-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - French Politics Undermines EUR

MNI US OPEN - Trump Warns BRICS Over Moving Away From USD

MNI ASIA OPEN: Key Employ Data Ahead

EXECUTIVE SUMMARY

- MNI POLICY: Fed's Brainard-'Substantial Progress' To Take Time

- MNI POLICY: Fed's Daly Calls Market Inflation Fears Overblown

- MNI: Fed's Brainard Says Watching Yield Spike Closely

- MNI: Fed's Brainard Sees Some 'Stretched Valuations'

- MNI INTERVIEW: Eurozone Needs Private Debts Wiped-WIIW Chief

- MNI INTERVIEW: UK Debt Costs To Stay Low-Resolution Foundation

- EU: Report On Debt Rules Echoes MNI's Earlier Exclusive

- US: Schumer: Senate Could Take Up COVID Bill 'As Early As Tomorrow'

US

FED: Federal Reserve Board Governor Lael Brainard said Tuesday the U.S. economy will take a while to recover enough for the central bank to begin scaling back its USD120 billion monthly bond purchases.

- "The economy remains far from our goals in terms of both employment and inflation, and it will take some time to achieve substantial further progress," Brainard said in a speech. "We will need to be patient to achieve the outcomes set out in our guidance." For more see MNI Policy main wire at 1300ET.

- "A swell of market and academic commentary has started to emerge about a quick snapback, an undesirable pickup in inflation, and the need for the Federal Reserve to withdraw accommodation more quickly than expected. I see this as the tug of fear," Daly said in the text of a speech to the Economic Club of New York. For more see MNI Policy main wire at 1400ET.

US: Senate majority leader Chuck Schumer (D-NY) says that the Senate could take up the COVID-19 relief package, passed by the House at the weekend, 'as early as tomorrow'.

- The package, officially known as the American Rescue Plan, is set to progress through the Senate as part of a reconciliation process, which will avoid a filibuster from Republicans.

- However, there remains major uncertainty surrounding the provision for a USD15/hour federal minimum wage. The Senate parliamentarian has ruled that the provision should not be included as part of the reconciliation process and jettisoned from the USD1.9trn package. Some progressive Democrats in Congress have called for the parliamentarian to be replaced in order to get the minimum wage hike through, but this would prove a controversial prospect.

US: Feb NFP Quicktake

Regarding the Feb employment report due this Friday, Societe Generale strategists expect a gain of 350k, citing a strong rebound in restaurant, manufacturing and construction sectors as " January softness in these two categories was a one-off event."

- Consumer spending was very strong in January, and even reports from the restaurant sector were encouraging, at least in terms of direction. Increased activity was from a low base, and we know most restaurants face many social restrictions. In February, New York state allowed New York City to reopen to 25% capacity at mid-month.

- The unemployment rate continued to edge down in January to 6.3%, much lower than most predictions. We project a further decline to 6.2% in February. US non-farm payrolls remain down nearly 10 million from their February 2020 levels. We look at the February comparison since it was prior to the COVID-19 lockdowns.

EUROPE

UK: Structural factors, including an ageing population and the Bank of England's monetary policy response to tighter financial conditions, should cap any rise in yields and keep the increase in UK debt interest costs manageable, James Smith, Research Director at the Resolution Foundation, told MNI.

- While the UK is vulnerable to rising debt interest costs, strong forces should contain them, Smith said in an interview ahead of Wednesday's Budget, in which Chancellor of the Exchequer Rishi Sunak, reportedly worried by the fiscal risks from higher interest rates, looks set to unveil an offsetting mix of extensions of Covid income support schemes and tax rises. For more see MNI Policy main wire at 1243ET.

EU: Report On Debt Rules Echoes MNI's Earlier Exclusive. The E.U. is " likely to suspend the bloc's debt rules through next year" amid the economic impact of the pandemic, Bloomberg reports citing sources. This follows our MNI Exclusive on Feb 18th:

- "The European Union is likely to extend a waiver of public borrowing rules under the eurozone's Stability and Growth Pact throughout 2022, but the bloc's overall fiscal stimulus is still set to decline next year, EU sourcesclose to the discussions among finance ministers told MNI."

EU: Deflation is still a threat to the eurozone, the head of a leading Austrian think tank told MNI, adding that his country's service sector faces "devastation" once emergency support measures are withdrawn and that private debts may have to be cancelled across the European Union.

- Supply-side problems driving a rise in prices are not being matched by higher wages or fuel costs and could ease in months, Mario Holzner, executive director of the Vienna Institute for International Economic Studies (WIIW) said an interview, warning that eurozone jobs sustained by public aid could soon be lost amid a wave of insolvencies. For more see MNI Policy main wire at 0727ET.

- In the past week, euro area yields across the maturity spectrum, including risk-free rates, have remained well above the levels seen at the start of this year. So we should not hesitate to increase the volume of purchases and to spend the entire PEPP envelope or more if needed. In this way, we can prevent a tightening of financing conditions which would otherwise lead to inflation remaining below our aim for longer.

OVERNIGHT DATA

US REDBOOK: FEB STORE SALES -0.3% V JAN THROUGH FEB 27 WK

US REDBOOK: FEB STORE SALES +3.1% V YR AGO MO

US REDBOOK: STORE SALES +4.6% WK ENDED FEB 27 V YR AGO WK

CANADA FLASH JAN GDP +0.5% MOM

CANADA Q4 GDP +9.6% ANNUALIZED

CANADA DEC GROSS DOMESTIC PRODUCT +0.1% MOM

CANADA DEC GOODS INDUSTRY GDP +0.6%, SERVICES -0.1%

CANADA REVISED NOV GROSS DOMESTIC PRODUCT +0.8% MOM

MARKET SNAPSHOT

Key late session market levels- DJIA up 37.12 points (0.12%) at 31572.71

- S&P E-Mini Future down 4.25 points (-0.11%) at 3894.5

- Nasdaq down 115.5 points (-0.9%) at 13472.88

- US 10-Yr yield is down 1 bps at 1.4068%

- US Jun 10Y are up 12.5/32 at 133-18.5

- EURUSD up 0.0043 (0.36%) at 1.2092

- USDJPY down 0.04 (-0.04%) at 106.72

- WTI Crude Oil (front-month) down $1.01 (-1.67%) at $59.63

- Gold is up $11.55 (0.67%) at $1736.65

European bourses closing levels:

- EuroStoxx 50 up 1.1 points (0.03%) at 3707.72

- FTSE 100 up 25.22 points (0.38%) at 6613.75

- German DAX up 26.98 points (0.19%) at 14039.8

- French CAC 40 up 16.94 points (0.29%) at 5809.73

US TSY SUMMARY: Sideways Trade Ahead Wed ADP

Relative calm sideways trade, Tsy yields declined while benchmark yield curves continued to steepen, focus on Wed's ADP private employ data.- After Mon's brief respite, the positive correlation between Tsy futures and equities turned back on: Bonds reversed gains as equities trade weaker in the first half, climbed back near session highs into the close as S&Ps pared losses (ESH1 -4.0). Little react to multiple Fed speakers, no substantive data

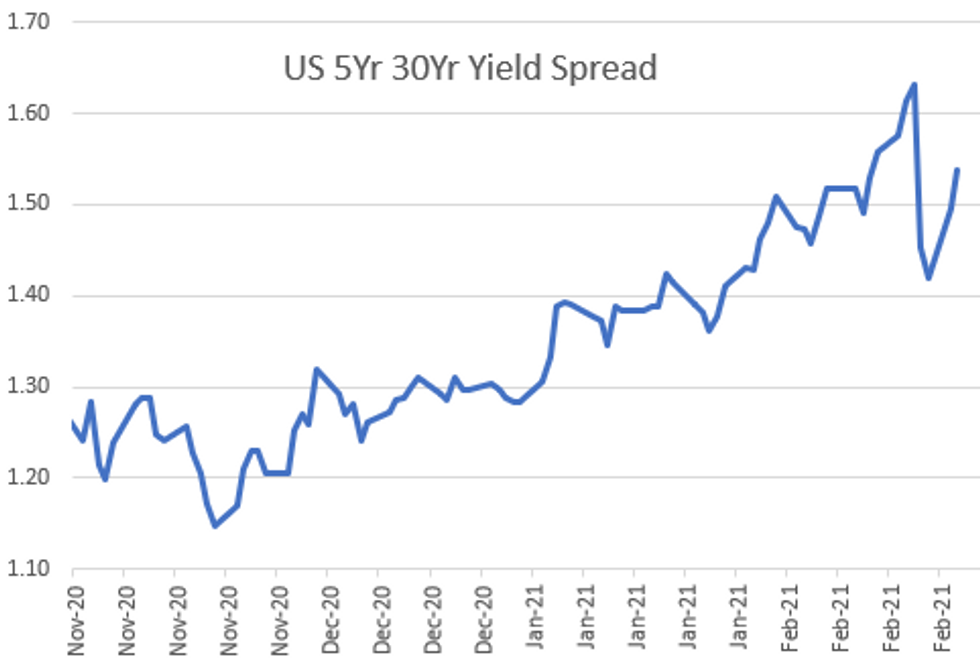

- Yield curves holding steeper profiles, however, 5s30s +4.050 at moment, just off session high of 154.405 vs. last Thu's 7Y high of 166.984. Trade more two-way, positioning ahead Fri's Feb NFP, option and deal-tied hedging in the mix, rate paying unwinds in the intermediates to long end.

- TYM technicals: Despite the recovery off last week's 131-31 low, the outlook in US 10y futures remains bearish. Price is still trading with the body of price action from Feb 25. In candle terms the pattern on this day is a bearish standard line - a continuation pattern

- Option implied vols declined vs. bounce in underlying futures, ongoing heavy downside skew buying targeting late 2022 rate hike via Eurodollar options: total +50,000 (10k screen) short Dec 95/96 put spds 3.0 over short Dec 98 calls. Heavy corporate issuance, $10B Siemens 7pt jumbo lead day's total over $25B.

- The 2-Yr yield is up 0.2bps at 0.1211%, 5-Yr is down 2.7bps at 0.669%, 10-Yr is down 1bps at 1.4068%, and 30-Yr is up 1.7bps at 2.2078%.

US TSY FUTURES CLOSE: Ylds Softer On Sideways Trade

Futures trading modestly higher after the bell, off midday highs on two way trade ahead Wed's ADP private employ data. Yld curves mixed while 5s30s marches back steeper, still appr 13bps off last Thu's high.

- 3M10Y -1.095, 137.054 (L: 135.506 / H: 141.418)

- 2Y10Y -0.335, 129.059 (L: 127.315 / H: 132.246)

- 2Y30Y +2.396, 209.151 (L: 204.45 / H: 210.942)

- 5Y30Y +4.95, 154.239 (L: 148.106 / H: 154.755)

- Current futures levels:

- Jun 2Y up 0.25/32 at 110-14.375 (L: 110-13.5 / H: 110-14.625)

- Jun 5Y up 7/32 at 124-17.75 (L: 124-10.25 / H: 124-18.5)

- Jun 10Y up 11.5/32 at 133-17.5 (L: 133-05 / H: 133-20.5)

- Jun 30Y up 10/32 at 159-16 (L: 158-24 / H: 160-01)

- Jun Ultra 30Y up 10/32 at 188-21 (L: 187-16 / H: 190-04)

US EURODOLLAR FUTURES CLOSE: Carry-Over Bid

Futures traded higher across the strip after the bell, Greens outperforming for a second day. Lead quarterly EDH1 steady however, even after 3M LIBOR set -0.00087 to 0.18338% (-0.00500/wk).

- Mar 21 steady at 99.828

- Jun 21 +0.005 at 99.845

- Sep 21 +0.005 at 99.830

- Dec 21 +0.005 at 99.785

- Red Pack (Mar 22-Dec 22) steady to +0.015

- Green Pack (Mar 23-Dec 23) +0.020 to +0.050

- Blue Pack (Mar 24-Dec 24) +0.060 to +0.075

- Gold Pack (Mar 25-Dec 25) +0.050 to +0.070

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N -0.00062 at 0.07888% (-0.00512/wk)

- 1 Month -0.00087 to 0.10838% (-0.01012/wk)

- 3 Month -0.00087 to 0.18338% (-0.00500/wk) ** (Record Low of 0.17525% on 2/19/21)

- 6 Month +0.00625 to 0.20675% (+0.00375/wk)

- 1 Year -0.00463 to 0.27900% (-0.00475/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $68B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $194B

- Secured Overnight Financing Rate (SOFR): 0.02%, $988B

- Broad General Collateral Rate (BGCR): 0.01%, $372B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $337B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, $1.734B accepted vs. $6.569B submission

- Next scheduled purchases:

- Wed 3/3 1100-1120ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 3/4 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 3/5 1100-1120ET: Tsy 2.25Y-4.5Y, appr $8.825B

PIPELINE: $25.05B To price Tuesday, $10B Siemens 7Pt Jumbo lead

- Date $MM Issuer (Priced *, Launch #)

- 03/02 $10B #Siemens: $1.25B 2Y +30, $1.5B 3Y +40, $1B 3Y FRN SOFR+43, $1.75B 5Y +55, $1.25B 7Y +65, $1.75B 10Y +75, $1.5B 20Y +80

- 03/02 $2.75B #CBA $1.5B 10Y +130, $1.25B 20Y +125

- 03/02 $2B #HSBC $1B PerpNC5 4%, $B PerpNC10 4.7%

- 03/02 $2B Bank of England 3Y +12

- 03/02 $1.3B #Entergy $650M 7Y +87, $650M 10Y +107

- 03/02 $1.3B #Mastercard $600M 10Y +50, $700M 30Y +78

- 03/02 $1.2B *KDB 00M $3Y +20, $300M 3Y FRN SOFR+25, $500M 5.5Y +35

- 03/02 $900M #Public Service Electric & Gas (PEG) $450M 5Y +32, $450M 30Y +77

- 03/02 $850M #Boston Properties 11Y +118

- 03/02 $750M #Suncor Energy 30Y +155

- 03/02 $700M #Commonwealth Edison 30Y +90

- 03/02 $500M #Flowers Food 10Y +105

- 03/02 $500M #Orix 10Y +88

- 03/02 $500M #Caterpillar WNG 10Y +57

- On tap for Wednesday:

- 03/03 $1B Kommunivest WNG 3Y +4a

FOREX: Initial Greenback Strength Reversed Into the Close

Ahead of US hours, the USD index traded at multi-week highs as the mini-dollar recovery extended. This trend switched ahead of the 1600GMT WMR fix, however, with USD selling flow dominant to boost the likes of EUR/USD and GBP/USD back into the green ahead of the close.

- This pressed the USD to the bottom-end of the G10 pile, providing some respite for haven currencies, although the USD pressure didn't stop USD/JPY inching higher to extend the current bullish sequence of higher highs.

- Vols were subdued, with front-end implieds offered across G10 FX. GBP was the only exception, with curves holding their ground given the close proximity to last week's multi-year high.

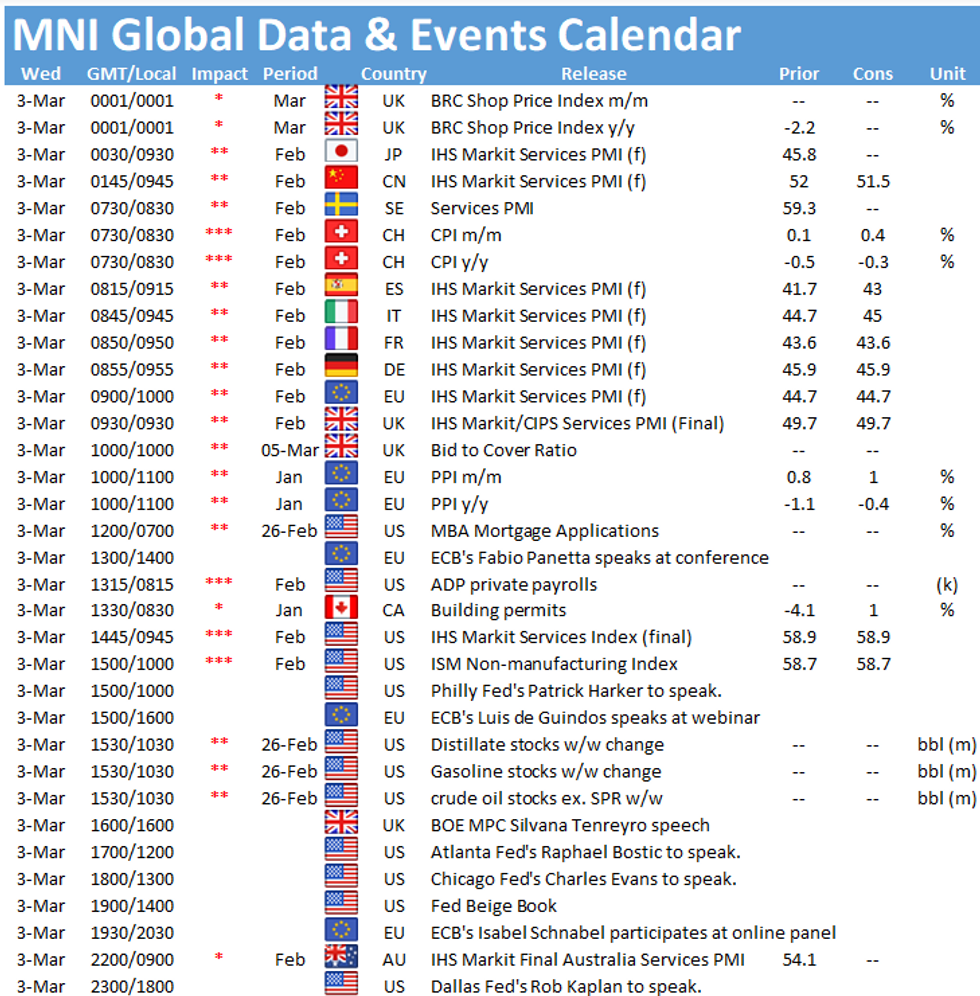

- Focus Wednesday turns to Australian GDP, final February PMI data and US ISM services index. Markets will be watching to see for further inflationary pressure after manufacturing ISM earlier in the week saw prices paid shoot to multi-decade highs.

BONDS/EGBs-GILTS CASH CLOSE: UK Long End Yields Collapse

An impressive day for Gilts, particularly at the long end, amid a broader rally in core FI.

- Gilt long-end outperformance accelerated following a long-dated BoE purchase operation that saw a low offer-to-cover (1.95x). The curve bull flattened sharply.

- Another day, another set of soothing comments by an ECB Exec Board member: this time Panetta saying that the steepening of the eurozone yield curve "must be resisted". But BTPs were weaker on an earlier report that the Italian gov't would further expand stimulus spending.

- Italy announced a mandate for its debut Apr-45 Green bond; earlier, we had issuance from Austria, Germany and the UK.

- The UK Budget is eyed Wednesday.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 0.6bps at -0.693%, 5-Yr is down 1.5bps at -0.644%, 10-Yr is down 1.8bps at -0.352%, and 30-Yr is up 0.3bps at 0.147%.

- UK: The 2-Yr yield is down 5.1bps at 0.048%, 5-Yr is down 5.3bps at 0.3%, 10-Yr is down 7.2bps at 0.687%, and 30-Yr is down 9.3bps at 1.241%.

- Italian BTP spread up 3.5bps at 102.7bps/ Spanish spread up 1.4bps at 67.2bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.