-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI ASIA OPEN - McConnell: Won't Be Bullied, Tsy Gain

EXECUTIVE SUMMARY

- MCCONNELL: SENATE WON'T BE `BULLIED' INTO MORE AID CHECKS; WON'T BREAK UP THREE TRUMP DEMANDS, Bbg

- MNI Chicago Business Barometer Edges Higher in Dec (59.5 vs. 56.0 est)

- MNI EXCLUSIVE: Biden Could Seek Another $900B Fiscal Bridge

- MNI BRIEF: China/EU Agree Comprehensive Investment Accord

- U.K. TIGHTENS ENGLAND CORONAVIRUS TIERS, Bbg

US

US: U.S. President-elect Joe Biden could be forced to seek another fiscal aid deal in the spring equal in size to the newly passed USD900 billion stimulus package to offer relief to state and local governments and see the labor market recovery through vaccine distribution, former government officials told MNI.

- Last week's deal is "very unlikely to be enough," said former Federal Reserve vice chair Alan Blinder. The economy likely needs double that amount, or about USD1.8 trillion, including supplemental benefits for the unemployed that extend past the current 11-week provision, he said. "But having palliatives in place right now, today, is extremely important," he added, as the winter surge in Covid cases takes its toll. For more see MNI Policy Mainwire at 0500ET.

EU/CHINA

EU/CHINA: China and the European Union have reached: an 'in principle' Comprehensive Agreement on Investment, the European commission said Wednesday.

- The deal was hailed by Brussels as of major economic significance and also binds the parties into a values-based investment relationship grounded in sustainable development principles. Link:

- https://www.consilium.europa.eu/media/47718/press-release.pdf

OVERNIGHT DATA

US DATA: MNI Chicago Business Barometer Edges Higher in Dec, two-month high. The indicator increased to 59.6 on a quarterly basis in Q4 and recorded the highest level since Q4 2018. All indices saw gains on a quarterly basis in Q4, signaling a further recovery after Q2's slump.- MNI CHICAGO BUSINESS BAROMETER 59.5 DEC VS 58.2 NOV

- MNI CHICAGO BUSINESS BAROMETER 59.6 Q4 VS 55.2 Q3

- MNI CHICAGO BUSINESS BAROMETER: STRONGEST Q/Q READING SINCE Q4 2018

- MNI CHICAGO: EMPLOYMENT SHOWED LARGEST M/M INCREASE; AT 1-YEAR HIGH

- The US international trade deficit widened to -USD84.8 billion in November, up 5.5% from October's -USD80.4 billion, the Census Bureau said Wednesday. * Exports of goods in November grew by USD1.1 billion over October to USD127.2, while imports of goods increased by USD5.5 billion to USD212 billion.

- Wholesale inventories fell 0.1% to USD649 billion, down 2.2% from one year ago.

- Retail inventories rose 0.7% in November to USD616.9 billion, but were still down 7.1% from year ago levels.

MARKETS SNAPSHOT: Key Late Session Market Levels

- DJIA up 83.1 points (0.27%) at 30335.67

- S&P E-Mini Future up 4.5 points (0.12%) at 3731.25

- Nasdaq up 34 points (0.3%) at 12850.22

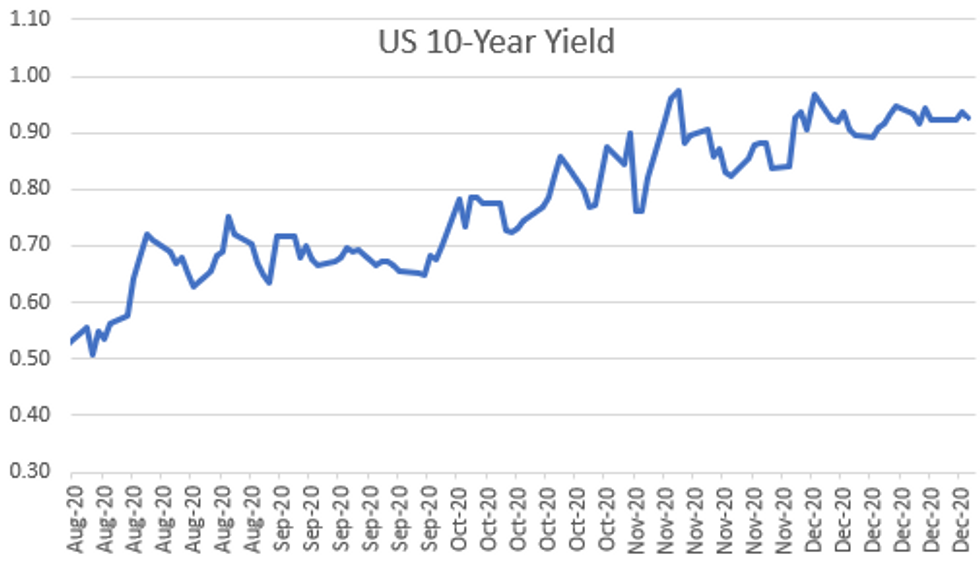

- US 10-Yr yield is down 1.2 bps at 0.9248%

- US Mar 10Y are up 1.5/32 at 137-31

- EURUSD up 0.0041 (0.33%) at 1.2289

- USDJPY down 0.32 (-0.31%) at 103.26

- WTI Crude Oil (front-month) up $0.30 (0.63%) at $48.30

- Gold is up $11.97 (0.64%) at $1890.28

European bourses closing levels:

- EuroStoxx 50 down 9.78 points (-0.27%) at 3585.74

- FTSE 100 down 46.83 points (-0.71%) at 6616.4

- German DAX down 42.6 points (-0.31%) at 13774.94

- French CAC 40 down 12.38 points (-0.22%) at 5619.34

US TSY SUMMARY

Rates finishing higher after a weaker start, modest risk-on unwind tone for the last full trade session of 2020.

- Late stimulus headlines lending to risk-off move: Sen majority leader McConnell "SENATE WON'T BE `BULLIED' INTO MORE AID CHECKS; WON'T BREAK UP THREE TRUMP DEMANDS."

- Futures bounce back to steady/mixed levels midmorning, volume spike in TYH1 over 38,000 on move from 137-28 to -30.5 pushing TYH1 volume up to 285k at the time (635k late). Not data related (PMI better than expected at 59.5 vs. 56.0 est) and unlikely related to confirmation that "huge swaths of England moving to tier 4, lockdown. Bid more likely month/year end allocations again -- similar gap trade on volume spike same time Tuesday.

- Couple large block buys in March Ultra-bonds contributed to second half rally: +4,655 WNH1 212-11 through 212-02 offer and +2,470 WNH1 at 212-28 through 212-21 offer.

- The 2-Yr yield is unchanged at 0.125%, 5-Yr is down 1bps at 0.3687%, 10-Yr is down 1.3bps at 0.9231%, and 30-Yr is down 1.6bps at 1.6589%.

MONTH-END EXTENSIONS: Updated Bloomberg-Barclays US Extension Estimates

Forecast summary compared to the avg increase for prior year and the same time in 2019. TIPS -0.03Y; Govt inflation-linked, -0.04. Note MBS extension climbs to 0.14Y from 0.09 in preliminary.

| Estimate | 1Y Avg Incr | Last Year | |

| US Tsys | 0.08 | 0.09 | 0.07 |

| Agencies | 0.08 | 0.06 | 0.09 |

| Credit | 0.07 | 0.09 | 0.07 |

| Govt/Credit | 0.07 | 0.09 | 0.07 |

| MBS | 0.14 | 0.05 | 0.09 |

| Aggregate | 0.08 | 0.08 | 0.06 |

| Long Gov/Cr | 0.07 | 0.09 | 0.06 |

| Iterm Credit | 0.05 | 0.08 | 0.06 |

| Interm Gov | 0.09 | 0.08 | 0.07 |

| Interm Gov/Cr | 0.08 | 0.08 | 0.06 |

| High Yield | 0.08 | 0.08 | 0.09 |

US TSY FUTURES CLOSE: Well Bid

Tsy futures trading near late session highs on the last full session of 2020 (early close Thursday, markets closed Friday for new year). Early risk-on tone gradually unwound, equities pared gains as hopes of additional Covid stimulus/relief dwindled.

- 3M10Y +0.358, 84.364 (L: 82.667 / H: 85.842)

- 2Y10Y -0.968, 79.781 (L: 79.615 / H: 82.056)

- 2Y30Y -1.345, 153.195 (L: 153.062 / H: 156.703)

- 5Y30Y -0.593, 128.865 (L: 128.573 / H: 131.071)

- Current futures levels:

- Mar 2Y up 0.125/32 at 110-15.375 (L: 110-14.875 / H: 110-15.375)

- Mar 5Y up 0.75/32 at 126-3.5 (L: 126-00.5 / H: 126-04.25)

- Mar 10Y up 1/32 at 137-30.5 (L: 137-24 / H: 137-31.5)

- Mar 30Y up 7/32 at 172-28 (L: 172-01 / H: 172-29)

- Mar Ultra 30Y up 17/32 at 212-26 (L: 211-02 / H: 212-28)

US EURODOLLAR FUTURES CLOSE

Eurodollar futures traded firmer for the most part -- near top end narrow session range while short end held steady despite reversal in 3M LIBOR benchmark: -0.01638 to 0.23750% (-0.00263/wk), more than making up for Tuesday's high set.

- Mar 21 steady at 99.830

- Jun 21 steady at 99.830

- Sep 21 +0.005 at 99.825

- Dec 21 +0.005 at 99.785

- Red Pack (Mar 22-Dec 22) steady to +0.010

- Green Pack (Mar 23-Dec 23) +0.005 to +0.010

- Blue Pack (Mar 24-Dec 24) +0.010 to +0.015

- Gold Pack (Mar 25-Dec 25) +0.015

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N -0.00175 at 0.08563% (+0.00463/wk)

- 1 Month -0.00275 to 0.14400% (-0.00113/wk)

- 3 Month -0.01638 to 0.23750% (-0.00263/wk)

- 6 Month +0.00237 to 0.25950% (-0.00713/wk)

- 1 Year +0.00113 to 0.34238% (+0.00200/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $69B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $154B

- Secured Overnight Financing Rate (SOFR): 0.10%, $945B

- Broad General Collateral Rate (BGCR): 0.08%, $361B

- Tri-Party General Collateral Rate (TGCR): 0.08%, $325B

- (rate, volume levels reflect prior session)

Updated NY Fed operational purchase schedule, $40.2B from 1/04-1/14

- Mon 1/04 1100-1120ET: Tsy 2.25Y-4.5Y, appr $8.825B

- Tue 1/05 1100-1120ET: Tsy 20Y-30Y, appr $1.750B

- Wed 1/06 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Thu 1/07 1100-1120ET: Tsy 20Y-30Y, appr $1.750B

- Fri 1/08 1100-1120ET: Tsy 0Y-2.25Y, appr $12.825B

- Mon 1/11 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

- Tue 1/12 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Wed 1/13 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Thu 1/14 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Thu 01/14 Next forward schedule release at 1500ET

PIPELINE

No new high-grade issuance since December 15; running total for month remains $52.24B.

FOREX:

EURUSD tested immediate resistance at 1.2305 1.764 proj of Nov 4 - 9 rally from the Nov 11 low. Some broader base buying went through around 14.00GMT/09.00ET

- The pair has since reversed on ECB Rehn: "We monitor exchange rate developments very closely and we will continue to do so in the future"

- EURUSD is now at 1.2287 at the time of typing.

- Focus this afternoon was on the UK, with Boris winning the first parliament vote on the Brexit deal.

- Matt Hancock stated that stated that the Midlands North East and areas of the North West and the South East have been moved to the highest tier

- Cable has been unaffected with pair trading around 1.3610, on the weaker dollar

EGBs-GILTS: Summary

Waiting for Tiers and School Clarity in the UK. With a lack of liquidity we have had an up and down day, but at the time of writing are almost exactly where we started after a sell-off this morning.

- The UK House of Commons has approved the Brexit deal today by a large margin. The vast majority of opposition MPs have voted in favour of the deal on the premise that any deal is better than no deal and there is of course no time to renegotiate anything at such a late stage.

- Attention now turns to the new Covid-19 tiers (which Health Secretary Matt Hancock is due to release shortly) and the announcement of whether the plan for schools to go back for the new term will change. The previous plan was for primary schools to return as normal on 4 January with pupils in exam years in secondary schools back the same day but with other year groups in secondary schools starting a week later.

- More of the UK was confirmed to be entering tier 4 lockdown from midnight. Now over 75% of the English population will be in tier 4 with the vast majority of the rest in tier 3. No areas will be in tier 2 and only the Isle of Scilly will be in tier 1. Secondary school openings have been pushed back a further week too (so most pupils will now start their term 2 weeks late). Primary schools will close across much of London and the parts of the South East that are worst affected with school closures reviewed at least every 2 weeks.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.