-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Stocks Swoon on Cap Gains Tax Hike Proposal

EXECUTIVE SUMMARY

- Pres Biden PROPOSAL over capital gains tax increase to 39.6% to as high as 43.4% for wealthy

- MNI: US-RUSSIA: Removal Of Troops From Ukrainian Border To Significantly Reduce Tensions

- Both Taiwan and UAE suspend flight from India to prevent spread of Covid-19 surging in India

- U.S. lawmakers intensify bipartisan efforts to counter China, Reuters

- JAPAN GOVT CONSIDERING STATE OF EMERGENCY FOR FOUR AREAS, INCLUDING TOKYO, FROM APRIL 25-MAY 11 - NHK

- RUSSIA'S PUTIN SAYS WE ARE READY TO HOST UKRAINIAN PRESIDENT ZELENSKIY FOR TALKS IN MOSCOW AT ANY TIME CONVENIENT FOR HIM, Rtrs

US TSY SUMMARY:

Rates higher after the closing bell -- a choppy session on an inside range day. Salient factors:

- Data finally returned but markets appeared indifferent to lower than expected weekly claims (547k vs. 610k est; prior revisions 586K; continuing claims -0.034M to 3.674M).

- First half attention more on ECB policy annc: unchanged (as expected), the most market-moving comment was Lagarde saying negative interest rates were an effective tool for providing accommodation - not a big surprise, but triggered a reversal higher in Bunds and Euribor.

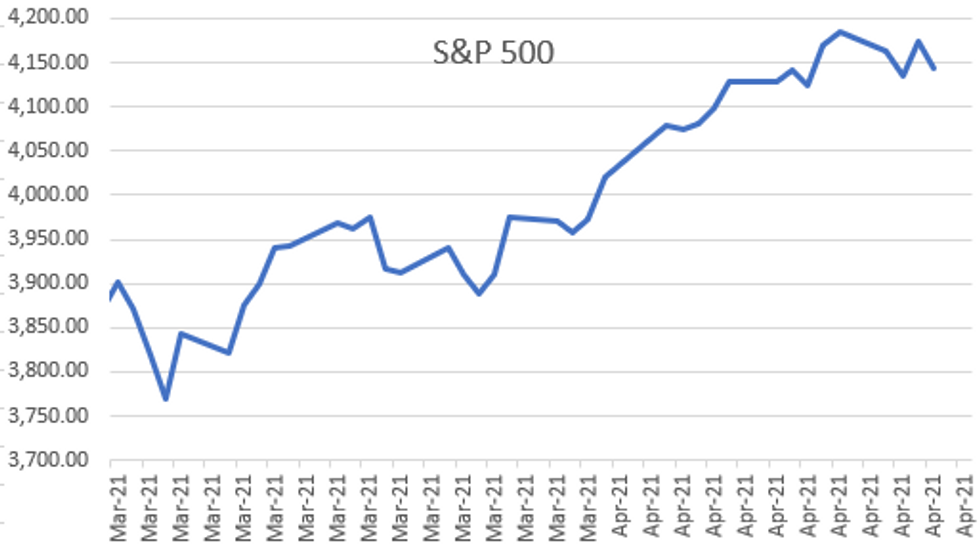

- Rates traded lower as quietly equities gained through midday, S&Ps did not quiet make it to Apr 16 all-time highs of 4179.75.

- Torpor broken around 1300ET over headlines Pres Biden PROPOSAL over capital gains tax increase to 39.6% to as high as 43.4% for wealthy. Risk-on reversed: equities sold off sharply/Bonds lead rebound while VIX neared 20.0.

- Late chop ensued as markets digested the headlines, estimating success of proposal to nearly double current cap gains tax as unlikely.

- The 2-Yr yield is up 0.2bps at 0.1492%, 5-Yr is up 0.3bps at 0.8001%, 10-Yr is down 0.3bps at 1.5521%, and 30-Yr is down 1.6bps at 2.2346%.

US

US/RUSSIA: With Defense Minister Sergey Shoygu stating to state-owned media outlet Tass that, at the conclusion of the current military drills, armed service personnel can return to their permanent bases (see 1233BST bullet), tensions between Russia and Ukraine/the West are likely to subside significantly.

- If it is the case that Russia will soon withdraw a large portion of the military buildup seen in Crimea and on Ukraine's eastern border in recent weeks it will serve to significantly reduce tensions in the region, averting an escalation that could have had major geopolitical consequences.

- Last week MNI published an article examining potential scenarios coming from the then-escalating Russia-Ukraine crisis (link): https://marketnews.com/mni-political-risk-analysis...arios. In that article we assessed the Base Case (most likely) scenario of being one where Russia used the crisis as a test of Ukrainian military capabilities and NATO's willingness to step in and aid Ukraine's defense, and it appears that it is this scenario that has played out:

- "Russia does not engage in any military offensive, instead seeking to probe both Ukrainian military strength and NATO willingness to support Kyiv. No resolution to Donbass crisis and sporadic fighting continues indefinitely, region remains a geopolitical hotspot."

- "the build up of troops and the rhetoric issued from the Kremlin acts as a probe of both the new US administration regarding its willingness to engage in foreign disputes, and Ukraine in terms of its military capabilities in defending its territory."

- "With no element of surprise, Ukraine has had ample time to deploy defensive forces in the east of the country. This may be Russia's primary goal, as it seeks to gauge the military capabilities of a Ukrainian armed forces that has been notably increased and improved since the 2014 annexation of the Crimea."

- As highlighted in the article, the long-term security issues surrounding the breakaway regions in eastern Ukraine will continue to result in occasional upticks in tension that will continue to risk regional stability.

OVERNIGHT DATA

- US JOBLESS CLAIMS -39K TO 547K IN APR 17 WK

- US PREV JOBLESS CLAIMS REVISED TO 586K IN APR 10 WK

- US CONTINUING CLAIMS -0.034M to 3.674M IN APR 10 WK

- U.S. MARCH INDEX OF LEADING ECONOMIC INDICATORS UP 1.3%

- NAR: US MARCH EXISTING HOMES SALES -3.7% MOM TO 6.01M SAAR

- NAR: TWO CONSECUTIVE MONTHS OF DECLINES MOM; HOME SALES +12.3% YOY

- NAR: INVENTORY +3.9% MOM TO 1.07M; -28.2% YOY

- NAR: MEDIAN HOME PRICE ROSE BY RECORD ANNUAL PACE 17.2% TO $329,100

- NAR: DAYS ON MARKET 18 DAYS, RECORD LOW

MARKETS SNAPSHOT

Key late session market levels

- DJIA down 326.27 points (-0.96%) at 33805.8

- S&P E-Mini Future down 37.25 points (-0.89%) at 4126.5

- Nasdaq down 128 points (-0.9%) at 13822.23

- US 10-Yr yield is down 0.5 bps at 1.5504%

- US Jun 10Y are up 1/32 at 132-18

- EURUSD down 0.003 (-0.25%) at 1.2006

- USDJPY up 0.01 (0.01%) at 108.08

- Gold is down $11.83 (-0.66%) at $1781.90

- EuroStoxx 50 up 38.39 points (0.97%) at 4014.8

- FTSE 100 up 42.95 points (0.62%) at 6938.24

- German DAX up 124.55 points (0.82%) at 15320.52

- French CAC 40 up 56.73 points (0.91%) at 6267.28

US TSY FUTURES CLOSE

- 3M10Y -0.009, 153.008 (L: 150.127 / H: 156.533)

- 2Y10Y -0.722, 139.909 (L: 138.372 / H: 143.031)

- 2Y30Y -1.872, 208.256 (L: 207.427 / H: 212.109)

- 5Y30Y -1.831, 143.371 (L: 142.95 / H: 145.735)

- Current futures levels:

- Jun 2Y down 0.125/32 at 110-12.625 (L: 110-12.25 / H: 110-13)

- Jun 5Y up 0.25/32 at 124-3.25 (L: 123-30.75 / H: 124-06.5)

- Jun 10Y up 1/32 at 132-18 (L: 132-09 / H: 132-24.5)

- Jun 30Y up 12/32 at 158-16 (L: 157-26 / H: 158-29)

- Jun Ultra 30Y up 28/32 at 188-8 (L: 186-29 / H: 188-29)

US EURODOLLAR FUTURES CLOSE

- Jun 21 +0.005 at 99.820

- Sep 21 steady at 99.805

- Dec 21 steady at 99.745

- Mar 22 steady at 99.775

- Red Pack (Jun 22-Mar 23) -0.005 to steady

- Green Pack (Jun 23-Mar 24) steady

- Blue Pack (Jun 24-Mar 25) -0.01 to -0.005

- Gold Pack (Jun 25-Mar 26) -0.005 to steady

Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N +0.00125 at 0.07338% (+0.00063/wk)

- 1 Month -0.00412 to 0.10613% (-0.00975/wk)

- 3 Month +0.0287 to 0.17575% (-0.01250/wk) ** (New Record Low 0.17288% on 4/22/21)

- 6 Month -0.00587 to 0.21063% (-0.01300/wk)

- 1 Year -0.00150 to 0.28075% (-0.01163/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $72B

- Daily Overnight Bank Funding Rate: 0.06%, volume: $250B

- Secured Overnight Financing Rate (SOFR): 0.01%, $882B

- Broad General Collateral Rate (BGCR): 0.01%, $371B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $346B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, appr $1.735B accepted vs. $3.624B submission

- Next scheduled purchases:

- Fri 4/23 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

PIPELINE: Still Waiting for Royal Bank of Canada

- Date $MM Issuer (Priced *, Launch #)

- 04/22 $750M *BOC Aviation 3Y +140

- 04/22 $500M *EIB 5Y TAP SOFR+17

- 04/22 $Benchmark Royal Bank of Canada 5Y +45, 5Y FRN SOFR

- 04/22 $Benchmark Petronas +10Y +135a, 40Y +155a

FOREX SUMMARY

EURUSD pare gains following ECB Lagarde on Negative rates.

- "Based on our experience, negative rates are an effective tool for providing monetary accommodation. It provides additional stimulus to the euro area economy.

- Negative rates in the euro area are passed on to Corporates in many cases. As far as households are concerned, it is 5% of deposits that have negative rates imposed.

- It is higher than that in Germany. I appreciate that people who are saving are not satisfied with being charged negative rates. But we have to look at the whole economy.

- Negative rates supporting the economy"

- Most notable price action has been in the Pound today, as Cable mean reversed, after falling to break above the 1.400 handle multiple times of late.

- Desks saw the Monday's spike as overdone, Cable is now at 1.3837.

- Market participants squared on shorter term profit taking.

EGBs-GILTS CASH CLOSE: Lagarde's "Negative" Comments Positive For Bunds

Gilts outperformed Bunds Thursday, with morning weakness in both reversing early afternoon amid ECB Pres Lagarde's press conference. Curves little changed, with periphery spreads flat too.

- With the ECB leaving policy unchanged (as expected), the most market-moving comment was Lagarde saying negative interest rates were an effective tool for providing accommodation - not a big surprise, but triggered a reversal higher in Bunds and Euribor.

- But those moves faded, and RX and ER are trading more or less where they were at ECB decision time. Reuters sources piece after the meeting saying that the policy "hawks" did not call for a PEPP taper merely corroborated what Lagarde said.

- Large supply from France and Spain (>E16bn in nominals combined) saw little reaction.

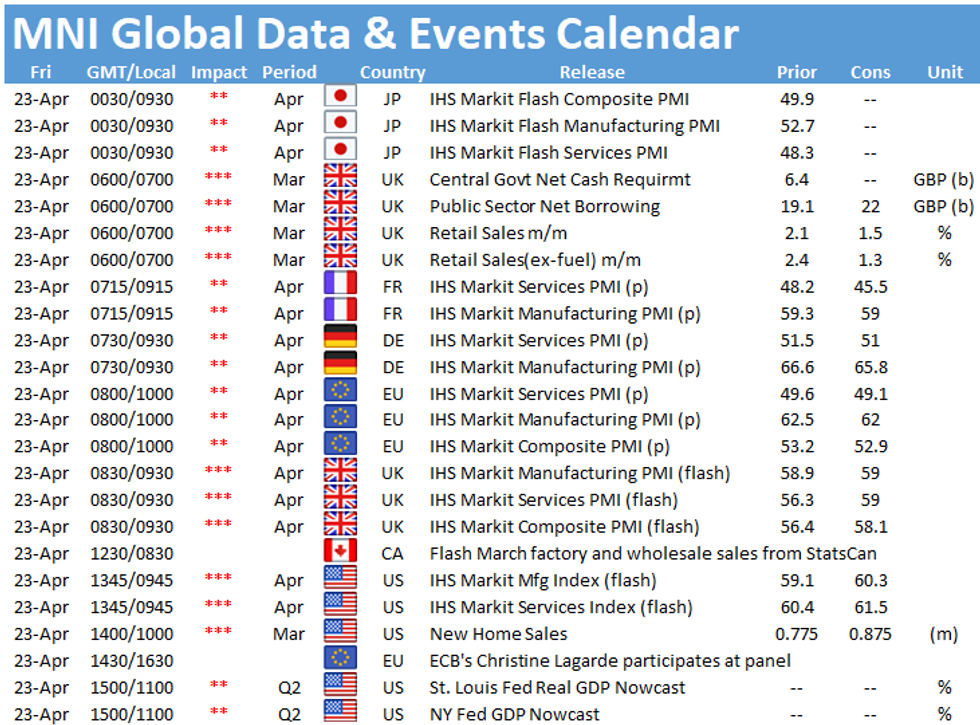

- Friday sees flash PMIs and UK retail sales.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 0.6bps at -0.69%, 5-Yr is up 0.8bps at -0.599%, 10-Yr is up 1bps at -0.252%, and 30-Yr is up 0.5bps at 0.286%.

- UK: The 2-Yr yield is up 0.5bps at 0.043%, 5-Yr is unchanged at 0.316%, 10-Yr is unchanged at 0.74%, and 30-Yr is down 1bps at 1.275%.

- Italian BTP spread down 0.8bps at 100.7bps /Spanish down 0.9bps at 64.5bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.