-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Virus Cares Underpin Tsys

EXECUTIVE SUMMARY

- MNI EXCLUSIVE: Congress Curbs Fed Backstop, Defers Wider Fight

- MNI BRIEF: Banks Eye Better Treasury Transactions- Fed Survey

- MNI BRIEF: Fed Sets Out To Replace IOER, Simplify Rate Formula

- TRUMP SIGNS FEDERAL SPENDING-STIMULUS LEGISLATION, Bbg

- NO BREAKTHROUGH YET IN BREXIT TALKS, EU DIPLOMAT SAYS, Bbg

- STILL NO AGREEMENT ON FISHERIES IN BREXIT TALKS: EU DIPLOMAT, Bbg

US

US: U.S. lawmakers' fiscal package blocks the Federal Reserve from re-opening four emergency lending facilities announced in March but stops short of blanket restraints on its crisis powers, deferring a bigger political fight over tackling the economic slump, former Congressional and Fed officials tell MNI.

- "The language of the stimulus bill regarding Fed facilities is less restrictive than feared -- only facilities that are 'the same' as those shut down can't be restarted, except for TALF," said Roberto Perli, a former Fed board economist now at Cornerstone Macro. TALF is the Term Asset-Backed Securities Lending Facility. For more see MNI Policy MainWire at 1117ET.

FED: The U.S. Federal Reserve announced Tuesday it is taking a formal step to take the interest on required reserves rate and the interest on excess reserves rate and replacing them with a single "interest on reserve balances" ("IORB") rate. For more see MNI Policy MainWire at 1500ET.

OVERNIGHT DATA

US DATA: Q3 GDP 33.4% in Third Estimate

- Third estimate of 3Q GDP was revised up to 33.4%,, slightly above expectations for an unrevised 33.1%.

- That was primarily driven by upward revisions to PCE and nonresidential fixed investment, which were partially offset by declines in federal and state and local government spending, the Bureau of Economic Analysis said Tuesday. Imports were also revised up.

- PCE inflation unrevised at 3.7%, core 3.4%.

US DEC PHILADELPHIA FED NONMFG INDEX -26.8US TSY OPTIONS: Early Trade

US REDBOOK: DEC STORE SALES -0.9% V NOV THROUGH DEC 19 WK

US REDBOOK: DEC STORE SALES +3.7% V YR AGO MO

US REDBOOK: STORE SALES +6.5% WK ENDED DEC 19 V YR AGO WK

US DATA: U.S. Nov Existing Home Sales -2.5% to 6.69 Million

- Sales fell in November for the first time in five months, National Association of Realtors said Tuesday. Housing a bright spot during the pandemic-led economic slump. Sales of previously-owned homes +25.5% YOY:

- NAR: US NOV EXISTING HOMES SALES -2.5% MOM TO 6.69M SAAR

- NAR: FIRST DECLINE AFTER FIVE STRAIGHT MONTHS OF SALES INCREASES

- NAR: HOME SALES +25.8% YOY; INVENTORY -22% YOY, -9.9% MOM

- NAR: MEDIAN HOME PRICE +14.6% YOY TO $310,800; 105 STRAIGHT MTHS

- NAR: DAYS ON MARKET 21 DAYS, SERIES LOW; 'VERY SWIFT MARKET'

- NAR'S YUN: 'HOMES SALES IN 2020 EASILY BEST YEAR SINCE 2006'

US CONF BOARD CONSUMER CONFIDENCE 88.6 IN DEC V NOV 92.9

CANADA DATA: Oct Payroll Employment +1.2%, 6.1% Below Pre-Pandemic

- Payroll employment +2.1M from June-Sept, still down 1.0M from before pandemic

- The benchmark Labour Force Survey shows employment through Nov still down 3.3% or 636k.

- Payroll survey "excludes the self-employed, owners and partners of unincorporated businesses and professional practices, and employees in the agricultural sector."

- Payroll hours worked +0.3% in Oct vs Sept +2.0%; now 5.4% below pre-pandemic from gap of 16.6% in May

- Job gains likely to slow as provinces tightened health restrictions towards end of year.

MARKET SNAPSHOT

- DJIA down 195.57 points (-0.65%) at 30024.6

- S&P E-Mini Future down 7.25 points (-0.2%) at 3676.5

- Nasdaq up 64.9 points (0.5%) at 12789.23

- US 10-Yr yield is down 1.7 bps at 0.918%

- US Mar 10Y are up 7/32 at 137-31.5

- EURUSD down 0.0085 (-0.69%) at 1.2154

- USDJPY up 0.36 (0.35%) at 103.7

- WTI Crude Oil (front-month) down $1.05 (-2.19%) at $46.89

- Gold is down $16.95 (-0.9%) at $1861.47

- European bourses closing levels:

- EuroStoxx 50 up 48.81 points (1.42%) at 3497.49

- FTSE 100 up 36.84 points (0.57%) at 6453.16

- German DAX up 171.81 points (1.3%) at 13418.11

- French CAC 40 up 73.52 points (1.36%) at 5466.86

US TSY SUMMARY: Tsys Near Highs, COVID Variant More Rapidly Transmissible

Rates extended highs across the curve into the close as virus concerns at the start of winter gained traction.

- Tsys have quietly climbed back to overnight highs by midmorning, anemic volumes slow to improve. "Don't be short a quiet market," one trading desk cautions, keeping a wary eye on Covid data, stimulus bill, geo-pol related headline risks.

- By midday, Tsy futures extended session highs, risk-off measure with equities nearing overnight lows, apparently on the back of latest CDC headlines regarding new virus headlines. Trading desks suggested algos were keying in on "more rapidly transmissible" variant. Risk-off support continued on light volumes into the close (TYH appr 710k).

- No react to decent round of data (GDP, Cons Conf, Existing Home Sales), Covid-related headlines tempered slightly by stimulus relief passing Congress late Monday, still await Pres Trump signature today.

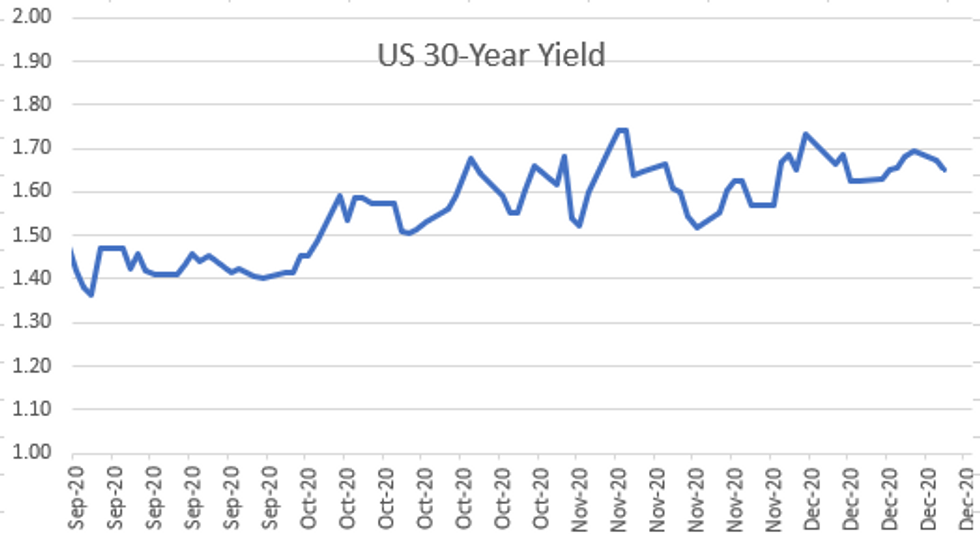

- US Tsy $15B 5Y-TIPS auction re-open (9127962Q1), yields -1.575% (compared to -1.320% prior) vs. -1.545%% WI; 2.86 bid/cover vs. 2.66 prior. The 2-Yr yield is down 0.4bps at 0.1169%, 5-Yr is down 1.8bps at 0.3622%, 10-Yr is down 1.8bps at 0.9164%, and 30-Yr is down 2.3bps at 1.6496%.

MONTH-END EXTENSIONS: Preliminary Bloomberg-Barclays US Month-End Index Extensions

Forecast summary compared to the avg increase for prior year and the same time in 2019. TIPS -0.03Y; Govt inflation-linked, -0.03.

| Estimate | 1Y Avg Incr | Last Year | |

| US Tsys | 0.09 | 0.09 | 0.07 |

| Agencies | 0.06 | 0.06 | 0.09 |

| Credit | 0.06 | 0.09 | 0.07 |

| Govt/Credit | 0.07 | 0.09 | 0.07 |

| MBS | 0.09 | 0.05 | 0.09 |

| Aggregate | 0.08 | 0.08 | 0.06 |

| Long Gov/Cr | 0.07 | 0.09 | 0.06 |

| Iterm Credit | 0.04 | 0.08 | 0.06 |

| Interm Gov | 0.09 | 0.08 | 0.07 |

| Interm Gov/Cr | 0.07 | 0.08 | 0.06 |

| High Yield | 0.08 | 0.08 | 0.09 |

US TSY FUTURES CLOSE:

Tsys trading just off late session highs after the bell, trading desks suggested algos were keyed in on "more rapidly transmissible" virus variant, risk-off tone weighing on equities (ESH1 -10.0). Yld curves bull flattening:

- 3M10Y -1.405, 83.69 (L: 81.163 / H: 84.931)

- 2Y10Y -1.053, 79.909 (L: 79.209 / H: 81.7)

- 2Y30Y -1.6, 153.195 (L: 152.795 / H: 155.602)

- 5Y30Y -0.608, 128.388 (L: 128.095 / H: 129.662)

- Current futures levels:

- Mar 2Y up 0.37/32a at 110-15.375 (L: 110-15 / H: 110-15.5)

- Mar 5Y up 2.5/32 at 126-1.75 (L: 125-31 / H: 126-02.5)

- Mar 10Y up 6/32 at 137-30.5 (L: 137-24.5 / H: 138-00)

- Mar 30Y up 20/32 at 173-0 (L: 172-14 / H: 173-03)

- Mar Ultra 30Y up 1-9/32 at 213-5 (L: 212-00 / H: 213-12)

US EURODLR FUTURES CLOSE: Long End Tapping Late Session Highs

Whites trading steady to modestly higher in Reds-Golds after the bell. Lead quarterly EDH1 back to steady after 3M LIBOR set' -0.00675 to 0.23813% (+0.00238/wk). Current levels:

- Mar 21 steady at 99.825

- Jun 21 steady at 99.830

- Sep 21 steady at 99.825

- Dec 21 steady at 99.785

- Red Pack (Mar 22-Dec 22) +0.010

- Green Pack (Mar 23-Dec 23) +0.010 to +0.020

- Blue Pack (Mar 24-Dec 24) +0.020-0.025

- Gold Pack (Mar 25-Dec 25) +0.025-0.030

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N +0.00050 at 0.08513% (+0.00075/wk)

- 1 Month -0.00200 to 0.14325% (-0.00050/wk)

- 3 Month -0.00675 to 0.23813% (+0.00238/wk)

- 6 Month +0.00225 to 0.26275% (+0.00425/wk)

- 1 Year +0.00475 to 0.33725% (+0.00325/wk)

- Daily Effective Fed Funds Rate: 0.09% volume: $57B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $145B

- Secured Overnight Financing Rate (SOFR): 0.09%, $922B

- Broad General Collateral Rate (BGCR): 0.07%, $359B

- Tri-Party General Collateral Rate (TGCR): 0.07%, $329B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, $1.735B accepted vs. $4.478B submitted

- Next scheduled purchase:

- Wed 12/23 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Mon 12/28 Next forward schedule release at 1500ET

PIPELINE: Still No Issuance For Week

- Date $MM Issuer (Priced *, Launch #)

- 12/22 No new issuance Tuesday; $52.24B/month

- 12/21 No new issuance Monday

FOREX: USD Rebounds Further, But No Breakout Yet

The greenback was comfortably the best performer in G10 Tuesday, helping the USD index to recover further off the early December lows at 89.730. There was little sign of a recovery in risk appetite, with US equities sold off the overnight highs to trade lower in cash markets.

- GBP had another bumpy session, with the ebb and flow of Brexit headlines still responsible for GBP volatility. GBP/USD initially at and around the Monday highs, but began to sell-off as the EU confirmed it had rejected the latest UK proposals on fisheries, leaving the clock still ticking before any pre-Christmas deal can be struck.

- USD, JPY were the strongest in G10, SEK, NOK and NZD traded poorly.

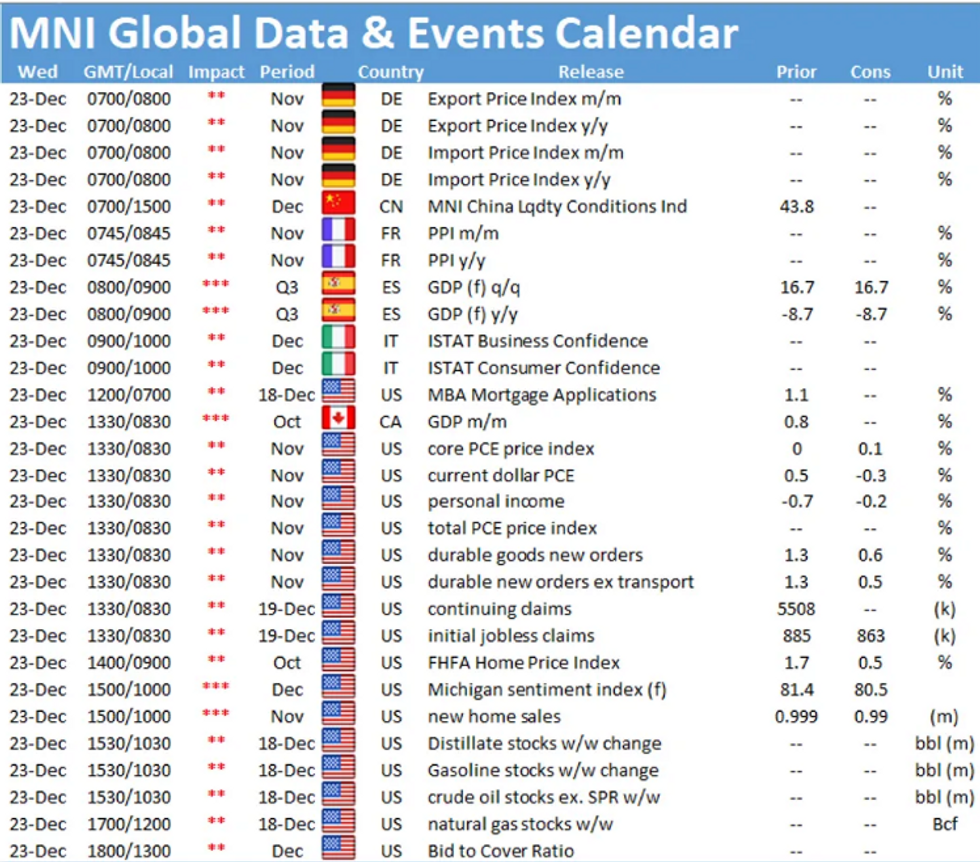

- Focus turns to Canadian GDP, US durable goods orders, personal income/spending and the early release of weekly jobless claims on Wednesday. There remain no central bank speakers of note.

EGBs-GILTS CASH CLOSE: And Still We Wait For A Brexit Breakthrough

Gilt and Bund yields finished near session lows, reversing the rises they incurred by midday. Periphery spreads slightly wider, with the risk tone mixed (equities up but EUR and GBP down).

- Competing headlines on whether the UK and EU were close to agreeing the fishing portion of the deal made up most of the intrigue overnight/this morning. Barnier's brief to ambassadors in the afternoon reportedly portrayed progress but with the two sides remain apart on fish and level playing field provisions.

- Only data Wednesday is Italy confidence; otherwise a quiet slate overall. Brexit and COVID developments likely still the focus.

- Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is unchanged at -0.736%, 5-Yr is down 0.9bps at -0.762%, 10-Yr is down 1.5bps at -0.595%, and 30-Yr is down 2.2bps at -0.198%.

- UK: The 2-Yr yield is down 2.6bps at -0.133%, 5-Yr is down 2.6bps at -0.106%, 10-Yr is down 2.2bps at 0.183%, and 30-Yr is down 2.1bps at 0.733%.

- Italian BTP spread up 0.1bps at 115bps / Spanish bond spread up 0.9bps at 64.5bps

- Portuguese PGB spread up 1.1bps at 63bps

UP TODAY:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.