-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI ASIA OPEN - Expedited Removal Trial Unlikely

EXECUTIVE SUMMARY

- McConnell Rejects Early Trump Trial After Likely Second Impeachment

- MNI POLICY: Fed's Brainard Sees USD120B QE Pace For Some Time

- MNI SOURCES: EC To Set Out SGP Reform Ideas As Split Lingers

- MNI BRIEF: Fed Committed to Averaging 2% Inflation- Clarida

- MNI BRIEF: Most Fed Districts Saw Modest Increase in Activity

- FED BRAINARD: TOO EARLY TO SAY HOW LONG WILL TAKE TO REACH GOALS, Bbg

- FED HARKER SAYS CENTRAL BANK IS GOING TO KEEP RATES LOW FOR LONG; SAYS FED IS WILLING TO OVERSHOOT INFLATION A LITTLE BIT BUT NOT LET IT RUN OUT OF CONTROL, Rtrs

US

FED: Federal Reserve Vice Chair Richard Clarida Wednesday reiterated the central bank's commitment to averaging 2% inflation, predicting interest rate normalization could be slower if survey measures of inflation expectations are low relative to pre-pandemic times.

FED: Federal Reserve Governor Lael Brainard expects the U.S. central bank to keep buying assets at the current pace of USD120 billion a month "for some time" as the economy sees damage from the winter Covid surge before vaccinations underpin a faster expansion later this year.

- The FOMC needs to see "substantial further progress" before dialing back its QE program and Brainard reiterated that commitment Wednesday. For more see MNI Policy Mainwire at 1300ET

US: Reuters reporting that according to an unnamed source, US senate Republican leadership is weighing whether to launch a Trump impeachment trial during pro-forma session of the Senate on Friday. Also states that no decision has been made yet.

- If this is the case, it would open the door to a vote on Trump's removal from office before the end of his term on 20 January.

- "Most Federal Reserve Districts reported that economic activity increased modestly since the previous Beige Book period," the report said. However, two reported little or no change in activity, while two others noted a decline.

- "Although the prospect of COVID-19 vaccines has bolstered business optimism for 2021 growth, this has been tempered by concern over the recent virus resurgence and the implications for near-term business conditions," the report said.

EUROPE

EU: Brussels remains divided over the direction reform of fiscal rules should take with Paulo Gentiloni, EU Commissioner for the Economy, likely to lay out his ideas for the long-term future of the Stability and Growth Pact in coming weeks, with a view to relaunching the consultation process in the spring, sources tell MNI.

- Underlining divisions within the Commission, sources say Gentiloni will argue that higher levels of public debt built up by some countries during the Covid crisis are sustainable in the current low-rate environment. For more see MNI Policy Mainwire at 0927ET.

OVERNIGHT DATA

U.S. CPI rose 0.4% in December following a smaller 0.2% gain in November, in line with market expectations, according to figures released Wednesday by the Bureau of Labor Statistics.

- December's increase as driven by a 8.4% gain in gasoline prices, accounting for more than 60% of the overall increase. Energy prices were up 4%.

- Food prices were up 0.4% after a 0.1% decline in November. Food at home prices also rose 0.4% after falling 0.3% in November. The cost of dining out was up 0.4% in December following a 0.1% gain in November.

- Excluding food and energy prices, CPI was up 0.1% in December.

- Apparel prices rose 1.4% after a 0.9% gain in November.

- New vehicle prices were up 0.4% following a 0.1% decline in November, while the cost of a used vehicle fell 1.2% in December.

- Owners' equivalent rent increased 0.1% after a flat reading in November.

- US TREASURY DEC BUDGET DEFICIT $144B VS $13B YR-AGO MONTH

- US TREASURY DEC BUDGET REVENUE $346B; +3% VS YR-AGO MONTH

- US TREASURY DEC BUDGET OUTLAYS $490B; +40% VS YR-AGO MONTH

- FYTD21 BUDGET BALANCE -$573B VS -$357B FYTD20

- US MBA: MARKET COMPOSITE +16.7% SA THRU JAN 8 WK

- US MBA: REFIS +20% SA; PURCH INDEX +8% SA THRU JAN 8 WK

- US MBA: UNADJ PURCHASE INDEX +10% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 2.88% VS 2.86% PREV

- CANADA FLASH DEC INDUSTRIAL PRICES +1.4% MOM, +1.5% YOY

- CANADA DEC IPPI EX-ENERGY +0.9% MOM, +4.4% YOY

MARKETS SNAPSHOT

- DJIA up 27.74 points (0.09%) at 31093.9

- S&P E-Mini Future up 13.25 points (0.35%) at 3807.75

- Nasdaq up 76.8 points (0.6%) at 13148.44

- US 10-Yr yield is down 4.3 bps at 1.0866%

- US Mar 10Y are up 12/32 at 136-24.5

- EURUSD down 0.0051 (-0.42%) at 1.2156

- USDJPY up 0.13 (0.13%) at 103.89

- WTI Crude Oil (front-month) down $0.26 (-0.49%) at $52.96

- Gold is down $1.28 (-0.07%) at $1853.33

European bourses closing levels:

- EuroStoxx 50 up 4.38 points (0.12%) at 3616.51

- FTSE 100 down 8.59 points (-0.13%) at 6745.52

- German DAX up 14.65 points (0.11%) at 13939.71

- French CAC 40 up 11.7 points (0.21%) at 5662.67

US TSY SUMMARY:

Rates as well as equities chopped higher Wednesday as the House most certainly will vote to impeach Pres Trump a second time in his term Wednesday. House members kicked off the debate in the morning should have vote count before 1700ET.

- Otherwise somber session as markets absorbed several Fed speaker comments on economy/outlook: Fed Gov Brainard expects Fed to keep buying assets current pace of $120B/m "for some time"; Fed VC Clarida commitment to 2% avg inflation, predicting rate normalization could be slower if survey measures of inflation expectations are low relative to pre-pandemic times.

- Tsys gained after Italy headline: "ITALY MINISTERS QUIT COALITION, PUTTING PREMIER CONTE AT RISK" -bbg amid robust volumes and wo-way trade w/better buying ahead House impeachment vote.

- Already on session highs -- Tsys surge after strong US Tsy $24B 30Y bond auction re-open (912810SS8) yielded 1.825% (1.665% last month) vs. 1.832% WI; w/ 2.47 bid/cover (2.480 prior).

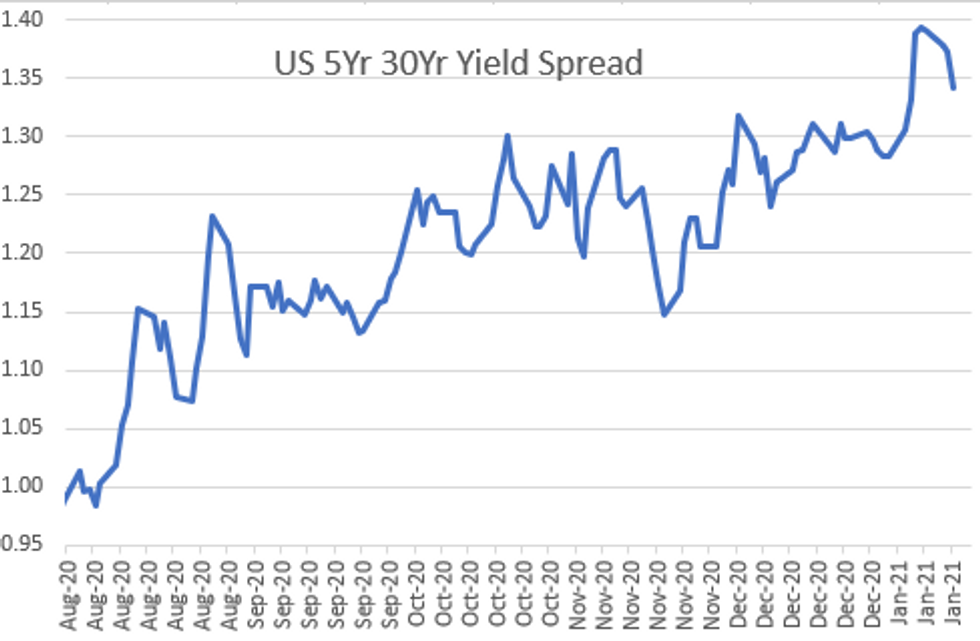

- The 2-Yr yield is up 0bps at 0.145%, 5-Yr is down 2.4bps at 0.4755%, 10-Yr is down 4.1bps at 1.0883%, and 30-Yr is down 5.4bps at 1.8183%.

US TSY FUTURES CLOSE

Futures finished strong, near top end of range with yield curves bull flattening off multi-year lows. Rather somber session despite the robust volumes (TYH1>1.73M) amid decent two-way trade focused on better buying ahead of the House impeachment vote this afternoon. equities bid as well, possibly on chatter that McConnell rejects early Trump trial to remove before Jan 20.

- 3M10Y -3.823, 100.209 (L: 98.259 / H: 104.463)

- 2Y10Y -4.079, 94.135 (L: 92.438 / H: 98.16)

- 2Y30Y -5.356, 167.139 (L: 165.882 / H: 172.708)

- 5Y30Y -2.959, 134.124 (L: 133.606 / H: 137.865)

- Current futures levels:

- Mar 2Y up 0.125/32 at 110-13.75 (L: 110-13.25 / H: 110-14)

- Mar 5Y up 4/32 at 125-19.5 (L: 125-14.5 / H: 125-20.75)

- Mar 10Y up 11.5/32 at 136-24 (L: 136-12 / H: 136-27.5)

- Mar 30Y up 1-5/32 at 169-11 (L: 168-08 / H: 169-22)

- Mar Ultra 30Y up 2-19/32 at 206-15 (L: 204-03 / H: 206-28)

US EURODOLLAR FUTURES CLOSE

Trading higher across the strip, long end back to Monday's levels, outpacing Whites. Lead quarterly held mild bid despite 3M LIBOR settle +0.00750 to 0.24125% (+0.01687/wk).

- Mar 21 +0.005 at 99.815

- Jun 21 +0.005 at 99.820

- Sep 21 +0.005 at 99.810

- Dec 21 +0.015 at 99.775

- Red Pack (Mar 22-Dec 22) +0.010 to +0.020

- Green Pack (Mar 23-Dec 23) +0.030 to +0.035

- Blue Pack (Mar 24-Dec 24) +0.045 to +0.055

- Gold Pack (Mar 25-Dec 25) +0.055 to +0.060

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N +0.00012 at 0.08600% (-0.00075/wk)

- 1 Month -0.00075 to 0.12650% (+0.00012/wk)

- 3 Month +0.00750 to 0.24125% (+0.01687/wk)

- 6 Month +0.00025 to 0.24788% (+0.00138/wk)

- 1 Year +0.00062 to 0.32625% (-0.00338/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $61B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $143B

- Secured Overnight Financing Rate (SOFR): 0.08%, $918B

- Broad General Collateral Rate (BGCR): 0.06%, $356B

- Tri-Party General Collateral Rate (TGCR): 0.06%, $334B

- (rate, volume levels reflect prior session)

FED: NY Fed Operational Purchases

- Tsy 7Y-20Y, $3.601B accepted vs. $10.924B submission

- Next scheduled purchases:

- Thu 1/14 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Thu 01/14 Next forward schedule release at 1500ET

PIPELINE: Royal Bank of Canada 4-Tranche Launched Late

- Date $MM Issuer (Priced *, Launch #)

- 01/13 $3.25B #Royal Bank of Canada $1B 3Y +22, $700M 3Y FRN SOFR+30, $1.25B 5Y +42, $300M 5Y FRN SOFR+52.5

- 01/13 $3.5B *Ontario 5Y +17

- 01/13 $2.5B #SK Hynix $500M 3Y +85, $1B 5Y +105, $1B 10Y +140

- 01/13 $2.5B #Dominican Republic $1B tap 10Y 3.875%, $1.5B 20Y 5.3%

- 01/13 $1.6B #Nippon Life 30NC10 2.75%

- 01/13 $1.5B *Japan Bank Int Cooperation (JBIC) 10y +25

- 01/13 $1.5B #Avalon Holdings $750M each 5Y +190, 7Y +215

- 01/13 $1.25B #Nordic Inv Bank 5Y +3

- On tap for Thursday:

- 01/14 $1B EIB 5Y FRN SOFR+22a

FOREX: EUR Recovers Italy-Inspired Losses Pre-Close

The single currency tumbled just after the London close as wires confirmed that Italy's Renzi was pulling ministers from the governing coalition, raising the risk of early elections in the country. EUR/USD slipped to touch 1.2140 in the immediate response, before recovering off the lows as Renzi stated he doesn't believe there will be new elections as a result.

- The greenback clawed back some of the recently lost ground, but the USD index made no sincere attempt on the Tuesday highs. December CPI data was ineffectual, with inflation all inline with expectations.

- Markets responded to the Riksbank's decision to start a transition to a fully financed FX reserve resulted in broad-based SEK weakness, prompting a EUR/SEK rally up to the 50-dma at 10.1645.

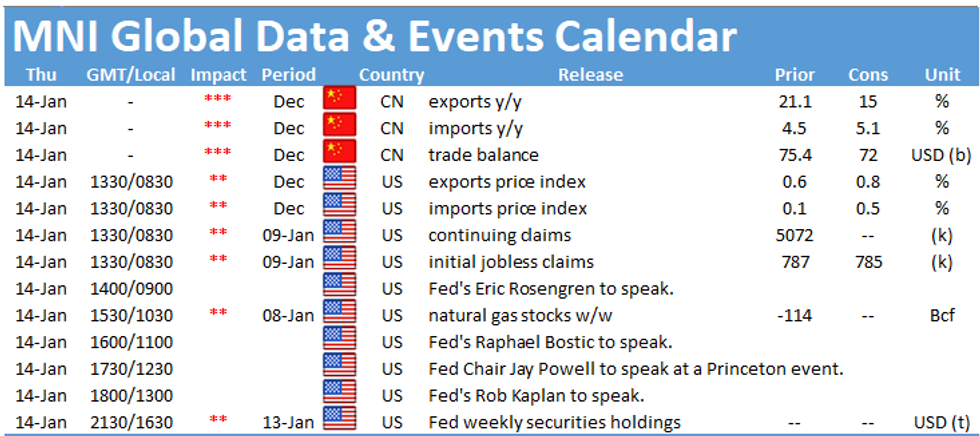

- Focus Thursday turns to Chinese trade balance, US weekly jobless claims and further Fed speakers including Rosengren, Bostic Powell and Kaplan.

EGBs-GILTS CASH CLOSE: Conte Rescues BTPs

Bunds and Gilts performed strongly for most of the session with bull flattening, and BTPs caught up as political risk reduced somewhat.

- BTPs rallied with 10-Yr spreads vs Bunds dropping 3.5bps when PM Conte said he's working on a new coalition pact that would last until the end of the legislature - easing fears of an imminent gov't collapse. This left spreads flat after earlier widening.

- As cash close arrived, coalition partner Renzi was due to give a press conference, w Conte due to speak in the evening.

- Thurs to be a quieter day for supply (Weds saw Spain selling E10bn in new Obli, Germany/Portugal/UK sales too) with just Italy selling 3-/7-/30-Yr BTP. ECB publishes accounts of December meeting. No data of note.

- Closing Yields / 10-Yr Periphery Spreads:

- Germany: The 2-Yr yield is down 1.4bps at -0.705%, 5-Yr is down 1.7bps at -0.705%, 10-Yr is down 5.4bps at -0.522%, and 30-Yr is down 5.7bps at -0.122%.

- UK: The 2-Yr yield is down 3.1bps at -0.108%, 5-Yr is down 2.3bps at -0.011%, 10-Yr is down 4.5bps at 0.307%, and 30-Yr is down 5bps at 0.878%.

- Italian BTP spread up 0.4bps at 112.2bps / Spain up 1.3bps at 59.1bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.