-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Final Stimulus Bill Vote Wednesday

EXECUTIVE SUMMARY

- MNI INTERVIEW: Swiss In Negative Rates Trap- Ex-SNB Economist

- China and US in talks for top-level relationship reset meeting in Alaska, SCMP

- HOUSE RECEIVED SENATE RELIEF BILL, Bbg, Will Vote Wednesday

US TSY SUMMARY: Bonds, Stocks Bounce Ahead CPI

No data on amid relative sedate trade in rates -- holding to narrow/higher band after making most of the rally in early overnight trade. CPI and $38B 10Y auction R/O Wed. Positive correlation (the new negative) between equities and Treasury futures continues: strong Treasury futures more than made up for Monday's weak finish, as are equities after the bell: S&Ps +76.5, NASDAQ over 530.0 higher, Dow Industrials +215.0.- Yield curves bull flattening, large late overnight flattener block contributing to move: -30,085 FVM 123-22.5, sell through 123-23.75 post time bid (dv01 $1.583M) vs. +18,650 TYM 132-10.5, buy through 132-08 post time offer (dv01 $1.657M)

- Midmorning 5s and 10s Block: 11,900 FVM 123-25.25 ($650k dv01) through the 123-24.5 post-time offer; 6,227 TYM 132-11 ($530k dvo1) through the 132-10 post-time offer. Desks still debating if double buy or a continuation of large flattener Block overnight -- leaning toward the latter.

- While implieds did not weaken significantly, option accts took advantage of rally in underlying to buy more puts at cheaper premium.

- Tsys gained after US Tsy $58B 3Y Note auction (91282CBR1) drew 0.355% high yield (0.196% last month) vs. 0.357% WI, 2.69 bid/cover vs. 2.39 previous -- sigh of relief after the 7Y auction tailed 4bp two weeks ago.

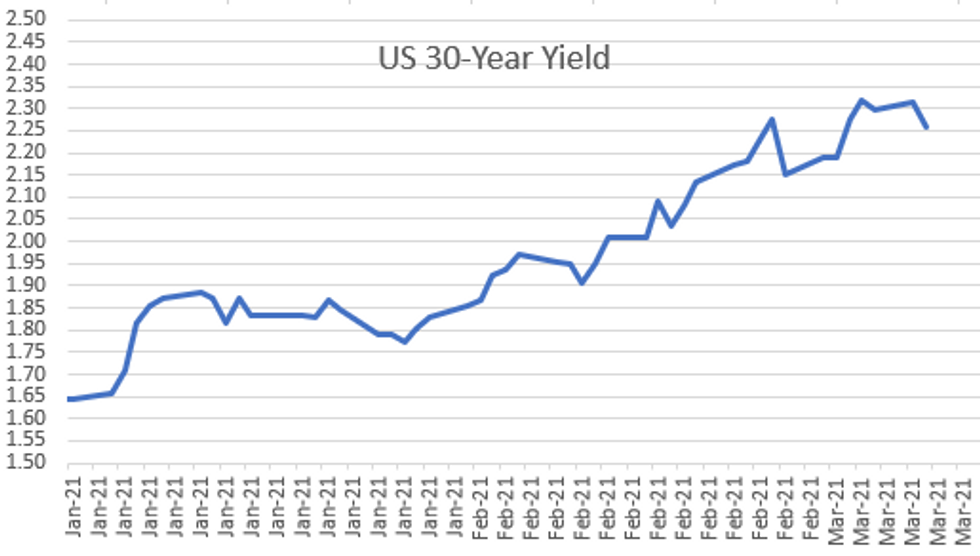

- The 2-Yr yield is up 0.2bps at 0.1647%, 5-Yr is down 3.4bps at 0.8197%, 10-Yr is down 4.7bps at 1.5437%, and 30-Yr is down 5.6bps at 2.26%.

EUROPE

SNB: The Swiss National Bank will struggle to raise rates above zero with its current monetary policy toolkit, one of its former senior economists told MNI, adding that it is unlikely to consider any increase in its policy rate before inflation rises above 1%.

- A revamp of monetary policy strategy is "probably the only possibility to abandon negative interest rates and weaken the Swiss franc at the same time," Daniel Kaufmann, who worked at the SNB for nine years until 2014, said in an interview in which he called for the bank to target higher inflation and a lower exchange rate via forex intervention.

OVERNIGHT DATA

US NFIB FEB SMALL BUSINESS INDEX 95.8 -- still well below near 50 year average of 98.0. NFIB Uncertainty index falls 5 to 75

- US REDBOOK: MAR STORE SALES -18.1% V FEB THROUGH MAR 06 WK

- US REDBOOK: MAR STORE SALES +8.0% V YR AGO MO

- US REDBOOK: STORE SALES +8.0% WK ENDED MAR 06 V YR AGO WK

MARKETS SNAPSHOT

Key late session market levels:- DJIA up 187.15 points (0.59%) at 31997.92

- S&P E-Mini Future up 73.25 points (1.92%) at 3893.5

- Nasdaq up 529.2 points (4.2%) at 13139.78

- US 10-Yr yield is down 4.9 bps at 1.542%

- US Jun 10Y are up 13.5/32 at 132-9.5

- EURUSD up 0.0056 (0.47%) at 1.1902

- USDJPY down 0.41 (-0.38%) at 108.48

- WTI Crude Oil (front-month) down $1 (-1.54%) at $64.03

- Gold is up $34.08 (2.02%) at $1717.51

European bourses closing levels:

- EuroStoxx 50 up 22.81 points (0.61%) at 3786.05

- FTSE 100 up 11.21 points (0.17%) at 6730.34

- German DAX up 57.03 points (0.4%) at 14437.94

- French CAC 40 up 21.98 points (0.37%) at 5924.97

US TSY FUTURES CLOSE: Strong Bounce In Rates W/Stocks

Strong bounce in Tsys and equities after Monday's weak finish, yield curves bull flattening with some impetus from large 5s/10s flattener blocks. No data, participants set sights on Wed's CPI.

- 3M10Y -4.71, 149.968 (L: 147.297 / H: 154.932)

- 2Y10Y -5.222, 137.358 (L: 136.217 / H: 142.58)

- 2Y30Y -5.976, 208.957 (L: 207.81 / H: 214.779)

- 5Y30Y -2.421, 143.655 (L: 141.415 / H: 146.347)

- Current futures levels:

- Jun 2Y steady at at 110-11.25 (L: 110-10.625 / H: 110-11.875)

- Jun 5Y up 5/32 at 123-25 (L: 123-18.75 / H: 123-26.5)

- Jun 10Y up 14/32 at 132-10 (L: 131-26.5 / H: 132-13)

- Jun 30Y up 1-0/32 at 157-24 (L: 156-21 / H: 158-06)

- Jun Ultra 30Y up 1-25/32 at 187-13 (L: 185-03 / H: 188-00)

US EURODOLLAR FUTURES CLOSE: Greens-Golds Stronger

Futures hold mostly steady in the short end to stronger in Greens-Golds, making up for Monday's sell-off. Lead quarterly EDH1 holds bid after 3M LIBOR set -0.00525 to 0.17725% (-0.00813/wk), just above Record Low of 0.17525% on 2/19/21.

- Mar 21 +0.005 at 99.820

- Jun 21 steady at 99.835

- Sep 21 steady at 99.815

- Dec 21 steady at 99.765

- Red Pack (Mar 22-Dec 22) steady to +0.010

- Green Pack (Mar 23-Dec 23) +0.010 to +0.050

- Blue Pack (Mar 24-Dec 24) +0.055 to +0.060

- Gold Pack (Mar 25-Dec 25) +0.060 to +0.065

Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N -0.00050 at 0.07713% (-0.00050/wk)

- 1 Month +0.00113 to 0.10713% (+0.00388/wk)

- 3 Month -0.00525 to 0.17725% (-0.00813/wk) (Just above Record Low of 0.17525% on 2/19/21)

- 6 Month -0.00675 to 0.18950% (-0.00638/wk)

- 1 Year -0.00062 to 0.27963% (+0.00188/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $66B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $213B

- Secured Overnight Financing Rate (SOFR): 0.02%, $928B

- Broad General Collateral Rate (BGCR): 0.01%, $362B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $339B

- (rate, volume levels reflect prior session)

- Tsy 7Y-20Y, $3.601B accepted vs. $13.415B submission

- Next scheduled purchase:

- Wed 3/10 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- hu 3/11 1500 Next scheduled release schedule

PIPELINE: $3B JP Morgan 2Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 03/09 $3B #JP Morgan $2B 3NC2 +53, $1B 3NC2 FRN SOFR+58

- 03/09 $Benchmark Swedbank 3Y +55a, 6NC5 dropped

- On tap for later in week:

- 03/10 $500M IADB 7Y FRN SOFR+27a

- 03/12 $800M Pitney Bowes 6NC3, 8NC3

FOREX: Greenback Softer After Monday Strength

- Markets hit reverse Tuesday, with equities higher led by tech, while the dollar edged off Monday's cycle highs. Markets looked to book profits on the recent run higher in the greenback, with the USD index faltering before any test on the 200-dma resistance at 92.924. Tuesday's move lower has relieved the technically overbought conditions that were starting to show after Monday's rally. This week, the RSI for the USD Index touched levels not seen since March's greenback rally.

- Similarly, CHF prices bounced firmly after trading in a solid downtrend since the middle of February. USD/CHF touched multi-month highs at 0.9376 before falling to fresh weekly lows ahead of the US close.

- Implied vols were subdued as markets stabilised, but the pullback from cycle highs in USD/JPY helped prop up demand for JPY upside hedges, supporting the front end of the implied curve.

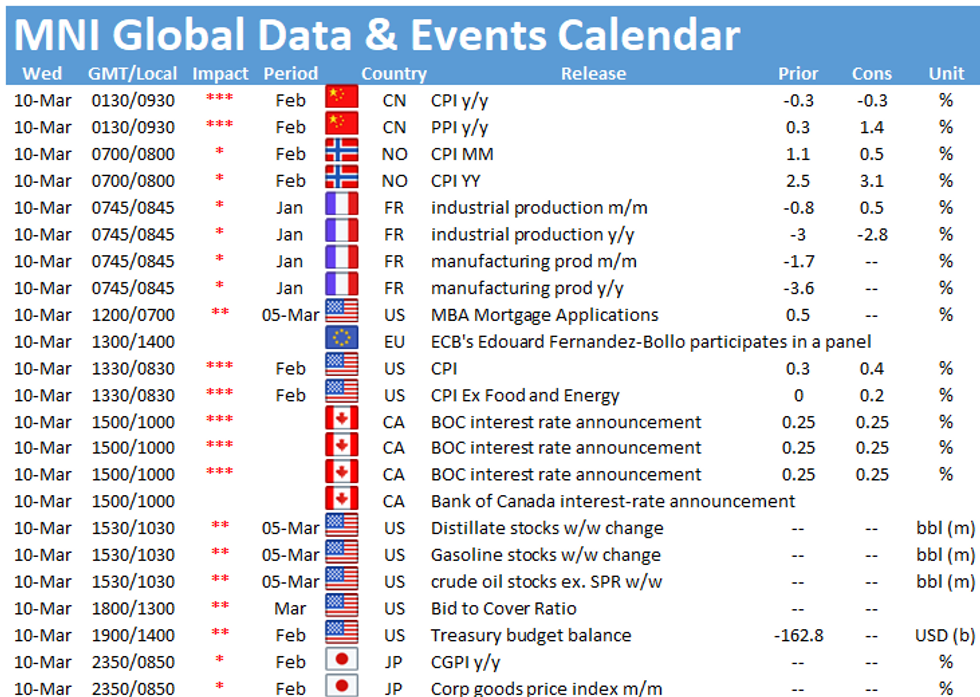

- Focus Wednesday turns to Chinese CPI & PPI data, French industrial production, US CPI and the Bank of Canada rate decision. The BoC are seen keeping rates unchanged at 0.25%.

BONDS/EGBs-GILTS CASH CLOSE: Bull Flattening Move Fades Post-ECB Data

Core FI curves finished Tuesday's session flatter, but yields failed to hold intraday lows. Periphery spreads saw steady compression.

- Bunds began weakening from session's best levels just after 1400GMT. This was (perhaps not coincidentally) after data showed fairly limited ECB asset redemptions last week, meaning that the flat weekly net purchases revealed yesterday were largely a consequence of the bank failing to ramp up bond purchases as many had expected it would.

- On that note, the question of the ECB's reaction function amid rising yields is the theme of our Governing Council decision preview published today (click here for PDF).

- Supply came from the UK (Gilts, GBP2.25bn), the Netherlands (DSL, EUR2.330bn), and the EU SURE syndication (E9bn).

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 0.1bps at -0.681%, 5-Yr is down 1.5bps at -0.609%, 10-Yr is down 2.4bps at -0.301%, and 30-Yr is down 2bps at 0.205%.

- UK: The 2-Yr yield is down 1.4bps at 0.084%, 5-Yr is down 2.5bps at 0.333%, 10-Yr is down 2.7bps at 0.727%, and 30-Yr is down 4.3bps at 1.242%.

- Italian BTP spread down 4bps at 99.3bps / Spanish spread down 1.2bps at 66.4bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.