-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: FOMC Only Yesterday?

EXECUTIVE SUMMARY

- MNI EXCLUSIVE: Ex-Fed Staffers Fear Inflation On Deficit Jump

- MNI STATE OF PLAY: BOE MPC Split On Outlook, Policy On Hold

- BOJ TO WIDEN TARGET YIELD BAND TO PLUS/MINUS 0.25%: NIKKEI

- BIDEN WEIGHING NEW SANCTIONS TO BLOCK NORD STREAM 2 PIPELINE, Bbg

- BIDEN EYES MID-MAY TO BEGIN RELAXING TRAVEL RESTRICTIONS: CNBC

- French PM announces new lockdown on Paris area

US

FED: Fears are growing in Federal Reserve circles that a mix of ultra-loose monetary policy combined with a surge in the budget deficit will generate an unwanted inflation spike to which the central bank may fail to respond in time, according to MNI interviews with several former staffers.

- Vague forward guidance on when the Fed will begin to taper asset purchases and raise interest rates increases the chances of a policy mistake, Dean Cruoshore, a long-time economist at the Federal Reserve Bank of Philadelphia, told MNI, echoing comments from other former officials and a serving Fed economist. For more see MNI Policy main wire at 1028ET.

Europe

BOE: The Bank of England's Monetary Policy Committee members are starting to diverge in opinions over the balance of risks to the economic recovery, the minutes of the March meeting show, despite policymakers voting unanimously to keep interest rates on hold at 0.1% and combined QE levels unchanged at GBP895 billion.

- There was no consensus on the MPC around the most likely path of the UK recovery, with deep uncertainty over how fast the supply and demand sides of the economy would recover as Covid related restrictions were lifted, with the minutes noting a "range of views across" on the degree of spare capacity in the economy currently (and) whether the recovery would see demand outstrip supply. For more see MNI Policy main wire at 1004ET.

French PM announces new lockdown on Paris area:

- WEEKEND LOCKDOWS NOT SUFFICIENT TO BREAK EPIDEMIC, Bbg

- WE NEED MORE DEMANDING MEASURES IN SOME REGIONS, Bbg

- NEW LOCKDOWNS WILL BE DIFFERENT FROM PREVIOUS ONES, Bbg

OVERNIGHT DATA

US JOBLESS CLAIMS +45K TO 770K IN MAR 13 WK

US PREV JOBLESS CLAIMS REVISED TO 725K IN MAR 06 WK

U.S. CONTINUING JOBLESS CLAIMS AT 4.124MLN TWO WEEKS AGO

US MAR PHILADELPHIA FED MFG INDEX 51.8 -- huge jump from 23.1 in February to highest lvl since 1973!

U.S. WEEKLY LANGER CONSUMER COMFORT INDEX AT 48.6 VS 49.4

MARKETS SNAPSHOT

Key late session market levels

- DJIA down 153.07 points (-0.46%) at 32847.5

- S&P E-Mini Future down 50.5 points (-1.27%) at 3902.75

- Nasdaq down 409 points (-3%) at 13113.56

- US 10-Yr yield is up 7.4 bps at 1.717%

- US Jun 10Y are down 24.5/32 at 131-10.5

- EURUSD down 0.0064 (-0.53%) at 1.1909

- USDJPY up 0.04 (0.04%) at 108.84

- WTI Crude Oil (front-month) down $5.53 (-8.56%) at $58.82

- Gold is down $10.18 (-0.58%) at $1733.36

European bourses closing levels:

- EuroStoxx 50 up 17.8 points (0.46%) at 3867.54

- FTSE 100 up 17.01 points (0.25%) at 6779.68

- German DAX up 178.91 points (1.23%) at 14775.52

- French CAC 40 up 7.97 points (0.13%) at 6062.79

US TYS SUMMARY: Off Overnight Lows Tied To BoJ Yld Band Widening Story

Can't read too much into it, but Tsys broke session range into the closing bell, still weaker and well off overnight levels, but trading at best levels of the NY session.

- Nascent buying around 1.75% in 10s (1.7082% after the bell, 1.7526%H/1.6268%L range on day) from prop, fast$ accts noted early in the session. Meanwhile, pick-up in geopolitical tensions between US and Russia, return of lockdowns in Europe (France, Italy, and Czechoslovakia) and accelerating weakness stocks spurred some positioning, and/or short covering in rates.

- Rates opened under pressure across the curve, long end underperforming after overnight spike in Tsys yields on back of Nikkei report ahead London open that the BoJ will widen 10Y JGB yield band +/- .25% vs +/- 0.2% around zero) at Fri's policy annc.

- Little to no react on weekly claims (+45K TO 770K; continuing claims 4.124M) but a huge jump in Philly Fed Mfg Index from 23.1 in Feb to 51.8 in march (highest lvl since 1973!) underscored the early risk-on tone.

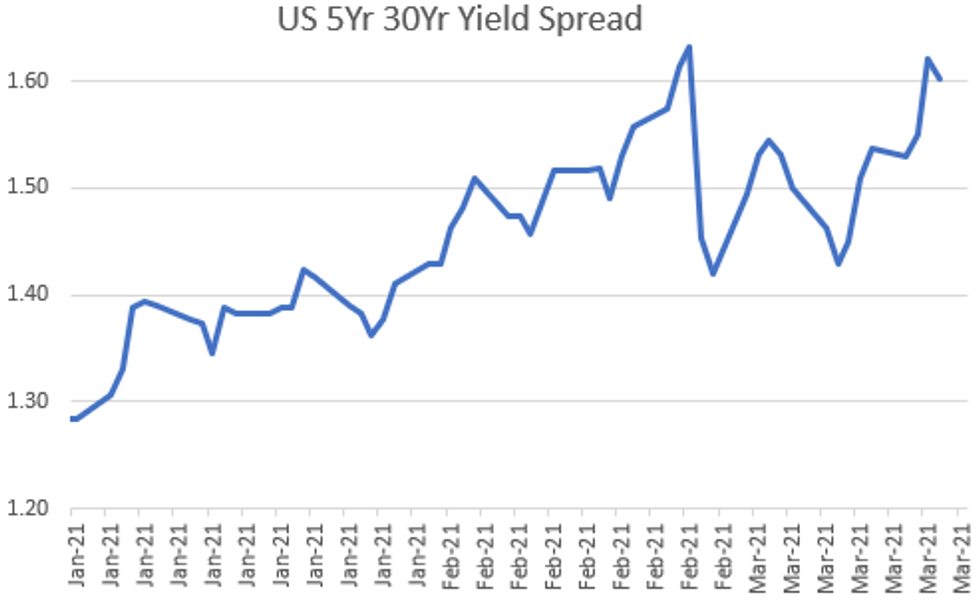

- Yield curves bear steepened, 5s30s climbed to 166.240 high (just off Feb 25 high of 166.984 -- Aug 2014 lvl) but retraced late morning and traded flatter after the bell. Note multiple steepeners (5s vs. 10s and 30s) Blocked overnight..

- The 2-Yr yield is up 2bps at 0.1531%, 5-Yr is up 5.7bps at 0.8555%, 10-Yr is up 7.1bps at 1.7135%, and 30-Yr is up 4.3bps at 2.4612%.

US TSY FUTURES CLOSE: Off Lows

10Y yields tapped 1.75% in early trade, selling in futures evaporated late as stock swooned (Nasdaq down 409 points (-3%) at 13113.56).

- 3M10Y +7.917, 170.41 (L: 160.403 / H: 174.243)

- 2Y10Y +4.693, 155.457 (L: 149.583 / H: 160.146)

- 2Y30Y +1.623, 229.921 (L: 227.351 / H: 236.776)

- 5Y30Y -2.209, 159.599 (L: 158.426 / H: 166.24)

- Current futures levels:

- Jun 2Y down 2.125/32 at 110-11.5 (L: 110-10.75 / H: 110-13.75)

- Jun 5Y down 12.75/32 at 123-21.25 (L: 123-14 / H: 124-01.5)

- Jun 10Y down 23/32 at 131-12 (L: 131-00 / H: 132-03)

- Jun 30Y down 26/32 at 154-11 (L: 153-07 / H: 155-17)

- Jun Ultra 30Y down 17/32 at 180-8 (L: 178-01 / H: 181-26)

US EURODOLLAR FUTURES CLOSE: Weaker Across Strip

Mirroring Tsy futures, Eurodollars were weaker across the strip, off early lows with long end underperforming.

- Jun 21 -0.010 at 99.830

- Sep 21 -0.010 at 99.810

- Dec 21 -0.015 at 99.750

- Mar 22 -0.010 at 99.790

- Red Pack (Jun 22-Mar 23) -0.03 to -0.015

- Green Pack (Jun 23-Mar 24) -0.06 to -0.04

- Blue Pack (Jun 24-Mar 25) -0.08 to -0.065

- Gold Pack (Jun 25-Mar 26) -0.085 to -0.08

Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N +0.00075 at 0.07875% (+0.00062/wk)

- 1 Month +0.00063 to 0.11088% (+0.00475/wk)

- 3 Month -0.00300 to 0.18663% (-0.00287/wk) (Record Low of 0.17525% on 2/19/21)

- 6 Month +0.00088 to 0.20388% (+0.00988/wk)

- 1 Year -0.00500 to 0.27588% (-0.00225/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $72B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $222B

- Secured Overnight Financing Rate (SOFR): 0.01%, $883B

- Broad General Collateral Rate (BGCR): 0.01%, $363B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $331B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, $1.743B accepted vs. $4,994B submission

- Next scheduled purchase

- Fri 3/19 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

PIPELINE: Toyota, Sumitomo Launched Late

$7.7B To price Thursday

- Date $MM Issuer (Priced *, Launch #)

- 03/18 $2.75B #Toyota $1.25B 3Y +35, $1B 5Y +48, $500M 10Y +65 (adds to $3B debt issued on Jan 6: $1B 3Y +25, $750M 3Y FRN SOFR+33, $700M 5Y +40, $550M 10Y +62.5)

- 03/18 $2.25B #Sumitomo Mitsui Trust $1.75B 3Y +55, $500M 5Y +70

- 03/18 $2.2B #Diamondback Energy $650m 2Y +75, $900m 10Y +145, $650m 30Y +195

FOREX: Greenback on Front Foot as Markets Rethink Fed

- Despite a spell of USD weakness following the Federal Reserve rate decision late on Wednesday, the greenback turned around Thursday, running higher against all others in G10. USD strength helped support a ~0.6% rally from the post-Fed lows, with the USD Index erasing the bulk of the Thursday losses.

- AUD/NZD traded well, with the cross topping the late February highs at 1.0828 to clear the way for a test on the 2021 highs posted at 1.0843.

- Initial NOK strength on the back of a steeper rate path projection from the Norges Bank faded into the close as the oil price reversed. Nonetheless, USD/NOK remains well within range of the 2021 lows at 8.3151.

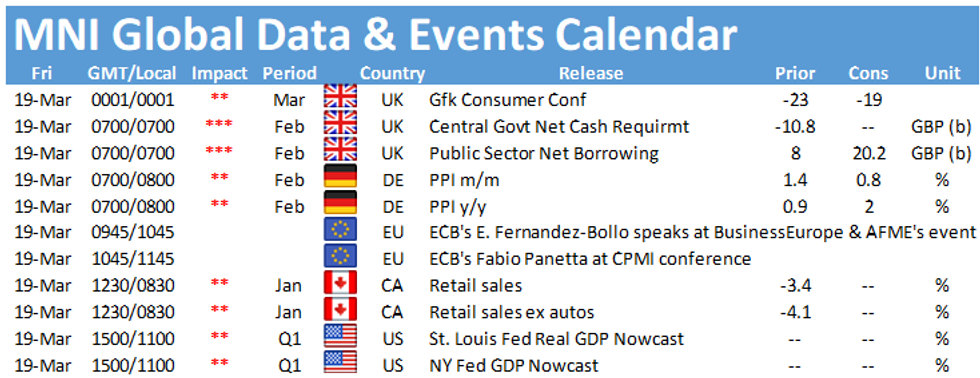

- Focus Friday turns to German PPI and Canadian retail sales as well as the Japanese and Russian central bank rate decisions. Speeches are scheduled from ECB's Panetta & Vasle and BoE's Cunliffe.

EGBs-GILTS CASH CLOSE: Afternoon Relief

European bond yields rose sharply at the open as part of a global move Thursday, but the sell-off paused for breath in the afternoon and yields closed below session highs.

- Gilts knee-jerked lower following the BoE decision (unchanged as expected) announcement at 1200GMT, and then rebounded as the BoE didn't slow down the pace of QE (as some had expected it might).

- Periphery spreads compressed for most of the session.

- The European Medicines Agency gave its backing to the AstraZeneca/Oxford vaccine.

- A pretty light Friday calendar lies ahead, with a few speakers (ECB's Panetta and Vasle, and BOE's Cunliffe), but little data.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is unchanged at -0.685%, 5-Yr is up 0.6bps at -0.618%, 10-Yr is up 2.7bps at -0.264%, and 30-Yr is up 4.6bps at 0.301%.

- UK: The 2-Yr yield is down 0.1bps at 0.11%, 5-Yr is up 2.2bps at 0.419%, 10-Yr is up 4.5bps at 0.875%, and 30-Yr is up 4.7bps at 1.405%.

- Italian BTP spread down 3.5bps at 95.3bps / Spanish spread down 2.9bps at 63.9bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.