-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: $1.9T Stimulus? Biden To Outline Thursday Evening

EXECUTIVE SUMMARY

- BIDEN EXPECTED TO OUTLINE $1.9 TRILLION STIMULUS PLAN: NYT

- Fed Powell: Fed Wants Inflation Above 2% 'For a Time'

- MNI BRIEF: Powell Sees Global Slack Holding Down Inflation

- MNI BRIEF: Powell Says Fed Shouldn't Debate QE Exit Too Soon

- MNI REALITY CHECK: US Dec Retail Sales Growth Seen Stalling

US

US: Not far off early estimates of $2T, NYT article reports Pres elect Biden's fiscal stimulus package to be discussed at 1915ET (still tentative) will be $1.9T. Not a lot of react, Tsys declined slightly, equities hold near lows.

FED: Federal Reserve Chair Jerome Powell on Thursday reaffirmed the central bank's commitment to a new policy framework that seeks to make up for past inflation misses.

- "The public will need to see us allow inflation to move moderately above 2% for a time before the new framework will be seen as fully credible," he told a webinar, adding he was encouraged by market signals so far.

- "Since we announced the framework shift in August, there's plenty of evidence that market participants have shifted their expectations in a way that's consistent with the changes."

- Federal Reserve Chairman Jerome Powell also said policy makers are going to be careful about communicating to markets "well in advance" of starting to reduce the pace of its bond buys.

US: U.S. retail sales growth was likely stagnant in December, figures due Friday should show, as increasing virus cases and still-dampened consumer confidence muted holiday spending and mobility, industry experts told MNI.

- There are some bight spots though with car sales in December higher than anticipated, Michelle Krebs, an analyst at online vehicle retailer Autotrader, told MNI, though year-end sales were still down roughly 3 million from 2019.

EUROPE

UK: Transport Sec Bans Arrivals From S. America, Portugal Over Brazilian Variant

- Transport Secretary Grant Shapps tweets: "I've taken the urgent decision to BAN ARRIVALS from ARGENTINA, BRAZIL, BOLIVIA, CAPE VERDE, CHILE, COLOMBIA, ECUADOR, FRENCH GUIANA, GUYANA, PANAMA, PARAGUAY, PERU, SURINAME, URUGUAY AND VENEZUELA - from TOMORROW, 15 JAN at 4AM following evidence of a new variant in Brazil. Travel from PORTUGAL to the UK will also be suspended given its strong travel links with Brazil - acting as another way to reduce the risk of importing infections."

- Comes after a similar ban placed on arrivals from South Africa and its surrounding countries over a variant of COVID-19 proliferating in the country.

- The UK continues to record large numbers of new daily cases, hospitalisations, and deaths related to COVID-19. However, it has one of the highest rates of vaccination per 100 population (and the highest of any large country worldwide), meaning that should the vaccination programme continue to accelerate we could see more bans on travel into the UK being implemented in the weeks and months ahead.

OVERNIGHT DATA

US JOBLESS CLAIMS +181K TO 965K IN JAN 09 WK

US PREV JOBLESS CLAIMS REVISED TO 784K IN JAN 02 WK

US CONTINUING CLAIMS +0.199M to 5.271M IN JAN 02 WK

- Initial jobless claims filed in the week ended Jan. 9 jumped to 965,000, the highest level since August and an increase of 181,000 over the previous week's revised 784,000, according to figures released Thursday by the Labor Department. Markets had expected initial claims to fall to 786,000.

- Continuing claims also inched higher through Jan. 2, the latest week for which data are available, growing by 199,000 to 5.271 million when markets had expected a drop to 5 million.

- Claims for Pandemic Unemployment Assistance, which extends jobless benefits to typically ineligible groups like independent contractors, increased to 284,000 through Jan. 9, up from 161,159 through Jan. 2.

- As of Dec. 26, 18.4 million Americans were claiming unemployment insurance benefits, according to the Labor Department data. That's down from 19.152 million through December 19.

US Dec Import Prices Rise 0.9%, Beat Expectations

- U.S. imports prices shot up 0.9% in December, after rising 0.2% from August to November, marking the largest monthly jump since August and beating market expectations for a 0.7% gain. On the year, import prices fell 0.3%.

- Prices were propelled by fuel, which rose 7.8% last month, the most since July. Still, import fuel prices declined 19.5% in the year 2020. Excluding fuel, import prices advanced 0.4% last month.

- Export prices rose 1.1% in December, also the most since June.

MARKETS SNAPSHOT

- DJIA down 18.05 points (-0.06%) at 31043.98

- S&P E-Mini Future down 9.25 points (-0.24%) at 3794.75

- Nasdaq up 2.9 points (0%) at 13133.74

- US 10-Yr yield is up 3.9 bps at 1.1224%

- US Mar 10Y are down 5.5/32 at 136-19

- EURUSD down 0.0001 (-0.01%) at 1.2156

- USDJPY down 0.13 (-0.13%) at 103.76

- WTI Crude Oil (front-month) up $0.7 (1.32%) at $53.60

- Gold is up $1.14 (0.06%) at $1846.85

- EuroStoxx 50 up 24.86 points (0.69%) at 3641.37

- FTSE 100 up 56.44 points (0.84%) at 6801.96

- German DAX up 48.99 points (0.35%) at 13988.7

- French CAC 40 up 18.47 points (0.33%) at 5681.14

US TSY SUMMARY:

Tsys sold-off, extended session lows early in the second half after some 11,400 FVH Block sales waved off interested buyers. Levels bottomed out over last hour but are looking to extend yet again in the minutes after the bell.

- Early chop -- Tsys moved off lows following lower than expected weekly claims (965k vs. 786 est) -- reversed gains just after the equity open (eminis dipped as well), no obvious driver at the time, but headline risk always a factor: tentative Biden presser at 1915ET to discuss fiscal package among other topics; $2T chatter.

- Biden will "deliver remarks on the public health and economic crises in Wilmington, Delaware. He will outline his vaccination and economic rescue legislative package to fund vaccinations and provide immediate, direct relief to working families and communities bearing the brunt of this crisis and call on both parties in Congress to move his proposals quickly."

Meanwhile, sovereigns debt issuance kept supply rolling as domestic names sidelined into earnings cycle. The 2-Yr yield is up 0.2bps at 0.145%, 5-Yr is up 1.5bps at 0.4836%, 10-Yr is up 4.6bps at 1.1292%, and 30-Yr is up 6bps at 1.8755%.

US TSY FUTURES CLOSE

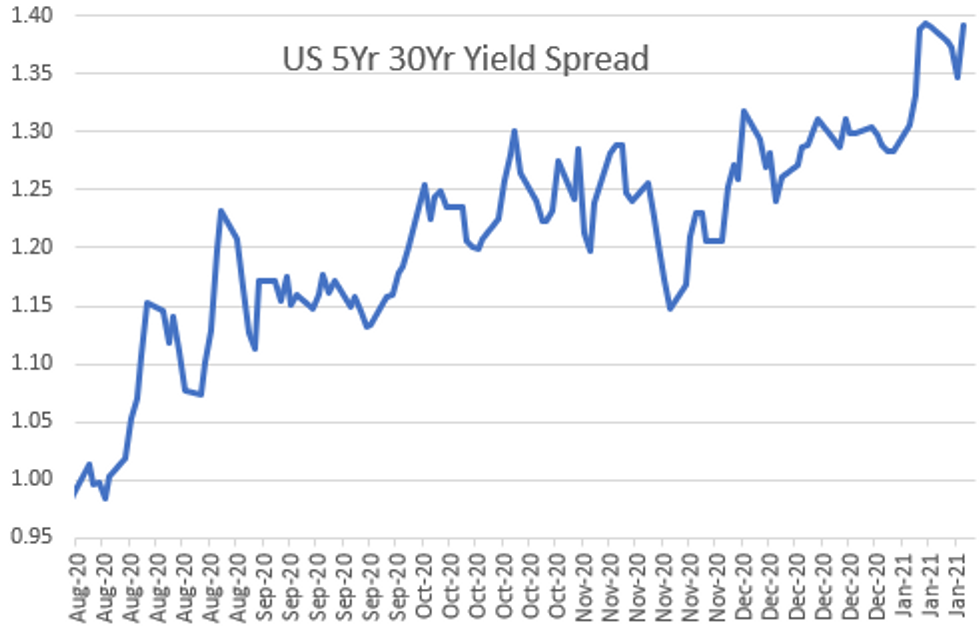

Futures trading weaker, yld curves steepening back near multi-year highs tapped Tuesday.

- 3M10Y +5.273, 104.466 (L: 98.175 / H: 105.489)

- 2Y10Y +4.456, 98.081 (L: 92.777 / H: 98.904)

- 2Y30Y +5.62, 172.479 (L: 165.813 / H: 173.915)

- 5Y30Y +4.458, 138.942 (L: 133.688 / H: 140.258)

- Current futures levels:

- Mar 2Y steady at at 110-13.625 (L: 110-13.375 / H: 110-14.25)

- Mar 5Y down 1/32 at 125-18.75 (L: 125-16.5 / H: 125-22.75)

- Mar 10Y down 6/32 at 136-18.5 (L: 136-16 / H: 136-28)

- Mar 30Y down 34/32 at 168-10 (L: 168-01 / H: 169-20)

- Mar Ultra 30Y down 64/32 at 204-17 (L: 203-27 / H: 207-02)

US EURODOLLAR FUTURES CLOSE

Mirroring the bear steepening in Tsy futures, Eurodollar futures trade weaker out the strip. Short end holding steady, lead quarterly blipped higher briefly after 3M LIBOR gapped -0.01562 to 0.22563% (+0.00125/wk), reversed back to steady for rest of day:

- Mar 21 steady at 99.815

- Jun 21 steady at 99.825

- Sep 21 steady at 99.815

- Dec 21 steady at 99.775

- Red Pack (Mar 22-Dec 22) steady to +0.010

- Green Pack (Mar 23-Dec 23) steady to +0.010

- Blue Pack (Mar 24-Dec 24) -0.015 to -0.005

- Gold Pack (Mar 25-Dec 25) -0.035 to -0.015

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N +0.00075 at 0.08675% (+0.00000/wk)

- 1 Month -0.00075 to 0.12650% (+0.00012/wk)

- 3 Month -0.01562 to 0.22563% (+0.00125/wk)

- 6 Month +0.00025 to 0.24788% (+0.00138/wk)

- 1 Year +0.00062 to 0.32625% (-0.00338/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $64B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $167B

- Secured Overnight Financing Rate (SOFR): 0.08%, $911B

- Broad General Collateral Rate (BGCR): 0.05%, $353B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $330B

- (rate, volume levels reflect prior session)

FED: NY Fed Operational Purchases

- Tsy 20Y-30Y, $1.732B accepted vs. $3.752B submission

Updated Operational Purchase schedule, $40.2B from 1/15-1/29

- Fri 1/15 1010-1030ET: Tsy 0Y-2.25Y, appr $12.825B

- Tue 1/19 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Wed 1/20 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

- Thu 1/21 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Fri 1/22 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.825B

- Mon 1/25 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Tue 1/26 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Thu 1/28 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 1/29 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Fri 01/29 Next forward schedule release at 1500ET

PIPELINE: Supra-Sovereign Outpace Domestics

- Date $MM Issuer (Priced *, Launch #)

- 01/14 $3.25B Oman $500M 2025 Tap 4.45%, $1.75B 10Y 6.25%, $1B 30Y 7.25%

- 01/14 $2.5B #Pioneer Natural $750M 3NC1 +55, $750M 5Y +65, $1B 10Y +105

- 01/14 $1.25B #Nationwide Building Society 3Y +37

- 01/14 $1B *EIB 5Y FRN SOFR+20

- 01/14 $500M #American Assets Trust 10Y +237.5

- 01/14 $500M #Public Storage WNG 5Y +43

- On tap for Friday:

- 01/15 $Benchmark Nederlandse Waterschapsbank (NWB) 2Y +4a

FOREX: Greenback Gives Back Stimulus Inspired Gains

After a firm start to the session, the USD was sold into the NY close as markets look ahead to an event from the Biden-Harris transition team, at which the President-Elect is expected to outline his economic plan for when he enters office. Reports of a stimulus package that could amount to as much as $2trl helped boost the USD initially, but selling pressure knocked the greenback as stocks advanced.

- Elsewhere, the single currency traded poorly, with the EUR slipping as Italian politics begins to take focus. Following the withdrawal of Matteo Renzi's ministers from the governing coalition, Italian PM Conte faces a stark set of choices to continue governing, including a snap general election.

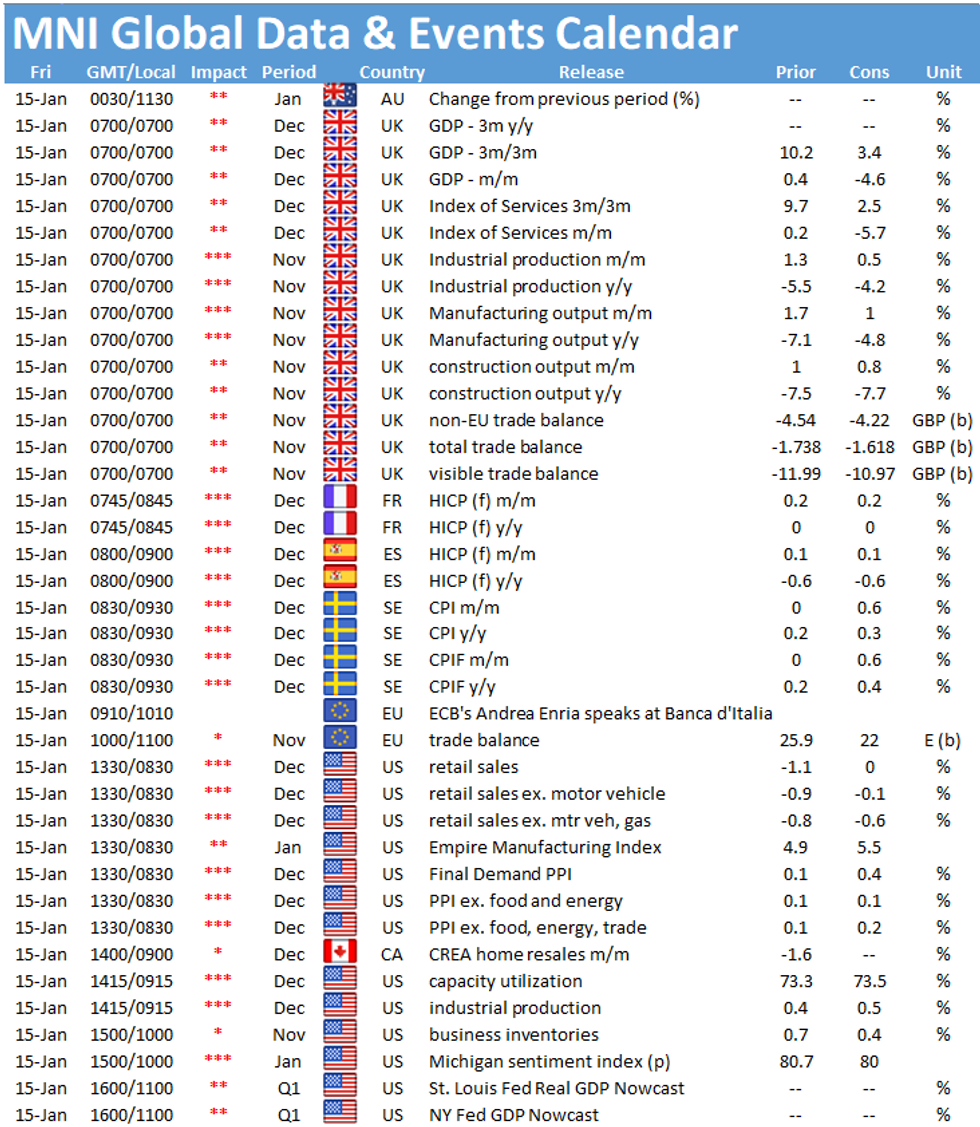

- UK industrial and manufacturing production, US PPI and retail sales data as well as the prelim Uni. of Michigan sentiment release are the highlights Friday. A number of ECB speakers are due, with Stournaras, Visco, Makhlouf among those due.

EGBs-GILTS CASH CLOSE: Italy Spreads Widen On Political Risk

Wider periphery spreads and stronger core FI were the themes of Thursday's session.

- Italian spreads ended wider on continued political uncertainty, with PM Conte set to address parliament (time/date TBD).

- The cash trading day ended with news of deepening lockdowns: France set to extend an 1800CET curfew across the country, with Bild reporting Germany's Merkel seeking to toughen lockdowns nationwide including school closures and potentially curfews. Little impact though as core FI had already rallied most of the day.

- Friday sees UK GDP data and some final Dec Eurozone nat'l CPIs, but no supply.

- Closing levels:

- Germany: The 2-Yr yield is down 2.2bps at -0.727%, 5-Yr is down 3.5bps at -0.74%, 10-Yr is down 2.8bps at -0.55%, and 30-Yr is down 2.4bps at -0.146%.

UK: The 2-Yr yield is down 1.2bps at -0.12%, 5-Yr is down 1.5bps at -0.026%, - UK: The 2-Yr yield is down 1.2bps at -0.12%, 5-Yr is down 1.5bps at -0.026%,10-Yr is down 1.6bps at 0.291%, and 30-Yr is down 1.3bps at 0.865%.

- Italian BTP spread up 7.1bps at 119.3bps / Spanish up 2bps at 61.1bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.