G10 Monday, with the currency slipping against all others in G10 after a new strain of COVID-19 was announced to be spreading in south-east England and London. This, twinned with lack of progress in Brexit negotiations and a disrupted flow of goods between the UK and France led to broad-based losses.

- Equities had a choppy session, with broad-based losses noted across European and US markets. Renewed fears over COVID, profit-taking ahead of the Christmas break and a less-than-impressive debut for Tesla in the S&P500 all contributed.

- NOK also traded poorly, with subdued oil prices largely responsible, falling against all others with the exception of GBP. USD, JPY traded the strongest on Monday.

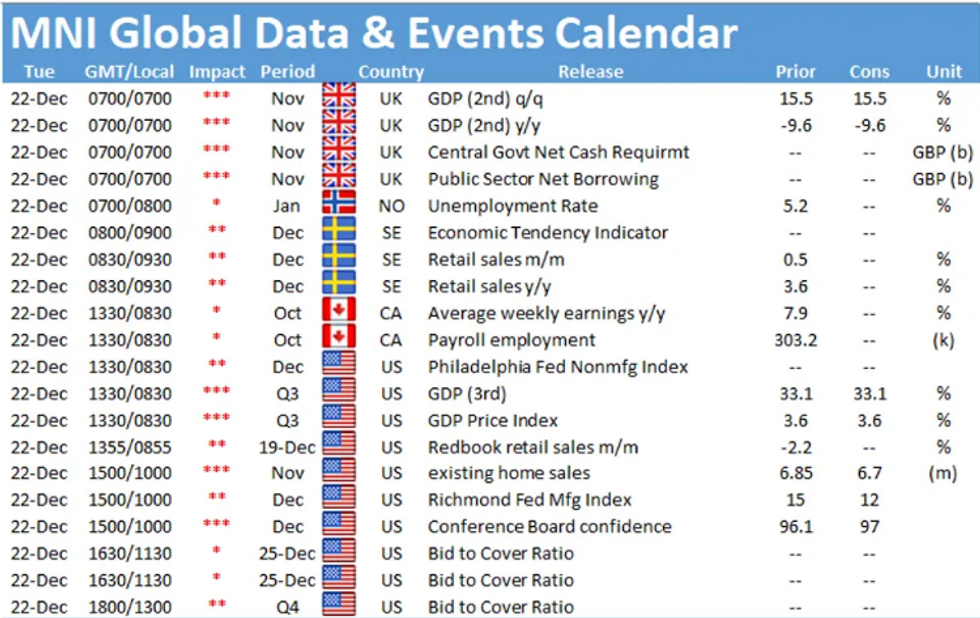

- Focus Tuesday turns to the final read of UK & US GDP for Q3 and December consumer confidence numbers

EGBs-GILTS CASH CLOSE: Flattening Reverses As U.K. Looks Isolated

The start of the week was dominated by COVID, both on fears of a mutant strain leading to severe lockdowns and travel bans for the U.K., and on the hope of a vaccine.

- COVID fears, plus hard Brexit looming, sparked strong bull flattening in the morning. Periphery spreads widened. But the moves largely reversed, starting w news the EMA had approved the use of the Pfizer-Biontech vaccine.

- Re the mutant strain, afternoon reports that E.U. would consequently impose a bloc-wide travel ban w the U.K. until midnight Tuesday, though easing the blow, similar reports said freight traffic would still be able to come to the U.K.

- As we came to the cash close, U.K. P.M. Johnson was due to speak, having convened the Cobra committee in the afternoon on the situation.

- Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is down 1.1bps at -0.736%, 5-Yr is down 0.9bps at -0.753%, 10-Yr is down 0.9bps at -0.58%, and 30-Yr is down 1.6bps at -0.176%.

- UK: The 2-Yr yield is down 2.3bps at -0.107%, 5-Yr is down 3.8bps at -0.08%, 10-Yr is down 4.4bps at 0.205%, and 30-Yr is down 5.2bps at 0.754%.

- Italian BTP spread up 1.3bps at 114.9bps / Spanish spread up 2bps at 63.6bps

UP TODAY

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.