-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: House To Vote: $2K Upsized Relief, Veto Override

EXECUTIVE SUMMARY:

MNI INTERVIEW: BOE Policy To Regain Traction As Covid EbbsMNI DATA IMPACT: US Spending Expectations Highest In 4 Years

MNI BRIEF: Dallas Fed Region Manufacturing Activity Picks Up

US

US TSYS: House Vote Update, Tweet from CSPAN's Bryan Caplan:

- HOUSE AT 4PM TODAY WILL BEGIN DEBATE ON $2,000 DIRECT PAYMENTS BILL FOLLOWED BY NDAA VETO OVERRIDE WITH THE ONLY VOTES OF THE DAY BEGINNING AS EARLY AS 5PM ET.

US TSYS: 2021: Tsy Negative Returns Call, 5th On Record

Bloomberg's chief US rates strategist Ira Jersey posits "Treasury returns in 2021 could be negative for only the fifth time since index inception."

- If our base scenario is realized and the curve bear-steepens, even on a relatively modest basis, long bonds could lose 18% in total return.

- The front end, however, would experience a very small negative total return. Such moves could see the Bloomberg Barclays Treasury Index fall more than 3%, perhaps approaching the worst annual loss on record.

- As yields rose in past interest-rate cycles, coupon income was able to absorb much of the price decline of bonds. However, with yields so low, there's little margin for error.

- On a risk-weighted basis, the possible curve steepening would still cause the long end to underperform, and the belly (read five-year sector) would still do better than long maturities

EUROPE

UK: UK monetary policy will regain effectiveness in providing stimulus as mass Covid vaccinations and the ebbing of the pandemic restore normal economic interactions, the head of macroeconomic policy at think-tank The Resolution Foundation told MNI.

- The enforced squeeze on supply and income loss in social spending sectors due to Covid, coupled with a surge in savings, have disarmed monetary policy, but this should regain traction as the economy emerges into a more typical downturn, James Smith said in an interview, noting that demand for monetary stimulus in the recovery phase will be strong. For more see MNI Policy Mainwire at 0443ET.

OVERNIGHT DATA

Dallas Fed Manufacturing Activity falls to 9.7 vs. 12.0 in November (10.2 est).

MARKETS SNAPSHOT

Key market levels in late NY trade

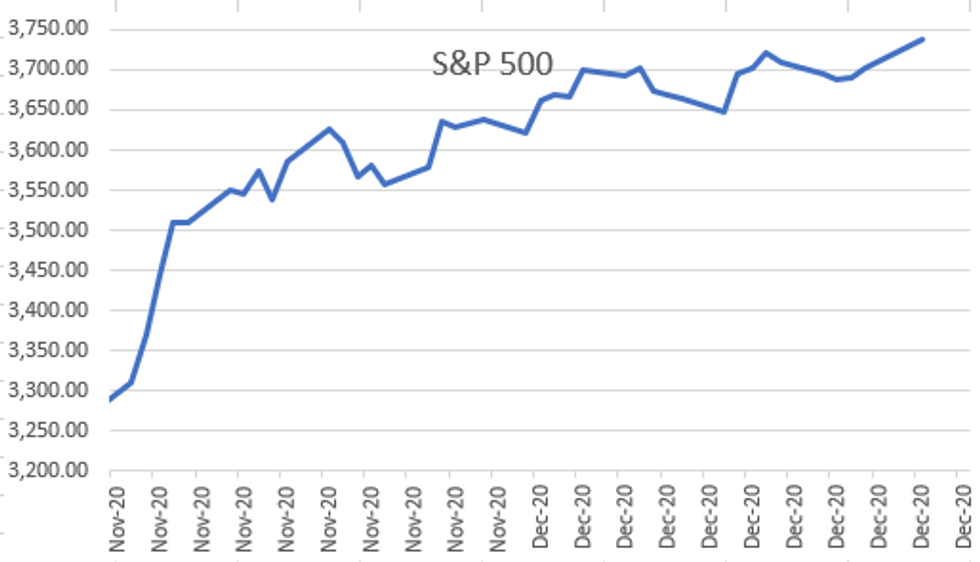

- DJIA up 239.34 points (0.79%) at 30199.87

- S&P E-Mini Future up 35.5 points (0.96%) at 3705.75

- Nasdaq up 121.8 points (1%) at 12804.73

- US 10-Yr yield is up 0.8 bps at 0.9314%

- US Mar 10Y are up 0.5/32 at 137-28.5

- EURUSD up 0.0015 (0.12%) at 1.2197

- USDJPY up 0.41 (0.4%) at 103.56

- WTI Crude Oil (front-month) down $0.58 (-1.2%) at $48.12

- Gold is down $7.28 (-0.39%) at $1894.42

- European bourses closing levels:

- EuroStoxx 50 up 32.13 points (0.91%) at 3543.28

- German DAX up 203.06 points (1.49%) at 13587.23

- French CAC 40 up 66.37 points (1.2%) at 5522.01

US TSY SUMMARY: Quiet Reversal

Rates quietly reversed weakness to steady/mixed levels, albeit session highs on very light holiday volumes (TYH just over 550k well after the close).

- Rate futures all the way back to Sunday evening levels -- prior to annc that Pres Trump signed Covid relief/US Govt spending bill that triggered risk appetite (note: equities climbed to new all-time highs and held gains after FI close: ESH1 +31.0 to 3726.0)

- House scheduled to vote on upsized $2k direct relief payment at 1600ET; National Defense bill veto override vote at 1700ET.

- Little react to weak 2Y Note auction: 0.137% high yield (0.165% last month) vs. 0.132% WI, bid/cover 2.45 vs. 2.71 previous.

- Tsy surged after 5Y tailed as well: Weak US Tsy $59B 5Y Note draws high yld of 0.394% (0.397% last month) vs. 0.391% WI; 2.39 bid/cover vs. 2.38 prior.

- The 2-Yr yield is up 0.4bps at 0.123%, 5-Yr is unchanged at 0.3622%, 10-Yr is up 0.5bps at 0.9281%, and 30-Yr is up 0.4bps at 1.6643%.

US TSY FUTURES CLOSE: Late Session Highs

Steady to mixed after the bell, futures quietly bounced back to early overnight levels -- prior to risk-on trigger when Pres Trump signed Covid relief/US Gov spending bill. Volumes exceptionally light, TYH just over 545k; yield curves steeper but well off highs.

- 3M10Y +0.326, 84.013 (L: 83.163 / H: 87.012)

- 2Y10Y +0.63, 80.64 (L: 80.141 / H: 83.232)

- 2Y30Y +0.466, 154.194 (L: 153.588 / H: 158.303)

- 5Y30Y +0.671, 130.317 (L: 129.781 / H: 132.891)

- Current futures levels:

- Mar 2Y down 0.125/32 at 110-15.25 (L: 110-14.75 / H: 110-15.5)

- Mar 5Y up 0.5/32 at 126-2.5 (L: 125-31 / H: 126-03)

- Mar 10Y up 1/32 at 137-29 (L: 137-21.5 / H: 137-30.5)

- Mar 30Y steady at at 172-24 (L: 171-27 / H: 172-30)

- Mar Ultra 30Y steady at at 212-18 (L: 210-21 / H: 212-26)

US EURODOLLAR FUTURES CLOSE: Steady/Mixed

Modest rebound in the second half, futures trading at/near session highs after the bell. Note, no LIBOR settles do to Boxing Day UK holiday, interbank rates resume Tuesday.

- Mar 21 steady at 99.825

- Jun 21 +0.005 at 99.830

- Sep 21 steady at 99.820

- Dec 21 steady at 99.780

- Red Pack (Mar 22-Dec 22) -0.005 to steady

- Green Pack (Mar 23-Dec 23) steady to +0.005

- Blue Pack (Mar 24-Dec 24) steady to +0.005

- Gold Pack (Mar 25-Dec 25) steady to +0.005

US TSY: Short Term Rates

Updated NY Fed operational purchase schedule, $40.2B from 1/04-1/14- Mon 1/04 1100-1120ET: Tsy 2.25Y-4.5Y, appr $8.825B

- Tue 1/05 1100-1120ET: Tsy 20Y-30Y, appr $1.750B

- Wed 1/06 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Thu 1/07 1100-1120ET: Tsy 20Y-30Y, appr $1.750B

- Fri 1/08 1100-1120ET: Tsy 0Y-2.25Y, appr $12.825B

- Mon 1/11 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

- Tue 1/12 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Wed 1/13 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Thu 1/14 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Thu 01/14 Next forward schedule release at 1500ET

PIPELINE:

No new high-grade issuance since December 15; running total for month remains $52.24B

UP TODAY

- 29-Dec 0900 S&P CoreLogic CS 20-City MoM SA (1.27%, 1.00%)

- 29-Dec 0900 S&P CoreLogic CS 20-City YoY NSA (6.57%, 6.95%)

- 29-Dec 0900 S&P CoreLogic CS 20-City NSA Index (232.53, --)

- 29-Dec 1130 US Tsy $30B 42D Bill CMB auction (9127964C0)

- 29-Dec 1130 US Tsy $30B 119D Bill CMB auction (9127964Z9)

- 29-Dec 1300 US Tsy $34B 52W-Bill auction (912796A90)

- 29-Dec 1300 US Tsy $59B 7Y-Note auction (91282CBB6)

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.