-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Pres Biden Zeros in on Wealthy w/Cap Gains Tax

EXECUTIVE SUMMARY

- MNI STATE OF PLAY: Fed To Stay Course Even As Jobs Gap Narrows

- Congressional Seat "Apportionment": As a result of 2020 Census, House announces apportionment changes for next decade.

- BIDEN WILL PROPOSE CHANGES TO CAPITAL GAINS TAX FOR THOSE WHO MAKE MORE THAN $1M, Bbg

US

FED: The Federal Reserve on Wednesday is expected to stay its course on near-zero interest rates and steady QE despite data showing hiring and spending are gathering momentum now that 42% of U.S. adults have received at least one dose of a Covid-19 vaccine.

- While Fed Chair Jay Powell will note a more upbeat outlook and encouraging data, he will emphasize the FOMC's resolve to see the recovery through without wavering in its aggressive efforts to encourage growth. For more see MNI Policy main wire at 1155ET.

US: Latest headlines from Pres Biden admin regarding cap-gains hike for the wealthy: WH Eco-Advisor Deese recently, No noticeable react this time around, eminis holding near first half highs.

- BIDEN WILL PROPOSE CHANGES TO CAPITAL GAINS TAX FOR THOSE WHO MAKE MORE THAN $1M, Bbg

- DEESE SAYS CHANGE WILL ONLY AFFECT 0.3% OF TAXPAYERS OR ABOUT 500,000 HOUSEHOLDS IN UNITED STATES, Bbg

- DEESE SAYS BIDEN PLAN AIMS TO EQUALIZE TREATMENT OF ORDINARY INCOME AND CAPITAL GAINS, Bbg

- DEESE SAYS THERE IS NO EVIDENCE OF A SIGNIFICANT IMPACT OF CAPITAL GAINS RATES ON LONG TERM INVESTMENT, Bbg

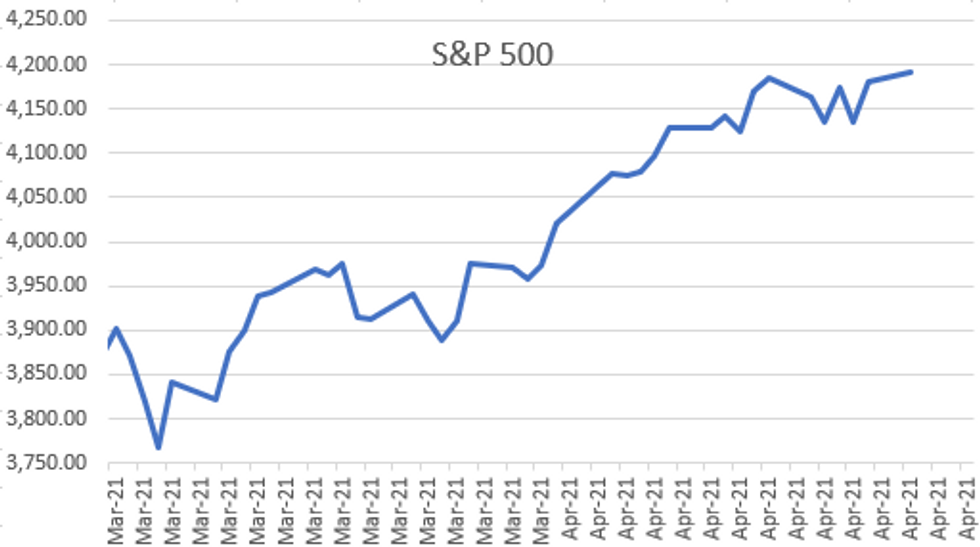

Last Thursday headlines Pres Biden PROPOSAL over capital gains tax increase to 39.6% to as high as 43.4% for wealthy spurred sharp sell-off in stocks, 30Y Bonds lead rebound while VIX neared 20.0. Stocks took with grain of salt Friday as S&P eminis made new all-time high 4186.0

US: As a result of 2020 Census, House announces apportionment changes for next decade. Politico reports:

- Texas, which had 36 congressional seats for the past decade, will elect two additional members of the House in next year's midterm elections. Other states that will add a single House seat: Colorado, Florida, Montana, North Carolina and Oregon.

- Meanwhile, seven states each lost a seat. Other than California, they were all east of the Mississippi River: Illinois, Michigan, New York, Ohio, Pennsylvania and West Virginia.

OVERNIGHT DATA

- US MAR DURABLE NEW ORDERS +0.5%; EX-TRANSPORTATION +1.6%

- US FEB DURABLE GDS NEW ORDERS REV TO -0.9%

- US MAR NONDEF CAP GDS ORDERS EX-AIR +0.9% V FEB -0.8%

- US APRIL DALLAS FED MANUFACTURING INDEX AT 37.3 -- well above 30.0 estimate (28.9 in March)

MARKETS SNAPSHOT

Key late session market levels

- DJIA down 15.37 points (-0.05%) at 34024.89

- S&P E-Mini Future up 12.75 points (0.31%) at 4184.25

- Nasdaq up 132.7 points (0.9%) at 14146.74

- US 10-Yr yield is up 1.1 bps at 1.5684%

- US Jun 10Y are down 2/32 at 132-12

- EURUSD down 0.0004 (-0.03%) at 1.2092

- USDJPY up 0.24 (0.22%) at 108.12

- WTI Crude Oil (front-month) down $0.23 (-0.37%) at $61.88

- Gold is up $3.09 (0.17%) at $1780.27

European bourses closing levels:

- EuroStoxx 50 up 7.49 points (0.19%) at 4020.83

- FTSE 100 up 24.56 points (0.35%) at 6963.12

- German DAX up 16.72 points (0.11%) at 15296.34

- French CAC 40 up 17.58 points (0.28%) at 6275.52

US TSY SUMMARY: Durable New Orders Much Weaker Than Expected

Tsys climbed off opening lows following weaker than expected Durable New Orders for March: +0.5% vs. +2.5% est, analysts cited nagging supply chain constraints, and volatile aircraft orders.

- Bonds lead the rally through midmorning and stalled after US APRIL DALLAS FED MANUFACTURING INDEX AT 37.3 -- well above 30.0 estimate (28.9 in March). Rates held higher levels on narrow range through the FI close.

- Week's Tsy auctions front-ended to accommodate Wednesday's FOMC policy annc.

- The $60B 2Y note (91282CBX8) auction tailed slightly with high yield of 0.175% vs. 0.170%, matching last Decembers 0.5% tail. Bid-to-cover lowest since June 2020 at 2.34x vs. 2.56x 5 month average.

- The $61B 5Y note (91282CBW0) auction came in near on-the-screws with high yield of 0.849% vs. 0.850% WI. Bid-to-cover lowest since July 2020 at 2.31x vs. 2.34x 5 month average.

- Late headline re: 2020 Census, House announces apportionment changes for next decade: rejiggering number of House seats may be boon for GOP.

- The 2-Yr yield is up 1.2bps at 0.1697%, 5-Yr is up 1.5bps at 0.8311%, 10-Yr is up 1.1bps at 1.5684%, and 30-Yr is up 0.9bps at 2.243%.

US TSY FUTURES CLOSE

- 3M10Y +1.4, 155.146 (L: 152.809 / H: 157.466)

- 2Y10Y -0.128, 139.697 (L: 139.141 / H: 143.134)

- 2Y30Y -0.033, 207.407 (L: 206.327 / H: 210.836)

- 5Y30Y -0.315, 141.27 (L: 140.728 / H: 143.114)

- Current futures levels:

- Jun 2Y down 0.75/32 at 110-11.625 (L: 110-11.5 / H: 110-12.375)

- Jun 5Y down 2.5/32 at 123-30.25 (L: 123-28.25 / H: 124-01.25)

- Jun 10Y down 2.5/32 at 132-11.5 (L: 132-05 / H: 132-16)

- Jun 30Y up 4/32 at 158-13 (L: 157-24 / H: 158-22)

- Jun Ultra 30Y up 4/32 at 187-28 (L: 186-27 / H: 188-20)

US EURODOLLAR FUTURES CLOSE

- Jun 21 steady at 99.815

- Sep 21 -0.005 at 99.80

- Dec 21 steady at 99.745

- Mar 22 -0.005 at 99.770

- Red Pack (Jun 22-Mar 23) -0.01 to -0.005

- Green Pack (Jun 23-Mar 24) -0.01 to -0.005

- Blue Pack (Jun 24-Mar 25) -0.01

- Gold Pack (Jun 25-Mar 26) -0.01

Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N +0.00037 at 0.07375% (+0.00063 total last wk)

- 1 Month +0.00000 to 0.11100% (-0.00488 total last wk)

- 3 Month +0.0262 to 0.18400% (-0.00687 total last wk) ** (New Record Low 0.17288% on 4/22/21)

- 6 Month -0.00225 to 0.20188% (-0.01950 total last wk)

- 1 Year +0.00112 to 0.28200% (-0.01150 total last wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $66B

- Daily Overnight Bank Funding Rate: 0.06%, volume: $259B

- Secured Overnight Financing Rate (SOFR): 0.01%, $871B

- Broad General Collateral Rate (BGCR): 0.01%, $380B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $352B

- (rate, volume levels reflect prior session)

- Tsy 7Y-20Y, $3.601B accepted vs. $9.100B submission

- Next scheduled purchases:

- Tue 4/27-Wed 4/28 Pause for FOMC

- Thu 4/29 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 4/30 1100-1120ET: Tsy 0Y-2.25Y, appr $12.825B

PIPELINE: Supra-Sovereigns Keep Issuance Running

- Date $MM Issuer (Priced *, Launch #)

- 04/26 $2B #NBN $750M 5Y +67, $1.25B 10Y +107

- 04/26 $1.25B #Ukraine 8Y 6.875%

- 04/26 $1B #Natura 7Y 4.125%

- 04/26 $Benchmark Maldives 5Y Tap Sukuk 10.5%a

- Later this week

- 04/27 $Benchmark Italy 3Y +60a, 30Y +200a

- 04/27 $Benchmark Development Bank of Kazakhstan 10Y investor calls

- 04/?? $Benchmark OQ (Oman energy co) 7Y

- 04/?? $Benchmark Abu Dhabi Ports 10Y

FOREX: Commodity Hot Streak Buoys Antipodeans

- AUD and NZD carried their outperformance throughout the European morning, trading well alongside industrial metals as the likes of copper, steel and iron ore shot higher. Expectations of better global growth in H2 this year were cited behind the move, with copper clearing 2021's earlier highs to strike the best levels in a decade. AUD/USD topped 0.78 at the London close, eyeing clustered resistance at 0.7815/16.

- The greenback held its ground for much of the European trading day, before selling pressure became evident ahead of the WMR fix, pressuring the USD index to its lowest levels since early March.

- Reflecting the better outlook for global trade, Chinese currencies put in a strong performance, helping USD/CNH and USD/CNY slip to the lowest levels in over two months.

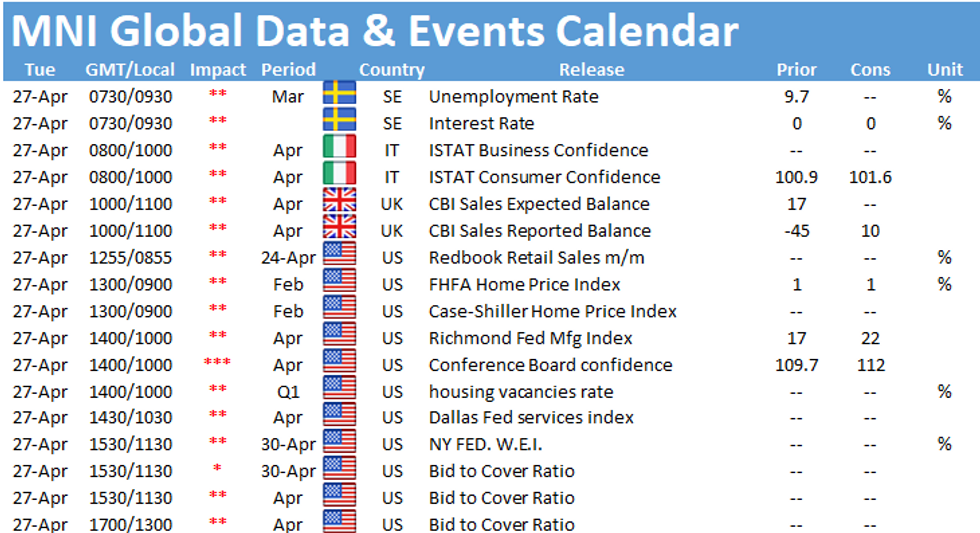

- Focus Tuesday turns to Italian and US consumer confidence numbers, with the Bank of Japan rate decision also due. Bank of Canada's Macklem is scheduled to speak as well as ECB's de Cos.

EGBs-GILTS CASH CLOSE: ECB Goes Bigger On PEPP

Bunds and Gilts traded mixed to start the week, starting weak but rallying from lows from midday. All the while, with no real conviction or apparent drivers. Periphery spreads were mixed as well.

- Data showed the ECB posted the highest net PEPP purchases last week (E22.2bn) since the week ending June 26, 2020 (and the highest overall net buys since that date too). It was the biggest week for PSPP purchases since the first week of December 2020.

- German IFO data came in on the weak side of expectations.

- ESM sold E2bn of 2031 bonds. Italy mandated banks for a 3-/30-Yr USD BTP sale.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 0.2bps at -0.689%, 5-Yr is up 0.5bps at -0.6%, 10-Yr is up 0.4bps at -0.253%, and 30-Yr is down 0.2bps at 0.288%.

- UK: The 2-Yr yield is up 1.5bps at 0.051%, 5-Yr is up 1.9bps at 0.327%, 10-Yr is up 1.2bps at 0.756%, and 30-Yr is up 0.6bps at 1.283%.

- Italian BTP spread up 1.4bps at 105.2bps / Spanish spread down 0.1bps at 65.4bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.